|

市場調查報告書

商品編碼

1640615

生物潤滑劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Bio-Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

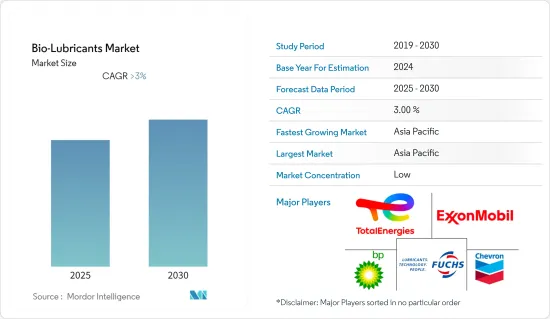

預測期內,生物潤滑劑市場預計將以超過 3% 的複合年成長率成長。

主要亮點

- 2020 年,新冠疫情對市場產生了負面影響。但預計2022年市場將達到疫情前的水平,並持續穩定成長。

- 生物基潤滑劑通常不會像石油基潤滑劑那樣引起皮膚刺激。此外,減少能源使用、人事費用、提高員工安全性、改善環境條件、延長機器壽命和提高生產產量等各種好處正在推動市場成長。

- 生物潤滑劑是透過酯化脂肪酸或酯交換植物油而生產的。此過程在均相酸/鹼催化劑8-10 存在下用長鏈醇或使用離子交換樹脂進行。這一過程增加了生物基潤滑劑的成本。這可能會阻礙市場成長。

- 已經完成了各種研究和開發計劃以改善生物基潤滑劑的物理化學性質。這些研究表明,生物潤滑劑可以作為石油基油的替代品,預計將為市場帶來積極的機會。

- 亞太地區佔據全球市場主導地位,其中中國、印度和日本等國家佔最大的消費量。

生物潤滑劑的市場趨勢

汽車和運輸領域對生物潤滑劑的需求不斷增加

- 汽車和運輸業佔據生物潤滑油市場的大部分佔有率。運輸業非常重視提高潤滑油的性能、壽命、能源效率和環保性。生物潤滑脂在許多應用中都有效,包括建築車輛、林業機械、軌道凸緣、軌道曲線和船舶機械。

- 預計許多行業在研磨、齒輪切削和一般加工中使用生物基金屬切削液和冷卻液將推動市場成長。生物基潤滑油具有毒性低、黏度指數高、潤滑性能強、機器壽命長、燃燒溫度高等特點,預計最終取代汽車產業的傳統潤滑油。

- 中國汽車產業的擴張預計將增加對生物潤滑油的需求。根據國際汽車工業組織(OICA)的數據,中國是最大的汽車生產國。光是中國在 2021 年就生產了 26,082,220 輛汽車。

- 印度的乘用車和商用車銷售也強勁成長。例如,2021-2022 年國內乘用車銷量為 3,069,499 輛,比 2020-21 年成長 13%。預計所有上述因素都將在預測期內推動全球市場的發展。

亞太地區佔市場主導地位

- 中國是亞太地區第三大生物潤滑油消費國。預計預測期內該地區發電產業的擴張將推動生物潤滑油市場的發展。

- 2021年,印度可再生能源裝置容量超過147.1吉瓦。這超過了報告期間 134.5 吉瓦的峰值,極大地支持了市場成長。

- 2021年,中國生產了約8,377兆瓦時的電力。這與前一年同期比較成長了近 10%。除水電外,2021年所有能源來源消耗均有較大幅度成長,其中主要以風能和太陽能發電增加。

- 此外,日本政府也計劃在國內新建45座採用高耗能、低排放技術、利用優質黑煤的燃煤發電廠。隨著該國發電廠數量的增加,預計預測期內發電廠對生物潤滑劑的需求將會加速成長。

- 因此,電力產業的成長預計將推動亞太地區生物潤滑油市場的發展。

生物潤滑油產業概況

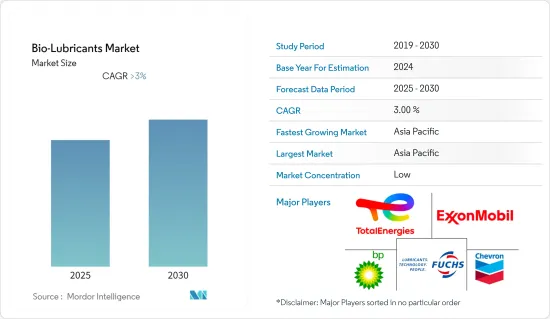

生物潤滑劑市場比較分散。市場的主要參與者包括 BP plc、雪佛龍公司、埃克森美孚公司、道達爾能源公司和 FUCHS。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 監理規範推動生物基潤滑劑的需求

- 其他促進因素

- 限制因素

- 生物性潤滑劑價格高昂

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依產品類型

- 機油

- 傳動液和液壓油

- 金屬加工油

- 通用工業用油

- 齒輪油

- 潤滑脂

- 加工油

- 其他產品類型

- 按最終用戶產業

- 發電

- 汽車和其他交通工具

- 重型機械

- 飲食

- 冶金與金屬加工

- 化學製造

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Axel Christiernsson

- Carl Bechem Lubricants India Private Limited

- BP plc

- Cargill

- Chevron Corporation

- Cortec Corporation

- Environmental Lubricants Manufacturing, Inc.

- Exxon Mobil Corporation

- FUCHS

- KCM Petro Chemicals

- Novvi, LLC.

- PANOLIN AG

- Shell plc

- TotalEnergies

第7章 市場機會與未來趨勢

- 推出性能更佳的新產品

簡介目錄

Product Code: 55763

The Bio-Lubricants Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- Bio-based lubricants do not cause skin inflammation, which is generally caused by petroleum-based lubricants. Additionally, they have various advantages, such as reduced energy usage, labor costs, increased employee safety, improved environmental conditions, increased machine life, and increased production, thereby augmenting the market's growth.

- Bio-lubricants are produced by esterifying a fatty acid or trans-esterifying vegetable oil. This process is being held with long-chain alcohol in the presence of a homogeneous acid/base catalyst 8 -10 or using an ion-exchange resin. This process increases the cost of bio-based lubricants. This is likely to hinder the market's growth.

- Various R&D projects have been completed to improve the physicochemical properties of bio-based lubricants. These studies have found that bio-lubricants can be used as substitutes for petroleum-based oils and are projected to act as an opportunity for the market.

- The Asia-Pacific region dominated the global market, with the largest consumption from countries such as China, India, and Japan.

Bio-Lubricants Market Trends

Increase in Demand for Bio-Lubricants in Automotive and Transportation Sector

- The automotive and transportation sector accounts for a considerable share of the market for bio-lubricants. The transportation industry emphasizes enhancing lubricant properties such as performance, longevity, energy efficiency, and environmental friendliness. Bio-greases work well in various applications, including construction vehicles, forestry machinery, rail flanges, rail curves, and nautical machinery.

- Many industries use bio-based metal cutting fluids and coolants for grinding, gear cutting, and general machining, which are anticipated to drive market growth. Due to their low toxicity, high viscosity index, potent lubricating properties, longer machine service life, high combustion temperature, and other characteristics, bio-based lubricants are expected to displace conventional lubricants in the automotive industry eventually.

- The expansion of the automotive sector in China is anticipated to cultivate the demand for bio-lubricants. According to the International Organization of Motor Vehicle Manufacturers (French: Organisation Internationale des Constructeurs d'Automobiles) (OICA), China is the largest producer of automobiles. The country alone produced 2,60,82,220 units of vehicles in 2021.

- Also, India witnessed a significant increase in the sales of passenger vehicles and commercial vehicles. For instance, the domestic sales of passenger vehicles were 3,069,499 for 2021-2022, representing an increase of 13% compared to 2020-21. All the aforementioned factors are expected to drive the global market during the forecast period.

Asia-Pacific to Dominate the Market

- China is the third largest bio-lubricant consumer in the Asia-Pacific region. The expanding power generation industry in the region is anticipated to drive the bio-lubricant market during the forecast period.

- In 2021, India had a capacity for more than 147.1 gigawatts of renewable energy. This was higher than the peak for the period under consideration in 2020, which was 134.5 gigawatts, supporting the market's growth significantly.

- Around 8,377 terawatt hours of electricity were produced in China in 2021. This was an increase over the previous year of almost 10%. Except for hydropower, all energy sources were more significantly consumed in 2021, with wind and solar power generating increases being majorly used.

- Moreover, the Japanese government has also been planning to build 45 new coal-fired power plants in the country by using high-energy, low-emission technology, which uses high-quality black coal. With the increasing number of power plants in the country, accelerated demand for bio-lubricants for use in power plants is expected during the forecast period.

- Therefore, this increase in the power industry is expected to drive the bio-lubricants market in the Asia-Pacific region.

Bio-Lubricants Industry Overview

The bio-lubricants market is fragmented in nature. Some of the major players in the market include BP p.l.c., Chevron Corporation., Exxon Mobil Corporation, TotalEnergies, and FUCHS, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Regulatory Norms Driving the Demand for Bio-based Lubricants

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Price of Bio-based Lubricants

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Hydraulic Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Other Product Types

- 5.2 End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Automotive and Other Transportation

- 5.2.3 Heavy Equipment

- 5.2.4 Food & Beverage

- 5.2.5 Metallurgy & Metalworking

- 5.2.6 Chemical Manufacturing

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Axel Christiernsson

- 6.4.2 Carl Bechem Lubricants India Private Limited

- 6.4.3 BP p.l.c.

- 6.4.4 Cargill

- 6.4.5 Chevron Corporation

- 6.4.6 Cortec Corporation

- 6.4.7 Environmental Lubricants Manufacturing, Inc.

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 FUCHS

- 6.4.10 KCM Petro Chemicals

- 6.4.11 Novvi, LLC.

- 6.4.12 PANOLIN AG

- 6.4.13 Shell plc

- 6.4.14 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Introduction of New Products with Better Properties

02-2729-4219

+886-2-2729-4219