|

市場調查報告書

商品編碼

1641878

燃氣發電機 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Gas Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

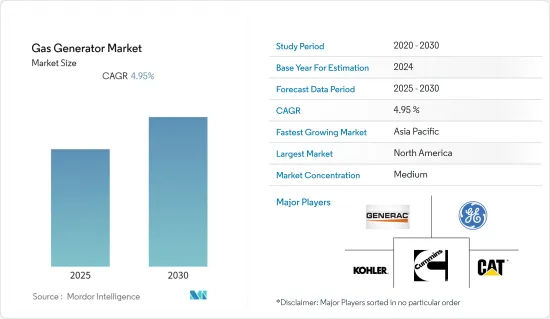

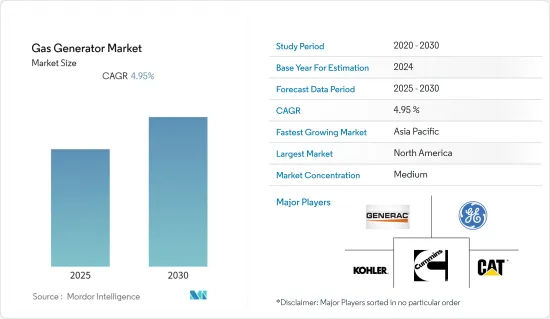

預測期內,燃氣發電機市場預計複合年成長率為 4.95%

關鍵亮點

- 從中期來看,人們越來越意識到天然氣是一種清潔可靠的燃料,對柴油維護和加油問題的日益關注,以及天然氣燃料價格的下降等因素預計將推動天然氣發電量在預測期內的成長期。

- 然而,由於燃料供應中斷,預計預測期內管道天然氣網連接的缺乏將阻礙天然氣發電機市場的發展。

- 新興經濟體商業和工業領域、新興經濟體住宅領域以及國防活動對電力的需求日益成長,預計將在預測期內為市場參與企業創造龐大的商機。

- 預計預測期內北美將成為燃氣發電機的最大市場,預計大部分需求來自美國和加拿大。

燃氣發電機市場趨勢

75kVA 或以下容量等級佔市場主導地位

- 75kVA以下的燃氣發電機用於通訊業、商業綜合體、小型餐廳、小型工業、加油站等,主要用作併並聯型地區的備用電源和離網地區的主電源。

- 隨著小型企業環境的變化,尤其是亞太和非洲開發中國家的小型企業環境,預計 75kVA 以下燃氣發電機的需求將會增加。大多數地區經常停電,因此大多數家庭和商店都喜歡可攜式且價格實惠的小型發電機。

- 印度和中國的智慧城市和綠色建築計劃等當前政府舉措正在推動建築市場的發展,預計將在預測期內產生對燃氣發電機的需求並推動市場發展。

- 隨著天然氣消費量的增加,天然氣在發電中的使用也在增加,預計將在預測期內推動市場發展。

- 天然氣產量的增加也是燃氣發電機組使用量增加的主要原因。 2022年,全球天然氣產量約4,0,438億立方公尺。此外,購買75kVA以下的燃氣發電機幾乎總是基於價格和提供緊急備用電源的要求,而不是效率。

- 這有助於小型發電機製造商抓住並增加新興經濟體的需求,這些經濟體的政府對住宅建設計劃、旅遊業和農業產業的投資十分活躍。

北美佔據市場主導地位

- 北美天然氣產業正經歷前所未有的變化,過去十年天然氣消費量成長了25%。頁岩地區豐富的天然氣資源可能會在預測期內增加對燃氣發電機的需求。

- 頻繁的颶風和雷暴擾亂了美國現有的電網,增加了對燃氣發電機的需求。

- 燃氣發電機市場的最大驅動力是該地區計劃中的資料中心,它們需要更可靠的電力供應。例如,Vantage 計劃於 2022 年 8 月擴大其加拿大業務,在蒙特婁開設新園區並擴大其在蒙特婁和魁北克市的現有資料中心。該公司宣布將向加拿大擴張額外投資 7.13 億美元。這項投資包括在蒙特婁開發第三個校區,並擴大蒙特婁和魁北克總合的兩個現有校區,使魁北克的 Vantage 校區總合達到四個,成為該地區第四大校區。達到143MW。

- 2023年2月,康明斯公司宣布將為北美客戶增加175千瓦和200千瓦天然氣備用發電機組。新型 175kW 和 200kW 天然氣發電機組為客戶提供業界領先的功率密度,旨在提供卓越的性能和一致的可靠性,以滿足他們的電力需求。

- 隨著美國排放法規越來越嚴格,加上環境效益的提高,與污染更嚴重的柴油發電機相比,對燃氣發電機的需求預計將大幅增加。

- 美國擁有世界上最發達的天然氣管網基礎設施之一,確保了穩定的燃料供應。隨著天然氣成本下降,住宅天然氣使用量預計會增加。預計這將在未來幾年推動住宅領域備用電源應用的燃氣發電機市場的發展。

- 因此,基於上述因素,預計北美將在預測期內主導全球燃氣發電機市場。

燃氣發電機產業概況

燃氣發電機市場適度細分。該市場的主要企業(不分先後順序)包括 Generac Holdings Inc.、Caterpillar公司、三菱重工有限公司、康明斯公司和科勒公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 越來越多的人認知到天然氣是一種清潔、可靠的燃料

- 人們對柴油維護和加油問題的擔憂日益增加

- 限制因素

- 由於缺乏管道天然氣網連接導致燃料供應中斷

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 額定功率

- 75kVA以下

- 75 至 375 kVA 或更低

- 375kVA以上

- 最終用戶

- 工業的

- 商業的

- 住宅

- 2028 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Generac Holdings Inc.

- Caterpillar Inc.

- AKSA Power Generation

- Cooper Corporation

- Mitsubishi Heavy Industries Ltd.

- Kohler Co.

- Cummins Inc.

- General Electric Company

- FG Wilson

- MTU America Inc.

第7章 市場機會與未來趨勢

- 國防行動對電力的需求日益成長

簡介目錄

Product Code: 61336

The Gas Generator Market is expected to register a CAGR of 4.95% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing awareness regarding natural gas as a clean and reliable fuel, increased concerns over diesel maintenance and refueling issues, and decreasing natural gas fuel prices will likely drive the gas generator market in the forecast period.

- On the other hand, the lack of gas grid connectivity via pipeline, resulting in hindered fuel supply, is expected to act as a restraining factor to the gas generator market during the forecast period.

- Nevertheless, the commercial and industrial sectors of emerging economies, the residential sector of developed economies, and the increasing need for power in defense operations are expected to create significant opportunities for market participants during the forecast period.

- North America is expected to be the largest market during the forecast period for gas generators, with most of the demand expected to come from the United States and Canada.

Gas Powered Generator Market Trends

Below 75 kVA Capacity Rating to Dominate the Market

- Less than or equal to 75 kVA gas generators are used in the telecommunication sector, commercial complexes, small restaurants, small-scale industries, and petrol stations, primarily as backup power in grid-connected areas and as the main power source in off-grid areas.

- The demand for less than or equal to 75 kVA gas generators is expected to increase with the change in the landscape for small businesses, especially in Asia-Pacific and Africa developing countries. Power failure is common in most regions, so most households and shops prefer portable and affordable small generators.

- The building and construction market is rising in India and China due to current government initiatives, such as smart cities and green building initiatives, which are expected to create the demand for gas generators during the forecast period, driving the market.

- With the increasing consumption of natural gas, the use of natural gas in power generation is expected to increase, driving the market in the forecast period.

- The rising production of natural gas is another primary reason for the increasing adoption of gas generators. In 2022, around 4043.8 bcm of natural gas was produced globally. Moreover, purchasing less than 75 kVA gas generators is mostly based on price and requirement rather than efficiency, as they offer emergency backup power.

- Therefore, it has helped small generator manufacturers to grow and capture the demand in developing countries, where residential construction projects and governmental investments in the tourism and agriculture industries are witnessing robust growth.

North America to Dominate the Market

- The natural gas industry in North America has changed by unprecedented magnitude and pace, with natural gas consumption witnessing a 25% increase over the past 10 years. The availability of abundant natural gas resources across shale regions will likely increase demand for gas generators during the forecast period.

- Frequent hurricanes and thunderstorms have caused disruptions to the well-established electricity transmission networks in the United States, increasing the demand for gas generators.

- The biggest driver of the gas-generator market is the data center plans in the region, requiring a more reliable power supply. For instance, in August 2022, Vantage planned to expand its operations in Canada by opening a new campus in Montreal and expanding existing data centers in Montreal and Quebec City. The company announced an additional USD 713 million investment in scaling its Canadian operations. This investment includes the development of a third campus in Montreal and the expansion of two existing campuses in Montreal and Quebec City, bringing the total number of Vantage campuses in Quebec to four, totaling 143 MW of capacity when fully developed.

- In February 2023, Cummins Inc. announced adding 175kW and 200kW natural gas standby generator sets for North American customers. The new 175kW and 200kW natural gas generator sets offer customers industry-leading power density and are engineered to provide exceptional performance and consistent reliability to meet customers' power requirements.

- As the air emission norms are becoming more stringent in the United States, coupled with the environmental benefits, the demand for gas generators is expected to witness a significant increase compared to diesel generators, which are considered more polluting.

- The United States enjoys one of the world's most developed gas-grid infrastructures, ensuring a steady fuel supply. With the falling cost of natural gas, the usage of natural gas across the residential sector is expected to increase. This, in turn, is expected to drive the gas generator market in the residential sector for backup power applications in the coming years.

- Therefore, based on the above factors, North America is expected to dominate the global gas generator market during the forecast period.

Gas Powered Generator Industry Overview

The gas generator market is moderately fragmented. Some of the key players in this market (not in particular order) include Generac Holdings Inc., Caterpillar Inc., Mitsubishi Heavy Industries Ltd, Cummins Inc., and Kohler Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Awareness Regarding Natural Gas as a Clean and Reliable Fuel

- 4.5.1.2 Increasing Concerns Over Diesel Maintenance and Refueling Issues

- 4.5.2 Restraints

- 4.5.2.1 Lack of Gas Grid Connectivity Via Pipeline, Resulting in Hindered Fuel Supply

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Rating

- 5.1.1 Less than 75 kVA

- 5.1.2 75-375 kVA

- 5.1.3 Above 375 kVA

- 5.2 End-User

- 5.2.1 Industrial

- 5.2.2 Commercial

- 5.2.3 Residential

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Generac Holdings Inc.

- 6.3.2 Caterpillar Inc.

- 6.3.3 AKSA Power Generation

- 6.3.4 Cooper Corporation

- 6.3.5 Mitsubishi Heavy Industries Ltd.

- 6.3.6 Kohler Co.

- 6.3.7 Cummins Inc.

- 6.3.8 General Electric Company

- 6.3.9 F.G. Wilson

- 6.3.10 MTU America Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Need for Power in Defense Operations

02-2729-4219

+886-2-2729-4219