|

市場調查報告書

商品編碼

1641867

紫外線固化印刷油墨:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)UV Cured Printing Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

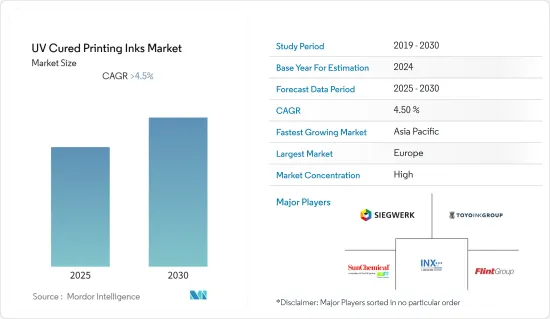

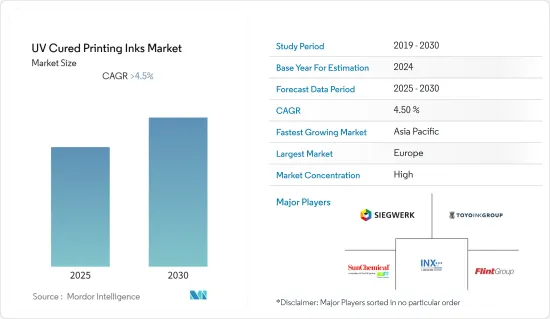

預測期內,紫外線固化印刷油墨市場預計將以超過 4.5% 的複合年成長率成長。

COVID-19 疫情擾亂了紫外線固化印刷油墨市場,由於封鎖、運輸限制和各行業的需求減少,導致供應減少。然而,由於紡織和包裝行業的需求增加,市場在 2022 年得以復甦。

主要亮點

- 市場研究的主要促進因素是數位印刷行業的需求不斷成長、包裝和標籤行業的需求不斷成長以及紡織業的需求不斷成長。

- 另一方面,傳統商業印刷業的衰退和替代品的出現阻礙了所研究市場的成長。

- 預計生物基紫外線固化油墨的發展和醫療產業的成長將在預測期內為市場成長提供各種機會。

- 歐洲佔據全球市場主導地位,其中大部分消費來自德國和義大利等國家。

UV固化印刷油墨市場趨勢

市場領先的包裝

- UV 固化印刷油墨可用於在各種基材上進行高品質的印刷。墨水透過紫外線照射固化,從而產生高品質、耐用的印刷品。

- 由於消費者偏好的改變,包裝產業面臨許多挑戰。然而,隨著數位印刷等各種升級技術的採用,包裝產業將迎來巨大的機會。數位印刷正在迅速擴展到標籤生產和靜電複印領域。由於數位印刷的廣泛應用,包裝行業預計將在未來十年經歷一場重大革命。

- Siegwerk 是一家生產用於包裝應用、標籤和目錄的印刷油墨的製造商,是第一家為食品和藥品包裝提供 LED UV 印刷油墨的公司。

- 包裝產業是為食品飲料、製藥和零售等各個製造業領域增加價值的重要產業。消費者對包裝商品(主要是食品和飲料)的支出增加是市場成長的主要動力。

- 中國、印度等發展中經濟體對包裝食品和藥品的需求不斷增加,預計將推動所研究市場的成長。

- 中國擁有世界第二大包裝產業。由於出口增加以及微波爐、零食和冷凍食品等食品領域的訂製包裝興起,預計該國在預測期內將呈現持續成長。預計未來幾年包裝的使用量將會增加。

- 包裝是印度經濟第五大產業。據印度包裝行業協會 (PIAI) 稱,這是該國成長最快的行業之一,複合年成長率為 22% 至 25%。印度食品加工產業佔全國整個食品市場的32%。

- 據軟包裝協會稱,軟包裝主要用於食品,佔整個市場的60%以上。軟包裝行業由於其能夠採用針對各種包裝問題的新解決方案而正在經歷強勁成長。

- 據IBEF稱,印度已成為全球領先的包裝材料出口國。印度包裝出口將以 9.9% 的複合年成長率成長,到 2021-22 年達到 11.19 億美元。

- 因此,由於上述方面,預計包裝行業在預測期內將會成長。

歐洲主導市場

- 歐洲的包裝需求正在強勁成長,這主要得益於數位印刷市場和軟包裝產業需求的成長。歐洲軟包裝市場受到食品和飲料、醫藥和醫療產品、零售袋和其他非食品相關產品行業的強勁需求的推動。

- 消費行為行為趨勢的變化和製造商便利性的提高正在推動該地區軟包裝市場的成長,從而進一步使紫外線固化印刷油墨市場受益。

- 據Food Drink Europe稱,該地區的食品和飲料行業是該地區領先的製造業部門。該地區佔歐盟製造業增加值的9.2%。

- 歐盟的包裝和包裝廢棄物指令(PPWD)設定了塑膠包裝的回收目標,分別為50%(2025年)和55%(2030年)。 2022 年,歐盟委員會要求增加塑膠再生利用和使用,到 2030 年使所有包裝都能夠經濟地回收。隨著對可回收包裝的關注度日益提高,歐洲對紫外線固化印刷油墨的需求也預計將上升。

- 由於上述因素,預測期內歐洲的紫外線固化印刷油墨市場預計將會成長。

UV 固化印刷油墨產業概況

紫外線固化印刷油墨市場正在整合,主要企業佔據約 60% 的市場佔有率。主要參與者包括 Sun Chemical、INX International Ink Co.、Flint Group、Siegwerk Druckfarben AG &Co.KGaA 和 Tokyo Printing Ink Manufacturing。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 數位印刷產業的需求不斷成長

- 包裝和標籤行業的需求不斷增加

- 紡織業需求增加

- 限制因素

- 傳統商業印刷業的衰退

- 替代產品的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 按固化工藝

- 電弧淬火

- LED 固化

- UV固化印刷油墨類型

- UV柔版油墨

- UV膠印油墨

- UV低能量/LED膠印油墨(不含UV膠印油墨)

- UV網版印刷油墨

- 其他紫外線固化印刷油墨類型

- 按應用

- 包裝

- 商業與出版

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析**/市佔分析

- 主要企業策略

- 公司簡介

- ALTANA

- APV Engineered Coatings

- AVERY DENNISON CORPORATION

- Flint Group

- FUJIFILM Holdings America Corporation

- Gans Ink & Supply

- HP Development Company, LP

- HUBERGROUP DEUTSCHLAND GMBH

- INX International Ink Co.

- Marabu GmbH & Co. KG

- Mimaki Engineering Co. Ltd

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- T&K TOKA Corporation

- TOKYO PRINTING INK MFG CO.,LTD.

- TOYO INK SC HOLDINGS CO., LTD.

第7章 市場機會與未來趨勢

- 生物基紫外光固化油墨的開發

- 醫療產業的成長

The UV Cured Printing Inks Market is expected to register a CAGR of greater than 4.5% during the forecast period.

The COVID-19 pandemic disrupted the UV-cured printing ink market, reducing supply due to closures, transportation restrictions, and declining demand from various sectors. Nonetheless, the market rebounded in 2022 due to increased demand from the textiles and packaging sectors.

Key Highlights

- Major factors driving the market study are growing demand from the digital printing industry, rising demand from the packaging and labels sector, and increased demand from the textile industry.

- On the flip side, the decline in the conventional commercial printing industry and the availability of substitutes are hindering the studied market's growth.

- The development of bio-based UV curable inks and growth from the medical industry is expected to offer various opportunities for market growth over the forecast period.

- Europe dominated the global market, with most of the consumption coming from countries such as Germany, Italy, and other countries.

UV Cured Printing Inks Market Trends

Packaging to Dominate the Market

- UV-cured printing inks are used for high-quality prints on a range of substrates. The inks are cured using ultraviolet radiation, which results in a high-quality and durable print.

- With the changing consumer preferences, the packaging industry faced numerous challenges. However, the packaging industry will see immense opportunity by adopting various upgraded technologies, like digital printing. Digital printing is rapidly expanding into label production and electrophotography. The packaging industry is expected to experience a significant revolution over the next decade due to the increasing application of digital printing.

- Siegwerk, a manufacturer of printing inks for packaging applications, labels, and catalogs, was the first to offer LED UV printing inks for food and pharmaceutical packaging.

- The packaging industry is crucial, adding value to various manufacturing sectors, including food and beverage, pharmaceutical, retail, and others. Increased consumer spending on packaged goods, mainly in food and beverage, is the major factor for market growth.

- The increasing demand for packaged food and pharmaceutical products in growing economies, such as China, India, and other countries, is expected to drive the studied market's growth.

- China includes the second-largest packaging industry in the world. The country is expected to witness consistent growth during the forecast period, owing to the rise of customized packaging in the food segment, like microwave, snack, and frozen foods, along with increasing exports. The use of packaging is expected to increase in the coming years.

- Packaging is the fifth largest sector in India's economy. It is one of the highest growth sectors in the country, with a CAGR of 22% to 25%, according to the Packaging Industry Association of India (PIAI). The Indian food processing industry contributes 32% of the country's overall food market.

- According to the Flexible Packaging Association, flexible packaging is mainly used for food, which accounts for more than 60% of the total market. Since it could incorporate new solutions for various packaging issues, the flexible packaging industry is experiencing robust growth.

- As per IBEF, India is an emerging key exporter of packaging materials globally. The packaging materials export from India grew at a CAGR of 9.9% to USD 1,119 million in 2021-22.

- Hence, based on the aspects above, the packaging segment is expected to grow during the forecast period.

Europe to Dominate the Market

- The demand for packaging is significant in Europe, which is majorly driven by the increasing demand from the digital printing market and the flexible packaging industry. The flexible packaging market in Europe is driven by high demand from food and beverage, pharmaceuticals and medicals, retail bags, and other non-food-related products industries.

- The changing trends in consumer behavior and manufacturers' easier convenience benefitted the flexible packaging market to grow faster in the region, further benefitting the UV-cured printing ink market.

- According to Food Drink Europe, the region's food and drinks industry is the leading manufacturing industry in the region. The region includes a share of 9.2% of value-added in the European Union's manufacturing industry.

- The EU Packaging and Packaging Waste Directive (PPWD) sets plastic packaging recycling targets of 50% (2025) and 55% (2030). In 2022, the Commission increased the reuse and use of recycled plastic, requiring all packaging to be economically recyclable by 2030. With the increased focus on recyclable packaging, the demand for UV-cured printing inks is also expected to rise in Europe.

- Based on the factors mentioned above, the UV-cured printing ink market is expected to grow during the forecast period in Europe.

UV Cured Printing Inks Industry Overview

The UV curable printing inks market is consolidated, with the top five players accounting for around 60%. Some major players include Sun Chemical, INX International Ink Co., Flint Group, Siegwerk Druckfarben AG & Co. KGaA, and Tokyo Printing Ink Mfg Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Digital Printing Industry

- 4.1.2 Rising Demand from the Packaging and Label Sector

- 4.1.3 Increase in Demand from Textile Industry

- 4.2 Restraints

- 4.2.1 Decline in the Conventional Commercial Printing Industry

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Curing Process

- 5.1.1 Arc Curing

- 5.1.2 LED Curing

- 5.2 UV Cured Printing Inks Type

- 5.2.1 UV Flexo Inks

- 5.2.2 UV Offset Inks

- 5.2.3 UV Low Energy/LED Offset Inks (Except UV Offset Inks)

- 5.2.4 UV Screen Printing Inks

- 5.2.5 Other UV Cured Printing Inks Type

- 5.3 Application

- 5.3.1 Packaging

- 5.3.2 Commercial and Publication

- 5.3.3 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/ Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA

- 6.4.2 APV Engineered Coatings

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Flint Group

- 6.4.5 FUJIFILM Holdings America Corporation

- 6.4.6 Gans Ink & Supply

- 6.4.7 HP Development Company, L.P.

- 6.4.8 HUBERGROUP DEUTSCHLAND GMBH

- 6.4.9 INX International Ink Co.

- 6.4.10 Marabu GmbH & Co. KG

- 6.4.11 Mimaki Engineering Co. Ltd

- 6.4.12 Siegwerk Druckfarben AG & Co. KGaA

- 6.4.13 Sun Chemical

- 6.4.14 T&K TOKA Corporation

- 6.4.15 TOKYO PRINTING INK MFG CO.,LTD.

- 6.4.16 TOYO INK SC HOLDINGS CO., LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based UV-Curable Inks

- 7.2 Growth in the Medical Industry