|

市場調查報告書

商品編碼

1640598

黏膠短纖維:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Viscose Staple Fiber - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

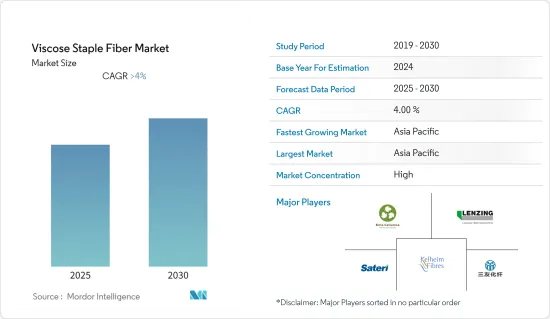

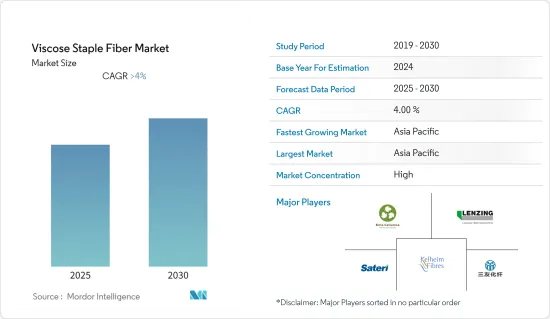

預測期內,粘膠短纖維市場預計將以超過 4% 的複合年成長率成長。

新冠肺炎疫情對各個維度的價值鏈產生了重大影響。政府的限制措施已導致原料供應停止。由於多個國家實施封鎖,粘膠纖維的價格下跌,迫使蘭精集團等許多公司開始在其工廠生產安全口罩,因為製造口罩需要不織布纖維。疫情對市場產生了負面影響,尤其是汽車和服飾應用。然而,2021 年,隨著一些公司開始在自己的工廠生產紡織品,該行業略有成長。根據預測,市場預計將實現正成長。

關鍵亮點

- 短期內,市場將受到時尚服飾領域對黏膠纖維的需求所推動。

- 合成纖維可能會阻礙黏膠纖維的市場擴張。

- 未來的市場機會可能來自於醫療領域高密度纖維的日益廣泛的應用。

- 亞太地區佔據市場主導地位,預計在估計和預測期內將以最快的複合年成長率成長。

粘膠短纖維市場趨勢

紡織纖維需求不斷成長

- 天然和生物分解性的粘膠短纖維 (VSF) 或人造棉纖維由木漿和棉狀漿製成,兩者都具有與棉纖維相似的特性。這些纖維具有延展性和柔韌性,可用於各種應用,包括服飾、家紡、家居裝飾、服裝材料、機織織物和針織品。

- 預計紡織品和服裝需求的增加將推動這些應用對 VSF 的需求。亞太地區是最大的紡織品市場,由於印度和中國等國家的需求不斷成長,該市場正在經歷健康成長。

- 在印度,隨著外國紡織品牌的增多,消費者的偏好不斷提升,服裝需求也隨之增加。數位化、社交網站和應用程式促進了服飾銷售的成長。根據美國商務部國際貿易管理局的數據,2021年印度對美國的服裝出口成長38.5%,總額達2.0963億美元。

- 黏膠纖維是最重要的人造纖維素纖維,約佔全部人造纖維素纖維79%的市場佔有率。

- 孟加拉等小地區人口不斷成長、生活水準不斷提高,推動了對針織布料的需求。

- 預計預測期內所有上述因素都將增加對黏膠短纖維的需求。

亞太地區可望主導市場

- 由於紗線產量的快速成長,預計預測期內亞太地區將主導 VSF 市場。中國是世界上最大的粘膠短纖維生產國和消費國。

- 中國是世界第一大服飾生產國,棉紡織、合成纖維紡織、絲織等產品生產能力位居世界第一。我國粘膠短纖維產業面臨的一個重大問題是存在產能過剩。

- 蘭精集團和博拉集團是全球主要製造商,在中國設有生產基地。

- 根據印度投資局預測,到2021年,國內服飾和紡織業將貢獻印度國內生產毛額的5%、工業以金額為準的7%和出口收入的12%。印度是世界第六大紡織品和服飾出口國。

- 隨著印度取消粘膠纖維反傾銷稅,未來幾年該產業將蓬勃發展。

- 由於印度工資上漲,紡織品生產預計將轉移到工資較低的東南亞國協,最終影響中國粘膠短纖維的銷售。

- 此外,修訂後的技術升級基金計畫(ATUFS)和綜合紡織工業計畫(SITP)等政府支持性法規以及馬哈拉斯特拉邦拉邦和哈里亞納邦為紡織產品提供的資本和運費補貼,均有助於促進紡織業的發展。因此,印度粘膠短纖維市場正在經歷強勁成長。

- 預計預測期內所有這些因素都將推動該地區粘膠短纖維市場的成長。

粘膠短纖維產業概況

黏膠短纖維市場較為集中,前五大公司約佔60%的市佔率。市場的主要企業包括蘭精集團、Birla Cellulose、SATERI、新疆中泰化工、唐山三友集團興達化纖等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 對服裝和服飾的需求不斷增加

- 棉花價格波動導致黏膠纖維布料的採用增加

- 限制因素

- 與合成纖維的競爭

- 受新冠疫情影響,情勢不利(尤其是汽車等終端用戶產業)

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 生產流程

- 產品技術進步

第5章 市場區隔(市場規模(基於數量))

- 應用

- 紡織品(紡織品和服裝)

- 不織布/特種

- 醫療

- 車

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 其他

- 巴西

- 阿根廷

- 其他

- 亞太地區

第6章 競爭格局

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Asia Pacific Rayon Limited

- Birla Cellulose

- Glanzstoff

- Jilin Chemical Fiber Group Co. Ltd

- Kelheim Fibres GmbH

- LENZING AG

- Nanjing Chemical Fibre Co. Ltd

- Sateri

- SNIACE Group

- Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd

- Yibin Hiest Fibre Limited Corporation(Milan)

- Xinjiang Zhongtoi Chemical Co. Ltd

第7章 市場機會與未來趨勢

- 纖維素纖維在醫療應用的使用日益增多

The Viscose Staple Fiber Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 pandemic has significantly impacted the value chain in every aspect. Because of the government's limitations, the supply of raw materials came to a standstill. As a result of the lockdowns in several countries, viscose fiber prices have dropped, forcing many companies, such as Lenzing AG, to start making safety masks at their factories, as non-woven fibers are needed for mask manufacturing. The pandemic had a detrimental influence on the market, particularly in automobile and garment applications. However, the industry saw marginal growth in 2021, as several firms have begun to produce woven textiles in their facilities. In the scheduled time, the market is expected to grow positively.

Key Highlights

- In the short term, the market will be driven by the demand for viscose fiber from the fashion apparel sector.

- Synthetic fibers may hamper the market expansion of viscose fibers.

- Future market opportunities will arise from the growing usage of dense fibers in the medical sector.

- The Asia-Pacific region dominated the market and is also estimated to record the fastest CAGR during the forecast period.

Viscose Staple Fibre Market Trends

Increasing Demand for Woven Fibers

- Natural and biodegradable viscose staple fibers (VSF) or artificial cotton fibers are made from wood pulp and cotton pulp, both of which have properties similar to cotton fibers. These fibers are adaptable and pliable and may be used in various applications, including garments, home textiles, home furnishings, dress materials, and woven and knitted.

- Increasing demand for textiles and apparel is expected to drive the demand for VSF in these applications. Asia-Pacific, the largest market for woven fabrics, is witnessing healthy growth due to the increasing demand in countries like India, China, etc.

- In India, the demand for apparel has increased with growing consumer preference in response to growing foreign textile brands. The demand has been augmented by digitalization and social networking sites and apps, which help increase garments sales. Indian apparel exports to the United States climbed by 38.5% in 2021 to a total of USD 209.63 million, according to The International Trade Administration of the U.S. Department of Commerce.

- Viscose is the most critical artificial cellulose fiber, with a market share of around 79% of all man-made cellulose fibers.

- Small regions, such as Bangladesh, have witnessed an increase in population and living standards, driving the demand for knitted fabrics.

- All the factors above are expected to increase the demand for viscose staple fiber during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the VSF market during the forecast period owing to the rapidly increasing yarn production.. China is the largest producer and consumer of viscose staple fiber globally.

- China is the largest clothing producer in the world and has the largest production capacity for textile products consisting of cotton, man-made fibers, and silk. The major problem faced by the Chinese viscose staple fiber industry is the presence of surplus production capacities.

- Lenzing and Birla are some of the major global manufacturers with their production facilities in China.

- According to Invest India, in 2021, India's domestic clothing and textile sector provides 5% of the GDP, 7% of industrial production in value terms, and 12% of export revenues. India is the world's sixth-largest exporter of textiles and clothing.

- With the removal of Anti Dumping Duty on viscose fiber in India, the industry is set to see a growth surge in the coming years.

- There has been an increase in wages in the country due to which the textile production is expected to shift to low-wage ASEAN countries, ultimately affecting the sales of viscose staple fiber in China.

- Additionally, supportive government regulations, such as the Amended Technological Upgradation Fund Scheme (ATUFS) and the Scheme for Integrated Textile Parks (SITP), and capital and freight subsidy on textiles by the states of Maharashtra and Haryana have provided a boost to the industry. This, in turn, has significantly driven the market for viscose staple fiber in India.

- Due to all these factors, the market for viscose staple fiber is expected to grow in the region during the forecast period.

Viscose Staple Fibre Industry Overview

The viscose staple fiber market is consolidated, and the top five manufacturers occupy around 60% of the market. The major players in the market include Lenzing AG, Birla Cellulose, SATERI, Xinjiang Zhongtai Chemical Co. Ltd, and Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Apparels and Clothing

- 4.1.2 Increased Adoption of Viscose Fabrics, due to Ambiguity in Cotton Prices

- 4.2 Restraints

- 4.2.1 Competition from Synthetic Fibers

- 4.2.2 Unfavorable Conditions Arising due to the Impact of COVID-19, Especially in End-user Industries like Automotive and Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Production Process

- 4.6 Technological Product Advancement

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Woven (Textile and Apparel)

- 5.1.2 Non-woven and Specialty

- 5.1.2.1 Healthcare

- 5.1.2.2 Automotive

- 5.1.2.3 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Other Rest of the World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share(%)**/Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Asia Pacific Rayon Limited

- 6.3.2 Birla Cellulose

- 6.3.3 Glanzstoff

- 6.3.4 Jilin Chemical Fiber Group Co. Ltd

- 6.3.5 Kelheim Fibres GmbH

- 6.3.6 LENZING AG

- 6.3.7 Nanjing Chemical Fibre Co. Ltd

- 6.3.8 Sateri

- 6.3.9 SNIACE Group

- 6.3.10 Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd

- 6.3.11 Yibin Hiest Fibre Limited Corporation (Milan)

- 6.3.12 Xinjiang Zhongtoi Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of Cellulose Fibers in Healthcare Applications