|

市場調查報告書

商品編碼

1640691

共乘:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global Ridesharing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

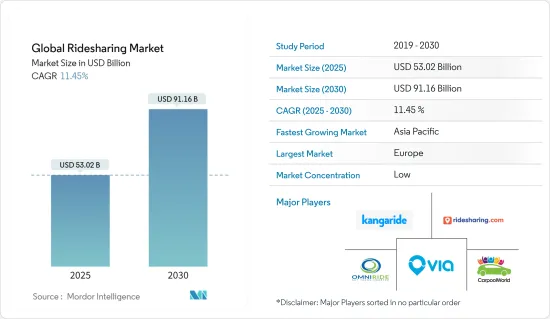

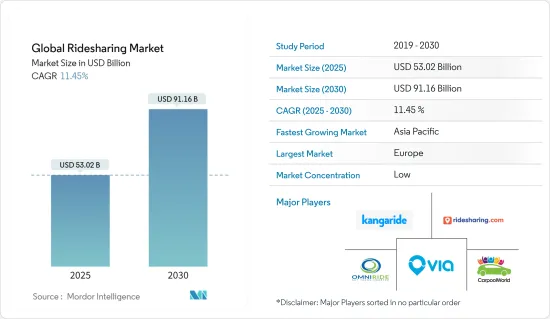

2025 年全球共乘市場規模估計為 530.2 億美元,預計到 2030 年將達到 911.6 億美元,預測期內(2025-2030 年)的複合年成長率為 11.45%。

共乘市場的成長受到多種因素的推動,例如汽車擁有成本的上升、鼓勵減少交通的環保問題以及提倡共乘的政府法規。這些因素是全球共乘激增的關鍵促進因素。這些服務因其成本效益而備受讚譽,預計將超越經濟型汽車持有。

主要亮點

- 在過去十年中,共乘已經成為一種全球趨勢,許多人選擇共乘而不是傳統的計程車服務。共乘公司通常使用 GPS 追蹤透過行動應用程式和網站將潛在乘客與司機聯繫起來。與傳統計程車服務不同,共乘公司能夠避免標準的許可和監管義務。汽車持有量下降、網際網路和智慧型手機普及率提高以及嚴格的二氧化碳減排目標等因素正在推動對共乘服務的需求增加。

- 此外,通勤人數的增加也推動了對共乘服務的需求。例如,根據美國人口普查局的數據,到2022年,美國將有大約1.4億人每天通勤上班。此外,根據 Move in Sync 的數據,《2023 年印度員工通勤報告》指出,孟買的員工返工率位居榜首,2022 年 12 月就超過了疫情前的水平。繼孟買之後,國家首都地區(NCR)的復工率為 92%,其次是班加羅爾(85%)和海得拉巴(81%)。預計大量通勤的通勤者數量將推動市場成長。

- 在全球範圍內,智慧型手機和智慧型穿戴裝置等智慧型裝置的普及率迅速成長,加上網路資料使用量的增加,也刺激了共乘服務的成長。共享交通服務的使用取決於網路連線。用戶將使用支援網際網路的智慧型手機應用程式來收集資訊並導航。 V2V通訊、導航和遠端資訊處理依靠這種連接來實現最佳效能。智慧型手機應用程式提供駕駛員姓名、號碼、照片、車輛識別、路線追蹤、過去行程記錄等功能,並提供額外的安全性。

- 隨著越來越多的服務提供者和應用程式供應商在知名市場營運,競爭迫使供應商以虧損的方式向消費者提供利益,而這種虧損在長期內可能是不永續的,從而形成了空間。如果服務提供者改變產業計畫,透過提高所提供服務的價格來增加盈利,消費者可能會轉向以有競爭力的價格提供類似服務的新參與企業。這種情況對服務提供者的成長提出了挑戰。

- 在經濟強勁成長時期,可支配收入的增加往往會推動共乘需求,個人更願意為便利付費。相反,就業率上升可能導致司機供應緊張,因為有能力或願意參與共乘的人越來越少。對於跨國共乘公司來說,外匯波動會影響盈利。不同市場的定價策略對於塑造需求至關重要,尤其是在不利的外匯波動導致價格上漲的情況下。

共乘市場趨勢

基於應用程式的服務將佔據市場佔有率

- 基於應用程式的共乘服務透過用戶下載到智慧型手機或平板電腦上的行動應用程式運作。這些應用程式允許用戶在應用程式介面內即時預訂共乘、追蹤司機和管理付款。該服務將乘客與擁有自己汽車的司機聯繫起來,為傳統計程車和公共交通提供替代方案。與基於網路的服務不同,基於應用程式的平台專為行動技術而構建,可提供更無縫且方便用戶使用的體驗。

- 過去十年,基於應用程式的共乘服務得到了顯著成長,這得益於智慧型手機普及率的提高、行動技術的進步以及消費者偏好的變化等多種因素。根據愛立信預測,2023年全球智慧型手機行動網路用戶數將達到約70億,到2028年將超過77億人。這些應用程式提供的便利性和易用性使其廣受歡迎,尤其是在對快速、可靠交通需求很高的都市區。

- 行動應用程式是更正資訊的簡化解決方案。當用戶需要輸入必要的詳細資訊(如旅行時間、日期、接送點、目的地等)時,行動應用程式允許用戶設定偏好、建立個人帳戶並隨時掌握重要資訊。它允許你保持

- 在北美和歐洲等新興市場,高智慧型手機擁有率和強大的網路基礎設施正在推動基於應用程式的共乘服務的成長。這些地區的消費者非常欣賞這些平台提供的效率和客製化服務,這些平台通常具有行程安排、票價報價以及從經濟型到高檔車的多種車輛選擇等功能。這些市場受益於強大的法規結構,有助於將共乘服務融入更廣泛的交通生態系統。

亞太地區成長強勁

- 中國、印度和東南亞等國家的經濟成長提高了可支配收入,使得更多人能夠享受共乘服務。人們對環境永續性和減少交通堵塞的必要性的認知不斷增強,促使消費者和政府支持共乘作為汽車所有權的可行替代方案。

- 在該地區營運的公司也根據當地偏好製化其服務,例如在二輪車常見的國家提供摩托車共乘服務。這種在地化方法,加上策略夥伴關係和對先進技術的投資,繼續推動亞太地區共乘市場的擴張。

- 2024 年 8 月,新加坡行動與快速商務領域的關鍵科技公司 Ryde Group Ltd 與領先的本地金融服務供應商 Singlife 建立了夥伴關係。此次合作旨在加強共乘的安全措施,並為乘客和司機提供無與倫比的保險保障。透過與定序的合作,Ride Group 不僅加強了對乘客的價值提案,而且確保了每次旅程的安心。

- 自2024年4月1日起,日本政府將基本解除對共乘服務的禁令,允許計程車公司在計程車短缺的地區和時間運作共乘服務。禁令解除是在政府於 2023 年 12 月 20 日通過《數位行政和金融改革中期報告》(中期報告)之後進行的。

共乘產業概況

共乘市場由全球參與者和一些小型企業組成。主要參與者包括 OmniRide(波托馬克-拉帕漢諾克運輸委員會的一部分)、Kangaride、Planete Covoiturage Inc./CarpoolWorld Inc.、Via Transportation Inc. 和 Ridesharing.com(COVOITURAGE MONTREAL Inc. 的一部分)。為了加強產品供應並確保永續的競爭優勢,這些參與者越來越重視夥伴關係和收購等策略。

2024 年 7 月:洛蘭縣交通局採取開創性舉措,與 TransitTech 領導者 Via 合作,推出了先進的按需公共交通服務「Via LC」。 7 月 15 日,ViaLC 計劃為 Lorain 和 Elyria 的居民徹底改變交通方式,讓他們只需按一下按鈕即可輕鬆預訂車輛。透過與洛蘭縣交通局合作,ViaLC 將大大增強社區使用更廣泛的公共交通網路的便利性。居民可以使用 ViaLC 行動應用程式方便地預訂洛蘭或伊利裡亞境內的車輛,並輕鬆換乘洛蘭縣交通管理局的巴士進行遠距旅行。

2024 年 6 月,Trinity Metro 與 TransitTech 供應商 Via 合作,開啟塔蘭特縣創新公共的新時代。 Via 以其成功的按需共乘服務 Zipzone 而聞名,是 Trinity Metro 雄心勃勃願景的核心。透過此次深入合作,Trinity Metro 旨在在其交通網路中引入先進技術以最佳化營運。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 宏觀經濟趨勢對市場的影響

- 技術開發

第5章 市場動態

- 市場促進因素

- 提高共乘/企業共乘服務的成本優勢和可用性

- 主要市場的政府獎勵和回扣

- 汽車持有成本的上升與環境效益

- 市場挑戰

- 對於最後一哩連接的擔憂、行業的動態性質以及叫車服務供應商的崛起,對現有企業構成了挑戰。

- 市場機會

- 汽車共享監管參數

- 商業/收益模式使用案例

第6章 市場細分

- 依會員類型

- 固定共乘

- 動態共乘

- 企業共乘

- 按服務類型

- 基於網路

- 基於應用程式

- 基於網路和應用程式

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- OmniRide(Potomac and Rappahannock Transportation Commission)

- Kangaride

- Plante Covoiturage Inc./CarpoolWorld Inc.

- Via Transportation Inc.

- Ridesharing.com(COVOITURAGEMONTREAL Inc.)

- Scoop Commute Inc.(Spacer Technologies)

- BlaBlaCar(Comuto SA)

- KINTO Join Limited(TOYOTA MOTOR CORPORATION)

- GoMore ApS

- Hitch Technologies Inc.

- Liftshare(Mobilityways Limited)

- gobyRIDE(RideShark Corporation)

- Sameride LLC

- Carma Technology Corporation

- Enterprise Holdings Inc.

- 共享出行經營模式中供應商的市場定位

第8章投資分析

第9章:市場的未來

The Global Ridesharing Market size is estimated at USD 53.02 billion in 2025, and is expected to reach USD 91.16 billion by 2030, at a CAGR of 11.45% during the forecast period (2025-2030).

Several factors drive the growth of the ride sharing market, such as rising vehicle ownership costs, environmental concerns prompting a reduction in traffic, and government regulations advocating for ride sharing. These factors are critical drivers of the global surge in ride sharing adoption. These services are favored for their cost-effectiveness and are also anticipated to outpace affordable car ownership.

Key Highlights

- Over the past decade, ride sharing has emerged as a global trend, with many individuals opting for it over conventional taxi services. Typically, ride sharing firms utilize GPS tracking to connect potential passengers with drivers via mobile applications or websites. Ride sharing companies can bypass standard licensing and regulatory mandates, unlike traditional taxi services. Factors such as declining car ownership, increasing internet and smartphone penetration, and stringent CO2 reduction targets collectively drive the rising demand for ride sharing services.

- The rise in the number of people commuting to work also propels the demand for ride sharing services. For instance, according to the US Census Bureau, almost 140 million people in the United States routinely commuted to work in 2022. Further, according to Move in Sync, the Employee Commute India 2023 report stated that Mumbai led the way in employee returns to the office, surpassing pre-pandemic levels in December 2022. Following Mumbai, the National Capital Region (NCR) saw a return rate of 92%, Bangalore at 85%, and Hyderabad at 81%. Such a huge number of people commuting and returning to offices would drive the market's growth.

- Globally, the surge in smart device adoption encompassing smartphones and smart wearables coupled with heightened internet data usage has catalyzed the growth of ride sharing services. Accessing ride transport services hinges on internet connectivity. Users leverage internet-enabled smartphone applications to gather information and navigate their rides. V2V communication, navigation, and telematics rely on this connectivity for optimal performance. Smartphone applications bolster security, offering features like driver's name, number, photograph, vehicle identification, route tracing, and historical ride records.

- There is an increase in the number of service providers and application vendors operating in prominent markets, thus creating a competitive space where vendors are forced to offer benefits to consumers at a loss that may not be sustainable over a long period. Once the service provider switches the business plan to turn toward profitability by increasing the prices of the services offered, consumers may switch to newer players offering similar services at competitive prices. Such scenarios are challenging the growth of service providers.

- During robust economic growth, rising disposable incomes often boost ride sharing demand, with individuals more inclined to pay for convenience. Conversely, high employment rates can tighten the supply of drivers, as fewer individuals are available or willing to participate in ridesharing. For multinational ride sharing firms, fluctuating exchange rates can sway profitability. Pricing strategies across diverse markets are crucial in shaping demand, especially if unfavorable currency shifts lead to price hikes.

Ridesharing Market Trends

App-based Services Hold Major Market Share

- Application-based ridesharing services operate through mobile applications that users download onto their smartphones or tablets. These apps allow users to book rides in real time, track their drivers, and manage payments within the app's interface. The service connects passengers with drivers using personal vehicles, offering an alternative to traditional taxis and public transport. Unlike web-based services, application-based platforms focus entirely on mobile technology, providing a more seamless and user-friendly experience.

- Application-based ridesharing services have grown significantly over the past decade, driven by several factors, including increased smartphone penetration, advancements in mobile technology, and changing consumer preferences. According to Ericsson, in 2023, the global smartphone mobile network subscriptions totaled nearly 7 billion and are estimated to surpass 7.7 billion by 2028. The convenience and ease of use offered by these apps have led to widespread adoption, particularly in urban areas where demand for quick and reliable transportation is high.

- A mobile application is a reasonable solution for modifying information. When a user needs to enter required details such as time of travel, date, pick-up point, and destination, a mobile app may work as a great addition as it allows users to set preferences, create personal accounts, and keep vital information at hand.

- In developed markets such as North America and Europe, the growth of application-based ridesharing services is bolstered by a high level of smartphone ownership and robust internet infrastructure. Consumers in these regions value the efficiency and customization offered by these platforms, which often include features like ride scheduling, fare estimates, and multiple vehicle options, ranging from economy to premium cars. These markets benefit from strong regulatory frameworks that support the integration of ridesharing services into the broader transportation ecosystem.

Asia-Pacific to Register Major Growth

- Economic growth in countries like China, India, and Southeast Asian nations has boosted disposable incomes, enabling more people to afford ridesharing services. The increasing awareness of environmental sustainability and the need to reduce traffic congestion have encouraged both consumers and governments to support ridesharing as a viable alternative to private car ownership.

- Companies operating in the region are also tailoring their offerings to meet local preferences, such as providing two-wheeler ridesharing options in countries where motorcycles are more common. This localized approach, combined with strategic partnerships and investment in advanced technologies, continues to drive the expansion of the ridesharing market across Asia-Pacific.

- In August 2024, Ryde Group Ltd, a tech firm pivotal in Singapore's mobility and quick commerce landscape, entered a partnership with Singlife, a key local financial services provider. This collaboration aims to enhance safety measures in ridesharing and offer unparalleled insurance coverage to both riders and driver-partners. Through this alliance with Singlife, Ryde Group not only boosts the value proposition for its users but also ensures peace of mind for every journey.

- The Japanese government lifted significant parts of its ban on ride-sharing services beginning April 1, 2024, allowing taxi companies to operate these services in areas and at times in which taxis are in short supply. The lifting of the ban follows the government's adoption on December 20, 2023, of the Digital Administrative and Financial Reform Interim Report (Interim Report).

Ridesharing Industry Overview

The ride sharing market showcases a blend of global players and numerous small-to-medium-sized enterprises. Key players include OmniRide (affiliated with the Potomac and Rappahannock Transportation Commission), Kangaride, Planete Covoiturage Inc./CarpoolWorld Inc., Via Transportation Inc., and Ridesharing.com (linked to COVOITURAGE MONTREAL Inc.). To bolster their product offerings and secure a lasting competitive edge, these players are increasingly turning to strategies like partnerships and acquisitions.

July 2024: In a groundbreaking move, Lorain County Transit, in partnership with TransitTech leader Via, launched "Via LC," a cutting-edge on-demand public transit service. Beginning July 15, ViaLC planned to revolutionize transportation for residents in Lorain and Elyria, enabling effortless ride bookings at the touch of a button. By joining forces with Lorain County Transit, ViaLC significantly enhances community access to the broader public transit network. Residents can conveniently book rides within Lorain or Elyria using the ViaLC mobile app or easily transfer to a Lorain County Transit bus for longer trips.

June 2024: Trinity Metro, in collaboration with TransitTech provider Via, is ushering in a new era of innovative public transportation in Tarrant County. Via, celebrated for its success with the ZIPZONE on-demand rideshare service, is now central to Trinity Metro's ambitious vision. With this deepened collaboration, Trinity Metro aims to infuse advanced technology and optimize operations across its entire transit network.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

- 4.5 Technological Developments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost Advantage and Increasing Availability of Carpooling/Corporate Pooling Services

- 5.1.2 Incentives and Rebates Provided by Governments in Major Markets

- 5.1.3 Increasing Cost of Vehicle Ownership and Environmental Benefits

- 5.2 Market Challenges

- 5.2.1 Last-mile Connectivity Concerns and Dynamic Nature of the Industry and Increasing Number of Ride Hailing Vendors Poses a Challenge for Existing Operators

- 5.3 Market Opportunties

- 5.4 Parameters for Car-sharing Regulation

- 5.5 Business/Revenue Model Use Cases

6 MARKET SEGMENTATION

- 6.1 By Membership Type

- 6.1.1 Fixed Ridesharing

- 6.1.2 Dynamic Ridesharing

- 6.1.3 Corporate Ridesharing

- 6.2 By Service Type

- 6.2.1 Web-Based

- 6.2.2 App-Based

- 6.2.3 Web and App Based

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 OmniRide (Potomac and Rappahannock Transportation Commission)

- 7.1.2 Kangaride

- 7.1.3 Plante Covoiturage Inc./CarpoolWorld Inc.

- 7.1.4 Via Transportation Inc.

- 7.1.5 Ridesharing.com (COVOITURAGEMONTREAL Inc.)

- 7.1.6 Scoop Commute Inc. (Spacer Technologies)

- 7.1.7 BlaBlaCar (Comuto SA)

- 7.1.8 KINTO Join Limited (TOYOTA MOTOR CORPORATION)

- 7.1.9 GoMore ApS

- 7.1.10 Hitch Technologies Inc.

- 7.1.11 Liftshare (Mobilityways Limited)

- 7.1.12 gobyRIDE (RideShark Corporation)

- 7.1.13 Sameride LLC

- 7.1.14 Carma Technology Corporation

- 7.1.15 Enterprise Holdings Inc.

- 7.2 Market Positioning of Vendors in Ridesharing Business Models