|

市場調查報告書

商品編碼

1640554

鉬 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Molybdenum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

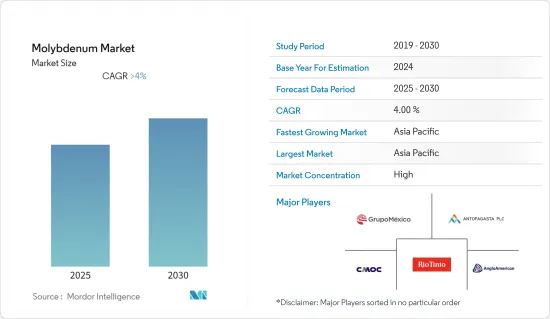

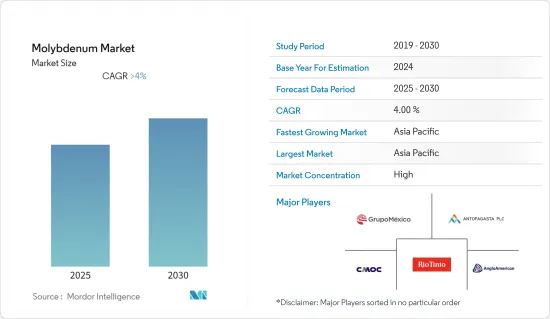

預計預測期內鉬市場複合年成長率將超過 4%。

COVID-19 正在對鉬市場產生負面影響。然而,各產業對鋼鐵的需求不斷成長,正在推動鉬的消費。

關鍵亮點

- 預計亞太地區鋼鐵產量的上升和能源產業需求的上升將推動市場成長。

- 鉬的高成本可能會阻礙市場成長。

- 對含鉬化學品的需求不斷增加可能會推動未來市場的成長。

- 亞太地區佔鉬消費量的很大佔有率。由於中國汽車產量龐大且該地區建築業的成長,預計預測期內該地區將以最快的速度成長。

鉬市場趨勢

航太和國防工業的需求不斷成長

- 鉬具有高溫穩定性、抗張強度、密度、防輻射和優異的材料加工性等多種特性,是航太和國防工業不可或缺的材料之一。

- 在航太工業中,鉬的強度高、重量輕,有助於減少振動並提高飛行員和乘客的舒適度。它們也用於穩定飛機的副翼、升降舵和方向舵、直升機葉輪和駕駛座儀表等控制面。

- 印度是世界第九大民航市場,預計2030年將成為全球最大民航市場。該國目前有 153 個機場,預計到 2040 會計年度將增加到 190-200 個。預計到 2027 年,持有飛機數量將增加至 1,100 架。

- 2021 年 9 月,國防部與西班牙空中巴士防務與航太公司簽署了為印度空軍購買 56 架 C-295MW 運輸機的合約。

- 根據美國聯邦航空管理局(FAA)預測,由於航空貨運量的增加,到2037年,民航機持有預計將達到8,270架。此外,由於現有機隊老化,美國主幹線航空公司預計每年將增加 54 架飛機。

- 根據美國國會預算辦公室(CBO)預測,2021年美國國防支出為7,420億美元,2022年將增加至7,600億美元。此外,預計到 2032 年該價值將達到約 1 兆美元,從而推動該領域對鉬的使用。

- 總體而言,航太和國防工業的穩定成長率以及鉬在該領域的不斷增加的應用預計將為鉬市場提供巨大的成長機會。

中國主宰亞太地區

- 預計預測期內亞太地區將成為全球最大的鉬市場。預計快速的工業化和不斷成長的消費將推動市場發展。

- 中國是世界上最大的鉬生產國之一。中國主要的鉬生產商包括洛陽鉬業、力拓集團和金堆城鉬業集團。

- 根據國際鉬協會(IMOA)統計,2022年第二季中國鉬產量為6,310萬磅,季增4%,年增14%。

- 鋼鐵業是我國最大的鉬消費產業之一。 2021年粗鋼產量為1,032.8噸,佔全球產量的50%以上,這意味著鉬的需求龐大。

- 中國將2022年國防預算增加7.1%,至1.45兆元(2,290億美元)。此外,根據中國航空工業發展研究中心的報告,到2025年,中國飛機總數預計將達到5,343架,這將進一步擴大所研究的市場。

- 因此,隨著各終端用戶產業對鉬的需求不斷增加,預計預測期內產量將進一步增加。

鉬行業概況

鉬市場是一個整合的市場,主要企業佔據市場主導地位。鉬市場的主要企業包括英美資源集團、力拓集團、安託法加斯塔集團、墨西哥集團、洛陽鉬業等(排名不分先後)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 亞太地區鋼鐵產量上升

- 能源產業需求增加

- 限制因素

- 鉬高成本

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

- 價格趨勢

第5章 市場區隔(市場規模(基於數量))

- 最終產品

- 鋼

- 化學

- 鑄件

- 莫金屬

- 鎳合金

- 其他最終產品(其他合金)

- 最終用戶產業

- 石油和天然氣

- 化工和石化

- 車

- 工業的

- 建築和施工

- 航太和國防

- 其他

- 地區

- 生產分析

- 中國

- 美國

- 智利

- 秘魯

- 墨西哥

- 亞美尼亞

- 其他國家

- 消費分析

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 歐洲其他地區

- 其他

- 南美洲

- 中東和非洲

- 生產分析

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AMERICAN CUMO MINING CORPORATION

- Anglo American

- Antamina

- Antofagasta PLC

- Centerra Gold Inc.

- China Molybdenum Co. Ltd

- Codelco

- Freeport-McMoRan

- Grupo Mexico

- Jinduicheng molybdenum group Co. Ltd

- MOLTUN

- Rio Tinto

第7章 市場機會與未來趨勢

- 含鉬化學品的需求不斷增加

簡介目錄

Product Code: 54707

The Molybdenum Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 has negatively affected the Molybdenum Market. However, the rising demand for steel in various industries is propelling the consumption of molybdenum.

Key Highlights

- The increasing steel production in Asia-Pacific and growing demand from the energy sector are expected to drive market growth.

- The high cost of molybdenum will likely hinder the market's growth.

- Increasing demand for molybdenum-bearing chemicals is likely to augment the market's growth in the future.

- Asia-Pacific holds the major share in the consumption of molybdenum. The region is also expected to witness the fastest growth during the forecast period, owing to the largest automotive production in China and the growing construction industry within the region.

Molybdenum Market Trends

Increasing Demand from the Aerospace and Defense Industry

- Molybdenum is one of the essential materials for the aerospace and defense industry because of its various properties, such as high-temperature stability, tensile strength, density, radiation protection, and excellent material machinability.

- In the aerospace industry, molybdenum reduces vibration and improves pilot and passenger comfort, as the material has high strength and less weight. It is also used to stabilize control surfaces for ailerons, elevators, and rudder sections of aircraft, helicopter rotor blades, and cockpit instrumentation.

- India is the ninth-largest civil aviation market in the world and is projected to become the largest by 2030. At present, there are 153 airports in the country, and it is anticipated to increase to 190-200 by FY 2040. The rising fleet size is expected to escalate the number of airplanes to 1,100 by 2027.

- In September 2021, the Ministry of Defence (MoD) signed a contract with M/s Airbus Defence and Space, Spain, for the acquisition of 56 C-295MW transport aircraft for the Indian Air Force.

- According to the Federal Aviation Administration (FAA), the total commercial aircraft fleet is expected to reach 8,270 in 2037, owing to the growth in air cargo. Also, the US mainliner carrier fleet is expected to grow at a rate of 54 aircraft per year due to the existing fleet getting older.

- According to the CBO (Congressional Budget Office), the UStates'States defense spending was USD 742 billion in 2021 and increased to USD 760 billion in 2022. Further, it is expected to reach around USD 1 trillion by 2032, propelling molybdenum usage in the sector.

- Overall, a steady growth rate in the aerospace and defense industry and an increase in molybdenum applications in the segment are expected to provide a huge opportunity for the molybdenum market to grow.

China to Dominate the Market in the Asia-Pacific Region

- Asia-Pacific is expected to have the largest market globally for molybdenum during the forecast period. Rapid industrialization and rising consumption are expected to boost the market.

- China is among the largest producer of molybdenum in the world. Major producers of molybdenum in the country are China Molybdenum Co. Ltd, Rio Tinto, and Jjinduicheng Molybdenum Group Co. Ltd, among others.

- According to International Molybdenum Association (IMOA), China's produced 63.1 million pounds of molybdenum in Q2 2022, an increase of 4% when compared to the previous quarter but a rise of 14% when compared to the same quarter of the previous year.

- The steel industry is one of the largest consumers of molybdenum in the country. In 2021, the annual production capacity of crude steel in the country stood at 1,032.8 metric tons registering more than 50% of global production, hence providing huge demand for molybdenum in the country.

- China has increased its 2022 defense budget by 7.1 percent to CNY 1.45 trillion (USD 229 billion) at a quicker pace than last year's growth. Also, by 2025, China's total number of aircraft will likely reach 5,343, according to the reports issued by the Aviation Industry Development Research Center of China, thus augmenting the market studied.

- Therefore, with the increasing demand for molybdenum from various end-user industries, production is expected to increase further during the forecast period.

Molybdenum Industry Overview

The Molybdenum Market is a consolidated market, with the top players accounting for a major chunk of the market. Key players in the molybdenum market include Anglo American, Rio Tinto, Antofagasta PLC, Grupo Mexico, and China Molybdenum Co. Ltd, among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Steel Production in the Asia-Pacific Region

- 4.1.2 Growing Demand from the Energy Sector

- 4.2 Restraints

- 4.2.1 High Cost of Molybdenum

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import and Export Trends

- 4.6 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End Product

- 5.1.1 Steel

- 5.1.2 Chemical

- 5.1.3 Foundry

- 5.1.4 MO-Metal

- 5.1.5 Nickel Alloy

- 5.1.6 Other End Products (Other Alloys)

- 5.2 End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Chemical and Petrochemical

- 5.2.3 Automotive

- 5.2.4 Industrial Usage

- 5.2.5 Building and Construction

- 5.2.6 Aerospace and Defense

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 United States

- 5.3.1.3 Chile

- 5.3.1.4 Peru

- 5.3.1.5 Mexico

- 5.3.1.6 Armenia

- 5.3.1.7 Other Countries

- 5.3.2 Consumption Analysis

- 5.3.2.1 Asia-Pacific

- 5.3.2.1.1 China

- 5.3.2.1.2 India

- 5.3.2.1.3 Japan

- 5.3.2.1.4 South Korea

- 5.3.2.1.5 Rest of Asia-Pacific

- 5.3.2.2 North America

- 5.3.2.2.1 United States

- 5.3.2.2.2 Canada

- 5.3.2.2.3 Mexico

- 5.3.2.3 Europe

- 5.3.2.3.1 Germany

- 5.3.2.3.2 United Kingdom

- 5.3.2.3.3 Italy

- 5.3.2.3.4 France

- 5.3.2.3.5 Russia

- 5.3.2.3.6 Rest of Europe

- 5.3.2.4 Rest of the World

- 5.3.2.4.1 South America

- 5.3.2.4.2 Middle-East and Africa

- 5.3.1 Production Analysis

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMERICAN CUMO MINING CORPORATION

- 6.4.2 Anglo American

- 6.4.3 Antamina

- 6.4.4 Antofagasta PLC

- 6.4.5 Centerra Gold Inc.

- 6.4.6 China Molybdenum Co. Ltd

- 6.4.7 Codelco

- 6.4.8 Freeport-McMoRan

- 6.4.9 Grupo Mexico

- 6.4.10 Jinduicheng molybdenum group Co. Ltd

- 6.4.11 MOLTUN

- 6.4.12 Rio Tinto

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Molybdenum-bearing Chemicals

02-2729-4219

+886-2-2729-4219