|

市場調查報告書

商品編碼

1640550

苯乙烯 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Styrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

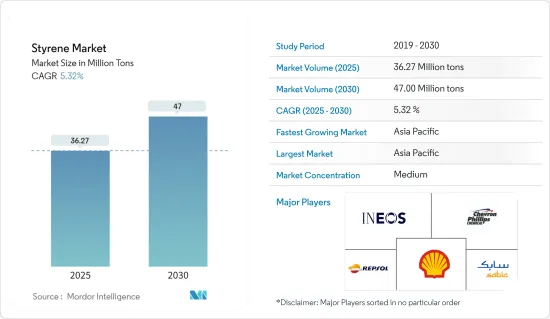

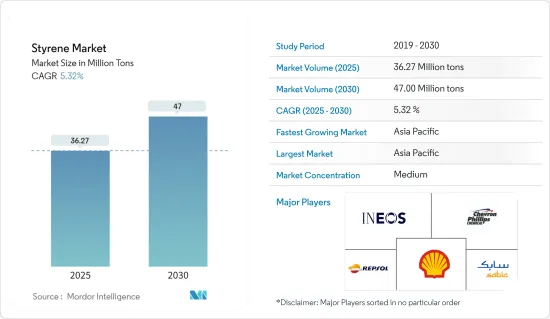

2025年苯乙烯市場規模預估為3,627萬噸,預估2030年將達4,700萬噸,預測期(2025-2030年)複合年成長率為5.32%。

COVID-19疫情對苯乙烯市場產生了負面影響。然而,由於包裝、建築和汽車等各行業的消費增加,市場在 2021 年已顯著復甦。

關鍵亮點

- 短期內,家用電子電器產業需求成長是市場成長的主要動力。

- 然而,包裝產業對生物基塑膠的使用日益增多可能會抑制市場的成長。

- 目前正在進行生物基聚苯乙烯的研究,這可能很快就會為全球市場創造有利可圖的成長機會。

- 亞太地區佔據苯乙烯市場的主導地位,最大的消費國是中國、日本和東南亞國協。

苯乙烯市場趨勢

包裝產業引領市場

- 苯乙烯因其優良的性能而廣泛用於包裝行業。它是一種用途廣泛、重量輕的塑膠,具有優異的透明度、抗衝擊性和絕緣性能。這些特性使其適用於廣泛的包裝應用。

- 苯乙烯在包裝產業中最常見的用途之一是生產聚苯乙烯泡沫塑膠(稱為發泡聚苯乙烯 (EPS) 或發泡聚苯乙烯)。 EPS泡棉廣泛用於緩衝等保護性包裝、生鮮產品的絕緣包裝和輕型運輸容器。

- 苯乙烯也用於製造硬質聚苯乙烯,常用於食品包裝。透明聚苯乙烯容器,例如蛤殼式容器、杯子和托盤,因其透明度而受到餐飲業的歡迎,因為顧客可以輕鬆看到裡面的東西。

- 此外,聚苯乙烯也用於醫療產業的各種包裝應用。根據IQVIA統計,近年來全球醫藥市場經歷了顯著成長。預計到 2022 年全球醫藥市場總額將達到 1.48 兆美元。這僅比 2021 年的 1.42 兆美元略有成長。

- 由於生活方式的改變、人們可支配收入的提高、勞動人口的增加以及對速食的偏好日益增加,亞太地區對包裝食品的需求正在成長。

- 受人均所得上升、電商巨頭崛起等因素推動,中國已成為全球最大的包裝消費國。據印度塑膠工業協會稱,印度包裝產業是世界第五大包裝產業,每年的成長率約為22-25%。高技能勞動力和低廉的人事費用意味著包裝和加工食品的成本比歐洲低 40%。人口的成長和包裝需求的增加預計將推動市場的發展。

- 同樣,到 2022 年,歐洲食品和飲料行業預計將僱用 460 萬人,收益,創造2300 億歐元(2423.7 億美元)的附加價值。個就業崗位,並且歐洲最大的製造業之一。因此,該地區食品和飲料行業的成長增加了對食品包裝的需求,從而促進了研究市場的發展。

- 根據德國聯邦統計局預測,2022年德國包裝產業收益將達350.4億歐元(377.1億美元),較前幾年成長。

- 這些因素可能會支持包裝領域對研究市場的需求。

亞太地區可望主導市場

- 亞太地區佔據市場主導地位,預計在預測期內將繼續佔據主導地位。

- 全部區域包裝應用的不斷增加、對電氣和電子產品的強勁需求以及汽車和運輸行業的快速成長正在積極推動苯乙烯市場的發展。

- 根據 ZEVI 的數據,2021 年亞洲電氣市場成長 10%,達到 3.11 兆歐元(3.67 兆美元)。預計 2022 年需求將成長 13%,2023 年成長預估為 7%。中國市場是世界上最大的市場,比工業國家市場的總合還要大。此外,預計中國電子產業2022年將成長14%,2023年將成長8%。

- 中國擁有全球最大的汽車生產基地,根據中國工業協會的數據,預計2022年汽車產量將達到2,700萬輛,較去年的2,600萬輛成長3.4%。

- 中國是世界包裝工業領先的國家之一。由於客製化包裝的增加和食品領域對包裝消費品的需求不斷增加,預計該國在預測期內將實現持續成長。根據Interpak統計,在中國食品包裝類別中,預計2023年包裝總量將達到4,470億個。

- 根據業界出版品報道,預計2021年至2022年間將有新的聚苯乙烯和ABS塑膠工廠投入生產,總合超過350萬噸,其中包括中石化古雷、浙江石化和山東利比亞等公司的新工廠。但由於該國的能源危機,可能會出現延誤。

- 同樣,根據印度包裝產業協會 (PIAI) 的數據,預測期內印度包裝產業預計將以 22% 的速度成長。此外,預計到 2025 年印度包裝市場規模將達到 2,048.1 億美元,2020-2025 年期間的複合年成長率為 26.7%。因此,該地區的塑膠射出成型市場預計將成長。

- 在電子領域,根據日本電子情報技術產業協會(JEITA)的數據,2022 年全球電子和 IT 產業產值預計為 3.44 兆美元,而 2021 年為 3.36 兆美元。與前一年同期比較1%。

- 因此,上述因素顯示該地區各終端用戶對苯乙烯的需求不斷增加。

苯乙烯產業概況

研究的市場被主要企業部分分割。主要企業(不分先後順序)包括殼牌公司、雪佛龍菲利普斯化學公司、沙烏地基礎工業公司、雷普索爾、英力士等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 家用電子電器產業需求不斷成長

- 包裝產業的需求不斷成長

- 其他促進因素

- 限制因素

- 包裝行業擴大使用生物基塑膠

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 產品類型

- 聚苯乙烯

- 丙烯腈丁二烯苯乙烯

- 苯乙烯-丁二烯橡膠

- 其他產品種類(苯乙烯-丙烯腈)

- 最終用戶產業

- 包裝

- 建築學

- 消費品

- 汽車和運輸

- 電氣和電子

- 其他最終用戶產業(紡織)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Chevron Phillips Chemical Company

- Covestro AG

- Hanwha Group

- INEOS(INEOS Styrolution)

- LG Chem

- LyondellBasell Industries Holdings BV

- Reliance Industries Ltd

- Repsol

- SABIC

- Shell PLC

- Versalis SpA(Eni SpA)

第7章 市場機會與未來趨勢

- 生物基聚苯乙烯的研究和開發正在進行中

- 其他機會

The Styrene Market size is estimated at 36.27 million tons in 2025, and is expected to reach 47.00 million tons by 2030, at a CAGR of 5.32% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the styrene market. However, the market recovered significantly in 2021, owing to rising consumption of various industries, such as packaging, construction, automotive, and others.

Key Highlights

- Over the short term, the growing demand from the consumer electronics industry is a major factor driving the growth of the market studied.

- However, increasing usage of bio-based plastics in the packaging industry is likely to restrain the growth of the market.

- Nevertheless, ongoing research to develop bio-based polystyrene is likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region dominates the styrene market, with the largest consumption coming from countries such as China, Japan, ASEAN countries, etc.

Styrene Market Trends

Packaging Industry to Drive the Market

- Styrene is commonly used in the packaging industry due to its favorable properties. It is a versatile, lightweight plastic with excellent clarity, impact resistance, and thermal insulation. These characteristics make it suitable for a wide range of packaging applications.

- One of the most common uses of styrene in the packaging industry is in producing polystyrene foam, often referred to as expanded polystyrene (EPS) or Styrofoam. EPS foam is widely used for protective packaging, including cushioning materials, insulation for perishable goods, and lightweight shipping containers.

- Styrene is also used to produce rigid polystyrene, which is commonly employed in food packaging. Clear polystyrene containers, such as clamshells, cups, and trays, are popular in the food service industry due to their transparency, allowing customers to view the contents easily.

- Furthermore, polystyrene is also used in the medical and healthcare industries for various packaging applications; IQVIA shows that the global pharmaceutical market has grown significantly in recent years. The total global pharmaceutical market was valued at USD 1.48 trillion by 2022. This is only a slight increase from 2021 when the market was valued at USD 1.42 trillion.

- In Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food.

- China is the world's largest packaging consumer across the world owing to the factors such as growing per capita income, coupled with rising e-commerce giants in the country. India's packaging industry is the fifth-largest in the world, and it is growing at about 22-25% per year, as per the Plastics Industry Association of India. Packaging and processing food costs can be 40% lower than in Europe because of highly skilled labor and cheap labor costs. The growing population and increasing demand for packaging are expected to drive the market.

- Similarly, in 2022, the Europe food and beverages industry employs 4.6 million people and generates EUR 1.1 trillion (USD 1.159 trillion) in revenue and EUR 230 billion (USD 242.37 billion) in value-added, making it one of the largest manufacturing industries in Europe. Thereby, the growing food and beverages industry in the region is increasing the demand for food packaging, as well as boosting the market studied.

- According to Statistisches Bundesamt, the revenue of the packaging industry in Germany has reached EUR 35.04 billion (USD 37.71 billion) in 2022 and has registered growth when compared to previous years.

- Such factors are likely to support the demand for the studied market from the packaging segment.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the market and will likely continue its dominance during the forecast period.

- Increasing packaging applications across the region, robust demand for electrical and electronic products, and the rapid growth of automotive and transportation sectors are actively boosting the styrene market.

- According to ZEVI, the Asian electro market reached EUR 3.11 trillion (USD 3.67 trillion) in 2021, a 10% rise. The demand increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even more significant than the combined markets of all industrialized countries. In 2021, the Chinese market contributed EUR 2.07 trillion (USD 2.45 trillion), or 41.6% of the world market; additionally, the Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023.

- According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year.

- China is one of the key packaging industries in the world. The country is expected to witness consistent growth during the forecast period due to the rise of customized packaging and increased demand for packaged consumer goods in the food segment. According to Interpak, in China, in the foodstuff packaging category, total packaging is expected to reach 447 billion units in 2023.

- According to industry publications, in 2021-2022, new factories for polystyrene and ABS plastics were expected to launch with a combined capacity of over 3.5 million tons, including new facilities for companies like Sinopec Gulei, Zhejiang Petrochemical, and Shandong Lihuaya. However, a delay may be observed due to the energy crisis in the country.

- Similarly, according to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025. Therefore, the plastic injection molding market is expected to grow in the region.

- Considering electronics, according to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3.44 trillion in 2022, registering a growth rate of 1% year on year, compared to USD 3.36 trillion in 2021.

- Thus, the abovementioned factors indicate the rising demand for styrene from various end users in the region.

Styrene Industry Overview

The market studied is partially fragmented among the top players. The key players (not in any particular order) include Shell PLC, Chevron Phillips Chemical Company LLC, SABIC, Repsol, and INEOS, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Consumer Electronics Industry

- 4.1.2 Increasing Demand from Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Usage of Bio-based Plastics in the Packaging Industry

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Polystyrene

- 5.1.2 Acrylonitrile Butadiene Styrene

- 5.1.3 Styrene Butadiene Rubber

- 5.1.4 Other Product Types (Styrene-Acrylonitrile)

- 5.2 End-user Industry

- 5.2.1 Packaging

- 5.2.2 Construction

- 5.2.3 Consumer Goods

- 5.2.4 Automotive and Transportation

- 5.2.5 Electrical and Electronics

- 5.2.6 Other End-user Industries (Textile)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company

- 6.4.2 Covestro AG

- 6.4.3 Hanwha Group

- 6.4.4 INEOS (INEOS Styrolution)

- 6.4.5 LG Chem

- 6.4.6 LyondellBasell Industries Holdings BV

- 6.4.7 Reliance Industries Ltd

- 6.4.8 Repsol

- 6.4.9 SABIC

- 6.4.10 Shell PLC

- 6.4.11 Versalis SpA (Eni SpA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ongoing Research to Develop Bio-based Polystyrene

- 7.2 Other Opportunities