|

市場調查報告書

商品編碼

1640680

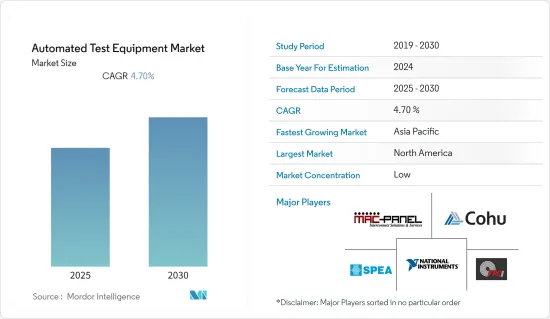

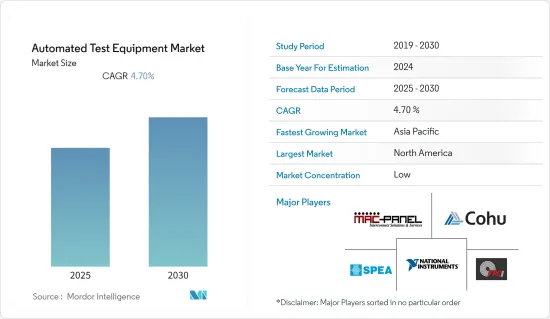

自動測試設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automated Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,自動測試設備 (ATE) 市場預計將實現 4.7% 的複合年成長率

關鍵亮點

- ATE 市場的成長與家用電子電器產業日益成長的需求成正比。 ATE 廣泛應用於家用電子電器中,用於測試製造後的電子元件和系統。 ATE 由電腦控制,包含複雜的測試設備,能夠測試和發現電子元件和積體電路中的缺陷。

- 全球對 5G 技術的需求不斷增加是電訊領域的一個突出因素,預計將刺激市場擴張。 Marvin Test Solutions, Inc. 是一家為航太、軍事和工業公司提供專有測試服務的開發商,該公司於2021 年4 月宣布,其產品已作為TS-900e 5G mmWave 半導體設備出售,該設備被矽晶圓製造商廣泛使用。

- 這些技術被廣泛應用,因為它們可以滿足毫米波半導體裝置的高通量製造要求。 TS-900e-5G 非常適合晶圓探測和封裝測試,並且與常見的製造機器人和處理設備相容。此外,半導體製造流程的發展和全球行動網路的擴張可能會對自動化測試工具市場的成長產生重大影響。

- 自動化測試技術的成本是阻礙全球自動化測試設備產業成長的主要因素。高昂的材料成本以及將被測設備(DUT)連接到其他系統的困難限制了可尋址市場的發展。

- 由於製造工廠關閉,COVID-19 疫情減少了許多產業對自動化測試技術的需求,尤其是工業、家用電子電器和汽車產業。然而,由於新冠疫情爆發,越來越多的人在家工作,對筆記型電腦、平板電腦和桌上型電腦的需求也增加了。這導致 OSAT 和消費性電子產品OEM對自動化測試技術的產業需求增加,使得該產業在疫情期間能夠持續成長。同時,消費性電子和航空業電子基礎設施技術的發展可能會在疫情後推動自動化測試設備產業的成長。

自動測試設備 (ATE) 市場趨勢

航太和國防預計將佔據較大的市場佔有率

- 由於各地區政府支出的增加,過去 30 年來航太和國防工業採用複雜設備的數量增加。這導致了技術的快速發展,創新提高了現有工具的效率並涵蓋了新的操作領域,使其具有更廣泛的功能。

- 隨著收益的增加,航太產業預計將在自動化測試設備上投入大量資金。根據美國人口普查局的數據,美國航太產品和零件製造業的收益逐漸增加。疫情期間收入會略有下降,之後會逐漸增加。預計未來兩年美國航太產品和零件製造銷售額將達到約 2,645 億美元。

- 航太和軍事領域使用的電子設備必須品質高,因為任何缺陷都可能導致災難性的事故。因此,航空和國防領域的電子設備製造需要藉助自動化測試設備進行廣泛檢查,從而推動預測期內的市場成長。

- 隨著新技術的引入,需要升級測試設備。例如,美國航空系統司令部(NAVAIR)在從舊系統過渡到新系統的過程中更新了技術,以測試航空母艦上的飛機和武器。該組織要求保持向後相容性,允許 eCASS 站使用先前的 CASS 程序的測試程序集。

- 幾十年來,航太和國防工業一直使用國家儀器公司 (NI) 的模組化儀器和應用軟體來降低與測試和支援其產品相關的整體成本和風險。 NI 與數千名工程師和領導團隊合作,透過測試工程和營運支援的進步來管理風險並創造永續的市場優勢。

預計北美將佔據較大的市場佔有率

- 對低成本消費產品的需求不斷成長以及半導體行業採用率的穩定成長被認為是推動北美(尤其是美國) ATE 市場成長的主要因素。雖然 ATE 非常昂貴,但從長遠來看,它是一種經濟有效的解決方案,因為它可以在最少的人為干預下測試大量樣本。

- 此外,該地區擁有大量供應商,促進了市場的成長。國家儀器公司、Astronics 公司、Roos Instruments, Inc. 等

- Stadler US是國際綜合列車設計與製造商Stadler Rail AG的完全子公司。 Astronix 與 Stadler 及其主要系統供應商合作設計自動測試和診斷設備,透過確保關鍵的鐵路車輛系統保持良好的維修狀態來確保乘客安全。

- 美國航太部門被認為是全球最重要的航空航太業之一,也是其他國家軍用和民用航太硬體的主要供應商。美國龐大的航太工業,其航太產品的大部分用於出口。該國的航太市場是世界上最大的市場,其特點是擁有技術熟練且樂於助人的勞動力、多樣化的產品和廣泛的分銷系統,這就是許多外國公司被該國航太市場吸引的原因。

- 自動化測試設備在國防領域進一步應用。該國國防工業的預算分配額比全球一半以上國家的經濟總額還要高。

- 此外,為了縮短發佈時間表,ATE 擴大應用於行動裝置等家用電子電器。隨著網路安全威脅的增加和應用程式變得越來越複雜,公司正在轉向 ATE 來增強其企業應用程式的測試和覆蓋範圍。

自動測試設備 (ATE) 產業概況

自動測試設備市場高度分散,主要參與者有 Virginia Panel Corporation、MAC Panel Company、Xcerra Corporation、National Instruments Corporation 和 SPEA SpA。此外,自動化測試設備廣泛應用於各行各業,為供應商提供了成長機會。市場參與企業正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 12 月,提高半導體製造產量比率和生產率的設備和服務的全球供應商 Cohu, Inc. 宣布與中華精測科技建立戰略合作夥伴關係。中華精測科技是領先的測試介面解決方案供應商,為半導體測試市場提供先進的探針卡和介面產品。 Cohu 的毫米波射頻探頭和插座技術與 CHPT 的精密基板和負載板相結合,為探測和最終測試提供了最佳化的承包介面解決方案,降低了客戶成本並加快了市場採用速度。 。

2022 年 4 月,美國國家儀器公司 (NI) 收購了 Kratzer Automation。透過收購 Kratzer Automation,NI 擴展了其 EV 測試能力。該公司提供與電動車測試軟體完全整合的測試設備,使其能夠測試電動車的所有關鍵部件,包括電池、逆變器和引擎控制。 NI 表示,NI 靈活的電動車硬體和軟體測試平台與Kratzer Automation 特定應用的電動車軟體和整合功能相結合,將使更廣泛的客戶能夠更好地適應不斷變化的測試需求。的反應時間、更短的測試時間推向市場,並降低整體測試成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 工業吸引力波特五力模型

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 消費性電子產品銷售成長與物聯網爆炸性普及

- 更重視先進的測試方法,從而產生多種測試案例

- 市場限制

- 測試設備高成本

第6章 市場細分

- 按測試設備類型

- 記憶

- 非記憶

- 離散的

- 測試處理程序

- 按最終用戶產業

- 航太和國防

- 消費性電子產品

- 資訊科技/通訊

- 車

- 醫療

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 日本

- 中國

- 韓國

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲國家

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Virginia Panel Corporation

- MAC Panel Company

- Xcerra Corporation

- National Instruments Corporation

- SPEA SpA

- Advantest Corporation

- Star Technologies

- Aeroflex, Inc.

- Astronics Corporation

- Roos Instruments, Inc.

- Chroma ATE, Inc.

- Samsung Semiconductor, Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Automated Test Equipment Market is expected to register a CAGR of 4.7% during the forecast period.

Key Highlights

- The ATE market's growth is directly proportional to the increase in demand from the consumer electronics industry. ATE is widely used in consumer electronics to test electronic components and systems after fabrication. It is controlled through a computer, which includes loads of complex test instruments capable of testing and finding faults in the electronic components or integrated circuits.

- The increase in demand for 5G technology adoption worldwide is a prominent element in the telecom sector projected to fuel market expansion. Marvin Test Solutions, Inc., a developer of unique test services for aerospace, military, and industrial enterprises, revealed on April 2021 that their products are TS-900e-5G industrial test equipment for 5G millimeter Wave semiconductor equipment widely utilized by silicon manufacturers.

- These technologies are widely used because they allow manufacturers to satisfy high-throughput manufacturing demands for millimeter Wave semiconductors devices. The TS-900e-5G is perfect for wafer probe and package testing and is compatible with most common manufacturing robotics and handling equipment. Furthermore, developments in semiconductor production processes and the global expansion of mobile networks would substantially influence the growth of the autonomous test tools market.

- The expenses of automated testing technology are a key hindrance to the growth of the global automation test device industry. Expensive material expenditures and difficulties linking the device under test (DUT) to additional systems restrict the targeted market's development.

- Due to the suspension of manufacturing factories, the COVID-19 outbreak has reduced demand for automation test technology from many industries, notably industrial, household electronics, and automotive. Nevertheless, the rise in the number of people working from home due to the outbreak has increased the demand for laptops, tablets, and desktops. This has raised industry demand for automation test technology from OSATs and household electronics OEMs, allowing the sector to continue growing during the outbreak. The development in electronic infrastructure technologies throughout the household electronics and aviation industries, on the other hand, is likely to boost growth in the automation test equipment industry after the pandemic.

Automated Test Equipment (ATE) Market Trends

Aerospace and Defence is Expected to Hold a Significant Market Share

- The aerospace and defense industry has witnessed a rise in the adoption of intricate devices in the last three decades, owing to increasing government spending in various regions. This has led to technology development at a rapid pace, with innovation leading to improvement in the efficiency of existing tools and further covering the new scope of operations useful for a wide range of functions.

- With more significant revenues, the aerospace industry is expected to spend significantly on automated test equipment. According to U.S. Census Bureau, The revenue of aerospace products and parts manufacturing in the U.S. is increasing Y-O-Y gradually. There is a slight decrease in revenue during a pandemic, and later, it increases gradually. The revenue of aerospace products and parts manufacturing in the U.S. is projected to amount to approximately USD 264,5 billion by the next two years.

- The electronic devices used in the aerospace and military sectors should be of high quality since any fault might result in major accidents. As a result, the manufacture of electronics equipment for the aviation and defense sectors must be extensively checked with the assistance of automation test equipment, driving the market growth over the forecast period.

- With the implementation of new technology, the need for upgrading the test equipment also arises. For instance, U.S. Naval Air Systems Command (NAVAIR) refreshed the technology as they transitioned from the older system to the newer system for testing aircraft and weapons on carriers. The organization maintained backward compatibility as a requirement, enabling the eCASS stations to leverage the test program set from the older CASS program.

- For decades, the aerospace and defense industry has used NI's (National Instruments Corp.) modular instrumentation and application software to reduce the overall cost and risk associated with its products' test and support. NI has worked with thousands of engineers and leadership teams to manage risk and generate a sustainable market advantage through test engineering and operational support advancements.

North America is Expected to Have a Significant Market Share

- The growing demand for low-cost consumer products, coupled with a steady rise in the adoption in the semiconductor industry, has been identified as the major driver for the growth of the ATE market in the North American region, especially the United States. Although ATE is highly expensive, they represent a cost-effective solution in the long term, as they can be used to test large volumes of samples with minimal human intervention.

- Moreover, the region has a strong foothold of vendors, contributing to the market's growth. Some include National Instruments Corporation, Astronics Corporation, and Roos Instruments, Inc.

- Stadler US is a wholly owned subsidiary of Stadler Rail AG, an international designer, and manufacturer of a comprehensive range of trains. Astronics would work with Stadler and its major systems suppliers to design and deploy automatic testers and diagnostics that ensure passenger safety by verifying that critical railcar systems remain in a state of good repair.

- The aerospace sector of the US is considered the global most significant and one of the leading suppliers of military and civil aerospace hardware to the rest of the world. The huge aerospace industry of the United States exports more of all aerospace production. Many foreign firms are attracted to the country's aerospace market as it is the largest in the world, characterized by a skilled and hospitable workforce, diverse offerings, and extensive distribution systems.

- Automated test equipment further finds its application in the defense sector. The defense industry in the country has a budget allocation that is more than the entire economy of more than half of the existing countries in the world.

- Also, the application of ATE in consumer electronics, such as mobile devices, is prospering to make the release schedules shorter. With growing cybersecurity threats and the rising complexity of applications, organizations are also enhancing the test coverage for their enterprise application suite with the help of ATE throughout the region.

Automated Test Equipment (ATE) Industry Overview

The automated test equipment market is highly fragmented, with major players like Virginia Panel Corporation, MAC Panel Company, Xcerra Corporation, National Instruments Corporation, and SPEA SpA, among others. Moreover, automated test equipment is used in various industries to provide vendors with growth opportunities. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In December 2022, Cohu, Inc., a global equipment and service supplier that improves semiconductor manufacturing yield and productivity, announced a strategic partnership with Chunghwa Precision Test Tech. Co., Ltd. is a leading test interface solution provider that delivers advanced probe card and interface products to the semiconductor test market. Cohu's mmWave RF probe head and socket technology, together with CHPT's sophisticated substrate and load boards, would result in an optimized turnkey interface solution for probe and final test, reducing client costs and increasing time to market.

In April 2022, National Instruments Corporation (NI) acquired Kratzer Automation. With the acquisition of Kratzer Automation, NI expands its EV test capabilities. The company could test all important components of EVs, such as the battery, inverter, and engine control, by supplying EV testing software and fully integrated test equipment. The combination of NI's flexible EV hardware and software test platform and Kratzer Automation's application-specific EV software and integration capabilities, according to NI, would enable faster responses to change test needs, faster time to market, and lower total cost of test for a broader range of customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Consumer Electronics Sales and Explosion of IOT

- 5.1.2 Increased Focus on Sophisticated Testing Methods Leading to Multiple Test Cases

- 5.2 Market Restraints

- 5.2.1 High Costs Associated With Testing Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Test Equipment

- 6.1.1 Memory

- 6.1.2 Non - memory

- 6.1.3 Discrete

- 6.1.4 Test Handlers

- 6.2 By End-user Industry

- 6.2.1 Aerospace and Defense

- 6.2.2 Consumer Electronics

- 6.2.3 IT and Telecommunications

- 6.2.4 Automotive

- 6.2.5 Healthcare

- 6.2.6 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 Japan

- 6.3.3.2 China

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle-East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Virginia Panel Corporation

- 7.1.2 MAC Panel Company

- 7.1.3 Xcerra Corporation

- 7.1.4 National Instruments Corporation

- 7.1.5 SPEA SpA

- 7.1.6 Advantest Corporation

- 7.1.7 Star Technologies

- 7.1.8 Aeroflex, Inc.

- 7.1.9 Astronics Corporation

- 7.1.10 Roos Instruments, Inc.

- 7.1.11 Chroma ATE, Inc.

- 7.1.12 Samsung Semiconductor, Inc.