|

市場調查報告書

商品編碼

1640690

智慧燃氣表:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Gas Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

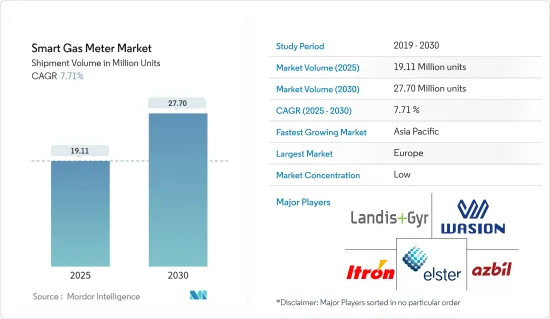

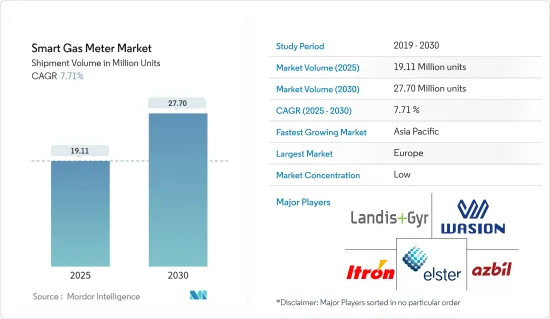

根據出貨量計算,智慧燃氣表的市場規模預計將從 2025 年的 1,911 萬台擴大到 2030 年的 2,770 萬台,預測期內(2025-2030 年)的複合年成長率為 7.71%。

全球對天然氣的需求不斷增加以及最終用戶對深入資料的需求不斷增加是推動市場成長的因素。

主要亮點

- 智慧燃氣表的大規模部署將實現與其他智慧燃氣表之間的通訊,從而改善電網和配電業務。研究區域的氣候目標和相關的能源效率舉措正在進一步推動其採用。配備智慧電錶的燃氣暖氣系統可以使用更少的燃料,並間接促進全自動電網的發展。預計這些發展將加速智慧燃氣表的普及。

- 此外,針對下一代物聯網最佳化的5G技術的出現,預計將推動智慧燃氣表從傳統RF平台遷移到NB-IoT等新興標準。 ITRON和Sensirion等領導者正在利用這一機會,推出具有競爭力的價格和超低電流消耗的下一代燃氣表,例如SGM6200系列。

- 智慧燃氣表透過提高運行安全性並降低燃氣公司的成本來推動產業發展。智慧燃氣表的採用是由其為燃氣公用事業提供的功能優勢推動的,例如無需手動記錄每月讀數、持續監控管道以及獲取即時資料。此外,天然氣公用事業公司可以利用優先警報和即時資料來提高安全標準。

- 而且,智慧燃氣表在技術上比傳統燃氣表更先進。因此,由於智慧燃氣表結合了測量和通訊系統,因此智慧電錶的安裝成本通常高於傳統電錶。

- 新冠疫情嚴重阻礙了該地區天然氣產業對燃氣表的需求。但2021年,新冠肺炎病例的減少導致鑽井活動和業務的恢復。全部區域的經濟逐漸復甦。

智慧燃氣表市場趨勢

天然氣需求成長推動市場成長

- 推動智慧燃氣表市場擴張的根本力量之一是全球對天然氣的需求不斷成長。天然氣作為發電和工業部門燃料的主導地位導致對天然氣的需求增加。

- 根據國際能源總署(IEA)預測,今年至2025年,全球天然氣消費量將以每年平均0.8%的速度成長,達到約4.24兆立方公尺。

- 此外,天然氣也受到經濟力量的影響。商業和工業部門對商品和服務的需求增加會在經濟擴張期間增加天然氣消耗。使用天然氣作為燃料和原料來製造多種產品的工業部門可能會經歷異常高的順週期消費成長。

- 能源消耗成本佔工業企業全部支出的很大一部分。因此,這些行業經常使用燃氣表來追蹤其天然氣消費量。

- 由於天然氣消費量較大,若消費量計量精度較差,會造成計費金額誤差較大。對於製造工廠和電力公司來說,這可能是有害的。

- 製造廠和電力供應公司可能會安裝燃氣表,以確保使用和計量的準確性和可靠性。這確保將此類差異保持在最低限度。這些發展正在推動市場成長。

歐洲市場維持顯著成長

- 在歐洲,由於英國政府主動在現有基礎設施的支持下同步推出能源表,英國佔了最大的單一國家佔有率。

- 能源和工業政策部負責制定該國透明的推廣計劃。據國家審核(NAO)稱,英國即將完成智慧電錶的安裝過程。到2021年終,英國將安裝超過2780萬台智慧電錶。此外,由於人口密度高、連結性好,該國享有良好的成本效益分析,從而進一步刺激成長。

- 該地區的公共產業部門正在採用先進的技術,對智慧電網的投資不斷增加,預計將進一步加速該國智慧燃氣表的採用。

- 此外,預計該國住宅和商業建築溫室氣體排放量的增加將進一步推動智慧燃氣表的採用。智慧瓦斯表有助於維持高效的瓦斯流動。

- 此外,該地區正在進行各種建設,以安裝燃氣表來滿足更大的燃氣供應。例如,2022年10月,英國第一台U16瓦斯智慧電錶安裝在諾森伯蘭郡粗花呢河畔貝里克的住宅中。 SMS PLC 安裝的U16瓦斯智慧表尺寸大約是U6燃氣表的兩倍。如果客戶的天然氣供應量超過每小時 16 立方米,例如大型住宅或商業場所,他們現在就可以改用智慧電錶。

智慧燃氣表產業概況

全球智慧燃氣表市場較為分散,由幾家主要企業組成。在一些地區,智慧燃氣表的需求已經成熟。因此,各公司都在努力維持市場競爭力。企業正在利用明智的合資企業來增加市場佔有率和盈利。為了提高產品性能,該公司還收購了新興企業並開發智慧燃氣表的市場技術。威勝集團控股有限公司、Landis+GYR Group AG 等公司都是不可或缺的參與者。

2022 年 11 月,Itron Inc. 宣布推出其 Itron Intelis gFlex 預付燃氣表。獨特的超音波固態測量技術與 Itron 30 年的預付費電錶解決方案專業知識相結合在下一代電錶中。 Intelis gFlex 整合到易於部署的 SaaS 解決方案中,並透過各種自動銷售管道和信用轉帳進行管理,幫助公共產業保護收益並降低財務風險。亞太地區、中歐和東歐、非洲(EMEA)、拉丁美洲和該地區目前均可購買該電錶。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

- 國內天然氣消費量統計(2010-2020年)

- 北美洲

- 歐洲和獨立國協

- 亞太地區

- 拉丁美洲

- 中東

- 非洲

第5章 市場動態

- 市場促進因素

- 最終用戶對深入資料的需求增加

- 智慧燃氣表可提高燃氣公司的營運安全性並降低成本

- 全球天然氣需求不斷成長推動市場成長

- 市場挑戰

- 用戶資料的高成本和安全隱患

- 基礎建設投入龐大,投資報酬延遲

第6章 市場細分

- 按地區

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲、中東和非洲

- 歐洲

- CIS

- 中東

- 非洲

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲和紐西蘭

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲國家

- 北美洲

第7章 競爭格局

- 公司簡介

- Landis+GYR Group AG

- Wasion Group Holdings

- Elster Group GmbH(Honeywell International Inc.)

- Itron Inc.

- Azbil Kimmon Co. Ltd(Azbil Corporation)

- Sagemcom SAS

- Diehl Stiftung GmbH & Co. KG

- Holley Technology Ltd(Zhejiang Huamei Holding Co. Ltd)

- Apator SA

- Yazaki Corporation

- Aichi Tokei Denki Co. Ltd

- Pietro Fiorentini SpA

- AEM

- Zenner International GmbH & Co. KG

- Sensus Usa Inc.(Xylem Inc.)

第8章投資分析

第9章 市場機會與未來趨勢

The Smart Gas Meter Market size in terms of shipment volume is expected to grow from 19.11 million units in 2025 to 27.70 million units by 2030, at a CAGR of 7.71% during the forecast period (2025-2030).

The rise in global demand for natural gas, along with increasing demand for drill-down data among end-users, are the driving factors of the market growth.

Key Highlights

- The adoption of smart gas meters on a large scale improves grid and distribution operations by allowing communication between other smart meters. The region under study's climate target and associated energy efficiency initiatives further encourage the adoption. Gas heating systems with smart meters use less fuel, indirectly contributing to developing a wholly automated grid. These developments are anticipated to accelerate the implementation of smart gas meters.

- Moreover, With the availability of next-generation IoT-optimized 5G technology, it is expected that there will be a shift from legacy RF platforms to emerging standards, like NB-IoT, in smart gas meters. Major companies, such as ITRON and Sensirion, are launching next-generation gas meters, like the SGM6200 series, with competitive prices and ultra-low current consumption to leverage the opportunity.

- Smart gas meters improve operational security while lowering gas companies' costs, which helps to drive the industry. The adoption of smart gas meters is fueled by the functional benefits they provide gas companies, such as the elimination of manually recording monthly readings, ongoing pipeline monitoring, and the availability of real-time data. Additionally, gas utility providers can use prioritized alarms and real-time data to raise the bar on safety.

- Moreover, Smart gas meters are technologically advanced compared with traditional gas meters. As a result, the cost of installing smart meters is typically higher than that of conventional meters, as a smart gas meter combines measurement and communication systems.

- The outbreak of COVID-19 significantly hampered the demand for gas meters from the regional gas sector. However, in 2021, the decline in COVID-19 cases led to the resumption of drilling activities and businesses reopening. This resulted in a slow economic recovery across the regions.

Smart Gas Meter Market Trends

The Rise in Global Demand for Natural Gas to Drive the Market Growth

- One of the fundamental forces driving the market expansion for smart gas meters is the increase in natural gas demand on a global scale. Due to its dominance as a fuel for the production of electricity and the industrial sector, natural gas is in greater need.

- The International Energy Agency predicts that between the current year and 2025, the world's natural gas consumption will increase at an average annual rate of 0.8%, reaching about 4,240 bcm.

- Additionally, natural gas is impacted by the economy's strength. Increased demand for goods and services from the commercial and industrial sectors might increase natural gas consumption during economic expansion. The industrial sector, where natural gas is used as a fuel and feedstock to create numerous products, is one where the growth in consumption tied to the economy can be exceptionally high.

- Energy consumption costs account for a sizeable portion of all expenses made by industrial establishments. As a result, these industries frequently utilize gas meters to track natural gas consumption.

- Due to the high volume of natural gas consumption, accuracy in the measurement of gas consumption would result in significant anomalies in the billing amount. In manufacturing plants or electrical utilities, this could be harmful.

- The production plant or power supplier might install gas meters to ensure accuracy and dependability in both use and metering. This will guarantee that these discrepancies are kept to a minimum. These developments are fueling the market's growth.

Europe to Hold Significant Market Growth

- In Europe, the United Kingdom accounts for the most significant single country share due to the government initiatives for the simultaneous rollout of energy meters supported by current infrastructure.

- The Department of Energy and Industrial Policy is in charge of the nation's crystal-clear rollout plan. According to the National Audit Office (NAO), the United Kingdom is set to complete the installation process of smart meters. Over 27.8 million smart meters were installed in the United Kingdom by the end of 2021. Additionally, due to a high population density and high connectivity, the country has a good cost-benefit analysis, further adding to the growth.

- The utility sector in the region is adopting sophisticated technologies, and the increasing investments in smart grids are further expected to accelerate the adoption of smart gas meters in the country.

- Also, the increasing greenhouse gas emissions from residential and commercial buildings in the country are expected to drive the adoption of smart gas meters further. They help maintain the efficiency of the gas flow.

- Further, the region is witnessing various developments for installing gas meters for larger gas supplies. For instance, in Oct 2022, the UK's first U16 gas smart meter was placed in Berwick-on-Tweed, Northumberland, at a residential building. The SMS PLC company installed the U16 gas smart meter, which is nearly twice as large as the U6 gas meter. Customers can now switch to smart meters if they have a more excellent gas supply than 16 cubic meters per hour, such as large residential or commercial premises.

Smart Gas Meter Industry Overview

The global smart gas meters market is fragmented and consists of several major players. In some areas, the demand for smart gas meters has reached maturity. Due to this, businesses are working hard to keep their competitive edge in the market. Companies are using smart joint ventures to grow their market share and profitability. To improve the capabilities of their products, the firms are also buying up start-ups and developing market technologies for smart gas meters. Wasion Group Holdings, Landis + GYR Group AG, and others are essential players.

In November 2022, Itron Inc. announced the release of the Itron Intelis gFlex prepayment gas meter. Ingenious ultrasonic solid-state measurement technology and Itron's 30 years of expertise in prepayment metering solutions are combined in the next-generation meter. Intelis gFlex assists utilities in ensuring their revenue and lowering their financial exposure by being integrated into an easy-to-deploy SaaS solution and managed through various combinations of vending channels and credit transfer alternatives. Asia Pacific, Middle East Europe, Africa (EMEA), Latin America, and the region can now purchase the meter.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Natural Gas Domestic Consumption Statistics (2010-2020)

- 4.5.1 North America

- 4.5.2 Europe and CIS

- 4.5.3 Asia Pacific

- 4.5.4 Latin America

- 4.5.5 Middle East

- 4.5.6 Africa

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Drill-down Data Among End-users

- 5.1.2 Smart Gas Meter Augment Operational Safety and Curtail Cost of Gas Companies

- 5.1.3 The Rise in Global Demand for Natural Gas to Drive the Market Growth

- 5.2 Market Challenges

- 5.2.1 High Cost and Security Concerns Pertaining to User Data

- 5.2.2 Huge Capital Investment for Infrastructure Installation and Slow/Delayed ROI

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada and Central America

- 6.1.2 Europe, Middle East and Africa

- 6.1.2.1 Europe

- 6.1.2.2 CIS

- 6.1.2.3 Middle East

- 6.1.2.4 Africa

- 6.1.3 Asia Pacific

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.3.3 South Korea

- 6.1.3.4 Australia and New Zealand

- 6.1.3.5 India

- 6.1.3.6 Rest of Asia Pacific

- 6.1.4 Latin America

- 6.1.4.1 Brazil

- 6.1.4.2 Mexico

- 6.1.4.3 Argentina

- 6.1.4.4 Rest of Latin America

- 6.1.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Landis + GYR Group AG

- 7.1.2 Wasion Group Holdings

- 7.1.3 Elster Group GmbH (Honeywell International Inc.)

- 7.1.4 Itron Inc.

- 7.1.5 Azbil Kimmon Co. Ltd (Azbil Corporation)

- 7.1.6 Sagemcom SAS

- 7.1.7 Diehl Stiftung GmbH & Co. KG

- 7.1.8 Holley Technology Ltd (Zhejiang Huamei Holding Co. Ltd)

- 7.1.9 Apator SA

- 7.1.10 Yazaki Corporation

- 7.1.11 Aichi Tokei Denki Co. Ltd

- 7.1.12 Pietro Fiorentini SpA

- 7.1.13 AEM

- 7.1.14 Zenner International GmbH & Co. KG

- 7.1.15 Sensus Usa Inc. (Xylem Inc.)