|

市場調查報告書

商品編碼

1640639

即時定位系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Real Time Location System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

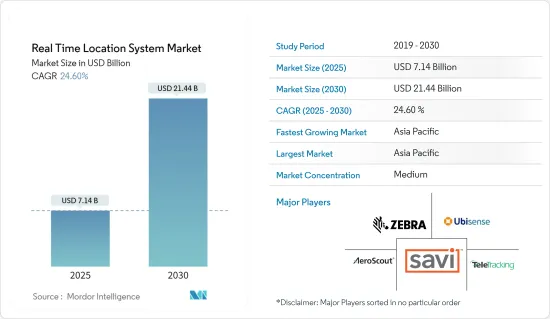

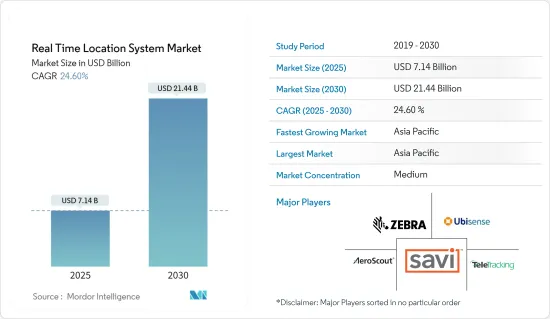

即時定位系統市場規模預計在 2025 年為 71.4 億美元,預計到 2030 年將達到 214.4 億美元,預測期內(2025-2030 年)的複合年成長率為 24.6%。

關鍵亮點

- 在您的業務流程中引入即時追蹤可以提高準確性和生產力,增強員工安全性,簡化物流和供應鏈業務,並最佳化您的整個流程。推動 RTLS 市場成長的關鍵因素包括資產追蹤需求的不斷成長、智慧型手機的廣泛普及、商業分析解決方案的日益普及以及對即時定位系統優勢的認知的不斷提高。

- 即時定位系統 (RTLS) 在電動車 (EV) 中發揮至關重要的作用,可增強導航、車隊管理和能源效率。透過利用 GPS、GNSS 和 IoT 連接等技術,這些系統可確保準確的位置追蹤和相關功能。例如,根據國際能源總署(IEA)的數據,2023年插電式電動車(PEV)的銷售量將達到約1,370萬輛。如此龐大的電動車數量預計將推動市場成長。

- 即時定位系統 (RTLS) 的整合改變了物流行業,徹底改變了貨物、車輛和流程的管理。 RTLS 使相關人員能夠即時監控貨物和庫存,提供端到端的可視性。此功能可最大程度地降低產品混淆的風險並增強課責。例如,根據印度港口部預測,2023會計年度印度的貨櫃總量將超過1.7億噸,上年度有顯著成長。如此龐大的貨櫃數量可能會促使公共和私人組織實施 RTLS,以確保順利運作。

- 即時定位系統 (RTLS) 在資產追蹤、物流和人員監控等領域提供了顯著的優勢。但也存在隱私和安全挑戰。這些挑戰源自於處理敏感地點。未經個人明確同意進行監控可能會導致違反道德和法律的行為,尤其是在職場或公共場所。長時間保留位置會增加濫用和違規的可能性,這可能與 GDPR 和 CCPA 等隱私法相衝突。此外,如果這些系統受到損害,即時和歷史位置都可能被公開,從而危及用戶的隱私和安全。

- 宏觀經濟因素對即時定位系統 (RTLS) 的採用、開發和市場動態有重大影響。這些系統依賴先進的硬體、軟體和網路基礎設施,而所有這些都容易受到宏觀經濟波動的影響。例如通貨膨脹:通貨膨脹會增加 RTLS 組件的成本。因此,零件成本的上升推高了整體 RTLS 解決方案的價格。這些價格上漲可能會阻止中小企業採用這些系統,因為它們認為這些系統是一項資本密集的投資。

- 例如,根據國際貨幣基金組織(IMF)的預測,2023年通膨率預計將為6.78%,2029年將達到3.37%。如果通膨下降,市場動態可能會改變。

即時定位系統的市場趨勢

醫療領域是成長最快的垂直市場,因為終端用戶

- 即時定位系統 (RTLS) 透過實現對資產、人員和患者的精確追蹤和管理,徹底改變了醫療保健領域。這種整合提高了業務效率,改善了患者照護,並顯著節省了成本。

- 2024 年 9 月,全球即時定位系統 (RTLS) 供應商 Quuppa 和醫療保健和關鍵產業資產管理解決方案創新者 ZulaFly 宣佈建立夥伴關係,重新定義位置服務格局。該聯盟結合了兩家公司的優勢,為全球企業提供無與倫比的精確度、創新和價值。

- Quuppa 的先進技術以其無與倫比的即時位置追蹤精度而聞名,並將與 ZulaFly 的先進資產管理和安全解決方案無縫整合。兩家公司將共同打造一個強大的生態系統,以滿足在安全、效率和保障至關重要的環境中對準確、即時資料日益成長的需求。

一些用途將會公佈。

- 資產追蹤和管理:醫院和醫療機構依賴各種醫療資產,例如輸液幫浦、輪椅、人工呼吸器、心臟去顫器等。 RTLS 可以即時追蹤這些資產,最大限度地減少搜尋設備的時間並確保在需要時可用。該技術不僅可以防止資產損失或被盜,還可以最佳化設備利用率。

- 病患追蹤與安全:RTLS 技術在監測病患方面發揮關鍵作用,尤其是那些容易走失的失智症或老年失智症患者。透過提供支援 RTLS 的腕帶,醫療保健提供者可以即時監控患者位置並確保其設施內的安全。

- 最佳化員工工作流程:最佳化醫療機構中的員工工作流程對於加強患者照護和最大限度地減少業務效率低下至關重要。 RTLS 可以追蹤醫護人員的位置,使管理人員能夠更有效地分配資源、減少回應時間並改善協調。

- 此外,預計各種變革趨勢將推動市場發展。例如,RTLS 市場轉型的核心是與物聯網 (IoT) 的無縫整合。透過利用物聯網技術,RTLS 可以提供準確的即時位置資料,使組織能夠簡化工作流程並提高業務效率。 RTLS 和物聯網的整合為從製造到零售等多個領域的高級資產追蹤、庫存監控和流程改進鋪平了道路。例如,根據愛立信預測,到2023年,近距離物聯網設備數量將達到1,209萬台,廣域物聯網設備數量將達到363萬台。

亞太地區強勁成長

工業成長和自動化

- 亞太地區有中國、日本、韓國和印度等主要製造地。各行各業都在採用 RTLS 來提高業務效率、追蹤資產並最佳化工作流程。例如,根據經濟調查,印度製造業在過去十年中年均成長率為 5.2%,在23會計年度貢獻了附加價值毛額的14.3%和總產值的35.2%。這一成長凸顯了其經濟重要性,並推動了亞太地區對即時定位系統的需求。根據國家統計局的數據,中國製造業已六個月來首次擴張,服務業在2024年10月實現復甦。

- 亞太地區的政府和私營部門擴大擁抱工業 4.0,重點關注自動化、物聯網整合和智慧工廠,所有這些都在推動 RTLS 的採用。例如,羅克韋爾自動化的最新研究顯示,到2023年,亞太地區44%的製造商計劃在未來一年內採用智慧製造。目前,中國80%的製造商、澳洲60%的製造商、印度59%的製造商已經實施此措施。此外,88%的亞太製造商預計智慧製造將維持或增加就業水準。隨著製造商越來越依賴先進技術來最佳化其營運和勞動力管理,這種轉變預計將推動該地區對即時定位系統的需求。

政府支持和基礎建設可望成為市場發展的驅動力

- 「健康中國2030」計劃提出,到2030年,中國醫療服務業規模將翻倍,達到約2.4兆美元。

- 同時,印度2024-25年聯邦預算強調了其對醫療保健轉型的承諾,累計8928.7億印度盧比(約107億美元)用於加強數位基礎設施和改善醫療保健服務。對醫療保健基礎設施和數位轉型的關注可能會推動亞太地區對即時定位系統的需求。因為這些系統可以支援衛生部門高效率的資源管理和服務交付。

- 根據新加坡海事及港務管理局的報告,新加坡2023年的貨櫃吞吐量將達到3,900萬標準箱,較2020年略有上升。聯合國貿易和發展會議進一步強調,新加坡港口船舶的平均載重噸為 17,224 噸。新加坡作為主要貿易樞紐的地位,加上其龐大的航運量,凸顯了其需要即時定位系統來最佳化業務效率。對提高效率的不斷成長的需求預計將推動亞太地區即時定位系統的應用,特別是在物流和供應鏈業務。

即時定位系統產業概況

即時定位系統市場由多個參與企業組成,主要是國內和國外,他們在競爭激烈的市場空間中爭奪關注。主要參與企業包括 Zebra Technologies Corporation、Ubisense Group PLC、Securitas Healthcare LLC(Securitas AB)、TeleTracking Technologies, Inc. 和 Savi Technology(La Salle Capital)。

市場技術的進步也為企業帶來了永續的競爭優勢。物聯網和雲端運算等技術正在重塑市場趨勢。較大的公司在研發和整合活動方面對市場具有強大的影響力。相反,市場滲透率高且細分化程度高。一家公司的品牌身份驗證對市場有重大影響。老字型大小企業有望佔據優勢,因為強大的品牌意味著更好的解決方案。

透過獲得分銷管道、現有的業務關係和創新平台,市場上的老牌企業比新競爭對手更具優勢。總體而言,供應商競爭激烈,預計在預測期內將進一步加劇。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 降低成本和最佳化流程的需求

- 在醫療領域迅速普及

- 追蹤技術的創新和車隊追蹤的最新進展將推動成長

- 市場問題

- 最終用戶中存在遺留基礎設施

- 隱私和安全問題

- 市場機會

- 透過自動接觸者追蹤抑制社區相關疾病的傳播

第6章 市場細分

- 按行業

- 醫療

- 主要應用

- 技術板塊

- Bluetooth

- Wi-Fi

- RFID

- 超寬頻(UWB)

- 紅外線 (IR)

- 製造業

- 主要應用

- 技術板塊

- Bluetooth

- RFID

- Wi-Fi

- UWB

- 零售

- 主要應用

- 技術板塊

- Wi-Fi

- UWB

- Bluetooth

- 運輸和物流

- 主要應用

- 技術板塊

- RFID

- UWB

- Bluetooth

- 政府和國防

- 主要應用

- 技術板塊

- RFID

- UWB

- 石油和天然氣

- 主要應用

- 技術板塊

- RFID

- UWB

- 醫療

- 按組件

- 硬體

- 軟體和服務

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Zebra Technologies Corporation

- Ubisense Ltd.

- Securitas Healthcare LLC.(Securitas AB)

- TeleTracking Technologies, Inc.

- Savi Technology(La Salle Capital)

- CenTrak, Inc.(Halma PLC)

- AiRISTA Offerings

- Midmark Corporation

- IDENTEC SOLUTIONS AG(Identec Group AG)

- Sonitor Technologies AS

- Kontakt Micro-Location Sp. Zoo

- Alien Technology, LLC.

- Impinj, Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Real Time Location System Market size is estimated at USD 7.14 billion in 2025, and is expected to reach USD 21.44 billion by 2030, at a CAGR of 24.6% during the forecast period (2025-2030).

Key Highlights

- Implementing real-time tracking in corporate processes boosts accuracy and productivity, enhances employee safety, streamlines logistical and supply chain operations, and optimizes overall processes. Key drivers fueling the growth of the RTLS market include rising demand for asset tracking, widespread smartphone usage, growing adoption of business analytics solutions, and heightened awareness of the benefits of real-time location systems.

- Real-time location systems (RTLS) are pivotal in electric vehicles (EVs) for enhancing navigation, managing fleets, and boosting energy efficiency. Leveraging technologies such as GPS, GNSS, and IoT connectivity, these systems ensure accurate location tracking and associated features. For instance, according to the IEA (International Energy Agency), 2023 saw plug-in electric light vehicle (PEV) sales of around 13.7 million units. Such a huge number of electric vehicles would propel the market growth.

- The integration of real-time location systems (RTLS) has transformed the logistics industry, revolutionizing the management of goods, vehicles, and processes. RTLS empowers stakeholders to monitor shipments and inventory in real-time, providing end-to-end visibility. This capability minimizes the risk of misplaced goods and bolsters accountability. For instance, according to the Ministry of Ports India, in fiscal year 2023, India witnessed a total container volume exceeding 170 million metric tons, marking a notable uptick from the previous year. Such a huge number of containers would propel the public and private agencies to deploy RTLS for smooth operations.

- Real-Time Location Systems (RTLS) provide substantial advantages in areas such as asset tracking, logistics, and personnel monitoring. However, they also bring forth significant privacy and security challenges. These challenges arise from the handling of sensitive location data. Monitoring individuals without their clear consent can result in ethical and legal breaches, particularly in workplaces or public venues. Holding onto location data for extended periods heightens the chances of misuse or breaches, potentially contravening privacy laws like GDPR or CCPA. Furthermore, if these systems are compromised, there's a risk of exposing both real-time and historical location data, jeopardizing user privacy and safety.

- Macroeconomic factors wield considerable influence over the adoption, development, and market dynamics of Real-Time Location Systems (RTLS). These systems hinge on a sophisticated blend of hardware, software, and network infrastructure, all of which are susceptible to macroeconomic fluctuations. Take inflation, for instance: It can drive up the costs of RTLS components. Consequently, this surge in component costs elevates the overall price of RTLS solutions. Such price hikes might deter SMEs from embracing these systems, perceiving them as capital-intensive investments.

- For instance, according to the International Monetary Fund (IMF), the inflation rate in 2023 was 6.78% and is expected to reach 3.37% by 2029. A decline in the inflation rate would change the dynamics of the market.

Real Time Location System Market Trends

Healthcare Sector to be the Fastest End-user Vertical

- Real-Time Location Systems (RTLS) have transformed healthcare by enabling precise tracking and management of assets, personnel, and patients. This integration has boosted operational efficiency, elevated patient care, and yielded substantial cost savings.

- In September 2024, Quuppa, the global provider of real-time location systems (RTLS), and ZulaFly, an innovator in healthcare and critical industry asset management solutions, announced a partnership set to redefine the landscape of location-based services. This collaboration brings together two industry players, combining their strengths to deliver unparalleled precision, innovation, and value to businesses worldwide.

- Quuppa's advanced technology, known for its unparalleled accuracy in real-time location tracking, will seamlessly integrate with ZulaFly's advanced asset management and safety solutions. Together, the two companies are poised to create a robust ecosystem that addresses the growing demand for precise, real-time data in environments where safety, efficiency, and security are paramount.

Some of the applications include:

- Asset Tracking and Management: Hospitals and healthcare facilities rely on various medical assets, including infusion pumps, wheelchairs, ventilators, and defibrillators. With RTLS, these assets can be tracked in real-time, minimizing the time spent searching for equipment and ensuring availability when needed. This technology not only prevents asset loss or theft but also optimizes equipment utilization.

- Patient Tracking and Safety: RTLS technology plays a crucial role in monitoring patients, particularly those susceptible to wandering, like individuals with dementia or Alzheimer's. By providing RTLS-enabled wristbands, healthcare providers can monitor patients' real-time locations, ensuring their safety within the facility.

- Staff Workflow Optimization: Optimizing staff workflows in healthcare facilities is vital for enhancing patient care and minimizing operational inefficiencies. RTLS tracks healthcare workers' locations, allowing administrators to allocate resources more effectively, shorten response times, and improve coordination.

- Further, there are various transformative trends which are expected to propel the market. For instance, central to the transformation of the RTLS market is the seamless integration of the Internet of Things (IoT). By harnessing IoT technologies, RTLS delivers accurate, real-time location data, empowering organizations to streamline workflows and boost operational efficiency. The convergence of RTLS and IoT paves the way for advanced asset tracking, inventory oversight, and process refinement across a myriad of sectors, spanning from manufacturing to retail. For instance, according to Ericsson, in 2023, there are 12.09 million short-range IoT devices and 3.63 million wide-area IoT devices.

Asia Pacific to Register Major Growth

Industrial Growth and Automation

- APAC is home to major manufacturing hubs like China, Japan, South Korea, and India. Industries are adopting RTLS to improve operational efficiency, track assets, and optimize workflows. For instance, India's manufacturing sector grew at an average annual rate of 5.2% over the last decade, contributing 14.3% to gross value added and 35.2% to total output in FY23, as per the Economic Survey. This growth highlights its economic importance and is driving demand for real-time location systems in the Asia-Pacific as industries adopt these solutions to optimize operations and improve efficiency. China's manufacturing sector expanded for the first time in six months, with services recovering in October 2024, according to the National Bureau of Statistics.

- Governments and private sectors in APAC are increasingly embracing Industry 4.0, which emphasizes automation, IoT integration, and smart factories, all of which drive RTLS adoption. For instance, Rockwell Automation's latest study revealed in 2023 that 44% of APAC manufacturers plan to adopt smart manufacturing within the next year. Currently, 80% of Chinese manufacturers, 60% of Australian manufacturers, and 59% of Indian manufacturers have already implemented it. Additionally, 88% of APAC manufacturers expect smart manufacturing to sustain or grow employment levels. This shift is likely to drive demand for real-time location systems in the region as manufacturers increasingly rely on advanced technologies to optimize operations and workforce management.

Governmental Support and Infrastructure Development is Expected to Drive the Market Opportunities

- By 2030, the Healthy China 2030 initiative aims to double the nation's health service industry, targeting a valuation of around USD 2.4 trillion.

- Concurrently, India's Union Budget for 2024-25 emphasizes a commitment to healthcare transformation, designating INR 89,287 crores (approximately USD 10.70 billion) to enhance digital infrastructure and improve healthcare accessibility. This focus on healthcare infrastructure and digital transformation is likely to increase the demand for real-time location systems in the Asia-Pacific region, as these systems can support efficient resource management and service delivery in the healthcare sector.

- In 2023, Singapore's container throughput hit 39 million TEUs, marking a slight uptick from 2020, as reported by the Maritime and Port Authority of Singapore. Additionally, UNCTAD highlighted that vessels at Singapore's port boasted an average DWT of 17,224. Singapore's position as a major trading hub, coupled with its high shipping traffic, underscores the need for real-time location systems to optimize operational efficiency. This growing demand for enhanced efficiency is expected to drive the adoption of real-time location systems across the Asia-Pacific region, particularly in logistics and supply chain operations.

Real Time Location System Industry Overview

The RTLS market primarily comprises multiple domestic and international players fighting for attention in a contested market space. The major players include Zebra Technologies Corporation, Ubisense Group PLC, Securitas Healthcare LLC (Securitas AB), TeleTracking Technologies, Inc., and Savi Technology (La Salle Capital).

Technological advancements in the market also give companies a sustainable competitive advantage. Technologies, such as IoT and cloud, are reshaping market trends. Major companies strongly influence the market in terms of R&D and consolidation activities. Conversely, the market can be characterized by high levels of market penetration and increasing levels of fragmentation. The brand identity associated with the companies has a major influence on the market. Strong brands are synonymous with better solutions, so long-standing players are expected to have the upper hand.

Access to the distribution channel, already present business relations, and the innovative platform give the established giants in the market an advantage over the new competitors. Overall, the intensity of competitive rivalry among the vendors is expected to be high and increase during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key Stakeholder Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Cost Reduction and Process Optimization

- 5.1.2 Rapid Adoption in the Healthcare Segment

- 5.1.3 Innovations in Tracking Technology and Recent Advancements in Fleet Tracking to Aid Growth

- 5.2 Market Challenges

- 5.2.1 Presence of Legacy Infrastructure Across End Users

- 5.2.2 Privacy and Security Concerns

- 5.3 Market Opportunities

- 5.3.1 Automated Contact Tracing to Mitigate the Spread of Community-related Diseases

6 MARKET SEGMENTATION

- 6.1 By End-user Vertical

- 6.1.1 Healthcare

- 6.1.1.1 Major Applications

- 6.1.1.2 Segmentation by Technology

- 6.1.1.2.1 Bluetooth

- 6.1.1.2.2 Wi-Fi

- 6.1.1.2.3 RFID

- 6.1.1.2.4 Ultra-wideband (UWB)

- 6.1.1.2.5 InfraRed (IR)

- 6.1.2 Manufacturing

- 6.1.2.1 Major Applications

- 6.1.2.2 Segmentation by Technology

- 6.1.2.2.1 Bluetooth

- 6.1.2.2.2 RFID

- 6.1.2.2.3 Wi-Fi

- 6.1.2.2.4 UWB

- 6.1.3 Retail

- 6.1.3.1 Major Applications

- 6.1.3.2 Segmentation by Technology

- 6.1.3.2.1 Wi-Fi

- 6.1.3.2.2 UWB

- 6.1.3.2.3 Bluetooth

- 6.1.4 Transportation and Logistics

- 6.1.4.1 Major Applications

- 6.1.4.2 Segmentation by Technology

- 6.1.4.2.1 RFID

- 6.1.4.2.2 UWB

- 6.1.4.2.3 Bluetooth

- 6.1.5 Government and Defense

- 6.1.5.1 Major Applications

- 6.1.5.2 Segmentation by Technology

- 6.1.5.2.1 RFID

- 6.1.5.2.2 UWB

- 6.1.6 Oil and Gas

- 6.1.6.1 Major Applications

- 6.1.6.2 Segmentation by Technology

- 6.1.6.2.1 RFID

- 6.1.6.2.2 UWB

- 6.1.1 Healthcare

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software and Services

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zebra Technologies Corporation

- 7.1.2 Ubisense Ltd.

- 7.1.3 Securitas Healthcare LLC. (Securitas AB)

- 7.1.4 TeleTracking Technologies, Inc.

- 7.1.5 Savi Technology (La Salle Capital)

- 7.1.6 CenTrak, Inc. (Halma PLC)

- 7.1.7 AiRISTA Offerings

- 7.1.8 Midmark Corporation

- 7.1.9 IDENTEC SOLUTIONS AG (Identec Group AG)

- 7.1.10 Sonitor Technologies AS

- 7.1.11 Kontakt Micro-Location Sp. Z.o.o.

- 7.1.12 Alien Technology, LLC.

- 7.1.13 Impinj, Inc.