|

市場調查報告書

商品編碼

1641881

分散式天線系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Distributed Antenna Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

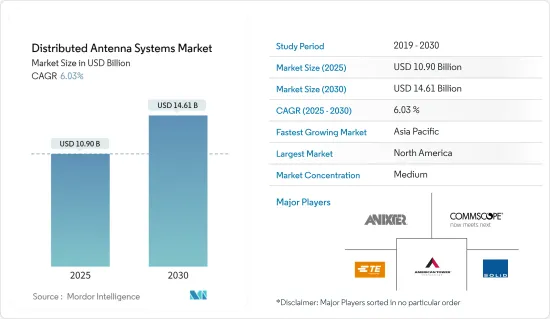

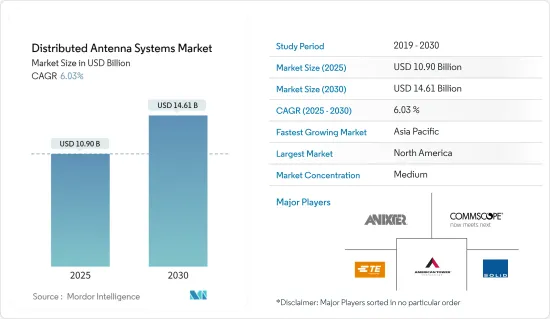

分散式天線系統市場規模預計在 2025 年為 109 億美元,預計到 2030 年將達到 146.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.03%。

通訊技術的發展使得連接速度更快、網路設備功耗更低、連接範圍更廣,從而推動了 DAS 系統市場的發展。此外,對穩定和不間斷連接的需求不斷成長以及連接設備數量的增加正在支持所研究市場的成長。

關鍵亮點

- 分散式天線系統的概念已經存在多年,而智慧家庭和連網型設備應用的建築無線網路的快速成長進一步刺激了市場對 DAS 系統的採用。 DAS 系統比單天線系統具有多種優勢,使企業能夠獲得其應用所需的覆蓋範圍。

- 此外,雖然客戶期望無處不在的高品質語音覆蓋,但資料和視訊主導應用程式的使用正在迅速成長,重新定義了 DAS 系統的作用。

- 透過採用 LTE 和 LTE-Advanced (LTE-A) 標準,無線產業不斷努力滿足對更高頻寬和更高速應用的指數級資料使用日益成長的需求。僅靠宏蜂窩蜂巢式網路無法有效滿足上一代應用的要求。這使得人們更加關注部署 DAS 網路以滿足用戶需求的必要性,包括辦公室、體育場、家庭、機場和高層建築的服務。

- 此外,事實證明 DAS 不僅僅是一種用於語音通話的室內網路覆蓋解決方案。例如,在智慧城市中,DAS 正在成為幫助建立實現互聯系統所需基礎設施的重要解決方案。智慧建築、購物中心、醫院和車輛交通管理等各種基礎設施都需要持續通訊,預計這將推動市場需求。

- 然而,分散式天線系統的成本是阻礙調查市場發展的主要挑戰之一,因為 DAS 解決方案的定價是基於時間和範圍的。例如,用於持續識別行動行動電話商覆蓋範圍的被動 DAS 成本較低,只需幾百到幾千美元。相反,有源 DAS 用於擴展一個或多個行動服務供應商網路的室內覆蓋範圍,但成本較高。

分散式天線系統市場趨勢

體育和娛樂領域佔很大市場佔有率

- 分散式天線系統 (DAS) 透過天線系統為大型基礎緊急應變(主要是體育場館和體育場)提供無線服務,以提供統一的連接並減少這些地點大型聚會的需要。無線電通訊並在緊急情況下出現在現場。

- 當今的體育和娛樂愛好者期望不間斷的無線服務,讓他們能夠在觀看現場活動的同時快速輕鬆地與朋友和家人聯繫。此外,社群媒體更新、共用照片和影片、發送簡訊和撥打電話也是體驗實況活動的重要且預期的部分。然而,體育場和競技場由於其規模、形狀和資料使用的變化,對行動通訊提出了獨特的挑戰。

- 室內無線解決方案解決了體育場和競技場中這些獨特的挑戰,確保觀眾始終擁有可靠的連線。透過 DAS 系統,體育場還可以為保全人員和公共初期應變人員配備支援蜂窩和公共頻寬的關鍵任務通訊資源。

- 此外,5G技術將影響人們生活的幾乎每個方面,包括所有體育和娛樂場所的球迷體驗。新體育場館的建設從一開始就考慮到了 5G 技術,現有的幾個平台也正在融入 5G,以滿足球迷的期望,並透過創新解決方案簡化連接。

- 此外,全球範圍內舉辦的體育和娛樂活動數量不斷增加,推動了新體育場館和體育及娛樂綜合體建設的投資,這有利於所研究市場的成長。

亞太地區將經歷最高成長

- 高層住宅、購物中心、商業園區和其他商業空間的建設正在蓬勃發展,同時,新加坡智慧國家和印度智慧城市計劃等多項政府舉措也不斷訂定,4G智慧型手機數量不斷增加,自帶設備趨勢。地區DAS 用戶數量的增加是DAS 市場發展的促進因素之一。

- 蜂窩技術的最新進展是預測期內推動該地區強勁成長的關鍵因素之一。這是因為新興國家部署 LTE 網路的計畫不斷增加。此外,行動網路虛擬和開放 API 的快速採用也是推動市場成長的其他因素。

- 亞太地區是一個充滿反差的地區。韓國、日本等已開發市場過去幾年一直在進行5G網路密集化計劃。香港、澳門和新加坡等高度都市化的中國城市在小型基地台和DAS的廣泛使用方面處於相似水平。同時,印度和印尼等新興市場依靠傳統的宏塔來覆蓋其農村人口。馬爾地夫和其他太平洋島國也是這群人的例子,它們徹底拆除了訊號塔,轉而採用更便宜的衛星行動網路。

- 因此,中國當地、韓國和日本目前是該地區最大的塔市場。然而,這些市場的塔樓覆蓋範圍已經覆蓋了大多數人口,因此未來塔樓的成長將在很大程度上取決於透過使用小型基地台和 DAS 實現都市區的網路密集化。

- 該地區還正在見證多項夥伴關係和合作關係,為進一步的技術進步鋪平道路。例如,諾基亞和中國移動聯合開發了這種5G低成本混合分散式室內系統來應對這些挑戰。智慧室內覆蓋系統利用諾基亞 5G Pico 遠端無線電頭系統以及被動 DAS 天線和低功耗藍牙 (BLE) 技術。與傳統的純被動 DAS 系統相比,新解決方案還降低了部署成本,同時提供了比 DAS 更高的容量。

分散式天線系統產業概況

分散式天線系統市場競爭適中,但受到行動資料流量不斷成長、物聯網(IoT) 帶來的聯網設備激增、對頻譜效率日益成長的需求以及消費者對更大網路覆蓋範圍和不間斷連接的需求的推動。目前,許多公司正在以不同的規模進入該市場。主要參與企業包括 Anixter、CommScope、TE Connectivity、Corning 和 American Tower Corporation。最近的市場發展包括:

2022 年 12 月,足球俱樂部皇家貝蒂斯宣布與無線通訊和廣播基礎設施供應商 Cellnex 建立合作夥伴關係,以開發俱樂部的數位基礎設施並為球迷提供最佳的數位體驗。根據該契約,Cellnex 將在貝尼托維拉馬林體育場安裝分散式天線系統 (DAS)。

2022 年 11 月,分散式天線系統 (DAS) 和中繼器領先供應商 Advanced RF Technologies (ADRF) 宣布推出其新的 ADXV DAS C 波段解決方案和 SDRX C 波段中繼器。 ADXV DAS C 波段模組提供高功率遠端 (HPR) 和中功率遠端 (MPR) 選項,支援 3.7GHz 至 3.98GHz 的 C 波段頻率,使建築業主、行動電信商、系統整合商和中立主機能夠為任何規模的建築物和場所提供無處不在的5G覆蓋。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- DAS 功能和支援多通訊業者的先進技術

- 市場問題

- 高升級成本是市場成長的障礙

第6章 市場細分

- 按類型

- 積極的

- 被動的

- 數位的

- 混合

- 按最終用戶

- 製造業

- 醫療

- 政府

- 運輸

- 體育與娛樂

- 通訊

- 其他

- 按應用

- 企業 DAS

- 公共DAS

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Anixter Inc.

- Cobham PLC

- Antenna Products Corporation

- CommScope Inc.

- Tower Bersama Group

- SOLiD Inc.

- TE Connectivity Ltd.

- Corning Inc.

- Comba Telecom Systems Holdings Ltd.

- Boingo Wireless Inc.

- American Tower Corporation

第8章投資分析

第9章:未來市場展望

The Distributed Antenna Systems Market size is estimated at USD 10.90 billion in 2025, and is expected to reach USD 14.61 billion by 2030, at a CAGR of 6.03% during the forecast period (2025-2030).

The developments in communication technology that have led to the evolution of high-speed connectivity, lesser power-consuming network devices, and more substantial connectivity coverage have boosted the market for DAS systems. Additionally, the rising demand for stable and uninterrupted connectivity and the growing number of connected devices support the studied market's growth.

Key Highlights

- The concept of distributed antenna systems has been there for many years, and the surged usage of wireless networks in buildings with potential applications in smart homes and connected devices has further promoted the implementation of DAS systems in the market as it facilitates several advantages over single-antenna systems, allowing businesses to get the coverage essential for applications.

- Moreover, while customers expect ubiquitous high-quality voice coverage, the rapidly growing use of data and video-driven applications redefine DAS systems' role.

- The wireless industry consistently strives to keep pace with the growing demand for higher bandwidth and surging data usage for high-speed applications by incorporating LTE standards and the LTE-Advanced (LTE-A) standards. Depending on macro cellular networks alone could not efficiently meet the requirements of the last generation of applications. This has further focused on the need to deploy DAS networks for accommodating user demands such as services in offices, stadiums, homes, airports, and high-rises.

- Furthermore, DAS has turned out to be more than an indoor network coverage solution in regard to voice calls. For instance, in smart cities, DAS has turned out to be a crucial solution in aiding to creation of the needed infrastructure for achieving connected systems. Various infrastructures such as smart buildings, shopping complexes, hospitals, and vehicular traffic management require continuous communication; thus, this is expected to propel market demand.

- However, the cost of distributed antenna systems is among the major factors challenging the studied market's development, as the price of a DAS solution is determined based on the time and range. For instance, passive DAS utilized for identifying the coverage of cellular carriers consistently is at the lower end and may cost only a couple of hundreds or thousands of dollars; on the contrary, active DAS utilized for increasing in-building coverage of one or more mobile service provider networks that is available at higher costs.

Distributed Antenna Systems Market Trends

Sport and Entertainment Segment to Hold a Significant Market Share

- Distributed Antenna Systems (DAS) provide wireless service via an antenna system, mainly to large infrastructural establishments such as sports complexes, stadiums, etc., to provide even connectivity and to ensure that emergency responders maintain wireless communications within a building structure and on-the-job in emergencies, considering large gatherings at these places.

- Currently, sports and entertainment fans expect uninterrupted wireless service that can enable them to quickly and easily stay connected with their friends and family while enjoying any live event. Moreover, updating social media, sharing photos and videos, sending texts, and placing calls are integral and expected parts of experiencing a live event. However, stadiums and arenas have presented unique challenges for mobile communications due to their size, shape, and variation in data use.

- The in-building wireless solutions have solved these unique challenges of stadiums and arenas to ensure that spectators always have reliable connectivity. Using DAS systems, stadiums can also equip their security personnel and public safety first responders with mission-critical communication resources supporting both cellular and public safety bands.

- Moreover, 5G technology impacts almost every aspect of people's lives, including fans' experience at any sports and entertainment venue. New stadiums are being built with 5G-ready technologies taken into consideration from the beginning, while multiple existing platforms are also incorporating them to keep up with fans' expectations and streamline connectivity through innovative solutions.

- Furthermore, the increasing number of sporting and entertainment events being organized globally, driving investment in the construction of new stadiums and sports and entertainment complexes, are expected to create a favorable market scenario for the studied market growth.

Asia-Pacific to Witness Highest Growth

- Owing to the rapidly increasing construction of high-rise residential buildings and commercial spaces, such as malls and business parks, coupled with the multiple government initiatives, such as Smart Nation Singapore and Smart Cities Mission India, among others, with a growing volume of 4G enabled smartphones, the rising popularity of Bring Your Own Device trends have been some of the other factors that are driving the region's DAS market.

- The recent advancements in cellular technology are one of the major factors for the region's excellent growth over the forecast period. This can be attributed to the growing number of planned deployments of LTE networks in emerging economies. Also, the virtualization of mobile networks and the rapid adoption of open APIs are other factors contributing to the market's growth.

- Asia-Pacific has been a region of contrasts. Advanced markets such as South Korea and Japan have had network densification projects for 5G for the past few years. The highly urbanized Chinese administrative regions of Hong Kong and Macau and the city-state of Singapore are comparable in their extensive usage of small cells and DAS. On the other hand, the development curve in emerging markets such as India and Indonesia which are still relying on the traditional macro-towers in order to cover their large rural populations. The Maldives and the Pacific island nations are also an example of this group, eschewing towers altogether in favor of even less expensive satellite-based mobile networks.

- Hence, Mainland China, South Korea, and Japan are currently the largest tower markets in the region. However, tower coverage in these markets has already reached the majority of the population, which implies that future tower growth would significantly rely on network densification in urban areas through the usage of small cells and DAS.

- The region is also witnessing several partnerships and collaborations, paving the way for further technological evolution. For instance, Nokia and China Mobile have jointly developed this 5G low-cost hybrid distributed indoor system in order to meet these challenges. The smart indoor coverage system leverages the Nokia 5G Pico Remote Radio Head system together with the passive DAS antennas and Bluetooth Low Energy (BLE) technology. This new solution also reduces deployment costs as compared to the traditional passive-only DAS systems while delivering greater capacity than DAS.

Distributed Antenna Systems Industry Overview

The distributed antenna systems market is moderately competitive; however, the competition is expected to grow owing to the increasing mobile data traffic, the proliferation of connected devices due to the Internet of Things (IoT), the rising need for spectrum efficiency, and the growing consumer demand for extended network coverage and uninterrupted connectivity. Many companies are now entering the market with an array of scopes. Some of the key players in the market are Anixter, CommScope, TE Connectivity, Corning Inc., and American Tower Corporation. Some recent developments in the market include:

In December 2022, Real Betis Balompie football club announced a partnership with Cellnex, a wireless telecommunication and broadcasting infrastructure provider, to develop the club's digital infrastructure and provide the best digital experience for its fans. As per this agreement, Cellnex installed a distributed antenna system (DAS) at the Benito Villamarin Stadium.

In November 2022, Advanced RF Technologies (ADRF), a leading pure-play distributed antenna system (DAS) and repeater provider, launched its new ADXV DAS C-band solution and the SDRX C-band repeater. The ADXV DAS C-band modules include high-power remote (HPR) and mid-power remote (MPR) options supporting C-band frequencies ranging from 3.7 GHz to 3.98 GHz and allow building owners, mobile carriers, system integrators, and neutral hosts to bring ubiquitous 5G coverage for buildings and venues of every size.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 DAS Ability to Support Multiple Telecom Carriers and Upcoming Technologies

- 5.2 Market Challenges

- 5.2.1 High Cost to Upgrade challenges the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Active

- 6.1.2 Passive

- 6.1.3 Digital

- 6.1.4 Hybrid

- 6.2 By End-User

- 6.2.1 Manufacturing

- 6.2.2 Healthcare

- 6.2.3 Government

- 6.2.4 Transportation

- 6.2.5 Sports and Entertainment

- 6.2.6 Telecommunications

- 6.2.7 Other End-Users

- 6.3 By Application

- 6.3.1 Enterprise DAS

- 6.3.2 Public Safety DAS

- 6.3.3 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Anixter Inc.

- 7.1.2 Cobham PLC

- 7.1.3 Antenna Products Corporation

- 7.1.4 CommScope Inc.

- 7.1.5 Tower Bersama Group

- 7.1.6 SOLiD Inc.

- 7.1.7 TE Connectivity Ltd.

- 7.1.8 Corning Inc.

- 7.1.9 Comba Telecom Systems Holdings Ltd.

- 7.1.10 Boingo Wireless Inc.

- 7.1.11 American Tower Corporation