|

市場調查報告書

商品編碼

1641862

植絨黏合劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Flock Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

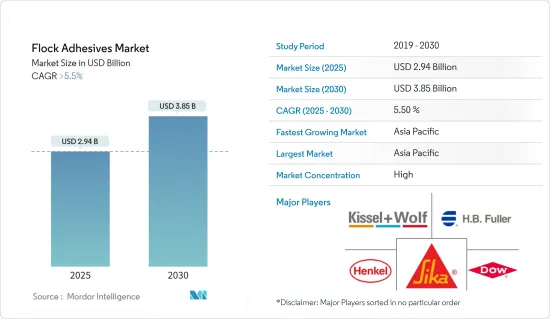

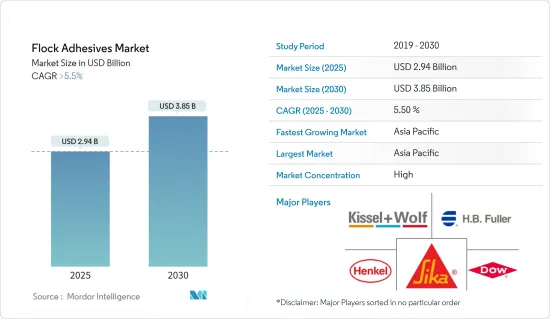

2025 年植絨黏合劑市場規模估計為 29.4 億美元,預計到 2030 年將達到 38.5 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5.5%。

COVID-19 疫情對植絨膠市場產生了負面影響。多個國家實施了全國性的封鎖和嚴格的社會隔離措施,導致紡織製造廠和汽車廠關閉,影響了植絨膠市場。然而,在這項限制取消之後,市場卻錄得了顯著的成長率。由於汽車、紡織、紙張和包裝應用對植絨黏合劑的需求不斷增加,市場呈現成長率。

塗層織物和成品的需求不斷增加、輕型和低碳排放汽車的需求不斷成長以及亞太地區對植絨膠的需求不斷增加,預計將推動植絨膠市場的發展。

另一方面,原料價格的波動預計會阻礙市場成長。

預計在預測期內,對環保和永續植絨黏合劑的需求不斷成長將為市場創造機會。

預計亞太地區將主導市場。此外,汽車、紡織、紙張和包裝應用對植絨膠的需求不斷增加,預計在預測期內將出現最高的複合年成長率。

植絨黏合劑市場趨勢

紡織應用主導市場

- 市場的成長是由紡織產品所推動的。植絨膠用於紡織工業,特別是用於麂皮絨的植絨。

- 中國是世界主要紡織品生產國之一。 2022年,中國成為全球最大紡織品出口國,出口額約1,480億美元。

- 同樣,歐盟以約 710 億美元的出口額位居第二。預計未來幾年紡織品出口額將進一步增加,從而推動目前的研究市場發展。

- 歐盟委員會表示,歐盟的紡織生態系統創造了價值並提供了投資和創新的機會。紡織和服飾(T&C) 產業是歐洲規模最大、最多樣化的工業產業之一,擁有 150 萬名員工,營業額約 1,620 億歐元(1,790 億美元)。因此,紡織品市場的擴大有望推動該地區植絨膠市場的發展。

- 此外,在印度,隨著過去十年來紡織業的外國直接投資(FDI)不斷增加,紡織品產量不斷上升,因此植絨膠的使用量也在增加。根據印度品牌資產基金會統計,2023年4月至2023年10月,印度紡織品和服裝出口額(包括手工藝品)為211.5億美元。預計到 2025-26 年將達到 1900 億美元。

- 此外,根據美國全國紡織組織理事會(NCTO)的數據,美國是世界第三大紡織品出口國。美國紡織業提供美國軍方8000多種紡織產品。此外,2022年該國的紡織品和服裝出貨收益將達658億美元。

- 因此,預計紡織應用領域將在預測期內佔據植絨黏合劑市場的主導地位。

亞太地區佔市場主導地位

- 由於汽車、紡織、紙張和包裝應用方面的需求不斷增加,預計亞太地區將主導植絨黏合劑市場。

- 亞太地區的汽車產量正在成長,其中中國和印度是領先的製造商。根據OICA預測,2022年該地區汽車產量將達5,002萬輛,而上一年為4,676萬輛。因此,預計汽車產量的增加將推動該地區植絨膠市場的發展。

- 在印度,隨著人口的成長,對汽車的需求也日益增加。因此,各製造商紛紛宣布擴張計劃,以提高在該國的汽車生產能力。例如,MG Motor India 在 2023 年 1 月宣布將投資 1 億美元擴大生產能力,並在 2023年終前實現 70% 的成長。因此,預計預測期內中國和印度汽車市場的成長將推動對植絨膠的需求。

- 此外,中國紡織業的市場成長顯著。根據中國國家統計局預測,2022年中國紡織品產量將達382億米,去年同期為235億米。 12月份,全國服飾布料產量約34.7億公尺。每月光纖產量持續超過30億公尺。

- 此外,由於生活方式的改變、人們可支配收入的提高、速食,亞太地區對包裝食品的需求正在成長。消費者偏好已調理食品,因為它們需要的準備時間明顯較少、新鮮,包裝美觀且堅固,這滿足了所研究市場的需求。

- 總體而言,預測期內汽車、紡織和包裝等行業的成長預計將推動該地區植絨膠黏劑市場的發展。

植絨膠黏劑產業概況

植絨黏合劑市場本質上是整合的。該市場的主要企業(不分先後順序)包括陶氏化學、富勒公司、漢高股份公司、Kissel+Wolf GmbH 和西卡股份公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 對塗層織物和最終產品的需求增加

- 對輕型、低碳車的需求不斷增加

- 亞太地區對植絨黏合劑的需求不斷成長

- 限制因素

- 原物料價格波動

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 樹脂類型

- 丙烯酸纖維

- 聚氨酯

- 環氧樹脂

- 其他樹脂種類(醇酸樹脂、氰基丙烯酸酯等)

- 應用

- 車

- 紡織產品

- 紙包裝

- 其他用途(印刷、鞋類等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Argent International

- Bostik(Arkema Group)

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- International Coatings

- Kissel+Wolf GmbH

- Lord Corporation

- NYATEX

- PARKER HANNIFIN CORP

- Sika AG

- Stahl Holdings BV

第7章 市場機會與未來趨勢

- 對環保、永續的植絨黏合劑的需求不斷增加

- 其他機會

The Flock Adhesives Market size is estimated at USD 2.94 billion in 2025, and is expected to reach USD 3.85 billion by 2030, at a CAGR of greater than 5.5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the market for flock adhesives. Due to nationwide lockdowns in several countries, strict social distancing measures resulted in the closure of textile manufacturing plants and automotive plants, thereby affecting the market for flock adhesives. However, the market registered a significant growth rate well after the restrictions were lifted. The market registered a growth rate due to the increasing demand for flock adhesives in automotive, textiles, paper, and packaging applications.

Increasing demand for coated fabrics and finished products, rising demand for lightweight, low carbon-emitting vehicles, and the increasing demand for flock adhesives in the Asia-Pacific region are expected to drive the market for flock adhesives.

On the flip side, volatility in raw material prices is expected to hinder the growth of the market.

The increasing demand for green, sustainable flock adhesives is expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for flock adhesives in automotive, textiles, paper, and packaging applications.

Flock Adhesives Market Trends

Textiles Application Segment to Dominate the Market

- The textile is expected to lead the growth of the market. Flock adhesives are used in the textile industry, especially for the flocking of suede fabrics.

- China is the leading producer of textiles in the world. In 2022, China was the top-ranked global textile exporter, with a value of approximately USD 148 billion.

- Similarly, the European Union ranked in second place, with an export value of around USD 71 billion. The export value of textiles is further expected to increase in the coming years, thereby driving the current studied market.

- According to the European Commission, the European Union's textiles ecosystem generates value and opens up opportunities for investment and innovation. Textiles and clothing (T&C) is one of Europe's largest and most diversified industrial sectors, with a workforce of 1.5 million and a turnover of around EUR 162 billion (USD 179 billion). Thus, the increasing market for textile products is expected to drive the market for flock adhesives in the region.

- Additionally, in India, with an increase in foreign direct investment (FDI) in the textile industry from the past decade, the production of textiles is increasing, thus resulting in increased use of flock adhesives. According to the Indian Brand Equity Foundation, India's textile and apparel exports (including handicrafts) from April 2023 to October 2023 stood at USD 21.15 billion. The industry is expected to reach USD 190 billion by 2025-26.

- Furthermore, according to the National Council of Textile Organization (NCTO), the United States is the world's third-largest exporter of textiles. The United States textile industry supplies the US military with over 8,000 textile products. Further, the textile and apparel shipments in the country reached USD 65.8 billion in 2022.

- Thus, the textiles application segment will dominate the market for flock adhesives during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for flock adhesives due to rising demand from the automotive, textile, paper, and packaging applications in the region.

- The production volume of automotive vehicles is increasing in the Asia-Pacific region, with China and India being the major manufacturers. According to OICA, in 2022, the total production volume of automotive vehicles in the area reached 50.02 million, compared to 46.76 million units manufactured in the previous year. Thus, the increase in the production volume of automotive vehicles will drive the market for flock adhesives in the region.

- In India, the demand for automotive vehicles is increasing with the rising population. Thus, various manufacturers have announced their expansion plans to increase the production capacity of automotive vehicles in the country. For instance, in January 2023, MG Motor India announced to invest USD 100 million to expand capacity and register a growth of 70% by the end of 2023. Thus, the growing markets for automotive vehicles in China and India are expected to drive the demand for Flock adhesives during the forecast period.

- Furthermore, in China, the textile industry registered significant market growth. According to the National Bureau of Statistics of China, the textile production volume in China accounted for 38.2 billion meters in 2022, compared to 23.5 billion meters during the same period in the previous year. In December, approximately 3.47 billion meters of clothing fabric were produced in China. Monthly textile production volume was consistently above three billion meters.

- Furthermore, in the Asia-Pacific, the demand for packaged food is growing, owing to lifestyle changes, the growing disposable income of people, the increasing number of working professionals, and the growing preference for fast food. Consumers prefer ready-to-consume foods because they require considerably less time for cooking, are fresh, and have attractive and sturdy packaging, supporting the demand for the market studied.

- Overall, the growth of industries such as automotive, textiles, and packaging will likely drive the market for flock adhesives in the region during the forecast period.

Flock Adhesives Industry Overview

The flock adhesives market is consolidated in nature. Some of the major players in the market (not in any particular order) include Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Kissel + Wolf GmbH, and Sika AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand of Coated Fabrics and Finished Products

- 4.1.2 Rising Demand for Light weight Low Carbon Emitting Vehciles

- 4.1.3 Increasing Demand for Flock Adhesives in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Acrylic

- 5.1.2 Polyurethane

- 5.1.3 Epoxy resin

- 5.1.4 Other Resin Types (Alkyd, Cyanoacrylate, etc.)

- 5.2 Application

- 5.2.1 Automotive

- 5.2.2 Textiles

- 5.2.3 Paper and Packaging

- 5.2.4 Other Applications (Printing, Footwear, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Argent International

- 6.4.2 Bostik (Arkema Group)

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 International Coatings

- 6.4.7 Kissel + Wolf GmbH

- 6.4.8 Lord Corporation

- 6.4.9 NYATEX

- 6.4.10 PARKER HANNIFIN CORP

- 6.4.11 Sika AG

- 6.4.12 Stahl Holdings B.V

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Demand for Green Sustainable Flock Adhesives

- 7.2 Other Opportunities