|

市場調查報告書

商品編碼

1640685

會計軟體 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Accounting Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

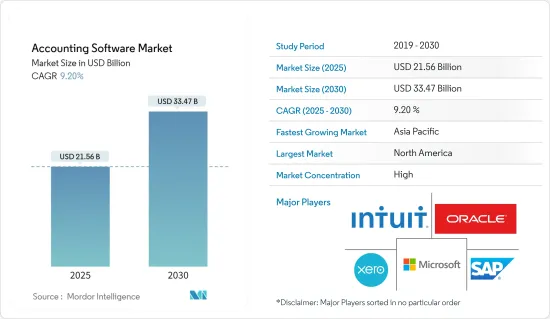

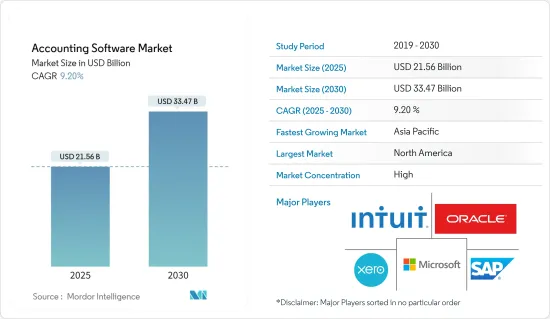

預計 2025 年會計軟體市場規模為 215.6 億美元,預計到 2030 年將達到 334.7 億美元,預測期內(2025-2030 年)的複合年成長率為 9.2%。

在過去的二十年裡,財務和會計軟體解決方案市場經歷了無數的變化。最大的變化之一是雲端基礎的會計軟體解決方案交付。

關鍵亮點

- 會計軟體解決方案簡化了會計流程,節省了時間並確保了企業和客戶之間的交易沒有錯誤。這些系統旨在透過歸檔、自動化和與人力資源系統的整合來提高生產力。為小型企業實施會計軟體可以幫助減少與客戶和公司打交道時的錯誤,從而改善關係和聲譽,並騰出時間專注於您的核心業務理念。

- 中小企業與電子商務參與企業合作以及與自動銀行資訊傳輸和自動發票功能等其他線上應用程式整合的趨勢日益明顯,這將推動預測期內會計軟體的採用,預計...該軟體透過追蹤所有會計交易並控制企業的資金流入和流出來幫助您提高效率。該軟體也為企業會計管理提供了更好的解決方案。輕鬆管理應付帳款、應收帳款、薪資核算、總分類帳和其他業務模組。

- 市場上,以會計為核心業務的供應商正在利用雲端運算的成本效益來佔領大量市場佔有率。此外,這些供應商瞄準的受眾比以往任何時候都更小眾:微型、小型和中型企業。這些會計軟體新進業者展示的一項顯著策略是將人工智慧等先進功能融入規劃、學習、解決問題和語音辨識的應用程式中。

- 例如,MYOB Advisor 是一家來自澳洲的稅務、會計和其他商業服務軟體供應商的解決方案,它可以自然地解釋公司的財務狀況。會計師和簿記員可以根據小型企業客戶的知識和經驗客製化報告。此外,MYOB Advisor 提供的洞察還包括現金流量可見性,讓顧問能夠幫助客戶了解現金流向何處並了解其主要帳戶,從而幫助他們更好地管理高價值關係。

- 此外,許多公司正在擴大合作夥伴計劃以增加市場佔有率。 2022 年 3 月,GTreasury 宣布與 Infor 建立合作關係。 GTreasury 建立在 Azure 平台上,為 Infor 客戶提供全面的財務解決方案,包括現金管理、付款、負債和投資管理、風險和曝險管理、避險會計以及包括儀表板在內的報告功能。此次收購將把 Infor資料與 GTreasury 的功能結合起來,幫助 Infor 客戶更好地處理現金管理。

- 此外,隨著世界各國面臨應對冠狀病毒疫情和封鎖的挑戰,越來越多的企業,甚至是小型企業,都在遠距辦公。這推動了個人對更動態、遠端存取財務記錄和系統的需求,這些人需要這些資訊來業務,也需要及時、準確的資訊來做出財務管理決策。

會計軟體市場趨勢

會計軟體效率的提高推動了市場成長

- 會計軟體用於記錄財務交易並管理企業的資金流入和流出,從而提高效率。會計軟體已成為管理企業財務的更好的解決方案,因為它允許您輕鬆管理應付帳款、應收帳款、薪資核算、總分類帳和其他業務模組。

- 此外,節省時間、高效營運和提高整體生產力等確保企業財務狀況準確的功能預計將推動需求。此外,這些因素使得該軟體更容易為中小型企業部署。

- 企業購買基於會計的軟體來增加功能並替換過時的系統。原因是會計計算繁瑣、複雜。要完成某件事,需要付出勞動。然而,會計軟體可以準確、精確地進行分析,無需任何勞動。

- 此外,會計行業的自動化也是軟體進步推動的持續趨勢。會計高度自動化,不需要大量物理干預。現代會計軟體使組織能夠最大限度地減少人力資源。這將帶來高效率的資本利用和更好的可用資源管理。

亞太地區將經歷最高成長

- 預計亞太地區會計軟體將出現加速成長,這主要歸因於商業會計行動應用程式的日益普及以及雲端運算技術和解決方案的日益普及。此外,中小企業的崛起以及它們在雲端運算和 SaaS 市場不斷增加的投資可能會推動市場成長。

- 透過實施各種舉措來提高企業對雲端的信任,地方政府在發展全部區域的雲端整合服務市場方面發揮著至關重要的作用,為所研究的市場創造了更多機會。

- 此外,該地區政府越來越重視促進組織付款和交易,並實現債務、負債和資產的追蹤,從而推動了對研究市場的需求。

- 此外,該地區的國家正在推動擁抱自動化的新技術的開發和使用,這反過來又增加了對會計軟體的需求,以幫助企業最佳化業務。中國、日本和印度等國家在工業級數位技術方面取得了進展,對雲端基礎的會計軟體有著強烈的偏好,財務管理和稅務規劃方法也得到了改善。此外,企業正在向數位化和工業 4.0 邁進以滿足其需求,加速了各行業對會計軟體的採用。這是因為他們必須應對商業世界中正在發生的激烈競爭。

會計軟體行業概況

會計軟體市場適度整合。主要企業佔有較大的佔有率。此外,現有的企業已經擁有基本客群,因此不願意轉換新參與企業,而從長遠來看,新參與企業也會被排名更高的企業收購,因此他們將無法維持其在市場中的地位。長期..主要參與企業包括 Oracle Corporation、Microsoft Corporation、Intuit Inc.、SAP SE、Sage Software Inc.、Infor Inc.、Epicor Software Corporation、Xero Ltd. 和 Unit4 Business Software Limited。

- 2023 年 3 月 - Focus Softnet 宣布推出其新的會計軟體,即 FocusLyte,這是一個雲端基礎的處理商業發票和付款的系統。該軟體主要針對中小型企業設計。

- 2023 年 1 月-Halfpricesoft.com 的 ezAccounting 軟體已更新。該公司已更新其軟體並免費提供給客戶。該軟體允許客戶在一個軟體應用程式中輕鬆且經濟地處理薪資核算和業務任務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 技術簡介

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 會計自動化趨勢日益增強

- 市場限制

- 缺乏意識

第6章 市場細分

- 依實施類型

- 本地

- 雲端基礎

- 按組織規模

- 中小型企業

- 大型企業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Intuit Inc.

- Sage Software Inc.

- SAP SE

- Oracle Corporation

- Microsoft Corporation

- Infor Inc.

- Epicor Software Corporation

- Unit4 Business Software Limited

- Xero Ltd

- Zoho Corp

- Red Wing Software Inc.

- MYOB Group Pty Ltd

- Reckon Ltd.

- Saasu Pty Ltd

8.供應商市場佔有率分析

第9章投資分析

第10章:投資分析市場的未來

The Accounting Software Market size is estimated at USD 21.56 billion in 2025, and is expected to reach USD 33.47 billion by 2030, at a CAGR of 9.2% during the forecast period (2025-2030).

Over the past two decades, the financial and accounting software solution market has witnessed numerous changes. One of the most significant changes is the cloud-based offering of accounting software solutions.

Key Highlights

- The accounting software solutions streamline the accounting process, save time, and ensure an error-free transaction between the companies and clients. These systems are designed to increase productivity by archiving, automating, and integrating human resource systems. Implementing accounting software across SMEs helps reduce errors from dealings with clients and companies, thereby improving relationships and reputations while ensuring time to focus on the core business idea.

- The increasing trend of small and medium enterprises collaborating with e-commerce players and integrating with other online applications, such as automated bank feeds and automated billing features, is expected to further drive the adoption of accounting software during the forecast period. It helps increase efficiency, keeping track of all the accounting transactions and managing the money flowing in and out of business. The software has also become a better solution for managing a company's accounts. It can easily manage account payables, account receivables, business payroll, general ledger, and other business modules.

- The market has seen a significant share of vendors with accounting at the core, leveraging the cloud's cost benefits. Additionally, they have been targeting the ever niche "micro and small and medium" businesses. One of the notable strategies exhibited by these new accounting software entrants is the inclusion of advanced features, such as artificial intelligence, for applications, such as planning, learning, problem-solving, and speech recognition.

- For instance, an Australia-based tax, accounting, and other business services software provider's solution, MYOB Advisor, gives natural descriptions of a business's financial position. Accountants and bookkeepers can customize the report based on their SME client's knowledge and experience. Moreover, the insights provided by MYOB Advisor include visualization of cash flow that enables the advisor to help their client see where their cash is going or give a view of top customers and help clients better manage their high-value relationships.

- Also, many companies are extending their partnership programs to increase their market share. Hence, in March 2022, GTreasury has announced a partnership with Infor. Built on the Azure platform, GTreasury will provide Infor customers with a comprehensive Treasury solution that includes cash management, payments, debt and investment management, risk and exposure management, hedge accounting, and reporting functionality that includes dashboards. The acquisition will combine the data from Infor with GTreasury features, enabling Infor customers to handle cash management better.

- Moreover, as multiple countries worldwide have faced the challenge of dealing with the coronavirus outbreak and lockdown, more businesses, tiny businesses, have been working remotely. This has increased the demand for more dynamic and remote access to the business financial records and systems by the individuals who need to work on them and those who must access this timely information accurately to make decisions to manage the financial affairs.

Accounting Software Market Trends

Increased Efficiency Offered by Accounting Software to Drive the Market Growth

- Accounting software increases efficiency as it is used to keep track of accounting transactions or to manage the money flowing in and out of business. It has emerged as a better solution for managing a company's accounts, as it can easily manage account payables, account receivables, business payroll, general ledger, and other business modules.

- Additionally, features that ensure the company's accurate financials, such as time-saving, cost-effective operation, and higher overall productivity, are expected to drive the demand. Besides, these factors make this software more deployable for small businesses.

- Businesses purchase accounting-based software to increase their functionality and replace the dated system. The reason being, in accounting calculation, is tedious and complex. It will require the workforce to complete things. But accounting software can do the analysis precisely and accurately without a workforce.

- Moreover, automation in the accounting industry is also an ongoing trend driven by software advancement. Accounting has been made highly automated without the need for significant physical intervention. The latest accounting software has enabled organizations to minimize their human resources. This has led to efficient capital utilization and better available resources management.

Asia-Pacific to Witness the Highest Growth

- The Asia-Pacific is expected to grow faster for accounting software, primarily due to the increasing penetration of business accounting mobile applications and higher adoption of cloud computing technologies and solutions across the region. Moreover, the emergence of small businesses and rising investments by SMEs in the cloud and the SaaS market will likely boost the market's growth.

- By implementing various initiatives to build more business confidence in the cloud, the local governments play a significant role in developing the cloud integration services market across the region, creating more opportunities for the studied market.

- Also, the government's growing focus in the region to ease organizational payments and transactions and generate a track of debt, liabilities, and assets increases the demand for the market studied.

- Moreover, countries in the region are adopting automation is promoting the development and use of new technologies, which has increased the demand for accounting software to help businesses optimize their operations. Countries like China, Japan, India are witnessing advancement in industrial-grade digital technology, A high preference for cloud-based accounting software, as well as an increase in demand for improved financial management and tax planning methods, all contribute to the market's expansion. Additionally, businesses are accelerating the adoption of accounting software in various industries as they move towards digitalization and Industry 4.0 in order to meet their needs. This is due to the need to deal with the ongoing, fierce competition in the business world.

Accounting Software Industry Overview

The accounting software market is moderately consolidated. The top players occupy a significant share of the market. Moreover, existing players already have their client base, which doesn't want to switch to new players, and new players cannot sustain the market for a more extended period as they get acquired by the top players in the long run. Some key players include Oracle Corporation, Microsoft Corporation, Intuit Inc., SAP SE, Sage Software Inc., Infor Inc., Epicor Software Corporation, Xero Ltd., and Unit4 Business Software Limited.

- March 2023 - Focus Softnet announced the launch of its new accounting software i.e FocusLyte which is a cloud-based system that assists in handling company's invoices and payments. The software is mainly designed for medium and small enterprises.

- January 2023 - ezAccounting software from Halfpricesoft.com has been updated. The company has updated its software and made it available for the customers at no additional cost. The software will allow customers to process payroll and business tasks all in one easy and affordable software application.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Technology Snapshot

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Trend of Accounting Automation

- 5.2 Market Restraints

- 5.2.1 Lack of Awareness

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intuit Inc.

- 7.1.2 Sage Software Inc.

- 7.1.3 SAP SE

- 7.1.4 Oracle Corporation

- 7.1.5 Microsoft Corporation

- 7.1.6 Infor Inc.

- 7.1.7 Epicor Software Corporation

- 7.1.8 Unit4 Business Software Limited

- 7.1.9 Xero Ltd

- 7.1.10 Zoho Corp

- 7.1.11 Red Wing Software Inc.

- 7.1.12 MYOB Group Pty Ltd

- 7.1.13 Reckon Ltd.

- 7.1.14 Saasu Pty Ltd