|

市場調查報告書

商品編碼

1640693

備用電源系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Backup Power Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

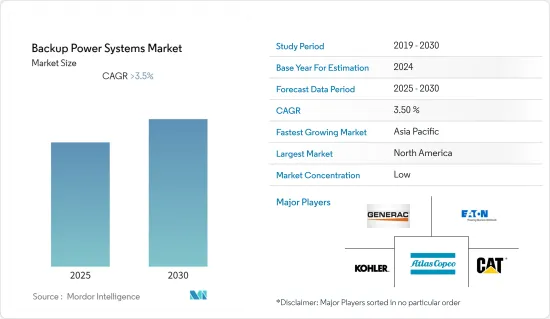

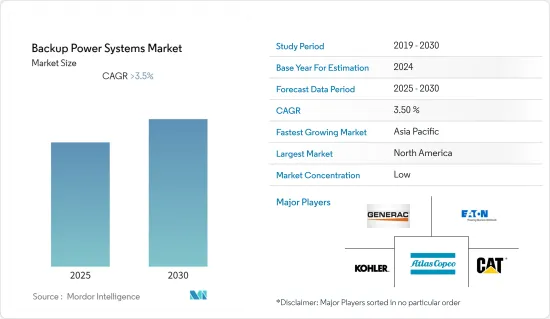

預測期內,備用電源系統市場預計將以超過 3.5% 的複合年成長率成長。

由於新冠疫情爆發,市場受到區域封鎖的負面影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 全球大面積停電以及備用電源需求不斷成長等因素預計將成為備用電源系統市場的最大驅動力。

- 然而,預計可再生能源和分散式技術在電網中的快速引入將在預測期內阻礙備用電源系統市場的成長。

- 新興經濟體工業領域和國防活動對電力的需求日益成長,很可能在不久的將來為市場參與企業創造龐大的商機。

- 由於美國停電現像日益增多,造成經濟損失並推動備用電源系統的需求,北美預計將成為最大的市場。

備用電源系統市場趨勢

預計商業部門將主導市場

- 2022年,商業部門將佔全球電力消耗量的22%左右,成為更重要的部分之一。此外,停電和不可靠的電網電力迫使商業部門客戶採用備用電源解決方案來在停電期間開展業務活動,從而推動市場成長。

- 此外,亞太地區的資料中心發展也正在顯著成長。例如,2022年5月,思科在印度推出了首個資料中心。該公司旨在滿足客戶對網路防禦和資料本地化日益成長的需求。因此,思科公司在印度建立了第一個資料中心。此外,透過這項投資,思科旨在印度建構面向未來、資料驅動的安全基礎設施。

- 此外,Google於2022年4月宣布將在美國內布拉斯加州建造新的資料中心。預計總投資約7.5億美元。此外,該公司還計劃在美國投資超過 95 億美元建造資料中心。過去五年來,Google已在26個州的辦公室和資料中心投資超過370億美元。

- 同樣,幾家公司已經簽署了在印度建立資料中心的協議。例如,2021年,Iron Mountain和Web Werks、EdgeConneX和Adani、Yondr和Everstone成立合資企業,在印度開發資料中心。

- 此外,2022年1月,阿達尼集團宣布將在印度北方邦的兩個資料中心計劃投資超過5.6億美元。預計這種情況將在預測期內推動對 UPS 等備用電源系統的需求。

- 因此,商業部門正擴大轉向備用電源,預計將在預測期內佔據市場主導地位。

北美可望主導市場

- 電力是現代生活的基石之一,在北美經濟中發揮著至關重要的作用。電力由發電廠生產,然後透過變電站、變壓器和輸電線路組成的複雜系統進行分配,將發電廠與消費者連接起來。電網有時會中斷,為需求者帶來災難性的後果。

- 在美國,佛羅裡達州、新罕布夏州、喬治亞、喬治亞州和佛蒙特州的平均停電時間最長。這五個州的平均停電時間從佛蒙特州的 15 小時到緬因州的 42 小時不等。全國每年因停電造成的損失平均約180億至330億美元。備用發電機和UPS系統被認為是確保業務不間斷的最實用的選擇。

- 根據Cloudscene的數據,截至2023年3月,北美佔全球資料中心的51%以上,而美國約佔43.5%,擁有約3,207資料資料。此外,美國是最早採用巨量資料、物聯網和人工智慧等先進技術的國家之一,隨著5G服務在全國範圍內的擴展,該地區的資料中心數量預計將增加。

- 因此,停電和電壓干擾會對嚴重依賴可靠電力的企業造成重大損失,從而推動發電機和 UPS 等備用電源解決方案的廣泛使用。

- 由於上述因素,預計預測期內北美將成為備用電源系統的領先地區。

備用電源系統產業概況

備用電源系統市場比較分散。主要參與企業包括(不分先後順序)Caterpillar公司、科勒公司、阿特拉斯·科普柯公司、Generac Holdings Inc. 和伊頓公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 技術板塊

- 備用發電機

- 不斷電系統(UPS)

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Atlas Copco AB

- Caterpillar Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Generac Holdings Inc.

- General Electric Co.

- Kohler Co.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Toshiba Corporation

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 57130

The Backup Power Systems Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- Factors such as the power outages that are prevalent worldwide and the rising demand for standby power sources are expected to be the biggest drivers for the backup power systems market.

- However, the rapid adoption of renewable power sources and distributed technologies onto the grid is expected to hamper the market growth of backup power systems during the forecast period.

- The industrial sectors of emerging economies and the increasing need for power in defense operations are likely to create significant opportunities for market participants in the near future.

- North America is expected to be the largest market due to increased power outages in the United States, leading to financial losses and driving the demand for backup power systems.

Backup Power Systems Market Trends

The Commercial Sector is Expected to Dominate the Market

- In 2022, the commercial sector accounted for about 22% of the global consumption of electricity, making it one of the more significant segments. Moreover, power outages and unreliable grid electricity lead customers in the commercial sector to adopt backup power solutions to perform their business activities at the time of power outages, driving the market's growth.

- Additionally, there is also a significant increase in the development of data centers in Asia-Pacific. For instance, in May 2022, Cisco launched its first data center in India. The company aims to cater to rising customer demands for cyberdefense and data localization. Thus, Cisco's Duo has established its first data center in India. Furthermore, with this investment, Cisco aims to build a future-ready, data-compliant security infrastructure in India.

- Moreover, in April 2022, Google announced building a new data center in Nebraska, United States. The total investment is expected to be around USD 750 million. Furthermore, the company aims to invest more than USD 9.5 billion in the data center, particularly in the United States. Google has already invested more than USD 37 billion in offices and data centers in 26 states in the last five years.

- Similarly, several players entered into agreements to construct data centers in India. For example, in 2021, Iron Mountain and Web Werks, EdgeConneX and Adani, and Yondr and Everstone started joint ventures to develop data centers in India.

- Additionally, in January 2022, Adani Group announced that it was investing more than USD 560 million in two data center projects in Uttar Pradesh, India. Such a scenario is expected to propel the need for backup power systems like UPS during the forecast period.

- Hence, the commercial sector is increasingly moving toward power backup sources, which are expected to dominate the market during the forecast period.

North America is Expected to Dominate the Market

- Electricity is one of the essential parts of modern life and plays a vital role in North America's economy. Electricity is generated at power plants and delivered through a complex system of substations, transformers, and power lines that connect electricity producers and consumers. The power system may sometimes get interrupted, leaving catastrophic results for the customers.

- In the United States, Florida, New Hampshire, Maine, Georgia, and Vermont, on average, have the most prolonged total time power interruptions. The average customer interruption time in these five states ranged from 15 hours in Vermont to 42 hours in Maine. Power outages cost an average of about USD 18 billion to USD 33 billion per year in the country. Backup generators and UPS systems are considered the most viable options for ensuring that business operations continue without interruption.

- According to Cloudscene, as of March 2023, North America accounted for more than 51% of data centers across the globe, with the United States accounting for almost 43.5% of data centers and having about 3,207 data centers. In addition, the number of data centers is expected to increase in the region, as the United States is the fastest adopter of advanced technology such as big data, IoT, artificial intelligence, and expanded coverage of 5G services across the country.

- Therefore, power outages from blackouts and voltage disturbances can cause significant losses to businesses that are highly dependent on reliable power, hence the promotion of backup power solutions such as generators and UPS.

- Based on the factors mentioned above, North America is expected to be the dominant region for backup power systems during the forecast period.

Backup Power Systems Industry Overview

The backup power systems market is fragmented. Some of the key players are (in no particular order) Caterpillar Inc., Kohler Co., Atlas Copco AB, Generac Holdings Inc., and Eaton Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Backup Generator

- 5.1.2 Uninterrupted Power Supply (UPS)

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco AB

- 6.3.2 Caterpillar Inc.

- 6.3.3 Eaton Corporation PLC

- 6.3.4 Emerson Electric Co.

- 6.3.5 Generac Holdings Inc.

- 6.3.6 General Electric Co.

- 6.3.7 Kohler Co.

- 6.3.8 Mitsubishi Electric Corporation

- 6.3.9 Schneider Electric SE

- 6.3.10 Toshiba Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219