|

市場調查報告書

商品編碼

1640703

雷達感測器 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Radar Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

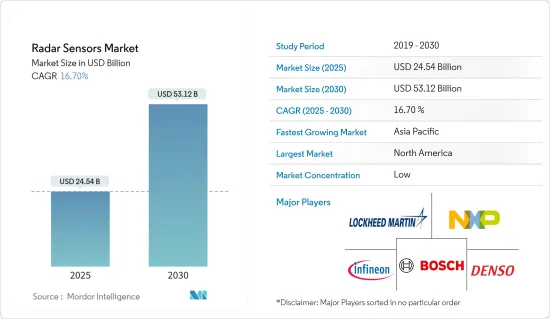

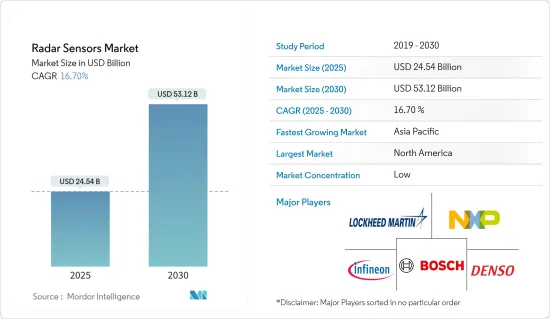

雷達感測器市場規模預計在 2025 年為 245.4 億美元,預計到 2030 年將達到 531.2 億美元,預測期內(2025-2030 年)的複合年成長率為 16.7%。

關鍵亮點

- 自動化程度的快速提高、自動駕駛的發展和工業 4.0 的進步,推動了對高級安全和控制的存在和運動檢測的需求。

- 汽車產業正在經歷技術轉型,以提高安全性、舒適性和娛樂性,為雷達感測器創造了充足的機會。無人機、自動駕駛汽車和 ADAS(高級駕駛輔助系統)等感測器密集型應用的發展推動了雷達感測器的需求。

- 雷達感測器技術的改進對市場成長產生了重大影響。毫米波(mm-Wave)技術的採用預計將成為雷達感測器市場的重點,該技術的採用將顯著提高感測器的功能和效率。

- 雷達感測器已成為智慧家庭市場的重要元素,其中包括提供照明、暖通空調、衛生系統和自動門的非接觸式控制,以及警報、門禁和追蹤應用等安全系統。

- 在航太領域,雷達感測器透過偵測飛機等遠程物體的位置和速度來確保安全標準。這些感測器透過精確的距離測量有助於使民航機和軍用飛機更安全、更有效率。它們也用於間諜飛機的空中監視系統,以探測敵軍的意外到來並追蹤其他可疑活動。

- 雷達感測器用於航空系統,提供有關導彈類型、彈道和目標的詳細資訊,並有助於提前檢測導彈襲擊。此外,航太和國防設備以及感知環境和檢測障礙物的設備的進步正在推動雷達感測器市場的成長。

- 然而,市場成長面臨的主要挑戰包括視野有限和加速度存在差異時的偵測能力有限。

雷達感測器市場趨勢

汽車產業可望大幅成長

- 汽車雷達在偵測車輛附近物體的速度和範圍方面發揮著至關重要的作用。根據豐業銀行預測,全球汽車銷售將從 2022 年的約 6,730 萬輛成長至 2023 年的約 7,530 萬輛。

- 雷達感測器在自動駕駛環境中發揮關鍵作用。 ADAS 車輛配備多個雷達,涵蓋多種安全和舒適應用,包括防撞、自動停車、內部監控、協同駕駛和群組情境察覺。

- 自動駕駛汽車生態系統中的人工智慧也將推動市場發展。數位雷達與最新的電腦視覺演算法結合使用,可提高人工智慧能力並使物體檢測和分類更容易。

- 這些數位雷達支援先進的自動駕駛,並可部署左轉輔助、盲點監控、自動緊急煞車、主動車距控制巡航系統、交通堵塞導航和高速公路導航等先進功能。為了顯著提高5G mmWave通訊的效率,正在開發一種基於先進模擬技術並提供5G主動和被動反射陣列的新型汽車雷達系統。

北美佔據雷達感測器市場的大部分佔有率

- 高階國防應用、智慧型手機、自動駕駛汽車和家用電子電器的日益普及是美國雷達感測器市場的主要成長動力。該地區的國防預算在世界上名列前茅,因此 FMCW 應用(尤其是短程應用)的興起勢頭強勁。

- 該地區正在開拓智慧電網、智慧家庭、智慧交通、智慧水網和使用雷達感測器技術的基礎設施等新興技術。雷達感測器技術的發展有望在這些領域開闢新的使用案例,為供應商創造成長機會。

- 隨著越來越多的製造商為行動電話添加新功能,智慧型手機的高普及率也有望推動雷達感測器的需求。 GSMA預測,到2025年終,北美近三分之二的行動電話連線將為5G,達到約2.7億。

- 考慮到雷達感測器所提供的優勢,許多政府機構和私人組織正在加強研發力度,以進一步提高這些感測器的效率,預計這將對市場產生積極影響。

雷達感測器產業概況

雷達感測器市場細分化,有許多重要的參與企業。著名參與企業包括羅伯特·博世有限公司、洛克希德·馬丁公司、恩智浦半導體公司、英飛凌科技公司、意法半導體公司和大陸汽車集團。

- 2024 年 1 月,恩智浦半導體公司 (NXP Semiconductors NV) 推出了其汽車雷達單晶片系列的擴充。新款 SAF86xx 無縫整合了高性能雷達收發器、多核心雷達處理器和 MACsec 硬體引擎,從而實現透過汽車乙太網路進行的最先進的安全資料通訊。此綜合系統解決方案與恩智浦的S32高效能處理器、車載網路連接和電源管理功能相結合,為先進的軟體定義雷達技術奠定了基礎。

- 2023 年 11 月,洛克希德馬丁公司宣布,在該公司位於紐約州遍遠地區的工廠經過數月的內部測試和調整後,美國將開始對其先進的 TPY-4 雷達進行進一步評估。這款軟體定義的感測器可以偵測和追蹤從小型無人機到噴射機再到彈道飛彈的一切物體,是3D遠徵遠距雷達(3DELRR) 的一部分,將取代已有數十年歷史的TPS-75雷達。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代產品的實力

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 國家安全需求日益增加

- 自動駕駛汽車增多,對安全性的重視程度不斷提高

- 市場問題

- 研發維護成本高

第6章 市場細分

- 按類型

- 成像雷達

- 非成像雷達

- 按範圍

- 短程雷達感測器

- 中程雷達感測器

- 遠距雷達感測器

- 按最終用戶

- 車

- 安全監控

- 工業的

- 環境及氣象監測

- 流量監控

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Robert Bosch GmbH

- Lockheed Martin Corporation

- NXP Semiconductors NV

- Denso Corporation

- Infineon Technologies AG

- Continental AG

- Hella KGaA Hueck & Co.

- Delphi Automotive LLP

- Baumer Group

- Smart Microwave Sensors GmbH

- InnoSenT GmbH

- Veoneer Inc.

- STMicroelectronics NV

- Hitachi Automotive Systems(Hitachi Ltd)

- Banner Engineering Corporation

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 57286

The Radar Sensors Market size is estimated at USD 24.54 billion in 2025, and is expected to reach USD 53.12 billion by 2030, at a CAGR of 16.7% during the forecast period (2025-2030).

Key Highlights

- Due to rapidly advancing automation, developments in autonomous driving, and the progression of Industry 4.0, the need for presence and motion detection for advanced safety and control is increasing.

- The automotive sector is undergoing a technological transition to improve safety, comfort, and entertainment and has ample opportunities for radar sensors. The need for radar sensors is being accelerated by the development of sensor-rich applications such as drones, autonomous cars, and advanced driver assistance systems.

- Technological improvements in radar sensors are a significant factor impacting market growth. The introduction of millimeter-wave (mm-Wave) technology, which is expected to become a primary focus in the radar sensors market, significantly improves sensor capabilities and efficiency.

- Radar sensors have become an integral part of the smart home market, particularly offering contactless control for lighting, air conditioning, sanitary systems, and automatic doors, as well as security systems such as alarms, access control, and tracking applications.

- In the aerospace sector, radar sensors are employed to ensure safety and security standards by detecting the position and velocity of an object found at a distance, such as an aircraft. These sensors help enhance the safety and efficiency of commercial and military aircraft through exact distance measurements. It is also used in airborne surveillance systems of spy planes to detect the surprising arrival of enemy forces and track other dubious activities.

- Radar sensors are used in aviation systems to deliver detailed information regarding the missile type, trajectory, and target, and they also help in the prior detection of missile attacks. Additionally, advancements in aerospace and defense equipment and instruments to sense the environment and detect obstacles are boosting the growth of the radar sensors market.

- However, some of the main challenges to market growth are factors like a limited field of vision and limitations in detection when there is an acceleration difference.

Radar Sensors Market Trends

The Automotive Sector is Expected to Witness Significant Growth

- Automotive radar plays a vital role in detecting the speed and range of objects in the car's proximity. According to Scotiabank, car sales worldwide grew to around 75.3 million units in 2023, up from around 67.3 million units in 2022.

- Radar sensors play a crucial role in the autonomous driving environment. An ADAS vehicle has multiple radars covering multiple safety and comfort applications, like crash avoidance, self-parking, in-cabin monitoring, cooperative driving, and collective situational awareness.

- AI in the autonomous vehicle ecosystem also drives the market. Digital radar is used with a modern computer vision algorithm to improve AI functionality, making object detection and classification easier.

- These digital radars can deliver a high degree of automatic driving and deploy sophisticated features, such as left turn assist, blindspot monitoring, automatic emergency braking, adaptive cruise control, traffic jam pilot, or highway pilot. In order to significantly increase the efficiency of 5G millimeter-wave communications, a new type of automotive radar system is being developed based on advanced analog technology and providing 5G active and passive reflection arrays.

North America Holds a Significant Share of the Radar Sensors Market

- High-end defense applications, smartphone penetration, autonomous vehicles, and consumer electronics devices are significant growth drivers for the US radar sensors market. As the region has the highest defense budget in the world, the increase in FMCW applications, particularly short-range applications, is gaining momentum.

- New and emerging technologies, like smart grids, smart homes, intelligent transport, smart water networks, and infrastructure with radar sensor technology, are being pioneered in the region. The development of radar sensor technology is expected to open up new use cases in these areas, creating growth opportunities for suppliers.

- The demand for radar sensors is also expected to be driven by the high penetration of smartphones as more manufacturers incorporate new features into their mobile phones. GSMA estimates that almost two-thirds of North America's cellular connections will be 5G by the end of 2025, with approximately 270 million contacts.

- Given the benefits that radar sensors provide, a number of government and commercial organisations are increasing their research and development efforts to further increase the efficiency of these sensors, which is expected to positively impact the market.

Radar Sensors Industry Overview

The radar sensors market is fragmented due to the presence of many significant players. Some prominent players include Robert Bosch Gmbh, Lockheed Martin Corporation, NXP Semiconductors, Infineon Technologies, STMicroelectronics NV, and Continental AG.

- January 2024: NXP Semiconductors NV launched an extension to its automotive radar one-chip family. The new SAF86xx seamlessly integrates a high-performance radar transceiver, a multi-core radar processor, and a MACsec hardware engine to facilitate cutting-edge secure data communication via Automotive Ethernet. This comprehensive system solution lays the groundwork for advanced, software-defined radar technology when coupled with NXP's S32 high-performance processors, vehicle network connectivity, and power management capabilities.

- November 2023: Lockheed Martin Corporation announced that the US Air Force would launch its advanced TPY-4 radar for further evaluation following months of internal testing and tweaks at company facilities in rural New York. The software-defined sensor, capable of detecting and tracking everything from small drones to jets to ballistic missiles, is slated to replace the decades-old TPS-75 radar as part of the Three-Dimensional Expeditionary Long Range Radar effort, or 3DELRR.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Substitute Product

- 4.3.5 Threat of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for National Security

- 5.1.2 Increasing Number of Autonomous Cars and Focus on Security and Safety Needs

- 5.2 Market Challenges

- 5.2.1 High R&D and Maintenance Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Imaging Radar

- 6.1.2 Non-Imaging Radar

- 6.2 By Range

- 6.2.1 Short-range Radar Sensor

- 6.2.2 Medium-range Radar Sensor

- 6.2.3 Long-range Radar Sensor

- 6.3 By End User

- 6.3.1 Automotive

- 6.3.2 Security and Surveillance

- 6.3.3 Industrial

- 6.3.4 Environment and Weather Monitoring

- 6.3.5 Traffic Monitoring

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Robert Bosch GmbH

- 7.1.2 Lockheed Martin Corporation

- 7.1.3 NXP Semiconductors NV

- 7.1.4 Denso Corporation

- 7.1.5 Infineon Technologies AG

- 7.1.6 Continental AG

- 7.1.7 Hella KGaA Hueck & Co.

- 7.1.8 Delphi Automotive LLP

- 7.1.9 Baumer Group

- 7.1.10 Smart Microwave Sensors GmbH

- 7.1.11 InnoSenT GmbH

- 7.1.12 Veoneer Inc.

- 7.1.13 STMicroelectronics NV

- 7.1.14 Hitachi Automotive Systems (Hitachi Ltd)

- 7.1.15 Banner Engineering Corporation

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219