|

市場調查報告書

商品編碼

1641874

先進功能材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Advanced Functional Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

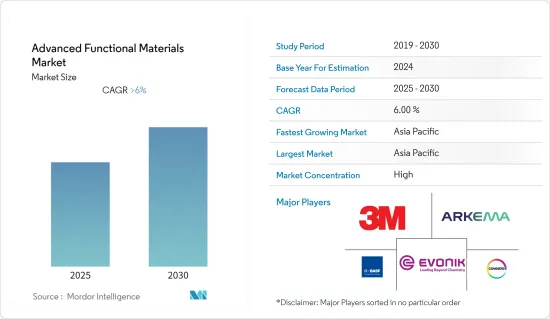

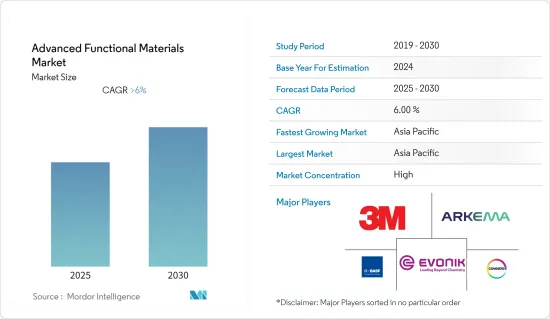

預計預測期內先進功能材料市場複合年成長率將超過 6%。

COVID-19 疫情對先進性能材料市場產生了重大影響,導致製造工廠關閉。這導致奈米材料和導電聚合物等先進功能材料的消費量大幅下降,限制了全球市場的成長。然而,在新冠疫情之後,由於電氣、電子和汽車行業的需求增加,需求再次回升。

關鍵亮點

- 短期內,醫療設備的進步將成為推動市場發展的主要因素之一。

- 此外,由於對診斷影像、醫療植入和再生、藥物傳輸設備製造和生物醫學科學的重視,對先進功能材料的需求正在迅速增加,從而推動市場成長。

- 受中國和印度等國家強勁需求的推動,亞太地區在全球市場佔據主導地位。

先進功能材料市場趨勢

航太和國防領域佔市場主導地位

- 預計預測期內航太和國防工業將成為先進功能材料的最大消費者之一。

- 奈米技術為軍事和國防應用提供了多項進步,包括改進的生物、核子和化學感測。此外,有記錄顯示,奈米技術可以減少軍事勞動力,降低戰場士兵的風險,並提高車輛性能。

- 暴力極端主義和分離主義叛亂等一系列安全挑戰將使全球軍事開支在疫情的第二年達到創紀錄的水平,2021年達到創紀錄的2.1兆美元,比2020年成長6.7%。這是支出連續第七年增加。美國佔全球軍費開支的38%。

- 波音公司預計,2028年民航機市場規模將達3.1兆美元。同時,營運商預計將擴大持有,用更省油的機型取代老噴射機,以滿足新興市場和成熟市場航空旅行的穩定成長。

- 未來20年,乘客需求成長和飛機退役預計將需要44,040架新噴射機,價值6.8兆美元。預計到 2038 年,全球民航機隊(包括所有新建和現役噴射機)將達到 50,660 架。

- 中國的國防工業正在蓬勃發展,許多中國公司承擔西方國防強國的責任。該國正在大力投資升級其軍隊,其中 8 家國防相關企業躋身世界前 25 名。此外,中國是世界第二大軍費開支國。例如,2021年中國軍費支出2,930億美元,比2020年成長4.7%。此外,中國2021年的預算是「十四五」規劃下的第一份預算,該規劃將持續到2025年。

- 中航工業是世界第三大航空公司,研發了中國第五代戰鬥機殲-20和新型隱形轟炸機轟-20。

- 由於這些因素,預計未來該市場將經歷顯著成長。

亞太地區佔市場主導地位

- 亞太地區是先進功能材料最大的市場。中國佔該地區消費的大部分。

- 據 OICA 稱,亞太地區近年來在全球汽車生產中佔據主導地位。中國是全球最大汽車生產國,2021年汽車產量達2,608萬輛,較2020年成長3%。因此,這種積極的生產狀況將有助於創造先進能力市場的需求。

- 近年來,中國對全球航空運輸量成長做出了重要貢獻。每年平均乘客成長率超過10%。這一成長主要得益於消費能力增強和航空連通性改善導致的客流量增加。因此,預計客運量的增加將推動飛機需求。

- 波音公司預測,2021年飛機市場新交付的價值將達到7.3兆美元,到2041年全球持有將比2019年疫情前的水平成長80%。預計這將推動未來幾年對先進功能材料的需求。

- 據印度品牌資產基金會稱,到 2030 年,印度的航太和國防 (A&D) 市場規模預計將超過 700 億美元。

- 印度2022-2023年國防預算為5,2516.6億印度盧比(676.6億美元),比2021-2022年增加11.4%。國防業務預算申請(DSE)涵蓋了三支武裝部隊和國防研究與發展組織的預算,從國防部(DRDO)的整體撥款中獲得了 3,2305.3 億印度盧比(462 億美元)。

- 預計所有上述因素都將對未來幾年的市場成長產生重大影響。

先進功能材料產業概況

全球先進功能材料市場本質上呈現部分整合狀態。市場的主要企業包括(不分先後順序)3M、阿科瑪、贏創工業集團、科思創、BASF集團等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大用作金屬和塑膠的替代品

- 醫療產業需求不斷成長

- 限制因素

- 原料成本和可得性阻礙先進材料市場

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 類型

- 陶瓷製品

- 能源材料

- 導電聚合物

- 奈米材料

- 複合材料

- 其他

- 最終用戶產業

- 電氣和電子

- 車

- 醫療

- 航太和國防

- 能源電力(含化工)

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率分析(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Arkema

- BASF SE

- CeramTec GmbH

- Covestro AG

- Evonik Industries AG

- Hexcel Corporation

- KYOCERA Corporation

- Momentive

- Emeren

- SHOWA DENKO KK

- Sumitomo Chemical Co., Ltd.

第7章 市場機會與未來趨勢

- 擴大奈米技術的使用

The Advanced Functional Materials Market is expected to register a CAGR of greater than 6% during the forecast period.

The COVID-19 pandemic drastically affected the market for advanced functional materials, resulting in the manufacturing facilities' closure. Due to this cause, the consumption of advanced functional materials, specifically nanomaterials and conductive polymers, was greatly reduced, which constrained the growth of the market globally. But the post-COVID-19 era saw a rebound again with increased demand from the electric, electronics, and automotive industries.

Key Highlights

- Over the short term, one of the major factors driving the market studied is the growing advancement in medical devices.

- Moreover, with an emphasis on diagnostic imaging, implants and regeneration in medicine, equipment manufacturing for drug delivery, and biomedical science, the demand for advanced functional materials is rising rapidly, which tends to boost the market's growth.

- The Asia-Pacific region dominated the global market, with robust demand from countries like China and India.

Advanced Functional Materials Market Trends

Aerospace and Defense Segment to Dominate the Market

- The aerospace and defense industry is expected to be one of the largest consumers of advanced functional materials during the forecast period.

- Nanotechnology provides several advances for military and defense applications, including biological, nuclear, and chemical sensing improvements. Additionally, nanotechnology offers offsetting reductions in the military workforce, reduced risks to troops on the battlefield, and improved vehicle performance.

- Due to numerous security challenges such as violent extremism and separatist insurgencies, the world'sworld's military expenditure reached a record level in the second year of the pandemic, reaching an all-time high of USD 2.1 trillion in 2021, which shows an increase of 6.7% compared to 2020. It was the seventh consecutive year that spending increased. The United States accounted for 38% of total military spending globally.

- According to Boeing, the market value for commercial airplanes is expected to reach USD 3.1 trillion by 2028, as operators are expected to replace older jets with more fuel-efficient models and expand their fleets to accommodate the steady rise in air travel across emerging and established markets.

- Over the next two decades, the increasing passenger volume and airplane retirements are expected to drive the need for 44,040 new jets (valued at USD 6.8 trillion). The global commercial fleet is forecast to reach 50,660 airplanes by 2038, considering all the new airplanes and jets that will remain in service.

- The Chinese defense industry is growing rapidly, with many Chinese firms displacing Western defense powerhouses. The country invests heavily to upgrade its military, thus making its eight defense firms rank among the top 25 in the world. Moreover, China is the world'sworld's second-largest military spending country. For instance, in 2021, China allocated USD 293 billion to its military, an increase of 4.7% compared with 2020. Furthermore, the 2021 Chinese budget was the first under the 14th Five-Year Plan, which runs until 2025.

- AVIC company ranks third in the world, and it developed China's fifth-generation J-20 fighter and the new H-20 stealth bomber, among other projects.

- The market will likely witness huge future growth due to all the abovementioned factors.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region was the largest market for advanced functional materials. China accounted for the major chunk of consumption in the region.

- According to the OICA, Asia-Pacific dominated global automobile production recently. China is the largest producer of automobiles globally, with a production volume of 26.08 million automobiles in 2021, which shows an increase of 3% compared with 2020. Therefore, such a positive production scenario helps create demand for an advanced functional market.

- China is a key contributor to global air traffic growth for the past few years. The average passenger growth rate is over 10% per year. This growth is primarily driven by rising passenger traffic due to higher spending power and better air connectivity. Thus, increasing passenger traffic is expected to boost the demand for aircraft.

- According to Boeing's estimates for 2021, the airplane market value will be USD 7.3 trillion for new airplane deliveries, with the global fleet increasing by 80% through 2041 compared to 2019 pre-pandemic levels. Therefore, this is expected to drive the demand for advanced functional materials in the coming years.

- The Indian aerospace and defense (A&D) market is expected to cross USD 70 billion by 2030, according to the Indian Brand Equity Foundation, led by burgeoning demand for advanced infrastructure and government thrust.

- India's defense budget for 2022-2023 is INR 5,25,166 crore (USD 67.66 billion), up 11.4% from 2021-2022. The Defence Services Estimates (DSE), which covers the budgets of the three armed forces and the Defence Research and Development Organisation, received INR 3,23,053 crore (USD 46.2 billion) from the Ministry of Defence's overall allocations (DRDO).

- All the factors above, in turn, are projected to show a significant impact on market growth in the coming years.

Advanced Functional Materials Industry Overview

The global advanced functional materials market is partially consolidated in nature. The major players in this market include (not in a particular order) 3M, Arkema, Evonik Industries AG, Covestro AG, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased use as an Alternative to Metals and Plastics

- 4.1.2 Increasing Demand from the Healthcare Industry

- 4.2 Restraints

- 4.2.1 The Cost and Availability of Raw Material to Hinder the Market for Advanced Functional Materials.

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Ceramics

- 5.1.2 Energy Materials

- 5.1.3 Conductive Polymers

- 5.1.4 Nanomaterials

- 5.1.5 Composites

- 5.1.6 Others

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Automotive

- 5.2.3 Healthcare

- 5.2.4 Aerospace and Defense

- 5.2.5 Energy and Power (incl. Chemical Industry)

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 BASF SE

- 6.4.4 CeramTec GmbH

- 6.4.5 Covestro AG

- 6.4.6 Evonik Industries AG

- 6.4.7 Hexcel Corporation

- 6.4.8 KYOCERA Corporation

- 6.4.9 Momentive

- 6.4.10 Emeren

- 6.4.11 SHOWA DENKO K.K.

- 6.4.12 Sumitomo Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth of Usage in Nano Technology