|

市場調查報告書

商品編碼

1641861

消費電池:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Consumer Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

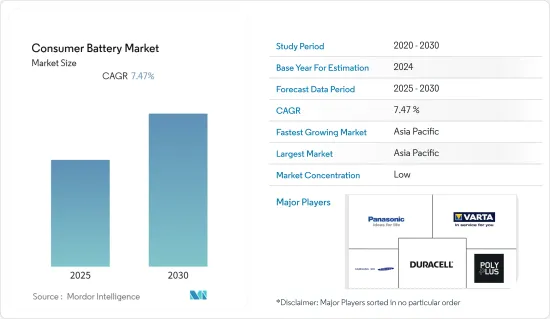

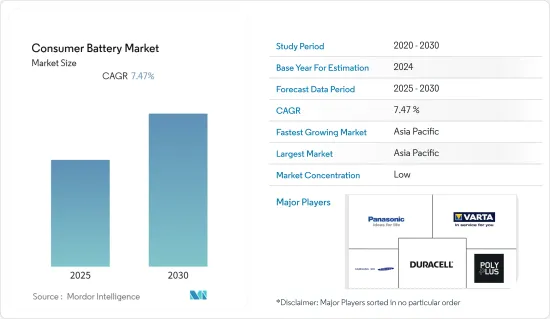

預計預測期內消費電池市場複合年成長率將達 7.47%

關鍵亮點

- 從中期來看,預計預測期內對智慧型手機、平板電腦和穿戴式裝置等可攜式電子設備的需求不斷增加將推動市場發展。

- 然而,消費電池(尤其是可充電電池)的壽命有限,預計會在預測期內阻礙市場的成長。

- 再生能源來源和能源儲存系統的日益普及預計將為消費電池市場創造巨大的商機。

- 由於亞太地區擁有龐大的電池製造基礎設施,預計該地區將成為消費電池市場的主導地區。

消費電池市場的趨勢

預計鋰離子電池領域將佔市場主導地位。

- 鋰離子電池是一種利用鋰離子儲存和釋放電能的可充電電池。它們廣泛應用於各種應用,包括家用電子電器、電動車和能源儲存系統。

- 與其他化學電池相比,鋰離子電池具有較高的能量密度。這意味著可以在更小、更輕的封裝中儲存更多的能量,使其成為需要緊湊外形規格和長效電力的可攜式電子設備的理想選擇。

- 鋰離子電池的壽命通常比其他可充電電池(例如鎳氫 (NiMH) 和鎳鎘 (NiCd) 電池)更長。它們可以承受更多次充電/放電循環,直到容量大幅下降,從而為消費者提供更長的使用時間並提升投資價值。

- 全球鋰離子電池製造商都致力於降低鋰離子電池的成本。過去十年來,鋰離子電池價格大幅下跌。 2022 年,鋰離子電池的平均價值約為每千瓦時 151 美元。與 2013 年相比,預計 2022 年價格將下跌 79% 以上。

- 此外,大多數智慧型手機公司都使用鋰離子電池,包括三星、iPhone、Infinix 和諾基亞。智慧型手機的使用量不斷成長預計將推動鋰離子電池市場的發展。愛立信稱,中國、印度和美國是全球智慧型手機行動網路用戶最多的國家,預計2022年將達到約66億,未來5年將超過78億人。

- 此外,2022 年 2 月,伯克希爾哈撒韋能源再生能源公司 (BHE Renewables) 宣布計劃於 2022 年中期在加州動工興建一座工廠,以測試從地熱鹽水中提取鋰的工藝的商業性可行性。如果測試成功,該公司預計將在未來三年內開始將氫氧化鋰和碳酸鋰商業化。這些發展可能會促進北美用於 ESS 應用的鋰離子電池市場的發展。

- 因此,如前所述,預計鋰離子電池將在預測期內佔據市場主導地位。

亞太地區可望主導市場

- 亞太地區,尤其是中國、日本、韓國和台灣等國家,已成為家用電子電器和電池的製造地。這些國家已經開發了供應鏈、生產設施和電池製造專業知識,以滿足全球對消費電池的需求。

- 此外,亞太地區擁有全球相當一部分人口,其中包括中產階級不斷壯大的新興經濟體。該地區可支配收入的提高和家用電子電器的日益普及正在推動對電池的需求,使其成為電池製造商的利潤豐厚的市場。

- 例如,2023年2月,馬來西亞政府承認電子市場是對該國經濟具有重要意義的潛在市場。為了促進電子業的製造業,政府宣布向遷至馬來西亞的製造公司提供稅收優惠,並決定將高階主管 15% 的稅率延長至明年。

- 亞太地區也是電動車(EV)產業的主要樞紐。由於電動車嚴重依賴鋰離子電池,中國、日本和韓國等國家電動車的日益普及預計將大大促進鋰離子電池的需求,幫助該公司在鋰離子電池領域佔據市場主導地位。 。

- 亞太地區的電子商務平台和線上零售也經歷著強勁成長。這使得消費電池更容易被更廣泛的客戶所接受,從而促進了市場擴張。在消費者購買電池方面,電子商務透過提供便利、有競爭力的價格和廣泛的選擇,進一步鞏固了其市場主導地位。

- 因此,鑑於上述情況,預計亞太地區將在預測期內主導消費電池市場。

消費性電池產業概況

消費電池市場是細分的。主要企業(不分先後順序)包括松下公司、VARTA Consumer Batteries GmbH & Co.KGaA、三星 SDI、金霸王公司和 PolyPlus Battery Company Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(百萬美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 攜帶式電子設備需求不斷成長

- 消費電池的技術進步

- 限制因素

- 電池壽命限制

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 類型

- 鋰離子電池

- 鋅碳電池

- 鹼性電池

- 鎳氫電池

- 鎳鎘

- 其他

- 2028 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 韓國

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Panasonic Corporation

- VARTA Consumer Batteries GmbH & Co. KGaA

- Maxell Holdings Ltd

- LG Chem Ltd

- Energizer Holdings Inc.

- PolyPlus Battery Company Inc.

- Samsung SDI Co. Ltd

- Battery Technology Inc.

- Duracell Inc.

- Jiangmen TWD Technology Co. Ltd

第7章 市場機會與未來趨勢

- 向可再生能源儲存的轉變

簡介目錄

Product Code: 60449

The Consumer Battery Market is expected to register a CAGR of 7.47% during the forecast period.

Key Highlights

- Over the medium term, the increasing demand for portable electronics items like smartphones, tablets, and wearables is expected to drive the market during the forecasted period.

- On the other hand, the limited lifespan of consumer batteries, especially rechargeable batteries, is expected to hinder the growth of the market during the forecasted period.

- Nevertheless, the increasing adaption of renewable energy sources and energy storage systems is expected to create huge opportunities for the Consumer Battery Market.

- Asia-Pacific is expected to be a dominant region for the Consumer Battery Market due to the presence of a large battery manufacturing infrastructure in the region.

Consumer Battery Market Trends

The Lithium-ion Batteries Segment is Expected to Dominate the Market

- Lithium-ion batteries are rechargeable batteries that use lithium ions to store and release electrical energy. They are widely used in various applications, including consumer electronics, electric vehicles, energy storage systems, etc.

- Lithium-ion batteries offer higher energy density compared to other battery chemistries. This means they can store more energy in a smaller, lighter package, making them ideal for portable electronic devices requiring long-lasting power in a compact form factor.

- Lithium-ion batteries typically have a longer lifespan than other rechargeable batteries, such as nickel-metal hydride (NiMH) or nickel-cadmium (NiCd) batteries. They can withstand more charge-discharge cycles before experiencing significant capacity loss, providing consumers with more usage time and value for their investment.

- Global lithium-ion battery manufacturers are focusing on reducing the cost of Lithium-ion batteries. The price of lithium-ion batteries declined steeply over the past ten years. In 2022, an average lithium-ion battery was valued at around USD 151 per kWh. It witnessed a decrease in the price of more than 79% in 2022 compared to 2013.

- Further, most smartphone companies, including Samsung, iPhone, Infinix, and Nokia use lithium-ion batteries. The increasing use of smartphones will drive the market for lithium-ion batteries. According to Ericsson, China, India, and the United States have the highest number of smartphone mobile network subscribers worldwide, with almost 6.6 billion in 2022, and is expected to surpass 7.8 billion in next five years.

- Additionally, in February 2022, Berkshire Hathaway Energy Renewables (BHE Renewables) announced its plans to break ground by mid-2022 on a California facility to test the commercial viability of a process that extracts lithium from geothermal brine. Once the test succeeds, the company will likely start commercializing lithium hydroxide and lithium carbonate in next three years. Such moves will likely boost the lithium-ion battery market for ESS applications in North America.

- Therefore, as mentioned above, the lithium-ion segment is expected to dominate the market during the forecasted period.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region, particularly countries like China, Japan, South Korea, and Taiwan, has established itself as a manufacturing hub for consumer electronics and batteries. These countries have well-developed supply chains, production facilities, and expertise in battery manufacturing, enabling them to meet the global demand for consumer batteries.

- Moreover, Asia-Pacific is home to a significant portion of the world's population, including emerging economies with growing middle-class populations. The increasing disposable income and rising adoption of consumer electronic devices in this region drive the demand for batteries, making it a lucrative market for battery manufacturers.

- For instance, in February 2023, the Malaysian government identified the electronics market as a potential market that can become significant to the country's economy. To promote manufacturing in the electronics segment, the government announced its decision to extend the tax incentive given to manufacturing companies that relocate to Malaysia and the tax rate of 15% for C-Suite until next year.

- The Asia-Pacific region is also a major hub for the electric vehicle (EV) industry. As EVs rely heavily on lithium-ion batteries, the growing adoption of electric vehicles in countries like China, Japan, and South Korea contributes significantly to the demand for lithium-ion batteries, strengthening the region's dominance in the market.

- The Asia-Pacific region has also witnessed substantial growth in e-commerce platforms and online retail. This has made consumer batteries easily accessible to a wide customer base, contributing to the market's expansion. E-commerce provides convenience, competitive pricing, and a vast range of options for consumers to purchase batteries, fueling the market's dominance.

- Therefore, per the points mentioned above, the Asia-Pacific region is expected to dominate the consumer battery market during the forecasted period.

Consumer Battery Industry Overview

The consumer battery market is fragmented. Some of the major companies (in no particular order) include Panasonic Corporation, VARTA Consumer Batteries GmbH & Co. KGaA, Samsung SDI Co. Ltd, Duracell Inc., and PolyPlus Battery Company Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Portable Electronic Devices

- 4.5.1.2 Technological Advancements in the Consumer Battery

- 4.5.2 Restraints

- 4.5.2.1 Limited Battery Lifespan

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Zinc-carbon batteries

- 5.1.3 Alkaline Batteries

- 5.1.4 Nickel Metal Hydride

- 5.1.5 Nickel Cadmium

- 5.1.6 Other Types

- 5.2 Geography Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)}

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 India

- 5.2.2.2 China

- 5.2.2.3 Japan

- 5.2.2.4 Australia

- 5.2.2.5 South Korea

- 5.2.2.6 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Spain

- 5.2.3.6 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Panasonic Corporation

- 6.4.2 VARTA Consumer Batteries GmbH & Co. KGaA

- 6.4.3 Maxell Holdings Ltd

- 6.4.4 LG Chem Ltd

- 6.4.5 Energizer Holdings Inc.

- 6.4.6 PolyPlus Battery Company Inc.

- 6.4.7 Samsung SDI Co. Ltd

- 6.4.8 Battery Technology Inc.

- 6.4.9 Duracell Inc.

- 6.4.10 Jiangmen TWD Technology Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shift towards Renewable Energy Storage

02-2729-4219

+886-2-2729-4219