|

市場調查報告書

商品編碼

1640682

企業伺服器 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Enterprise Server - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

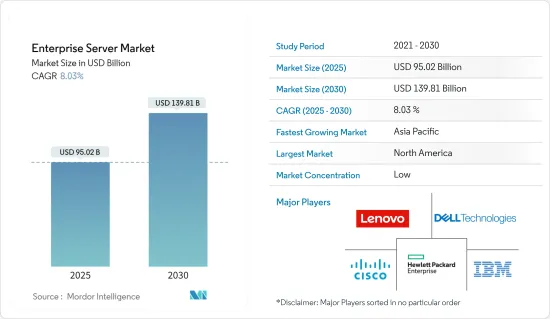

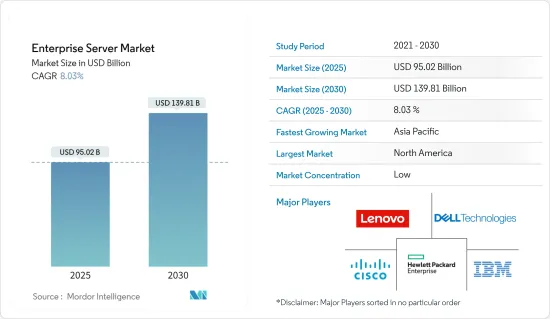

預計 2025 年企業伺服器市場規模為 950.2 億美元,到 2030 年將達到 1,398.1 億美元,預測期內(2025-2030 年)的複合年成長率為 8.03%。

預計市場將出現強大的創新,以提高效能、速度和內存,以支援巨量資料、高效能運算和商業智慧應用的普及。

關鍵亮點

- 企業伺服器是一種電腦伺服器,它包含滿足公司(而不是單一單位、使用者或特定應用程式)需求所需的程式。企業伺服器提供連線整合、廣播、TCP/IP、多播選擇以及使用者定義的衝突和休眠工具,以提高網路和桌面效能。

- 企業伺服器市場主要受到超大規模資料中心容量投資增加的推動,從而重塑了核心伺服器市場。此外,伺服器市場預計將經歷伺服器更新周期,這可能會對未來幾年的市場成長產生積極影響。

- 此外,快閃記憶體、虛擬和先進管理等新技術可能為市場成長提供新的途徑。為滿足企業和最終用戶的特定運算需求而開發的新應用程式也有望為企業伺服器市場的成長做出重大貢獻。

- 目前的伺服器數量無法在管理資料流量、工作負載和運算的同時跟上不斷成長的資料中心流量。不斷提高的伺服器運算能力和虛擬、多重工作負載以及每個實體伺服器更多的運算實例都要求有更多資料中心來處理這些負載。這是推動全球資料中心基礎設施投資的主要因素,為企業伺服器市場的成長做出了重大貢獻。

- 然而,使用企業伺服器的高昂前期和安裝成本是阻礙其廣泛採用的主要問題之一。高階企業伺服器對市場構成了障礙,因為它們的安裝和維護需要大量的技術技能。

企業伺服器市場趨勢

機架最佳化伺服器類型高速成長

- 機架伺服器比塔式伺服器相對較小,安裝在機架內。它旨在容納各種電子設備,包括冷卻系統、儲存單元、網路周邊設備、電池和 SAN 設備,這些設備垂直堆疊在伺服器旁邊。

- 使用機架伺服器的主要優點是使用者可以將所需的電子設備與伺服器堆疊在一起,一個機架可以存儲多台伺服器,佔用更少的空間,對全球許多人來說更實惠。愛。

- 預計預測期內,雲端服務供應商採用超大規模資料中心將大幅推動市場發展。此外,對機架最佳化伺服器的需求正在快速成長,迫使工業公司對這項技術進行投資。

- Supermicro 是解決方案供應商,該公司今天宣布,正在其核心 Supermicro 伺服器產品組合中擴大對領先開放硬體和開放原始碼技術的採用。此外,新發布的 8U 8-GPU 機架最佳化系統為大規模 AI 訓練提供了卓越的功率和熱性能,並包含一系列開放技術。

亞太地區成長率最高

- 據估計,由於人工智慧、物聯網和巨量資料等技術在各個終端用戶產業中的應用日益廣泛,對企業伺服器的需求也隨之增加,因此亞太地區預計將實現最高的成長率。

- 此外,隨著跨國和國內公司擴大轉向雲端服務供應商,資料中心服務的成長也推動了亞太地區企業伺服器的需求。

- 此外,印度政府的雲端運算政策規定,印度境內產生的資料可以儲存在印度境內,這可能導致印度境內資料儲存中心的數量和規模增加,從而有望振興企業伺服器市場。

- 此外,Google、蘋果等大公司也計劃在中國建立資料中心,為其不斷成長的業務尋求更好的連接和可擴展的解決方案。

企業伺服器產業概覽

企業伺服器市場競爭激烈,許多國內外參與企業進入該市場。目前,市場正在整合,少數參與企業佔據市場主導地位。主要企業採取的關鍵策略包括產品創新和併購。市場的主要企業包括惠普企業、戴爾科技公司、IBM 和思科系統公司。

- 2022 年 11 月,聯想將推出搭載第四代 AMD EPYC 處理器的 ThinkSystem 伺服器和 ThinkAgile 超融合 (HCI) 解決方案,包括 ThinkAgile VX 和 ThinkAgile HX,以加速混合多重雲端部署並簡化基礎架構管理。

- 2022 年 5 月,IBM 宣布將把 ESS 3500 添加到其 Spectrum Scale 企業儲存伺服器 (ESS) 產品組合中,具有更快的控制器 CPU 和更高的吞吐量。它旨在與 Nvidia 的 DGX 密集計算伺服器配合進行 AI 訓練。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果和先決條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 雲端遷移的興起

- 巨量資料的成長

- 市場限制

- 採用伺服器虛擬

第6章 市場細分

- 按作業系統

- Linux

- Windows

- UNIX

- 其他作業系統(i5/OS、z/OS 等)

- 按伺服器類別

- 高階伺服器

- 中階伺服器

- 低負載伺服器

- 按伺服器類型

- 刀刃

- 多節點

- 塔型

- 機架最佳化

- 按行業

- 資訊科技/通訊

- BFSI

- 製造業

- 零售

- 醫療

- 媒體娛樂

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Hewlett Packard Enterprise Co.

- Dell Technologies Inc.

- IBM Corporation

- Cisco Systems Inc.

- Lenovo Group Ltd

- Oracle Corporation

- NEC corporation

- Unisys Corporation

- Fujitsu Ltd

- Hitachi Ltd

- Toshiba Corporation

第8章投資分析

第9章:市場的未來

The Enterprise Server Market size is estimated at USD 95.02 billion in 2025, and is expected to reach USD 139.81 billion by 2030, at a CAGR of 8.03% during the forecast period (2025-2030).

The market landscape is expected to witness strong innovations to enhance performance, speed, and memory to support the surge of Big Data, high-performance computing, and business intelligence applications.

Key Highlights

- An enterprise server is a computer server that includes programs required to collectively serve the requirements of an enterprise instead of an individual unit, user, or specific application. An enterprise server provides consolidated connections, a choice of broadcast, TCP/IP, or multicast, as well as user-defined tools for conflation and hibernation, resulting in improved network and desktop performance.

- The market for enterprise servers is majorly driven by the increased investments in the capacity of hyperscale data centers to reshape the core server market. The server market is also expected to witness a server-refresh cycle, which may favorably impact market growth over the next few years.

- Furthermore, emerging technologies, such as flash storage, virtualization, and advanced management, may offer new avenues for market growth. New applications (developed to meet specific computing requirements of the enterprises and end users) are also expected to contribute significantly to the growth of the enterprise server market.

- With the current number of servers, managing data traffic, workload, and computing have been unable to keep up with the snowballing growth in data center traffic. With the increasing server computing capacity and virtualization, multiple workloads, and compute instances per physical server, there is a demand for more data centers to handle this load. This has been a significant factor driving investments in data center infrastructure across the world, significantly contributing to the growth of the enterprise server market.

- However, the high initial and installation costs related to using enterprise servers are one of the main concerns preventing their wider adoption. High-end corporate servers demand a significant level of technical skill to install and maintain, which is a barrier for the studied market.

Enterprise Server Market Trends

Rack Optimized Server Type to Witness High Growth

- A rack server is comparatively smaller and mounted within a rack compared to a tower server. It is designed to be positioned vertically, stacking various electronic devices, such as cooling systems, storage units, network peripherals, batteries, and SAN devices, with servers one over the other.

- The primary advantage of using a rack server is that a user can stack any required electronic devices with the server, wherein a single rack can contain multiple servers, hence, consuming lesser space, due to which it is now mostly preferred by many organizations across the world.

- Hyperscale data center adoption by cloud service providers is expected to drive the market considerably over the forecast period. Moreover, the demand for rack-optimized servers is rapidly increasing, compelling the industry players to invest in this technology.

- Supermicro, an IT solution provider for cloud, AI/ML, storage, and 5G/Edge, announced the expanded adoption of key open hardware and open source technologies into the core Supermicro server portfolio. Moreover, the newly launched 8U 8-GPU Rack Optimized Systems delivers superior power and thermal capabilities for large-scale AI Training and includes a host of open technologies.

Asia-Pacific to Witness Highest Growth Rate

- The Asia-Pacific region is estimated to register the highest growth rate, due to the increasing adoption of technologies, such as artificial intelligence, the Internet of Things, and Big Data, in various end-user industries, thus, increasing the demand for enterprise servers in this region.

- The increasing data center services in the Asia-Pacific region, owing to the growing number of multinational and domestic enterprises turning toward cloud service providers, are also driving the need for enterprise servers.

- Moreover, the Indian government's cloud computing policy, which says that the data generated in India may be stored within the country, may ramp up the number and size of data storage centers in India, thus, boosting the enterprise server market.

- Furthermore, major firms, such as Google and Apple, are also planning to open their data centers in China to seek enhanced connectivity and scalable solutions for their growing businesses.

Enterprise Server Industry Overview

The enterprise server market is competitive, owing to the presence of many players in the market in the market, both domestic and international. The market is consolidated as some players currently occupy most of the market. Some of the key strategies adopted by the major players are product innovation and mergers and acquisitions. Some major players in the market are Hewlett Packard Enterprise Co., Dell Technologies Inc., IBM Corporation, and Cisco Systems Inc., among others.

- On November 2022, Lenovo announced the launch of ThinkSystem servers and ThinkAgile hyper-converged (HCI) solutions, powered by 4th Gen AMD EPYC processors, including ThinkAgile VX and ThinkAgile HX, to enable faster hybrid multi-cloud deployment and simplify infrastructure management.

- On May 2022, IBM announced the launch of ESS 3500 to its Spectrum Scale Enterprise Storage Server (ESS) portfolio featuring a faster controller CPU and more throughput. It is designed to work with Nvidia's DGX-dense compute servers for AI training.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Migration to the Cloud

- 5.1.2 Growth of Big Data

- 5.2 Market Restraints

- 5.2.1 Adoption of Server Virtualization

6 MARKET SEGMENTATION

- 6.1 By Operating System

- 6.1.1 Linux

- 6.1.2 Windows

- 6.1.3 UNIX

- 6.1.4 Other Operating Systems (i5/OS, z/OS, etc.)

- 6.2 By Server Class

- 6.2.1 High-end Server

- 6.2.2 Mid-range Server

- 6.2.3 Volume Server

- 6.3 By Server Type

- 6.3.1 Blade

- 6.3.2 Multi-node

- 6.3.3 Tower

- 6.3.4 Rack Optimized

- 6.4 By End-user Vertical

- 6.4.1 IT and Telecommunication

- 6.4.2 BFSI

- 6.4.3 Manufacturing

- 6.4.4 Retail

- 6.4.5 Healthcare

- 6.4.6 Media and Entertainment

- 6.4.7 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hewlett Packard Enterprise Co.

- 7.1.2 Dell Technologies Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Lenovo Group Ltd

- 7.1.6 Oracle Corporation

- 7.1.7 NEC corporation

- 7.1.8 Unisys Corporation

- 7.1.9 Fujitsu Ltd

- 7.1.10 Hitachi Ltd

- 7.1.11 Toshiba Corporation