|

市場調查報告書

商品編碼

1640618

拉丁美洲資料中心冷卻:市場佔有率分析、產業趨勢與成長預測(2025-2031)Latin America Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

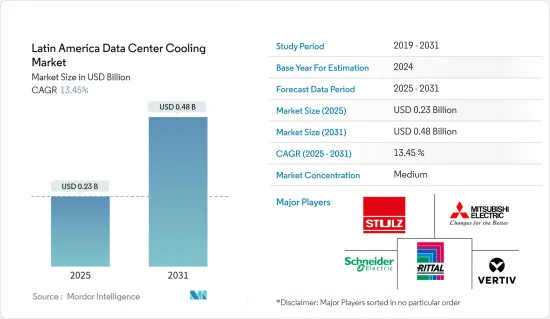

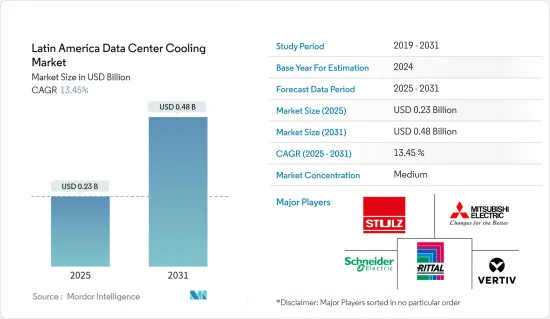

拉丁美洲資料中心冷卻市場規模預計在 2025 年為 2.3 億美元,預計到 2031 年將達到 4.8 億美元,預測期(2025-2031 年)的複合年成長率為 13.45%。

拉丁美洲資料中心冷卻市場的成長得益於雲端基礎服務的日益普及、該地區數位經濟的擴張、人工智慧技術的日益融合、5G 網路的不斷推出以及向可再生能源的顯著轉變採購。

在建IT負載容量:預計2030年,拉丁美洲資料中心市場未來IT負載容量將達到約2,400MW。

在建高建築面積:到 2030 年,該地區的占地面積預計將增加 860 萬平方英尺。

規劃機架數量:到2030年,該地區安裝的機架總數預計將達43萬個。

規劃中的海底電纜:該地區正在建造多條海底電纜系統。計劃於 2024 年底年終建成的海底電纜之一是 Firmina,長 14,517 公里,登陸點包括阿根廷的拉斯托尼納斯、巴西的大普拉亞、美國的默特爾比奇和烏拉圭的埃斯特角城。

拉丁美洲資料中心冷卻市場趨勢

預計 IT 和電信業將實現最高成長

- 拉丁美洲處於高科技革命的前沿,巴西、墨西哥、哥倫比亞、阿根廷和智利正在成為主要企業。墨西哥的 IT 產業規模達 280 億美元,是該地區第二大產業,但巴西則以 450 億美元的高科技市場領先。值得注意的是,巴西對科技的投資比例最高。

- 2022年,巴西在全球創新指數中在131個國家中排名第54。到 2023 年,軟體、服務和硬體產業的投資預計將超過 462 億美元(ABES)。此外,巴西擁有約 63 萬名 IT 領域專業人員,其中 133,000 名專門從事軟體開發。

- 此外,墨西哥公司堅持投資新興技術的計畫。預計未來兩年這些技術的採用率將翻倍。趨勢亮點:全球 42% 的企業已在使用 5G,邊緣運算採用率為 25%,IT 自動化採用率為 45%,區塊鏈採用率為 16%,但預計未來兩年將達到 100%預計將躍升至近30%。

- 在通訊業,大公司都優先考慮網路基礎建設,尤其是在已開發國家。例如,2024年4月,墨西哥領先的通訊公司America Movil宣布致力於5G投資。該公司計劃在2024年實施71億美元的資本支出。預計這些市場趨勢將在未來幾年推動資料中心需求的成長,從而推動資料中心冷卻基礎設施製造商的需求成長。

巴西是成長最快的

- 巨量資料資料中心市場的成長主要受到數位轉型、雲端採用、資料中心擴展、物聯網 (IoT)、電子商務成長、通訊基礎設施(5G 技術推出)和人工智慧 (AI) 的推動。數位化舉措。總體而言,這些因素推動了巴西市場對資料中心冷卻解決方案的需求不斷成長,鼓勵國內外參與企業投資冷卻系統,以支持該國日益成長的數位經濟。

- 巴西的資訊和通訊技術 (ICT) 產業處於技術創新的前沿,推動了顯著的進步並創造了面向未來的環境。最尖端科技的ICT產業正在開闢一個充滿可能性的世界,同時也面臨決定其發展的挑戰。

- 2023年,巴西ICT產業累計將創收7,080億雷亞爾(約1,420億美元),較2022年實質成長率為5.9%。具體來看,IT 產業處於領先地位,累計4,220 億雷亞爾,包括軟體、雲端服務、硬體和數位技術。同時,涵蓋語音、資料和網路實施的電訊服務佔剩餘的 2,850 億雷亞爾。

- 此外,受安全、資料管理、人工智慧 (AI) 和增強客戶體驗 (CX) 解決方案需求不斷成長的推動,軟體市場預計將在 2023 年成長 15.1%。特別值得注意的是,軟體即服務(SaaS)預計將成長27.6%,並佔所有軟體收入的一半。同時,包括應用管理、諮詢和系統整合在內的一般IT服務預計也將成長6.7%。

- 在IT和通訊擴展方面,2024年4月,巴西政府宣布與墨西哥著名通訊建立戰略合作夥伴關係,以加強光纖和5G基礎設施。這位企業家承諾在未來五年內向巴西注入約 400 億雷亞爾。考慮到上述案例,IT 和電訊領域將在可預見的未來產生更多的儲存需求。儲存需求的激增預計將推動對資料中心的需求,並增加對資料中心冷卻解決方案的需求。

拉丁美洲資料中心冷卻產業概況

拉丁美洲資料中心冷卻市場主要企業之間的整合程度尚不理想,近年來競爭愈發激烈。該領域的一些著名市場領導包括 Stulz GmbH、Rittal GMBH & Co.KG、施耐德電機 SE、Vertiv Group Corp. 和三菱電機株式會社。憑藉顯著的市場佔有率,這些行業巨頭正在積極致力於擴大其在該全部區域的基本客群。他們的成長策略主要依靠旨在增加市場佔有率和整體盈利的策略合作。此外,施耐德電機、江森自控國際有限公司和三菱電機等公司也提供液體和空氣冷卻產品。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 冷卻的主要成本考量

- 分析與資料中心營運相關的主要成本開銷,以了解資料中心冷卻情況

- 對每種冷凍技術的成本和營運考慮進行比較研究,主要考慮因素包括設計複雜性、PUE、優點、缺點以及可用的自然天氣條件範圍

- 資料中心冷卻的關鍵技術創新與發展

- 資料中心所使用的關鍵節能技術

第5章 市場動態

- 市場促進因素

- 政府措施和日益成長的數位化需求正在推動市場成長

- 綠色解決方案日益成長的趨勢推動了研究市場的需求

- 市場問題

- 冷卻解決方案相關法規的動態特性

- 市場機會

- 該地區採用人工智慧正在推動受訪市場的需求

- 生態系分析

第6章 區域資料中心足跡現況分析

- 資料中心 IT 負載能力與麵積足跡分析(2018-2030)

- 區域內目前資料中心熱點及未來擴展前景分析

- 該地區領先的資料中心承包商和營運商的分析

第7章 市場區隔

- 按冷卻技術

- 空氣冷卻

- 冷卻器和節熱器

- CRAH

- 冷卻塔(包括直接冷卻、間接冷卻、雙級冷卻)

- 其他空氣冷卻技術

- 液體冷卻

- 浸入式冷卻

- 晶片直接冷卻

- 後門熱交換器

- 空氣冷卻

- 按類型

- 超大規模資料中心業者(自有和租賃)

- 企業(本地)

- 搭配

- 按最終用戶產業

- 資訊科技和電訊

- 零售和消費品

- 醫療

- 媒體娛樂

- 聯邦政府

- 其他

- 按國家

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲國家

第8章 競爭格局

- 公司簡介

- Stulz GmbH

- Rittal GMBH & Co. KG

- Schneider Electric SE

- Vertiv Group Corp.

- Mitsubishi Electric Corporation

- Daikin Industries Limited

- Johnson Controls International PLC

- Munters

- Alfa Laval AB

- Emerson Electric Co.

第9章投資分析

第10章 市場機會與未來趨勢

第 11 章:出版商

The Latin America Data Center Cooling Market size is estimated at USD 0.23 billion in 2025, and is expected to reach USD 0.48 billion by 2031, at a CAGR of 13.45% during the forecast period (2025-2031).

The growth of the Latin American data center cooling market is fueled by the rising adoption of cloud-based services, the region's expanding digital economy, increased integration of AI technologies, the ongoing deployment of 5G networks, and a notable shift toward renewable energy sourcing.

Under Construction IT Load Capacity: The upcoming IT load capacity of the Latin American data center market is expected to reach around 2,400 MW by 2030.

Under Construction Raised Floor Space: The region's construction of raised floor area is expected to increase by 8.6 million sq. ft by 2030.

Planned Racks: The region's total number of racks to be installed is expected to reach 430K units by 2030.

Planned Submarine Cables: Many submarine cable systems are under construction in the region. One such submarine cable, estimated to be built by the end of 2024, is Firmina, which stretches over 14,517 km with landing points in Las Toninas, Argentina; Praia Grande, Brazil; Myrtle Beach, SC, United States; and Punta del Este, Uruguay.

Latin America Data Center Cooling Market Trends

IT and Telecom Expected to Experience Highest Growth

- Latin America is at the forefront of the tech revolution, with Brazil, Mexico, Colombia, Argentina, and Chile emerging as its key players. Mexico boasts a USD 28 billion IT industry, making it the region's second-largest, while Brazil leads with a tech market valued at USD 45 billion. Notably, Brazil also allocates the highest percentage of its investments to technology.

- In 2022, Brazil secured the 54th position out of 131 countries in the Global Innovation Index. In 2023, investments in software, services, and hardware industries surpassed USD 46.2 billion (ABES). Additionally, In Brazil, approximately 630,000 professionals possess strong expertise in the IT field, with 133,000 focusing specifically on software development.

- Further, organizations in Mexico are steadfast in their investment plans for emerging technologies. Over the next two years, the adoption rates for these technologies are projected to double. Highlighting the trends: 5G is already in use by 42% of global companies; edge computing has seen a 25% adoption rate; IT automation stands at 45%; and while blockchain currently has a 16% adoption, it is anticipated to surge to nearly 30% in the coming two years.

- In the telecom industry, major players are prioritizing network infrastructure development, especially in developed nations. For example, in April 2024, America Movil, a leading telecommunications company from Mexico, announced its commitment to 5G investments. The company is scheduled to execute its capital expenditure plan, amounting to USD 7.1 billion, set for 2024. Such instances in the market are expected to create more need for data centers, boosting the demand for data center cooling infrastructure manufacturers in the coming years.

Brazil to Witness Highest Growth

- The growth of the Brazilian data center market is primarily driven by digital transformation, cloud adoption, data center expansion, the Internet of Things (IoT), e-commerce growth, telecommunications infrastructure (rollout of 5G technology), artificial intelligence (AI), big data, and government initiatives toward digitalization. These factors collectively contribute to the increasing demand for data center cooling solutions in the Brazilian market, driving both domestic and international players to invest in cooling systems to support the country's growing digital economy.

- Brazil's information and communications technology (ICT) industry is at the forefront of innovation, driving remarkable progress and creating a future-proof environment. Utilizing state-of-the-art technologies, the ICT industry opens up a world of possibilities while facing the challenges that define its growth.

- In 2023, Brazil's ICT industry raked in BRL 708 billion (USD 142 billion), marking a 5.9% real-term growth from 2022. Breaking down the figures, the IT segment led the charge, contributing BRL 422 billion reais, encompassing software, cloud services, hardware, and digital technologies. On the other hand, telecom services, covering voice, data, and network implementation, accounted for the remaining BRL 285 billion.

- Further, in 2023, the software market was poised for a 15.1% growth, propelled by the rising demand for security, data management, artificial intelligence (AI), and enhanced customer experience (CX) solutions. Notably, software-as-a-service (SaaS) is set to dominate, with an anticipated 27.6% surge, accounting for half of all software sales. Concurrently, general IT services, encompassing application management, consulting, and systems integration, are forecasted to witness a 6.7% uptick.

- Regarding telecommunication expansion, in April 2024, the Brazilian government announced a strategic partnership with a prominent Mexican telecommunications entrepreneur to bolster its optic fiber and 5G infrastructure. The entrepreneur has committed to injecting an estimated BRL 40 billion into Brazil over five years. Considering the above instances, the IT and telecom segment is poised to generate a heightened demand for storage in the foreseeable future. This surge in storage needs is anticipated to boost the demand for data centers, fueling the need for data center cooling solutions.

Latin America Data Center Cooling Industry Overview

The Latin American data center cooling market exhibits a moderate level of consolidation among key industry players, having sharpened their competitive edge in recent years. Notable market leaders in this segment include Stulz GmbH, Rittal GMBH & Co. KG, Schneider Electric SE, Vertiv Group Corp., and Mitsubishi Electric Corporation. These industry giants, boasting significant market shares, are actively engaged in expanding their customer base throughout the region. Their growth strategies primarily hinge on strategic collaborative efforts aimed at enhancing market share and overall profitability. Moreover, companies such as Schneider Electric SE, Johnson Controls International PLC, and Mitsubishi Electric Corporation offer liquid and air-based cooling products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of the Key Cost Overheads Related to DC Operations With an Eye on DC Cooling

- 4.2.2 Comparative Study of the Cost and Operational Considerations Related to Each Cooling technology Based on Key Factors Such as Design Complexity, PUE, Advantages, Drawbacks, Extent Of Utilization Of Natural Weather Conditions)

- 4.2.3 Key innovations and developments in Data Center Cooling

- 4.2.4 Key energy efficiency practices adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government initiatives and rising demand for digitalization are propelling market growth.

- 5.1.2 Growing trend towards green solutions drives the demand for the studied market

- 5.2 Market Challenges

- 5.2.1 Dynamic nature of regulations on cooling solutions

- 5.3 Market Opportunities

- 5.3.1 Adoption of AI in the Region Drives the Demand for Studied Market

- 5.4 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN THE REGION

- 6.1 Analysis of IT Load Capacity & Area footprint of Data Centers (for the period of 2018-2030)

- 6.2 Analysis of the current DC hotspots and scope for future expansion in the Region

- 6.3 Analysis of major Data Center Contractors and Operators in the Region

7 MARKET SEGMENTATION

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH

- 7.1.1.3 Cooling Tower (covers direct, indirect, and two-stage cooling)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-Chip Cooling

- 7.1.2.3 Rear-Door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Type

- 7.2.1 Hyperscalers (owned & Leased)

- 7.2.2 Enterprise (On-premise)

- 7.2.3 Colocation

- 7.3 By End-user Industry

- 7.3.1 IT and Telecom

- 7.3.2 Retail and Consumer Goods

- 7.3.3 Healthcare

- 7.3.4 Media and Entertainment

- 7.3.5 Federal and Institutional agencies

- 7.3.6 Other End-user Industries

- 7.4 By Country

- 7.4.1 Brazil

- 7.4.2 Mexico

- 7.4.3 Chile

- 7.4.4 Rest of Latin America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Stulz GmbH

- 8.1.2 Rittal GMBH & Co. KG

- 8.1.3 Schneider Electric SE

- 8.1.4 Vertiv Group Corp.

- 8.1.5 Mitsubishi Electric Corporation

- 8.1.6 Daikin Industries Limited

- 8.1.7 Johnson Controls International PLC

- 8.1.8 Munters

- 8.1.9 Alfa Laval AB

- 8.1.10 Emerson Electric Co.