|

市場調查報告書

商品編碼

1640552

苯乙烯-丁二烯橡膠(SBR):市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Styrene Butadiene Rubber (SBR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

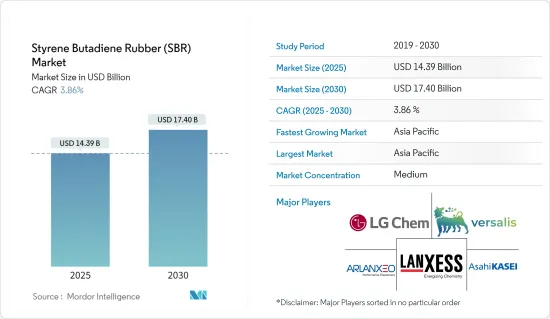

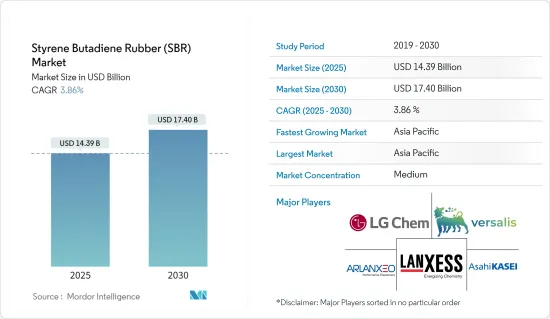

預計 2025 年苯乙烯-丁二烯橡膠市場規模為 143.9 億美元,到 2030 年將達到 174 億美元,預測期內(2025-2030 年)的複合年成長率為 3.86%。

COVID-19對苯乙烯-丁二烯橡膠市場產生了負面影響。封鎖措施、工廠關閉和運輸限制阻礙了貨物流通,影響了 SBR 及其原料的供應。隨著封鎖措施的解除,對商品和服務的需求增加,從而導致對用於多種用途的 SBR 的需求復甦。

關鍵亮點

- 天然橡膠和 SBR 交叉產品銷售的增加以及黏合劑和密封劑行業對 SBR 的需求不斷成長是預計推動苯乙烯-丁二烯橡膠市場發展的主要因素。

- 另一方面,原料的波動和永續材料的替代品預計會阻礙市場的成長。

- 性能添加劑和基礎設施開發計劃的技術創新帶來的需求不斷增加,預計將為苯乙烯-丁二烯橡膠市場提供機會。

- 亞太地區在苯乙烯丁二烯市場佔據主導地位,預計在預測期內仍將保持主導地位。

苯乙烯-丁二烯橡膠(SBR)市場趨勢

黏合劑領域佔據市場主導地位

- SBR 具有均衡的性能,包括良好的附著力、耐久性和柔韌性,適合配製各種用途的黏合劑。 SBR 基黏合劑用途廣泛,可應用於許多行業,因為它們可以黏合多種基材,包括金屬、塑膠、木材、紙張和紡織品。

- SBR 黏合劑對各種表面具有出色的黏合性,可在包裝、建築、汽車、鞋類和木工等應用中形成牢固持久的黏合。 SBR 形成內聚力和黏合力的能力使其在黏合劑領域中佔據主導地位。

- 苯乙烯-丁二烯橡膠用於改善輪胎的性能。它可以降低滾動阻力並提高燃油效率。它還提高了輪胎的濕抓地力和煞車性能。它還可以保護您的輪胎免受磨損,有助於延長其使用壽命。

- 根據美國輪胎工業協會發布的估計,2022年將有約630萬條原廠卡車輪胎和2,310萬條替換輪胎運往美國。

- 此外,美國勞工統計局估計, 年終年底美國乘用車充氣輪胎生產者物價指數為 180.2 指數點。

- 建築和包裝行業是 SBR 基黏合劑的重要消費者,用於黏合地毯、瓷磚、層壓板、膠帶、標籤和包裝材料。隨著這些行業在全球範圍內持續成長,對 SBR 基黏合劑的需求預計將增加,從而增強黏合劑領域在該市場的主導地位。

- 2022年,英國新建計劃(以現價計算)成長15.8%至1,329.89億英鎊(1,680.601.9億美元),創歷史新高。這是由於私部門就業人數增加了 140.93 億英鎊(178.954 億美元)以及公共部門就業人數增加了 40.68 億英鎊(5,118.055 億美元)。

- 這些因素導致苯乙烯-丁二烯橡膠需求增加,並將在未來一段時間內推動市場成長。

亞太地區佔市場主導地位

- 亞太地區有許多產業是 SBR 的重要消費者,包括汽車、建築、鞋類、紡織品和包裝。該地區快速的工業化、都市化和經濟成長正推動輪胎、輸送機、黏合劑、鞋底和瀝青改質劑各種應用領域對 SBR 基產品的需求。

- 亞太地區,尤其是中國,是合成橡膠(包括 SBR)生產的主要製造地。該地區受益於豐富的原料供應、完善的石化基礎設施和具有競爭力的生產成本,使其成為 SBR 生產的理想地點。尤其是中國,佔了全球SBR產能的很大佔有率。

- 根據中國汽車工業協會(CAAM)發布的預測,2022年中國乘用車銷量將達到約2,356萬輛,商用車銷量將達到約330萬輛。

- 根據印度汽車工業協會發布的估計,2022年印度將成為世界上最大的二輪車生產國。此外,該領域在國內市場佔據主導地位。 22會計年度,這個南亞國家國內二輪車銷量超過1,580萬輛。

- 亞太地區是鞋類和紡織品的重要生產國和消費國,其中SBR基材料被廣泛使用。 SBR 因其耐用性、耐磨性和柔韌性而常用於鞋底、鞋跟和運動鞋。該地區不斷成長的人口和不斷上升的可支配收入正在推動對基於 SBR 的鞋類和紡織產品的需求。

- 印度是繼中國之後的第二大鞋類生產國,2022會計年度將生產約2.19億雙鞋類。

- 因此,預計上述因素將推動苯乙烯-丁二烯橡膠,主要是在亞太地區。

苯乙烯-丁二烯橡膠(SBR)產業概況

苯乙烯-丁二烯橡膠(SBR)市場由主要企業主導。主要參與企業包括旭化成公司、阿朗新科、朗盛、Versalis SpA 和 LG 化學。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 增加天然橡膠/SBR 交叉產品的使用

- 對黏合劑和密封劑產業的需求增加

- 限制因素

- 原物料價格不穩定

- 永續材料替代

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按類型

- 乳液SBR

- 溶液SBR

- 按應用

- 胎

- 膠水

- 鞋類

- 其他用途(建築材料)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 越南

- 印尼

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 奈及利亞

- 埃及

- 卡達

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ARLANXEO

- Asahi Kasei Corporation

- China Petrochemical Corporation

- Dynasol Group

- ENEOS Corporation

- Kemipex

- KUMHO PETROCHEMICAL

- LANXESS

- LG Chem

- Sumitomo Chemical Asia Pte Ltd

- Synthos

- Trinseo

- Versalis SpA

第7章 市場機會與未來趨勢

- 性能添加劑的創新

- 基礎設施開發計劃需求增加

The Styrene Butadiene Rubber Market size is estimated at USD 14.39 billion in 2025, and is expected to reach USD 17.40 billion by 2030, at a CAGR of 3.86% during the forecast period (2025-2030).

COVID-19 negatively impacted the styrene butadiene rubber market. Lockdown measures, factory closures, and restrictions on transportation hampered the movement of goods and affected the availability of SBR and its feedstock materials. As lockdowns were lifted, the increased demand for goods and services led to a rebounding demand for SBR used in various applications.

Key Highlights

- Increasing sales of natural rubber and SBR crossover products and the rise in demand for SBR from the adhesives and sealants industry are the significant drivers expected to drive the styrene butadiene rubber market.

- On the flip side, fluctuation in the volatile raw materials and the substitution by sustainable materials are expected to hinder the growth of the market.

- Innovation in performance additives and the increasing demand from infrastructure development projects are expected to provide opportunities to the styrene butadiene rubber market.

- The Asia-Pacific region dominated the styrene butadiene market and is projected to retain its dominance over the forecast period.

Styrene Butadiene Rubber (SBR) Market Trends

Adhesives Segment to Dominate the Market

- SBR offers a balance of properties, including good adhesion, durability, and flexibility, making it suitable for formulating a wide range of adhesives for diverse applications. SBR-based adhesives can bond to various substrates, including metals, plastics, wood, paper, and textiles, making them versatile and applicable in many industries.

- SBR-based adhesives offer excellent adhesion to various surfaces, providing strong and durable bonds in packaging, construction, automotive, footwear, and woodworking applications. SBR's ability to form cohesive and adhesive bonds contributes to its dominance in the adhesive segment.

- Styrene butadiene rubber has been applied to improve the properties of tires. It helps reduce rolling resistance and increases fuel efficiency. It also improves tire wet grip and braking performance. In addition, it protects the tire from wear and tear to prolong its life.

- According to the estimate released by the US Tire Manufacturers Association, about 6.3 million original equipment and 23.1 million replacement truck tires were shipped to the United States in 2022.

- Furthermore, according to the Bureau of Labor Statistics estimate, the US producer price index for passenger car pneumatic tires was 180.2 index points at the end of 2022.

- The construction and packaging industries are significant consumers of SBR-based adhesives for bonding carpets, tiles, laminates, tapes, labels, and packaging materials. The demand for SBR-based adhesives is projected to rise as these industries keep growing worldwide, strengthening the dominance of the adhesive segment in this market.

- In 2022, the value of new building projects in current prices increased by 15.8% to a record high of GBP 132,989 million (USD 168,060.19 million) in Great Britain. This is due to increased private and public sector employment of GBP 14,093 million (USD 17809.54 million) and GBP 4,068 million (USD 5118.05), respectively.

- This increase in demand for styrene butadiene rubber, which will help the market grow during the upcoming period, is a result of these factors.

Asia-Pacific to Dominate the Market

- Asia-Pacific is home to a wide range of industries that are significant consumers of SBR, including automotive, construction, footwear, textiles, and packaging. The region's rapid industrialization, urbanization, and economic growth drive demand for SBR-based products in various applications, such as tires, conveyor belts, adhesives, shoe soles, and asphalt modifiers.

- Asia-Pacific, particularly China, is a central manufacturing hub for synthetic rubber production, including SBR. The region benefits from abundant feedstock availability, well-established petrochemical infrastructure, and competitive manufacturing costs, making it attractive for SBR production. China, in particular, accounts for a significant share of global SBR production capacity.

- According to the estimate released by the China Automotive Association Manufacturers (CAAM), in China, about 23.56 million passenger cars and 3.3 million commercial vehicles were sold in 2022.

- According to the estimate released by the Society of Indian Automobile Manufacturers, in 2022, India became the world's biggest producer of two wheels. This segment has also dominated the country's market. More than 15.8 million units of two-wheelers were sold domestically in South Asian countries during the financial year 2022.

- Asia Pacific is a significant producer and consumer of footwear and textiles, extensively using SBR-based materials. SBR is commonly used in shoe soles, heels, and athletic footwear due to its durability, abrasion resistance, and flexibility. The region's growing population and increasing disposable incomes drive demand for SBR-based footwear and textiles.

- India is the second largest footwear producer after China, with around 219 million pairs of footwear produced during FY 2022.

- Thus, the abovementioned factors are expected to increase the demand for styrene butadiene rubber, majorly from the Asia-Pacific region.

Styrene Butadiene Rubber (SBR) Industry Overview

The styrene butadiene rubber (SBR) market is consolidated among the top players. The key players include Asahi Kasei Corporation, Arlanxeo, Lanxess, Versalis SpA, and LG Chem, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage of Natural Rubber and SBR Crossover Products

- 4.1.2 Increasing Demand from Adhesives and Sealants Industry

- 4.2 Restraints

- 4.2.1 Volatile Raw Material Prices

- 4.2.2 Substitution by Sustainable Materials

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Emulsion SBR

- 5.1.2 Solution SBR

- 5.2 By Application

- 5.2.1 Tyres

- 5.2.2 Adhesives

- 5.2.3 Footwear

- 5.2.4 Other Applications (Construction Materials)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Vietnam

- 5.3.1.8 Indonesia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 France

- 5.3.3.3 Germany

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARLANXEO

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 China Petrochemical Corporation

- 6.4.4 Dynasol Group

- 6.4.5 ENEOS Corporation

- 6.4.6 Kemipex

- 6.4.7 KUMHO PETROCHEMICAL

- 6.4.8 LANXESS

- 6.4.9 LG Chem

- 6.4.10 Sumitomo Chemical Asia Pte Ltd

- 6.4.11 Synthos

- 6.4.12 Trinseo

- 6.4.13 Versalis SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Performance Additives

- 7.2 Increasing Demand from the Infrastructure Development Projects