|

市場調查報告書

商品編碼

1641837

衛星轉發器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Satellite Transponder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

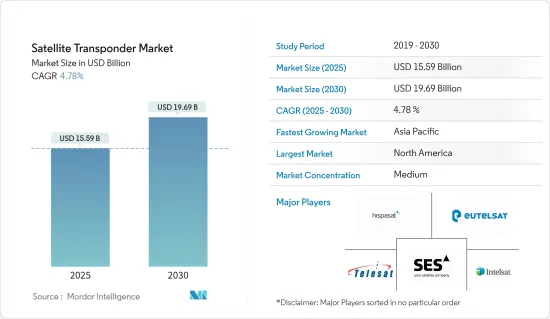

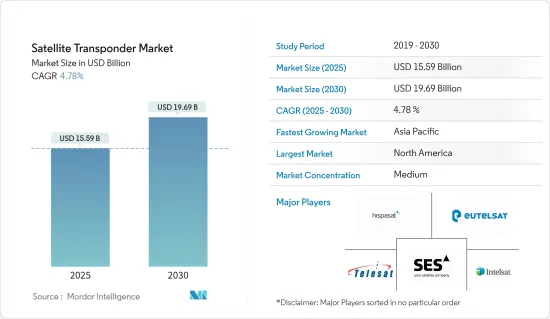

衛星轉發器市場規模預計在 2025 年為 155.9 億美元,預計到 2030 年將達到 196.9 億美元,預測期內(2025-2030 年)的複合年成長率為 4.78%。

衛星轉發器是內建於衛星的小型晶片大小的電路,用於將上行資料和資訊傳輸到下行鏈路,反之亦然。預計在預測期內,新型經濟高效的衛星技術的開發、通訊服務需求的不斷成長、高效實用的技術解決方案的提供以及Ku波段和Ka波段需求的不斷成長將推動衛星轉發器市場的發展。

關鍵亮點

- 隨著網路在全球的興起,寬頻連線已成為重要的資訊來源。再加上對高速網路日益成長的需求,未來幾年可能會大幅推動對衛星轉發器的需求。例如,根據國際電信聯盟的資料,全球網路用戶數將從2018年的37.29億增加到2021年的49.01億。

- 全球商業部門正在使用 C 波段(在廣闊的地理區域提供較低的傳輸,通常需要大型地面設施進行接收)和Ku波段(在較小的地理區域提供較高的傳輸)。較小的地面設備接收(英語:Analytics (wave, 200Mbps))預計將在未來促進衛星轉發器市場的成長。

- 此外,衛星通訊業者目前正在開發Ku波段和Ka波段頻譜中的應用,以便使用較小的地面設備實現更快的傳輸和關鍵資訊傳輸。 Ka波段和Ku波段頻寬/轉發器租約預計將佔衛星轉發器市場成長的大部分。在這些租賃中, Ka波段預計在預測期內呈現最高的成長率。

- 此外,預計在預測期內,對Ku波段服務的需求不斷成長將為衛星轉發器帶來巨大的推動力。 Ku波段衛星通訊系統正擴大用於自然災害期間的各種緊急通訊,以及電視廣播廣播公司在沒有光纖和有線網路的偏遠和農村地區的衛星新聞採集 (SNG)。

- 此外,隨著物聯網 (IoT) 和工業 4.0 在全球的興起,寬頻連接在向個人提供資訊方面發揮著至關重要的作用。通訊業的參與企業正在租賃衛星轉發器,以便不僅向偏遠地區提供寬頻設施,而且向全球提供寬頻設施。新加坡電信 (Singtel) 等各類市場供應商都利用了這個機會,提供廣泛的覆蓋範圍、無限的轉發器容量頻寬和靈活的衛星轉發器租賃服務,以滿足業務需求。

- 在新冠肺炎疫情期間,衛星通訊實現了遠端醫療,可以診斷疾病並治療隔離患者,減少了負責人和患者之間面對面接觸的需要。衛星轉發器的應用主要支援此類案例,對市場成長產生積極影響。然而,COVID-19疫情對全球經濟的影響,導致多個衛星通訊計劃被推遲、延遲或取消,對我們的衛星轉發器租賃業務產生重大影響。

衛星轉發器市場趨勢

轉發器租賃服務可望獲得巨大發展

- 由於轉發器租賃推動了全球轉發器成本上漲,預計它將在衛星轉發器市場中獲得巨大發展。此外,對可靠地支援頻寬密集型的需求不斷成長,推動了各種應用中對轉發器租賃的需求。

- 衛星轉發器租賃服務有助於企業和社區與世界建立聯繫。安全可靠的衛星連線使企業無論身在何處都能保持聯繫。快速點對點進入新市場、靈活的應答器租賃以及穩定的地面控制設施使開展業務變得更加容易。

- Thaicom 和 Singtel 等多家知名市場供應商不斷創新其衛星轉發器服務,以滿足對Ku波段等先進頻譜日益成長的需求,從而實現行動回程資料、廣播和行動通訊。租賃服務。此外,市場供應商還提供靈活的轉發器租賃,預計這將影響未來幾年轉發器租賃領域的成長。

- 通訊轉發器租賃在很大程度上依賴高清視訊廣播的採用和高動態範圍 (HDR) 應用的普及。此外,新電視平台的進步加上 OTT 平台用戶群的增加也增加了對轉發器租賃的需求,從而對市場成長產生了積極影響。

- 此外,影像串流、寬頻和DTH對可靠衛星通訊的需求日益成長,也為市場成長提供了光明的未來。 Netflix 和 Amazon Prime 等主要 OTT 和串流媒體平台的參與企業以及用戶數量的增加也在推動市場成長。例如,根據Netflix 2022年第四季報告的資料,Netflix的付費用戶群從2019年第一季的1.4886億成長到2022年第四季的2.3075億。

北美佔據很大市場佔有率

- 北美是一個反應非常迅速的市場,隨著時間的推移經歷了各種技術變化。從許多方面來看,北美 C 波段影片服務領域是商業衛星轉發器租賃服務成長的主要貢獻者。總體而言,衛星產業和通訊業者正在意識到Ka波段在提供 4K-UHD(超高清)和 OTT 電視服務方面的潛力。這些市場發展預計將推動北美對Ka波段Ka波段的需求,因為它們顯著降低了雨水造成的衰減。

- 預計預測期內北美地區將佔據衛星轉發器市場的最大佔有率。主要衛星轉發器供應商的廣泛存在以及對安全可靠的衛星通訊的廣泛需求促成了北美地區在該市場的主導地位。

- 此外,隨著衛星通訊技術的不斷發展和進步,衛星通訊能力的不斷提高,衛星通訊的應用越來越廣泛,區域服務品質也不斷提高。此外,通訊、電子和航太等領域的技術不斷進步,推動著快速發展。這些因素進一步加速了該地區的市場成長。

- 此外,美國定位/導航衛星訊號的商業應用數量正在增加。衛星發射的精確時間訊號有許多用途,包括控制自動化農業機械、無線電話產業緊急定位服務的訊號定時,以及作為美國國家空中交通管制系統的基礎。

- 例如,2023年4月,SpaceX宣布將發射Intelsat的IS-40e通訊。該衛星將搭載美國太空總署的首個託管有效載荷,同時滿足日益成長的機上連接需求。該衛星將配備Ku波段和Ka波段通訊能力,設計發射重量約 6 噸,輸出功率約 8 千瓦。

- 同樣,2023年5月,美國國防承包商SAIC宣布與歐洲製造商GomSpace建立戰略夥伴關係,為美國政府機構、大學和私人公司開發小型衛星。透過此次合作,SAIC 旨在利用其在傳統太空系統開發方面的經驗和深厚的技術專長來鞏固其在新空間經濟中的地位。

- 國防和安全管理、緊急服務和國防安全保障對先進商業成像衛星的需求正在上升。此外,該地區的衛星產業預計將增加對產品開發的投資。商業衛星的先進和創新功能正在推動該地區衛星轉發器市場的成長。

衛星轉發器產業概況

衛星轉發器市場半固體且由幾個主要企業組成。從市場佔有率來看,目前市場主要被幾家主要企業所佔據。 SES SA、Arabsat、Embratel Star One、Eutelsat Communications SA、Hispasat、Intelsat SA 等是全球衛星轉發器市場的主要企業。公司採用多種成長和擴大策略來獲得競爭優勢。產業參與者遵循價值鏈整合,跨多個價值鏈階段進行營運。

- 2024 年 2 月-印度成功將其第三代氣象衛星 INSAT-3DS 發射入軌道。該衛星的先進有效載荷,包括通道成像器、通道探測器、資料繼電器轉發器(DRT)和衛星輔助搜索和救援(SA&SR)轉發器,將促進全面的資料收集和傳播。

- 2023 年 5 月—Inmarsat 宣布採用一顆新的小型衛星 Inmarsat-8,並將於 2026 年發射,以提供關鍵的安全服務並支援緊急追蹤的進步。三顆 i-8 衛星將增強網路彈性並確保 Inmarsat 全球L波段安全服務的未來。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 對新電視平台和技術的需求不斷增加

- KU波段和KA波段服務的成長

- 市場限制

- 與光纖傳輸電纜網路的競爭

- 需要昂貴的資本投資

- 技術簡介

- C波段

- KU波段

- KA 頻段

- S波段、 L波段、 X波段

第6章 市場細分

- 按應用

- 商業通訊

- 政府通訊

- 導航

- 遙感探測

- 其他

- 按服務

- 租

- 維護支援

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- SES SA

- Telesat

- Intesat SA

- Eutelsat Communications SA

- Hispasat SA(Red Electrica)

- Singapore Telecommunication Ltd(Singtel)

- SKY Perfect JSAT Corporation

- EchoStar Corporation

- China Satellite Communications Co. Ltd.

- Russian Satellite Communications Company

第8章投資分析

第9章 市場機會與未來趨勢

The Satellite Transponder Market size is estimated at USD 15.59 billion in 2025, and is expected to reach USD 19.69 billion by 2030, at a CAGR of 4.78% during the forecast period (2025-2030).

Satellite transponders are minor chip-size circuits integrated into satellites to transmit the uplink data or information to the downlink and vice-versa. The development of new cost-effective satellite technologies, growing demand for telecommunication services, and availability of efficient and practical technological solutions coupled with growth in demand for Ku-band and Ka-band are likely to drive the satellite transponder market over the forecast period.

Key Highlights

- With the rise of internet penetration worldwide, broadband connectivity has become a critical source of information. This, coupled with the growing demand for high-speed internet, will significantly drive the demand for satellite transponders in the coming years. For instance, according to the ITU data, internet users worldwide increased from 3,729 million in 2018 to 4,901 million in 2021.

- The increasing demand for C band (which provides lower transmission power over vast geographic areas and typically requires larger ground equipment for reception) and Ku band (which offers higher transmission power over smaller geographic regions and can be received with smaller ground equipment) transponder by the commercial sector worldwide, is expected to augment the growth of the satellite transponders market in the future.

- In addition, satellite operators are now developing applications over the Ku-band and Ka-band frequency bands, which may facilitate increased transmission speeds and important information transfer with the usage of small ground equipment. Ka-band and Ku-band bandwidth/transponders' leasing is expected to account for the majority of the growth in the satellite transponder market. Of this leasing, Ka-band is expected to witness the highest growth rate in the forecast period.

- Moreover, growth in Ku-band service demand is expected to generate significant traction for satellite transponders over the forecast period. Ku-band satellite communication systems are increasingly being deployed for various emergency communications during natural disasters and for satellite news gathering (SNG) by TV broadcasters in remote or rural areas where fiber and cable networks are unavailable.

- Further, with the emergence of the Internet of Things (IoT) and Industry 4.0 across the globe, broadband connectivity plays a crucial role in providing information to individuals. The telecom industry players are looking to lease satellite transponders to deliver broadband facilities to isolated places as well as across the globe. Various market vendors, such as Singtel, are capitalizing on the opportunity and offering extensive coverage, myriad transponder capacity bandwidths, and flexible satellite transponder lease services to fulfill business needs.

- During the COVID-19 pandemic, satellite communications enabled access to telemedicine to diagnose diseases or treat individuals who were quarantined, reducing the need for face-to-face interaction between healthcare personnel and patients. The applications of satellite transponders primarily supported such instances, thus positively impacting the market's growth. However, the impact of the COVID-19 pandemic on the global economy resulted in some satellite communication projects being postponed, delayed, and canceled, significantly impacting the satellite transponder leasing business.

Satellite Transponder Market Trends

Transponders Leasing as Service is Expected to Gain Significant Traction

- Transponder leasing is expected to gain significant traction in the satellite transponder market owing to fuelling the cost of transponders throughout the globe. In addition, the increasing demand to support bandwidth-intensive applications with reliability drives the need for transponder leasing in various applications.

- Satellite transponder lease service helps to connect businesses and communities globally. With the help of secure and reliable satellite connectivity, organizations can be connected wherever they are. The faster point-to-point access to new markets, flexible transponder leases, and stable on-ground control facilities help businesses get easier.

- Various prominent market vendors such as Thaicom and Singtel are continuously innovating their satellite transponder services to cater to the growing demand for advanced spectrum such as Ku-band to provide effective transponder leasing services for data, broadcast, and mobile backhaul connectivity across the world. In addition, market vendors are also providing flexible transponder leases, which is expected to influence the transponder leasing segment growth in the coming years.

- The leasing of communication satellite transponders is extremely dependent upon the adoption of HD video broadcasting and the widespread of High Dynamic Range (HDR) applications. Moreover, the advancement in new TV platforms coupled with an increase in subscriber base in OTT platforms is also augmenting the demand for transponder leasing, thus positively impacting the market growth.

- In addition, the growing need for reliable satellite-based communication in video distribution, broadband, and DTH is providing a promising future for the market's growth. The presence of major OTT and streaming platform players such as Netflix, Amazon Prime, etc., and its increasing subscriber base also aid the market's growth. For instance, according to the data from Netflix's Q4 2022 report, the number of Netflix paid subscribers rose to 230.75 million in Q4 2022 from 148.86 million in Q1 2019.

North America to Occupy Significant Share in the Market

- North America has been an extremely responsive market and has witnessed various technological changes over a long period. In many ways, the North American C-band video services segment is the major contributor to the growth of commercial satellite transponder leasing services. Overall, the satellite industry and satellite operators have realized the potential of Ka-band in delivering 4K-UHD (Ultra-high-definition) and OTT TV services. These evolving markets would drive demand for Ka-band transponders in the North American region as the Ka-band transponders eliminate rain attenuation to a great extent.

- North American region is expected to amount to the largest share of the satellite transponder market over the forecast period. The extensive presence of key satellite transponder providers and the widespread necessity for secure and reliable satellite-based communication are contributing to the dominance of the North American region in this market.

- Moreover, as satellite communication technology continues to develop and advance, and the satellite communication capability continues to improve, the utilization of satellite communication is becoming increasingly widespread, and the quality of service in the area is continuously improving. In addition, there is a swift development owing to the augmented technology advancement of communications, electronics, aerospace, etc. Such factors are further augmenting the growth of the market in the region.

- Moreover, the number of commercial applications for location/navigation satellite signals is growing in the United States. The accurately and precisely timed signals emitted by the satellites are used for many purposes, including the control of automated farm equipment, the timing of signals for the wireless telephone industry emergency location services, and as the basis for a U.S. national air traffic control system.

- For instance, in April 2023, SpaceX announced the launch of Intelsat's IS-40e communications satellite to help the operator meet the growing demand for connectivity on planes while also carrying its first hosted payload for NASA. The satellite is equipped with Ku- and Ka-band capacity; the satellite weighed around six metric tons at launch and is designed to have roughly eight kilowatts of power.

- Similarly, in May 2023, SAIC, a U.S. defense contractor, announced a strategic partnership with GomSpace, a European manufacturer, to develop small satellites for U.S. government agencies, universities, and commercial firms. Through this partnership, SAIC aims to leverage its heritage and deep technical expertise in legacy space systems development and strengthen its position in the new space economy.

- The demand for advanced commercial imaging satellites for defense and security administration, emergency services, and homeland security is on the rise. The satellite industry in the region is also expected to witness increased investments in product development. The availability of advanced and innovative features in commercial satellites propels the growth of the satellite transponder market in the region.

Satellite Transponder Industry Overview

The satellite transponder market is semi-consolidated and consists of several major players. In terms of market share, few major players currently dominate the market. SES S.A., Arabsat, Embratel Star One, Eutelsat Communications S.A., Hispasat, Intelsat S.A., and others are among the major players in the global Satellite Transponder market. The companies use several growth and expansion strategies to gain a competitive advantage. Industry participants follow value chain integration with business operations in multiple value chain stages.

- February 2024 - India successfully launched 3rd gen meteorological satellite INSAT-3DS into orbit. The satellite's advanced payloads, including Channel Imager, Channel Sounder, Data Relay Transponder (DRT), and Satellite-aided Search and Rescue (SA&SR) transponders, will facilitate comprehensive data collection and dissemination.

- May 2023 - Inmarsat announced the introduction of its new Inmarsat-8 small satellites, which will be launched in 2026 to provide crucial safety services and support advances in emergency tracking. The three I-8 satellites will provide additional network resilience, securing the future of Inmarsat's global L-band safety services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for New TV Platforms and Technologies

- 5.1.2 Growth in KU-Band and KA-Band Services

- 5.2 Market Restraints

- 5.2.1 Competition From Fiber-Optic Transmission Cable Networks

- 5.2.2 Requirement of High Capital Investment

- 5.3 Technolgy Snapshot

- 5.3.1 C-Band

- 5.3.2 KU-Band

- 5.3.3 KA-Band

- 5.3.4 S-band and L-band and X-band

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Commercial Communications

- 6.1.2 Government Communications

- 6.1.3 Navigation

- 6.1.4 Remote Sensing

- 6.1.5 Other Applications

- 6.2 By Service

- 6.2.1 Leasing

- 6.2.2 Maintenance and Support

- 6.2.3 Other Services

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SES SA

- 7.1.2 Telesat

- 7.1.3 Intesat SA

- 7.1.4 Eutelsat Communications SA

- 7.1.5 Hispasat SA (Red Electrica)

- 7.1.6 Singapore Telecommunication Ltd (Singtel)

- 7.1.7 SKY Perfect JSAT Corporation

- 7.1.8 EchoStar Corporation

- 7.1.9 China Satellite Communications Co. Ltd.

- 7.1.10 Russian Satellite Communications Company