|

市場調查報告書

商品編碼

1640565

氯化鈉-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Sodium Chloride - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

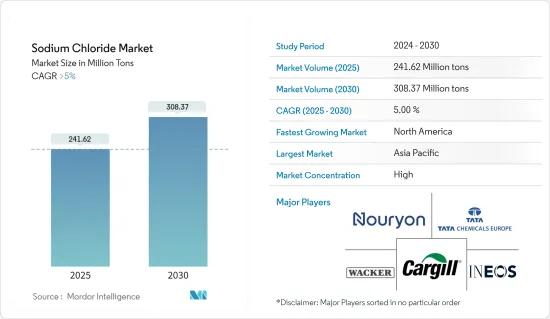

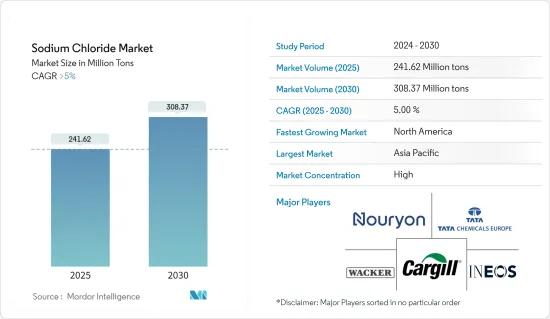

預計 2025 年氯化鈉市場規模為 2.4162 億噸,到 2030 年將達到 3.0837 億噸,預測期內(2025-2030 年)的複合年成長率將超過 5%。

2020 年 COVID-19 疫情爆發,導致全球建築工程暫停、化學製造設施關閉,對市場產生了不利影響。然而,預計市場將在預測期內復甦並遵循類似的路徑。

關鍵亮點

- 在北美和歐洲,市場擴張預計將受到食品和飲料行業對氯化鈉的需求增加以及對醫藥級氯化鈉的需求的推動。

- 然而,大量性能改良、可用作防腐劑和除冰劑的替代化學品的出現可能會阻礙市場的成長。

- 鈉基電池的使用和氯鹼產品的生產日益增多,預計將為未來的市場成長提供各種機會。

- 預計亞太地區將主導市場,而北美預計將在整個預測期內快速發展。

氯化鈉市場趨勢

化學品生產領域佔市場主導地位

- 氯化鈉用於生產許多化學品,包括有機、無機和氯鹼化合物,例如氯、堿灰和苛性鈉。這些材料用於製造各種產品,包括聚氯乙烯(PVC)、清潔劑、玻璃、染料和肥皂。

- 碳酸鈉(堿灰)用於清潔劑製造、冶金工業以及生產磷酸鹽、矽酸鹽和玻璃等重化學品。索爾維法使用廉價且廣泛可用的石灰石和氯化鈉。氨和二氧化碳將鹽和石灰石轉化為碳酸鈉。

- 2023 年上半年,歐盟 27 國、挪威、瑞士和英國生產了約 3,628,468 噸氯。然而,與 2022 年上半年相比,產量下降了 19.4%。 2023 年 9 月的氯氣產量與 2022 年 9 月相比增加了 2%。

- 報告稱,所生產的氯大部分用於PVC和EDC/VCM應用,約佔31.6%,其次是異氰酸酯和含氧酸鹽(30.8%)和無機物(12.7%)。

- 根據美國人口普查局的數據,2023 年的建築價值將達到 1.9787 兆美元,比 2022 年的 1.8487 兆美元高出 7%。這導致對硬質發泡絕緣板和聚氨酯建築行業材料等 PVC 產品的需求增加。

- 此外,苛性鈉,該製程將木材轉化為木漿,而燒鹼在造紙製程中仍佔主導地位。根據《氯鹼工業評論》預測,至2023年9月,歐盟27國、挪威、瑞士和英國將生產2,422.5千噸苛性鈉,其中有機物佔主要佔有率。

- 因此,由於上述因素,預計化學產品領域將在未來幾年佔據市場主導地位。

亞太地區佔市場主導地位

- 由於化學工業的需求不斷成長,亞太地區佔據了全球市場佔有率的主導地位。中國是化學加工中心,佔全球化學產品產量的大部分。

- 根據中國國家統計局統計,中國生產氫氧化鈉超過3,900萬噸,用於化學品、水處理和金屬加工。除了工業用途外,氫氧化鈉也常用於家用清潔劑。

- 根據印度投資局(Invest India)發布的統計數據,預計2023-24年(截至2023年8月)印度主要化學品產量將下降至53.54噸,2022-2023年同期將成長至54.32噸以上。然而,截至 2023 年 8 月的有機化學品產量與去年同期相比成長了 4.52%。

- 氯化鈉在製藥工業中也有多種用途。它們用於製造原料藥和其他產品,例如透析溶液、輸液、生理食鹽水、鹽水輸液和口服補液鹽。

- 根據印度品牌資產基金會(IBEF)預測,到2030年,印度製藥業的規模將達到1,300億美元。中國是全球最大的疫苗生產國,約佔全球疫苗總量的60%。它也是世界第三大藥品生產國。

- 預計亞太地區將主導氯化鈉市場,因為與市場相關的各個細分領域的需求將以某種方式繼續成長。

氯化鈉行業概況

氯化鈉市場由主要企業主導。主要企業(不分先後順序)包括 Nouryon、嘉吉公司、瓦克化學股份公司、INEOS 和塔塔化學歐洲公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 食品和飲料業對氯化鈉的需求不斷增加

- 北美和歐洲對醫藥級氯化鈉的需求不斷增加

- 限制因素

- 用作防腐劑和除冰劑的新興替代化學品

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 年級

- 岩鹽

- 日曬鹽

- 真空製鹽

- 應用

- 化學製造

- 解凍

- 水質調節

- 農業

- 食品加工

- 藥品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 越南

- 馬來西亞

- 印尼

- 泰國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 土耳其

- 義大利

- 北歐的

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 卡達

- 奈及利亞

- 阿拉伯聯合大公國

- 埃及

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Cargill, Incorporated.

- CK Life Sciences Int'l.(Holdings)Inc.

- Compass Minerals

- INEOS

- K+S Aktiengesellschaft

- Nouryon

- Pon Pure Chemicals Group

- Rio Tinto

- Sudwestdeutsche Salzwerke AG

- Swiss Salt Works AG

- Tata Chemicals Europe

- Wacker Chemie AG

第7章 市場機會與未來趨勢

- 鈉基電池的使用增加

- 增加氯鹼產品產量

The Sodium Chloride Market size is estimated at 241.62 million tons in 2025, and is expected to reach 308.37 million tons by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 outbreak in 2020 had a detrimental influence on the market due to the temporary halt in construction operations and the worldwide shutdown of chemical manufacturing facilities. However, the market picked up and is expected to follow a similar projection during the forecast period.

Key Highlights

- The increasing demand for sodium chloride in the food and beverage industry and the demand for pharmaceutical-grade sodium chloride in North America and Europe are expected to fuel the market expansion.

- However, the emergence of numerous alternative chemicals with improved properties that can be utilized as preservatives and deicing agents may stifle market growth.

- The increasing usage of sodium-based batteries and the production of chlor alkali products are expected to offer various opportunities for future market growth.

- Asia-Pacific dominates the market, and North America is predicted to develop quickly throughout the forecast period.

Sodium Chloride Market Trends

The Chemical Production Segment to Dominate the Market

- Sodium chloride produces many chemicals, including organic and inorganic, and chlor alkali compounds, such as chlorine, soda ash, and caustic soda. These materials are then used to make various products, including polyvinyl chloride (PVC), detergents, glass, dyes, and soaps.

- In addition to being utilized in the production of detergents and the metallurgical industry, sodium carbonate (soda ash) is employed in producing heavy chemicals, including phosphates, silicates, and glass. Limestone and sodium chloride, both of which are inexpensive and widely accessible, are used in the Solvay process. Ammonia and carbon dioxide turn salt and limestone into sodium carbonate.

- In the first half of 2023, about 3,628,468 tonnes of chlorine were produced in EU-27 countries, Norway, Switzerland, and the United Kingdom. However, this was a 19.4% decrease in production volume compared to the first half of 2022. In September 2023, an increase of 2% was observed in chlorine production volume over September 2022.

- According to the report, most chlorine produced was used in the PVC, EDC/VCM application, accounting for approximately 31.6%, followed by isocyanates and oxygenates (30.8%) and inorganics (12.7%).

- According to the US Census Bureau, the value of construction in 2023 was USD 1,978.7 billion, 7% above the USD 1,848.7 billion spent in 2022. It, in turn, enhanced the demand for PVC products and polyurethane-based construction industry materials, such as rigid foam insulation panels.

- Furthermore, caustic soda is used in the Kraft process, which converts wood into wood pulp and is still the dominant method in paper manufacturing. According to the Chlor-Alkali Industry Review, 2,422.5 kilotons of caustic soda were produced in EU-27 countries, Norway, Switzerland, and the United Kingdom till September 2023, with organics accounting for the major share.

- Therefore, based on the factors mentioned above, the chemical products segment is expected to dominate the market in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global market share, with rising demand from the chemical industry. China is a hub for chemical processing, accounting for most chemicals produced globally.

- According to the National Bureau of Statistics of China, the country generated over 39 million metric tons of sodium hydroxide, which is used to make chemicals, water treatment, and metal processing. In addition to industrial use, sodium hydroxide is commonly found in domestic cleaning detergents.

- According to the statistics presented by Invest India, the production of major chemicals in India decreased to 53.54 lakh tonnes during 2023-24 (up to August 2023), with over 54.32 lakh tonnes produced during the corresponding period of 2022-2023. However, the production of organic chemicals up to August 2023, as compared to the corresponding period of the previous year, recorded an increase of 4.52%.

- Sodium chloride also serves its purpose in various applications in the pharmaceutical industry. It is used in manufacturing APIs and other products, such as dialysis and infusion solutions, injections, saline drips, and oral rehydration salts.

- According to the India Brand Equity Foundation (IBEF), the Indian pharmaceutical industry is expected to reach ~USD 130 billion by 2030. The country is the largest producer of vaccines worldwide, accounting for around 60% of the total vaccines globally. Additionally, the country ranks third across the globe for pharmaceutical production by volume.

- With the ever-increasing demands in the different sectors related to the sodium chloride market in one way or another, the market for the same is expected to be dominated by Asia-Pacific.

Sodium Chloride Industry Overview

The sodium chloride market is consolidated among the top players. The key players (not in a particular order) include Nouryon, Cargill Incorporated, Wacker Chemie AG, INEOS, and Tata Chemicals Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Sodium Chloride from Food and Beverage Industry

- 4.1.2 Increasing Demand for Pharmaceutical-grade Sodium Chloride in North America and Europe

- 4.2 Restraints

- 4.2.1 Emergence of Numerous Alternative Chemicals that can be Utilized as Preservatives and Deicing Agents

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Rock Salt

- 5.1.2 Solar Salt

- 5.1.3 Vacuum Salt

- 5.2 Application

- 5.2.1 Chemical Production

- 5.2.2 Deicing

- 5.2.3 Water Conditioning

- 5.2.4 Agriculture

- 5.2.5 Food Processing

- 5.2.6 Pharmaceutical

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Vietnam

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Thailand

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Turkey

- 5.3.3.7 Italy

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 Nigeria

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Cargill, Incorporated.

- 6.4.2 CK Life Sciences Int'l. (Holdings) Inc.

- 6.4.3 Compass Minerals

- 6.4.4 INEOS

- 6.4.5 K+S Aktiengesellschaft

- 6.4.6 Nouryon

- 6.4.7 Pon Pure Chemicals Group

- 6.4.8 Rio Tinto

- 6.4.9 Sudwestdeutsche Salzwerke AG

- 6.4.10 Swiss Salt Works AG

- 6.4.11 Tata Chemicals Europe

- 6.4.12 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Sodium-based Batteries

- 7.2 Increasing Production of Chlor-alkali Products