|

市場調查報告書

商品編碼

1640596

矽酸鈉-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Sodium Silicate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

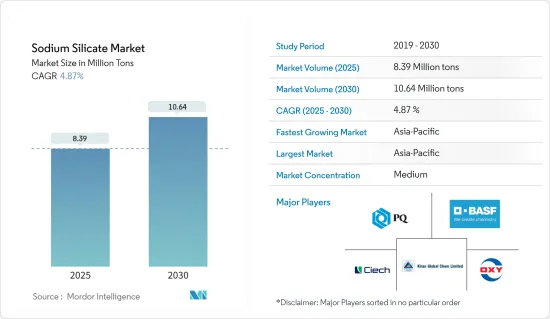

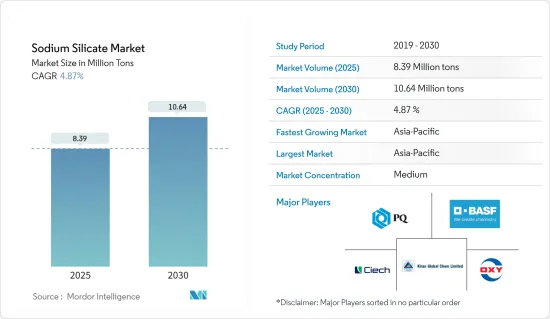

預計 2025 年矽酸鈉市場規模為 839 萬噸,預估 2030 年將達到 1,064 萬噸,預測期內(2025-2030 年)的複合年成長率為 4.87%。

新冠肺炎疫情為市場帶來了負面影響。這是因為製造設施和工廠由於封鎖和限制而關閉。供應鏈和運輸中斷進一步擾亂了市場。但2021年,產業復甦,市場需求回歸。

關鍵亮點

- 從中期來看,再生紙需求的增加以及橡膠和輪胎行業對沉澱二氧化矽的需求的增加是推動市場成長的因素之一。

- 另一方面,嚴格的政府監管和因矽酸鈉的有害影響而增加的健康風險預計將阻礙矽酸鈉市場的成長。

- 然而,預計預測期內建築業的成長將提供許多機會。

- 由於各種應用的需求量很大,亞太地區佔據了市場主導地位。

矽酸鈉市場趨勢

清潔劑市場需求旺盛

- 矽酸鈉是一種由二氧化矽和氧化鈉組成的無色化合物。用於生產肥皂、清潔劑和矽膠。矽酸鈉在清潔劑組合物中的作用是抑製油脂和有機油的腐蝕、鹼化和乳化,並降低鈣和鎂的硬度。

- 許多清潔劑作業都使用矽酸鈉進行,包括金屬清洗、紡織品加工、洗衣、紙張脫墨,以及清洗餐具、酪農用具、瓶子、地板、機車等。

- 液體清潔劑主要用於清洗衣物,主要有兩個最終用戶群:住宅和商業。液體清潔劑的需求正在成長,因為它使用起來更方便,而且比粉狀清潔劑產生的廢物更少。

- 北美目前是全球液體清潔劑需求和消費的主要地區。美國是家用和工業清潔劑的新興市場之一。例如,根據《Happi》雜誌的報道,截至2022年10月30日的52週內,美國液體清潔劑類別的銷售量總合約為6.41億台。

- 此外,2022 年,汰漬是美國第一大洗衣精品牌,銷售額超過 12 億美元,其次是「Gain」和「All」品牌。所有品牌銷售額均突破1億美元。

- 在德國,由於人們對健康和衛生的關注度日益提高,對洗衣精的需求也日益增加。例如,根據IKW的數據,2022年德國洗衣精和清潔產品的銷售額將達到51.4億歐元(約54.2億美元),較2021年成長1%。因此,洗衣精消費量的增加預計將促進矽酸鈉市場的發展。

- 預計此類應用將增加對矽酸鈉的需求。

亞太地區主導矽酸鈉市場

- 亞太地區是一個主要的工業地區,擁有多個重工業、工業和小型工業。由於中國和印度等國家對矽酸鈉產品的需求很高,預計亞太地區的矽酸鈉市場將會成長。

- 中國是世界上最大的水消耗國之一,每年需要6,100億立方公尺的飲用水添加劑供人類消費量。這是矽酸鈉市場的一個潛在驅動力,因為自從矽酸鈉被核准作為人類飲用的飲用水添加劑以來,它被廣泛用於水處理。例如,2022年6月,專注於水環境治理的環保公司中國光大水務取得山東省淄博市張店東化學工業園區工業污水處理擴建升級計劃。該計劃將採用建設-營運-轉移(BOT)模式營運,每日處理工業污水能力約為5,000立方米。

- 此外,2022年3月中國紙製品及紙板產量為1,246萬噸,較2021年3月的1,197萬噸產量增加4%。 2022年9月,加工紙和紙板產量約1,160萬噸。

- 在韓國,政府透過《2016-2025 年水環境管理總體規劃》採取的舉措可能會進一步促進該國的水處理活動,從而在預測期內推動矽酸鈉市場的成長。

- 水和污水處理是印尼的主要問題。印尼的水資源量佔全球的6%,亞太地區的21% 。處理系統。例如,根據聯合國兒童基金會的數據,印尼只有 75% 的人口能夠獲得水和衛生設施。政府正在不遺餘力地建造足夠的水處理基礎設施,以確保飲用水水資源部門不會落後。為了全面提供水衛生設施,每人每年需要投資 70,000印尼幣(5 美元)。雅加達對清潔水的需求預計將從 2017 年的每秒 28 立方公尺(m3/s)增加到 2030 年的每秒 41.6 立方公尺(m3/s)。

- 根據國家統計局預測,2022年中國紙及紙製品製造企業銷售收入將超過2,175億美元,較2021年成長3.59%。此外,根據聯合國商品貿易資料庫,2022年中國紙和紙板、紙漿、紙和紙板製品出口額為316.3億美元。因此,這些紙和紙板的出口預計將使矽酸鈉市場受益。

- 預計預測期內各行業的成長將推動亞太地區矽酸鈉市場的發展。

矽酸鈉產業概況

矽酸鈉市場本質上呈現部分盤整態勢。該市場的主要企業(不分先後順序)包括 CIECH Group、Kiran Global Chem Limited.、PQ Corporation、 BASF SE、Occidental Petroleum Corporation 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 再生紙需求不斷增加

- 橡膠和輪胎產業對沉澱二氧化矽的需求不斷增加

- 其他促進因素

- 限制因素

- 矽酸鈉的有害影響

- 其他限制因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 類型

- 固體的

- 液體

- 應用

- 黏合劑和塗料

- 清潔劑

- 食品保鮮

- 沉澱二氧化矽

- 造紙

- 水處理

- 其他用途(建築、金屬鑄造)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Alumina doo Zvornik

- BASF SE

- CIECH Group

- C THAI GROUP

- Evonik Industries AG

- FUJI SILYSIA CHEMICAL LTD.

- Hindcon

- Kiran Global Chem Limited

- Occidental Petroleum Corporation

- PQ Corporation

- Silmaco

- WR Grace & Co.-Conn.

- Z. Ch. Rudniki SA

第7章 市場機會與未來趨勢

- 建築業成長

- 其他機會

The Sodium Silicate Market size is estimated at 8.39 million tons in 2025, and is expected to reach 10.64 million tons by 2030, at a CAGR of 4.87% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the medium term, the increasing demand for waste paper recycling and increasing demand for precipitated silica from the rubber and tyre industry are some of the factors driving the growth of the market studied.

- On the flip side, stringent government regulations and increased health risks due to the hazardous effects of sodium silicate are expected to hinder the growth of the sodium silicate market.

- However, growth in construction sector is anticipated to provide numerous opportunities over the forecast period.

- Asia-Pacific dominated the market, owing to the high demand from various applications.

Sodium Silicate Market Trends

Detergents Segment to Witness Healthy Demand

- Sodium silicate is a colorless compound of silica and oxides of sodium. It is used in soaps, detergents, and the making of silica gel. The role of sodium silicate in the composition of detergents is to control the corrosion, alkalization, and emulsion of fats and organic oils, and reduce the hardness of calcium and magnesium.

- Many detergent operations are performed using sodium silicates, such as metal cleaning, textile processing, laundering, and de-inking paper, to wash dishes, dairy equipment, bottles, floors, and locomotives.

- Liquid laundry detergent is primarily used in cleaning laundry and has two main end-user segments, namely, residential and commercial. The demand for liquid laundry detergent is growing due to the comfort and ease of application and lesser wastage than detergent powders.

- North America is currently the region leading the global demand and consumption of liquid laundry detergent. The United States is among the developed markets for household and industrial detergents. For instance, according to Happi Magazine, for the 52 weeks that ended October 30, 2022, the liquid laundry detergent category had sales totaling approximately 641 million units in the United States.

- Moreover, in 2022, Tide was the leading unit dose laundry detergent brand in the United States, registering over USD 1.2 billion in sales, followed by the brands "Gain" and "All". The brand, All, had a sales value of over USD 100 million.

- In Germany, due to increasing demand for laundry detergent drugs owing to growing concerns regarding the health and hygienic living among the people. For instance, according to IKW, in 2022, revenue from laundry detergents and cleaning products in Germany amounted to EUR 5.14 billion (~USD 5.42 billion), which showed an increase of 1% compared to 2021. Therefore, increasing the consumption of laundry detergents is expected to create an upside for the sodium silicate market.

- Such aforementioned applications are, in turn, expected to boost the demand for sodium silicate.

Asia-Pacific to Dominate the Market for Sodium Silicate

- Asia-Pacific is a major industrialized region that houses multiple heavy, medium, and small-scale industries. The Asia-Pacific sodium silicate market is expected to experience growth on account of high product demand in China, India, etc.

- China is one of the biggest water consumers worldwide, with a consumption volume of 610 billion cubic meters of drinking water additives for human consumption. This is a potential driver for the sodium silicate market, as sodium silicate has been extensively used in water treatment since its approval as a drinking water additive for human consumption. For instance, in June 2022, an environmental protection company that focuses on water environment management, named China Everbright Water secured the expansion and upgrading project of the ZhangdianEast Chemical Industry Park Industrial Wastewater Treatment in Zibo City, Shandong Province. This project will be operated on a BOT (Build-Operate-Transfer) model, with a designed daily industrial wastewater treatment capacity of around 5 thousand m3.

- Moreover, China produced 12.46 million metric tons of processed paper and cardboard in March 2022, compared to 11.97 million metric tons in March 2021, registering a growth of 4%. In September 2022, the production volume of processed paper and cardboard in the country was around 11.6 million metric tons.

- In South Korea, the government initiative, under the Water Environment Management Master Plan of 2016-2025 plan, is likely to further boost the water treatment activities in the country, which, in turn, will proliferate the sodium silicate market growth during the forecast period.

- Water and wastewater treatment is an important issue in Indonesia. Indonesia's water resources account for 6% of the world's and 21% of Asia-Pacific's water resources, and yet 68% of rivers in Indonesia are heavily polluted due to the discharge of wastewater without treatment, thus, requiring huge investment in water treatments system that will augment the demand sodium silicate market in the country. For instance, according to UNICEF, only 75% of Indonesians have complete water accessibility and sanitation. The government is trying to put significant efforts to build sufficient infrastructure for water treatment so that the drinking water sector is not left behind. An investment of IDR 70 thousand (USD 5.00) per capita per year is needed in the country to ensure fully developed water sanitation. Clean water needs in Jakarta are expected to rise from 28 cubic meters per second (m3/s) in 2017 to 41.6 m3/s by 2030.

- According to the National Bureau of Statistics, paper and paper product manufacturers in China generated a revenue of more than USD 217.5 billion in 2022, which showed an increase of 3.59% compared to 2021. Moreover, according to United Nations COMTRADE database on international trade, China's exports of paper and paperboard, articles of pulp, paper, and board amounted to USD 31.63 billion in 2022. Therefore, these paper and paperboard exports are expected to create an upside for the sodium silicate market.

- Such growth in various industries is expected to drive the market for sodium silicate in the Asia-Pacific region during the forecast period.

Sodium Silicate Industry Overview

The Sodium Silicate Market is partially consolidated in nature. The major players in this market (not in a particular order) include CIECH Group, Kiran Global Chem Limited., PQ Corporation, BASF SE, and Occidental Petroleum Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Waste Paper Recycling

- 4.1.2 Rising Demand for Precipitated Silica from the Rubber and Tyre Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Hazardous Effects of Sodium Silicate

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Solid

- 5.1.2 Liquid

- 5.2 Application

- 5.2.1 Adhesives and Paints

- 5.2.2 Detergents

- 5.2.3 Food Preservation

- 5.2.4 Precipitated Silica

- 5.2.5 Paper Production

- 5.2.6 Water Treatment

- 5.2.7 Other Applications (Construction, Metal Casting)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alumina doo Zvornik

- 6.4.2 BASF SE

- 6.4.3 CIECH Group

- 6.4.4 C THAI GROUP

- 6.4.5 Evonik Industries AG

- 6.4.6 FUJI SILYSIA CHEMICAL LTD.

- 6.4.7 Hindcon

- 6.4.8 Kiran Global Chem Limited

- 6.4.9 Occidental Petroleum Corporation

- 6.4.10 PQ Corporation

- 6.4.11 Silmaco

- 6.4.12 W. R. Grace & Co.-Conn.

- 6.4.13 Z. Ch. Rudniki S.A.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Construction Sector

- 7.2 Other Opportunities