|

市場調查報告書

商品編碼

1641828

顯示面板-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Display Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

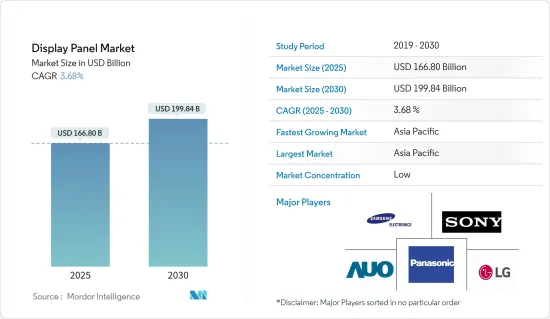

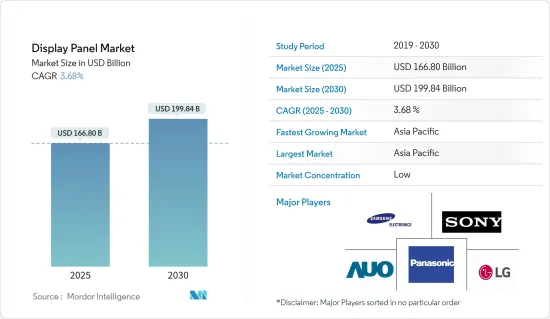

預計2025年顯示面板市場規模為1,668億美元,到2030年將達到1998.4億美元,預測期間(2025-2030年)的複合年成長率為3.68%。

顯示器技術透過技術發展逐年進步,實現了高解析度、低功耗。奈米粒子在電子電路和透明感測器中的發展正在推動透明顯示器市場的進步。在當前情況下,軟性顯示器正在被開發來取代剛性方形面板,這對消費者來說更具互動性。預計這將為透明顯示器市場的成長提供巨大的機會。

顯示器市場受到對 OLED 和 PMOLED 等增強型顯示器、擴展顯示器和可捲曲透明顯示器等日益成長的需求的推動。 OLED技術可實現明亮、高效、纖薄的顯示器和照明面板。 OLED 目前廣泛應用於許多行動裝置、電視和照明設備。 OLED 顯示器提供比 LCD 或電漿顯示器更好的影像質量,並且可以做得透明和靈活。

此外,顯示器的一個重要應用領域是抬頭顯示器裝置。這些設備在 AR/VR、軍事/國防和汽車市場需求強勁,推動了顯示面板市場的發展。具有透明顯示器的裝置比視訊擴增實境具有更高的解析度並且顯示更逼真的擴增實境實境。

氧化物TFT的需求不斷成長,促使企業提高產能以補充市場需求。例如,2021年12月,TCL集團旗下的中國顯示面板製造商華星光電科技(CSOT)宣布安裝8.6G氧化物TFT-LCD生產線,該生產線將於2023年第一季投產. 已安排。

從硬體銷售來看,頭戴式顯示器佔據了市場主導地位。這是因為對更高品質 HMD 的需求不斷成長,以支援對高品質內容和改進功能的持續需求,並為消費者提供透明顯示器可以提供的更好的沉浸式體驗。預計這將推動市場發展。

Nvidia 的 DriveAR 平台採用儀表板安裝的顯示器,該顯示器使用透明顯示器疊加來自汽車周圍影像的圖形。系統會指出沿途的一切危險和歷史地標。由於該平台的成功,奧迪、賓士、特斯拉、豐田和沃爾沃等主要汽車製造商已與該公司簽訂契約,共同開發該技術。

2023 年 4 月,三星宣布將為法拉利車型供應下一代高階顯示面板。這使得該公司的業務範圍超越了電視和智慧型手機,進入了跑車市場。

受新冠疫情影響,人員跨境流動受限,索尼難以派遣工程師前往中國和東南亞國家製造地推出新產品並提供製造指導,這對SONY的業務產生了影響。此外,它還受到全球封鎖和零售店關閉的影響。

顯示面板趨勢

OLED顯示面板將發揮重要作用

OLED有望取代顯示生態系中的現有技術。為此,不少廠商開始大力投入OLED相關的研發。由於頭戴式顯示器 (HMD) 供應商的需求不斷增加,OLED 透明顯示器正在獲得市場滲透率。

例如,2023年4月,三星宣布將在韓國投資30億美元用於筆記型電腦和平板電腦的OLED面板。同樣,2022 年 4 月,三星宣布了其未來電視的新計劃。該計劃旨在使量子點(QD)-OLED面板比現在更薄。這使得三星將捲屏電視視為其電視產品線的一個新可能性。新的面板類型還可降低生產成本。

由於在電池壽命方面取得成功,LG Display 於 2022 年 2 月贏得一份契約,為蘋果公司提供基於低溫多晶氧化物 (LTPO) 技術的有機發光二極體面板,用於 2022 年下半年發布的 iPhone 14 系列。

此外,一些領先的製造商正專注於推出具有 OLED 顯示器的產品,以帶來創新並獲得競爭優勢。例如,2023年5月,三星宣布將在SID顯示器週上推出帶有感應器的OLED顯示器。此顯示器將指紋掃描器整合到 OLED 螢幕中,因此無需智慧型手機品牌安裝螢幕下指紋掃描器模組。

此外,2023 年 1 月,LG Display 在 CES 2023 上發布了第三代 OLED 電視面板。該公司最新的採用「META 技術」的 OLED 電視面板可提供極致的畫質。該公司最新的 OLED 顯示器比傳統 OLED 顯示器提供的影像亮度提高 60%、視角提高 30%,同時更節能。該公告旨在加強該公司在大型OLED面板產業的地位。

印度預計在亞太地區實現強勁成長

在印度,可支配收入的提高推動了個人消費的擴張,隨著足球迷數量的增加,對電視的需求也激增。因此,印度電視製造商正在推出配備先進技術的更大螢幕,這可能會在預測期內促進該國市場的成長。

此外,電視連接行為的變化預計將推動市場成長。隨著 Netflix 和 Amazon Prime 等訂閱服務現已在智慧電視和 Android 電視上推出,需求日益成長,從而推動了市場成長。

根據IBEF預測,到2025年連網智慧電視數量預計將達到約4,000萬至5,000萬台。該螢幕上消費的內容的 30% 將是社交媒體、遊戲和短影片。

例如,2022 年 5 月,LG 宣布將重點關注 OLED(有機發光二極體)電視,因為它計劃在印度不斷成長的高階電視領域擴大其影響力。如今,許多消費者對購買更大螢幕的產品感興趣。消費者越來越傾向於高階電視,LG 希望透過其最新的 OLED 電視系列來抓住這一機會。

同樣,2022 年9 月,三星印度宣布推出其模組化MicroLED“Wall All-In-One”,這將徹底改變顯示器的未來,以及“Flip Pro”,這是一款互動式顯示器,將把教育體驗提升到一個新的水平。 Wall All-in-One 有 110 吋和 146 吋兩種尺寸可供選擇,針對公司辦公室進行了最佳化。

三星還將在印度德里郊區建立其首家智慧型手機顯示器製造廠。根據向公司註冊處(RoC)提交的申請,這家韓國公司將向位於諾伊達的工廠投資超過 350 億印度盧比。該工廠將生產行動電話和 IT 顯示螢幕,之後可能擴展到筆記型電腦和電視。

此外,為了鞏固其地位,印度政府正在為晶片和顯示器製造提供激勵措施,進一步推動顯示面板市場的成長。例如,2022 年 9 月,印度政府宣布將根據一項 100 億美元的計畫擴大對半導體製造設備和顯示器設備的財政誘因。

顯示面板行業概覽

全球顯示面板市場競爭激烈。由於市場參與企業眾多,有大有小,因此市場呈現細分化。所有主要參與者都擁有相當大的市場佔有率,並致力於擴大其全球消費群。市場的主要企業包括友達光電、日本京東方、群創光電、LG 電子、三星電子和松下公司。為了在預測期內獲得競爭優勢,公司正在建立多種夥伴關係並投資推出新產品以增加市場佔有率。

2023年5月,HTC宣布推出HTC U23 Pro。 U23 Pro 配備全高清+ 有機發光二極體螢幕、Snapdragon 7 Gen 1 晶片組等。支援 5G 的 Android 智慧型手機配備專用的 microSD 卡插槽,可用於擴充板載儲存。

2023年1月,聯想宣布將發表有機發光二極體筆記型電腦Yoga Book 9i。這是聯想最新的折疊式筆記型電腦,搭載第 13 代英特爾酷睿 i7-U15 處理器,搭配英特爾 Iris X 整合顯示卡和 16GB LPDDR5X RAM。該公司預計 Yoga Book 9i 將於 2023 年 6 月發售。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 對顯示面板市場的影響

第5章 市場動態

- 市場促進因素

- 電視對超高清顯示面板的需求不斷增加

- 家用電子電器市場需求不斷成長

- 市場問題

- 消費性產品實施成本高昂

第6章 市場細分

- 按顯示類型

- LCD

- 有機發光二極體

- 其他顯示器類型(AMOLED、MicroLED 等)

- 按決議

- 8K

- 4K

- 高清(高清、WQHD、FHD)

- 按應用

- 智慧型手機和平板電腦

- 個人電腦和筆記型電腦

- 電視機

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- AUO Corporation

- BOE Japan Co. Ltd

- Innolux Corporation

- LG Electronics

- Samsung Electronics Co. Ltd

- Panasonic Corporation

- Sharp Corporation

- Hisense International

- Sony Corporation

- Japan Display Inc.

第8章投資分析

第9章:市場的未來

The Display Panel Market size is estimated at USD 166.80 billion in 2025, and is expected to reach USD 199.84 billion by 2030, at a CAGR of 3.68% during the forecast period (2025-2030).

Display technologies, aided by technological developments, have evolved over the years to offer higher resolution and lower power consumption. The developments in nanoparticles and transparent sensors in the electronic circuit have boosted the progression of the transparent display market. In the present scenario, development is progressing on replacing hard square panels with flexible displays that are more interactive to the consumer. This is expected to provide a substantial opportunity for the growth of the transparent display market.

The display market is driven by the growing demand for enhanced displays, such as OLED and PMOLED, augmented displays, and rollable transparent displays. OLED technology enables bright, efficient, and thin displays and lighting panels. They are currently used in numerous mobile devices, TVs, and lighting fixtures. OLED displays provide better image quality than LCD or Plasma displays - and can be made transparent and flexible.

Moreover, a significant application area of displays has been the heads-up display devices. These devices have witnessed strong demand from AR/VR, military and defense, and automotive markets, thereby driving the market for display panels. A device with a transparent display has a much higher resolution and displays much more realistic augmented reality than video augmented reality.

The growing demand for oxide TFT has encouraged players to increase their production capacity to compensate for the market demand. For instance, in December 2021, China Star Optoelectronics Technology (CSOT), a China-based display panel maker belonging to the TCL Group, announced setting up an 8.6G oxide TFT-LCD production line, with production scheduled to begin in first-quarter 2023.

Out of the hardware sales, head-mounted displays dominated the market. This results from the rising demand for higher-quality HMDs to support the ongoing demand for high-quality content and functionality improvements and provide an improved immersive experience to consumers, which can be achieved through transparent displays. This is expected to drive the market.

DriveAR platform from Nvidia uses a dashboard-mounted display overlaying graphics based on camera footage around the car, using a transparent display. This system points out everything from hazards to historic landmarks along the way. Following the platform's success, automotive manufacturing giants like Audi, Mercedes-Benz, Tesla, Toyota, and Volvo have signed up with the company to work with the technology.

In April 2023, Samsung announced to supply premium, next-generation display panels to Ferrari models. Through this, the company aims to expand beyond television and smartphones and target the fastest automotive market.

Due to the COVID-19 pandemic, Sony's business was impacted by factors such as restrictions on the movement of people across national borders, making it difficult for the company to send engineers to manufacturing hubs such as China and countries in Southeast Asia to help with new product launches or give instructions on manufacturing. Moreover, sales of Sony's products were also affected by global lockdowns and retailer closings.

Display Panel Market Trends

OLED Type of Display Panel to Hold a Significant Position

OLEDs are expected to replace existing technologies in the display ecosystem. Owing to this, many vendors started investing heavily in R&D related to OLED. OLED transparent displays are penetrating the market due to increasing demand for these displays from head-mounted display (HMD) vendors.

For instance, in April 2023, Samsung announced to invest USD 3 billion in OLED panels for laptops and tablets in South Korea. Similarly, in April 2022, Samsung announced a new project underway for future TV offerings. The project aims to make its quantum dot (QD)-OLED panels thinner than they are now. With this, the company will be eyeing a new possibility for its TV lineup - rollable screen TVs. The new panel types will also help cut down production costs.

Owing to success over battery life, in February 2022, LG Display won the contract to supply OLED panels based on low-temperature poly-crystalline oxide (LTPO) technology to Apple for the iPhone 14 series, which will be launched in the second half of 2022.

Moreover, several leading manufacturers focus on launching products with OLED displays to bring innovation and gain a competitive advantage. For instance, in May 2023, Samsung announced to release sensor OLED display at the SID Display Week. The display integrates the fingerprint scanner into the OLED screen, eliminating the need for smartphone brands to install a separate fingerprint scanner module under the screen.

Furthermore, in January 2023, LG Display announced releasing its third-generation OLED TV panel at CES 2023. Based on 'META Technology,' the company's newest OLED TV panel delivers the ultimate picture quality. The company's latest OLED displays achieve 60 percent brighter images and 30 percent wider viewing angles than conventional OLED displays, on top of improved energy efficiency. This release aims to strengthen its position in the large OLED panel industry.

India in the Asia Pacific region is Expected to Witness Significant Growth

Consumer spending in India is increasing, due to rising disposable income, due to which the demand for televisions is witnessing a high spike owing to the rising soccer fan base in countries such as India. As a result, the TV makers in India are launching larger screens with advanced technologies, which, in turn, is likely to boost the market growth in the country over the forecast period.

Furthermore, the changing behavior in TV connections is expected to drive market growth. Subscriptions, such as Netflix and Amazon Prime, have been made available for Smart and Android TVs, owing to which the demand is gaining high traction, thereby propelling the market growth.

According to IBEF, connected smart televisions are expected to reach approximately 40-50 million by 2025. 30% of the content viewed on this screen will be social media, gaming, and short video.

For instance, in May 2022, LG announced that the company is eyeing heavily OLED (organic light-emitting diode) Televisions as it plans to increase its footprint in India's growing premium Television segment. These days, many consumers are interested in buying bigger screens, especially after the pandemic when there is a limitation to cinema halls. Consumers increasingly gravitate toward premium TVs, and LG aims to grab the opportunity with the updated OLED TV range.

Similarly, in September 2022, Samsung India announced the launch of Wall All-In-One, a modular MicroLED that will revolutionize the future of displays, and Flip Pro, an interactive display that will take the educational experience to the next level. Available in 110" and 146" sizes, the wall all-in-one is optimized for corporate offices.

Also, Samsung is setting up India's first smartphone display manufacturing unit on the outskirts of Delhi. The South Korean company is investing over Rs 3,500 crore in this facility in Noida, per a regulatory filing with the Registrar of Companies (RoC). The plant would produce displays of mobile phones and IT displays and could later extend it to laptops and televisions.

Moreover, the government of India is offering incentives for chips and display unit manufacturing to strengthen its position, further supporting the display panel market growth. For instance, in September 2022, the Indian government announced increased financial incentives for setting up semiconductor manufacturing units and displays under USD 10 billion plan.

Display Panel Industry Overview

The Global Display Panel Market is very competitive. The market is fragmented due to various small and large players. All the major players account for a large market share and focus on expanding their worldwide consumer base. Some significant players in the market are AUO Corporation, BOE Japan Co. Ltd, Innolux Corporation, LG Electronics, Samsung Electronics Co. Ltd, Panasonic Corporation, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In May 2023, HTC announced to release HTC U23 Pro. The U23 Pro packs a Full HD+ OLED Screen, Snapdragon 7 Gen 1 Chipset, and much more. It is a 5 G-enabled Android smartphone with a dedicated microSD card slot for expanding onboard storage.

In January 2023, Lenovo announced to launch a dual-screen OLED Laptop, the Yoga Book 9i. It is Lenovo's latest foldable laptop and comes with 13th Gen Intel Core i7-U15 processors inside, with Intel Iris X integrated graphics and 16GB of LPDDR5X RAM inside. The company expects the Yoga Book 9i to be available in June 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Display Panel Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for UHD Display Panels for TVs

- 5.1.2 Increasing Demand in the Consumer Electronics Market

- 5.2 Market Challenges

- 5.2.1 Expensive Deployments in Consumer Products

6 MARKET SEGMENTATION

- 6.1 By Type of Display

- 6.1.1 LCD

- 6.1.2 OLED

- 6.1.3 Other Type of Displays (AMOLED, MicroLED, etc.)

- 6.2 By Resolution

- 6.2.1 8K

- 6.2.2 4K

- 6.2.3 HD (HD, WQHD, and FHD)

- 6.3 By Application

- 6.3.1 Smartphones and Tablets

- 6.3.2 PC and Laptop

- 6.3.3 Television

- 6.3.4 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AUO Corporation

- 7.1.2 BOE Japan Co. Ltd

- 7.1.3 Innolux Corporation

- 7.1.4 LG Electronics

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Panasonic Corporation

- 7.1.7 Sharp Corporation

- 7.1.8 Hisense International

- 7.1.9 Sony Corporation

- 7.1.10 Japan Display Inc.