|

市場調查報告書

商品編碼

1640567

力感測器 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Force Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

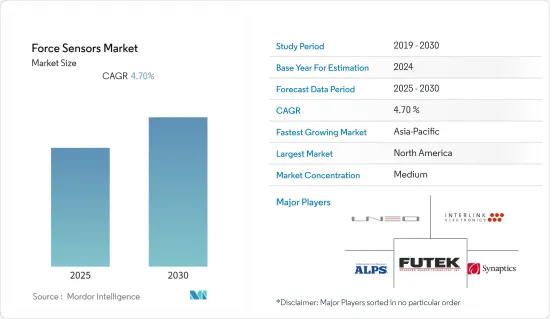

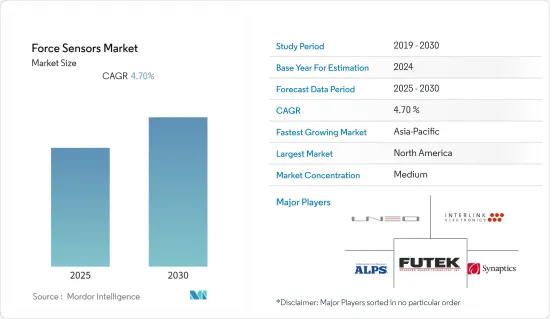

預測期內,力感測器市場預計將實現 4.7% 的複合年成長率

關鍵亮點

- 力感應使表面更加直覺,顯示器允許使用者體驗設計師簡化和改善許多家用電子電器產品中控制表面的佈局。這使得探索新一代家用電子電器產品使用者介面的設計師能夠將力感測器無縫整合到他們的新設計中。

- 力感測器用於測量車輛部件(例如車軸樑和減震器)以避免疲勞故障,尤其是在大型機動車輛(例如建築卡車和採礦車輛)中,過載或意外應力水平可能導致維護成本增加。被安裝以追蹤設備所受到的力。

- 此外,日益嚴格的安全法規和快速普及的ADAS(高級駕駛輔助系統)——可根據多種參數向駕駛員發出警告——預計也將在預測期內推動對力感測器的需求。

- 此外,工業機器人的適應性、智慧化和自主性也不斷增強。力感測器技術的發展正在促進機器人技術的進步。力感測器可以檢測作用於機器人手腕或手臂末端工具的各種力。由於製造成本低廉、技術進步、工業機器人需求增加、力測量醫療設備的出現以及工業領域的擴展和創新,力感測器市場正在不斷擴大。

- 此外,隨著各國政府在疫情後逐步解除限制措施,汽車、家用電子電器和醫療產業的需求增加,汽車和家用電子電器,導致對力感測器的需求增加。成長。新冠疫情後,由於電動車、自動駕駛汽車、智慧型手機、智慧醫療設備等各類應用的需求,全球力感測器市場呈現穩定成長。預計此類應用將在不久的將來推動市場發展。

- 目前的力感測器產品系列代表了相對標準的產品供應。儘管市場有潛力解決許多應用問題,但市場參與企業提供的產品相當有限。然而,市場開始採用根據特定目的地設備製造商(OEM)需求量身定做的力感測器產品。

- 然而,市場的一個關鍵限制因素是終端用戶產業需求的波動。終端用戶領域的需求並不固定,這對生產計畫帶來了挑戰。由於損壞和靈敏度低而導致的製造設施的拒收率正在降低整體生產能力。此外,汽車、醫療和航太領域快速變化的需求要求更精確的測量。

力感測器市場趨勢

汽車產業可望大幅成長

- 汽車銷售和全球汽車產量的上升預計將創造商機。根據國際汽車製造商協會(OICA)統計,2021年中國汽車銷量達2,608萬輛,創歷史新高。 2021年,全球機動車產量約8,014萬輛,包括轎車和商用車。

- 此外,力感測器通常用於汽車領域,以檢測機動過程中的向心力,以提高駕駛員的安全性。它也用於引擎管理系統(MAP/BAP)和油壓監測。由於這些優勢,未來幾年汽車產業對力感測器的需求可能會成長。

- 汽車產業為資訊娛樂系統研發中的力感測器提供了許多新機會。近年來,汽車產業已成為觸控螢幕需求的重要來源。博世、電裝和英飛凌科技等知名汽車感測器製造商正在為一系列車輛投資技術先進、更安全、更可靠的基於感測器的產品。

- 此外,汽車領域對技術複雜功能的需求不斷成長,其中力感測器用於駕駛員安全、引擎管理系統、液壓系統等,預計未來對力感測器的需求將會增加。此外,機器人技術的日益普及和工業物聯網的進步將推動市場的發展。

- 此外,日益嚴格的安全法規和快速普及的 ADAS(高級駕駛輔助系統)預計也將在預測期內推動對力感測器的需求,ADAS 可根據多種參數向駕駛者發出警告。

- 然而,由於中國是原料和成品的主要供應國之一,汽車產業受到了新冠肺炎疫情的影響。該行業面臨產量減少、供應鏈中斷和價格波動的問題。知名電子公司的銷售受到了影響,但預計很快就會成長。

亞太地區成長顯著

- 人工智慧和物聯網技術的成長以及亞太地區的高需求將繼續推動力感測器市場的成長。印度和中國等新興國家的技術進步和汽車標準的提高正在影響製造業對感測器的需求的成長,因為它們提供了多種好處,例如最大限度地提高業務效率、可靠性和有效性。

- 該地區也是最有利可圖的市場之一。由於該地區工業製造業蓬勃發展,且使用配備力感測器的設備的產品國內消費量很高,因此該地區是力感測器的優先市場。

- 印度汽車工業也正在崛起,並在全球汽車市場中發揮越來越重要的作用。例如,根據IBEF的數據,2021年印度的乘用車市值為327億美元,預計五年後將達到548.4億美元。此外,預計到 2025 年印度的電動車 (EV) 市場規模將達到 5,000 億印度盧比(70.9 億美元)。此外,根據印度國家轉型委員會 (NITI Aayog) 和落基山研究所 (RMI) 的數據,到 2030 年,印度的電動車融資產業規模可能達到 37 億印度盧比(370 萬美元)。預計到 2026 年,印度電動車市場的複合年成長率將達到 36%。這些因素預計將推動亞洲新興國家的力感測器市場的發展。

- 此外,日本政府的目標是到2050年,日本銷售的所有新車都是電動或混合動力汽車汽車。國家將提供補貼,加速私人開發電動車電池和馬達。此外,增加投資以鼓勵部署自動駕駛汽車預計將推動力感測器的成長前景。

- 預計這種樂觀的區域發展將在預測期內推動市場成長。預計它具有推動力感測器市場發展的巨大潛力。

力感測器產業概況

力感測器市場競爭相當激烈,且細分程度適中,由 Sensata Technologies、Alps Electric、Synaptics Inc.、Interlink Electronics Inc.、Pressure Profile Systems Inc. 和 Uneo Inc. 等幾家大公司組成。

- 2022 年 10 月 - Sensata Technologies 推出用於電子機械煞車 (EMB) 的新型煞車力道,讓煞車系統更安全、性能更好。 Sensata 的微應變計制動力感測器支援未來的煞車。該感測器的引入將比現有技術縮短車輛的停車距離。它透過更準確、更快地捕捉駕駛員的煞車意圖來改善煞車。

- 2022年10月-Forsentek Co.Ltd.推出先進的荷重元、力感測器和各種測量儀器。它們採用高品質組件設計,以確保最佳功能。還提供具有先進功能的多軸力感測器。這些感測器採用高阻力設計,因此可以承受高衝擊並繼續有效運作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 家用電子電器領域的創新與發展

- 汽車領域需求激增

- 市場限制

- 市場需求波動與客製化問題

- 價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場區隔

- 類型

- 張力感測器

- 壓縮力感測器

- 張力和壓縮感測器

- 最終用戶產業

- 醫療

- 製造業

- 車

- 航太和國防

- 消費性電子產品

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Alps Electric Co. Ltd

- Synaptics Inc.

- Interlink Electronics Inc.

- Pressure Profile Systems Inc.

- Uneo Inc.

- Futek Advanced Sensor Technology Inc.

- Tekscan Inc.

- Hottinger Baldwin Messtechnik(HBM)GmbH

- Kavlico Corporation

- Flintec Group AB

- Tecsis GmbH

- Shenzhen New Degree Technology Co. Ltd

- Sensel Inc.

- Tangio Printed Electronics

- NextInput Inc.

第7章投資分析

第8章 市場機會與未來趨勢

簡介目錄

Product Code: 54986

The Force Sensors Market is expected to register a CAGR of 4.7% during the forecast period.

Key Highlights

- Force sensing makes surfaces more intuitive, and the displays enable user experience designers to simplify and improve the control surface layouts on many appliances. It has allowed designers to seamlessly integrate force sensors into new designs by exploring a new generation of appliance user interfaces.

- Force sensors are frequently installed to track the force experienced by vehicle parts such as axle beams and dampers to avoid fatigue failure, particularly in heavy automotive vehicles such as construction trucks and mining vehicles, where overloading or unexpected stress levels may result in higher maintenance costs.

- Furthermore, the increasing safety regulations and rapidly rising adoption of advanced driver assistance systems (ADAS), which alert drivers based on several parameters, are expected to drive the demand for force sensors over the forecast period.

- Moreover, industrial robots are more adaptable, intelligent, and autonomous. The development of force sensor technologies is driving the advancement of robots. Force sensors can detect different forces when applied to the robot's wrist or end-of-arm tooling. The market for force sensors is expanding due to cheap production costs, technical advancements, rising industrial robot demand, the creation of force-measuring medical devices, and expansion and innovation in the industrial sector.

- Additionally, the demand from automotive, consumer electronics, and healthcare industries has increased post-pandemic situation as the government released the restriction and increased demand from the consumer for automotive and consumer electronics, which will further be expected to add growth for the force sensor market. After the COVID-19 pandemic, the global force sensor market showed steady growth due to its demand for various applications such as electric vehicles, autonomous vehicles, smartphones, and smart healthcare devices. Such applications will boost the market in the near future.

- The market's current force sensor product portfolio is relatively standardized in product offerings. Although the market has the potential to cater to a plethora of applications, the offerings of the market players are pretty limited. However, the market is witnessing the introduction of customized force sensor products for specific original equipment manufacturing (OEM) needs.

- However, the significant restraint in the market is the fluctuating demands of the end-user industry. Need is not fixed in the end-user sector and is a challenge to production schedules. Rejection rates at manufacturing facilities are due to damage or poor sensitivity, reducing overall production capacity. Additionally, rapidly changing requirements in the automotive, medical, and aerospace sectors drive the need for more accurate measurements.

Force Sensors Market Trends

Automotive Sector is Expected to Register a Significant Growth

- The rising automotive sales and increasing production of vehicles globally are expected to create opportunities. According to the OICA (Organisation Internationale des Constructeurs Automobiles), the sales of automobiles in China in 2021 reached the highest at 26.08 million units. In 2021, around 80.14 million motor vehicles, including cars, and commercial vehicles, were produced globally.

- Furthermore, force sensors are commonly employed in the automotive sector to detect centripetal force during maneuvers to increase driver safety. They are also used in engine management systems (MAP/BAP) and oil pressure monitoring. Because of these advantages, the demand for force sensors in the automobile industry may expand in the coming years.

- The automotive industry has many new opportunities for force sensors in the Research and development of infotainment systems. In recent years, the automotive industry has emerged as an excellent source of demand for touchscreen units. Prominent automotive sensor manufacturers like Bosch, Denso, and Infineon Technologies are investing in technologically advanced, safer, and more secure sensor-based products for various automotive applications.

- Moreover, the increasing demand for technologically sophisticated functionalities in the automotive sector, where force sensors are used for driver safety, engine management systems, and oil pressure systems, is expected to increase demand for force sensors in the future years. Furthermore, the growing popularity of robotics and advancements in IIoT will propel the market.

- Additionally, the increasing safety regulations and rapidly rising adoption of advanced driver assistance systems (ADAS), which alert the driver based on several parameters, are expected to drive the demand for force sensors over the forecast period.

- However, the automotive industry has been impacted by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The sector faced a reduction in production, disruption in the supply chain, and price fluctuations. The prominent electronic companies' sales were affected but are expected to grow soon.

Asia-Pacific to Witness the Significant Growth

- Growing AI and IoT technologies and high demand from the Asian-Pacific region continue to drive the force sensor market growth. Technological advances and rising automotive standards in developing countries such as India, China, and others are impacting the increasing demand for sensors in the manufacturing sector due to multiple benefits, including maximizing operational efficiency, reliability, and effectiveness.

- The region is also one of the most lucrative markets. It is becoming a priority for force sensors due to its prosperous industrial manufacturing industry and high domestic consumption of products that utilize devices with force sensors.

- The automotive industry has also been increasing in India, playing an increasingly important role in the global automotive market. For instance, according to IBEF, the Indian passenger car market was valued at USD 32.7 billion in 2021, and it is expected to reach USD 54.84 billion after five years. Additionally, India's electric vehicle (EV) market is projected to reach INR 50,000 crores (USD 7.09 billion) by 2025. Moreover, according to NITI Aayog and Rocky Mountain Institute (RMI), India's EV financial industry could reach INR 37 lakh (USD 3.7 million) by 2030. India's EV market is predicted to increase at a CAGR of 36% by 2026. These factors will drive the market for force sensors in developing Asian countries.

- Moreover, the Japanese government aims to have all new cars sold in Japan electric or hybrid by 2050. The country plans to offer subsidies to accelerate the private sector development of batteries and motors for electricity-powered cars. Besides, the increasing investments to encourage the deployment of autonomous vehicles are expected to drive the growth prospect for force sensors.

- Such optimistic regional developments are expected to boost market growth during the forecast period. It is expected to drive the market for force sensors likely.

Force Sensors Industry Overview

The force sensors market is moderately fragmented as the market is quite competitive and consists of a few major players, such as Sensata Technologies, Alps Electric Co. Ltd, Synaptics Inc., Interlink Electronics Inc., Pressure Profile Systems Inc., and Uneo Inc.

- October 2022 - Sensata Technologies announced its new Brake Pedal Force Sensor for electromechanical brakes (EMBs), enabling safer and better-performing braking systems. Sensata's micro strain gauge Brake Pedal Force sensor supports the future of braking. Implementing this sensor reduces a vehicle's stopping distance compared to existing technologies. It improves braking by accurately and rapidly capturing a driver's braking intent.

- October 2022 - Forsentek Co. Limited released advanced load cells, force sensors, and various measuring instruments. These are designed with high-quality components to ensure they function at their best. Clients can also get a multi-axis force sensor designed with advanced functionality. These sensors are designed with a high resistance level to ensure they can withstand high impacts and keep working effectively.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Innovation and Development in the Consumer Electronics Sector

- 4.2.2 Surging Demand in the Automotive Sector

- 4.3 Market Restraints

- 4.3.1 Fluctuating Market Demands and Customization Issues

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Tension Force Sensors

- 5.1.2 Compression Force Sensors

- 5.1.3 Tension and Compression Force Sensors

- 5.2 End-user Industry

- 5.2.1 Healthcare

- 5.2.2 Industrial Manufacturing

- 5.2.3 Automotive

- 5.2.4 Aerospace and Defense

- 5.2.5 Consumer Electronics

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alps Electric Co. Ltd

- 6.1.2 Synaptics Inc.

- 6.1.3 Interlink Electronics Inc.

- 6.1.4 Pressure Profile Systems Inc.

- 6.1.5 Uneo Inc.

- 6.1.6 Futek Advanced Sensor Technology Inc.

- 6.1.7 Tekscan Inc.

- 6.1.8 Hottinger Baldwin Messtechnik (HBM) GmbH

- 6.1.9 Kavlico Corporation

- 6.1.10 Flintec Group AB

- 6.1.11 Tecsis GmbH

- 6.1.12 Shenzhen New Degree Technology Co. Ltd

- 6.1.13 Sensel Inc.

- 6.1.14 Tangio Printed Electronics

- 6.1.15 NextInput Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219