|

市場調查報告書

商品編碼

1641885

大規模 MIMO -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Massive MIMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

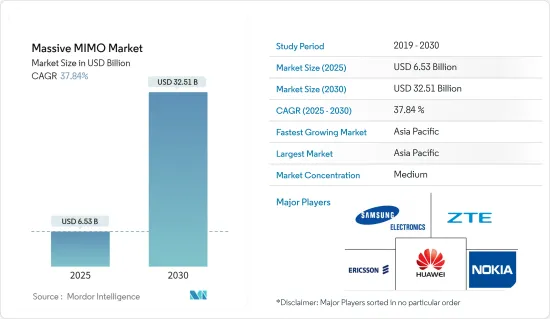

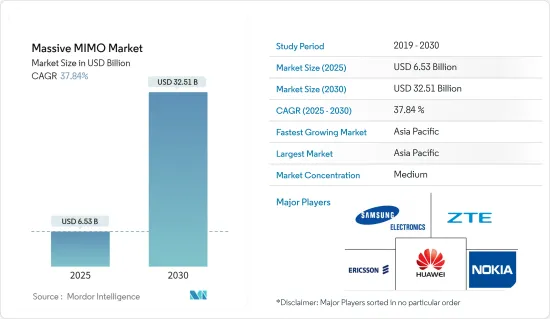

大規模 MIMO 市場規模在 2025 年預計為 65.3 億美元,預計到 2030 年將達到 325.1 億美元,預測期內(2025-2030 年)的複合年成長率為 37.84%。

目前,全球約有52.5億人使用網際網路,佔全球人口的66.2%。北美的網路普及率最高,為93.4%,其次是歐洲,為88.4%。據稱,全球54.4%的網路流量是由行動電話用戶消耗的。行動電話用戶和上網需求的快速成長給現有網路帶來了壓力。為了減輕這種負擔,電信業者正在採用 MIMO 等解決方案,為消費者提供更快、不間斷的服務。

關鍵亮點

- 從 LTE 到 5G 等網路技術的進步也創造了對不間斷連接的需求。 MIMO引進網路將使市場持續受益於現有的4G FDD網路,同時提升5G FDD網路的效能。通訊業者越來越注重推廣 5G 服務,預計這將在預測期內推動 Massive MIMO 市場的成長。

- 在新冠肺炎疫情期間,網路使用量顯著增加。從線上教育和在家工作到遠距諮詢和網路購物,對高速網路服務的需求很大。電訊認知到更高頻寬的需求,從而產生了對 MIMO 等解決方案的需求以實現更好的連接。

- Wi-Fi 和行動電話網路採用 MIMO 技術來提高頻譜效率、最大資料傳輸速率和網路運算容量。 MU-MIMO 僅對快速移動設備有效,因為形成過程複雜且效率低。因此,MU-MIMO 對於頻繁在公司網路間漫遊的設備來說並不有效。

大規模多輸入多輸出的市場趨勢

5G 部署增加可能推動市場成長

- 大規模 MIMO 是 MIMO 的擴展,透過在基地台安裝更多的天線實現超越舊有系統的擴展。增加天線數量有助於集中能量,進而大幅提高吞吐量和效率,確保5G順利運作。

- 2022 年 10 月 - 英國電信集團 (BT Group) 的網路服務供應商EE 與愛立信合作,利用愛立信開發的超輕量級無線電技術在英國各地提供 5G 能源效率和網路效能。愛立信表示,該技術節能,可減少高達 40% 的能耗,並且是目前最輕、最小的 Massive MIMO 無線電,有助於實現更廣泛的永續性目標。 EE 計劃首先在倫敦推出,然後擴展到更多都市區。

- 2022 年 9 月-NEC 和 Mavenir 部署 Massive MIMO Orange 5G 獨立 (SA) 實驗網路。 5G SA mMIMO 的部署是開發 Open RAN 和從虛擬向雲端化網路過渡的重要里程碑。這樣的合作展示了多供應商、雲端原生、基於標準的方法的潛力。

北美佔據主要市場佔有率

- 根據GSMA的報告,預計2025年美國將成為全球5G採用率第二高的國家。 5G連線將佔北美所有行動連線的64%,到2025年達到2.8億。隨著通訊業者加大中頻段頻譜部署,美國和加拿大的 5G 覆蓋率預計將大幅提升,預計到 2025 年,加拿大的 5G 人口覆蓋率將達到 92%,美國將達到 100%。

- 此外,GSMA 強調,T-Mobile 是最大的 5G 供應商,到 2022 年第一季將擁有 90 萬 FWA用戶,並計劃在 2025 年達到約 700 萬用戶。加拿大通訊業者也正在探索5G FWA市場,尤其是在農村地區。

- 隨著大多數通訊業者對 5G 技術進行大量投資,預計在預測期內,Massive MIMO 在該地區的採用率將會增加。

- 2022 年 2 月-美國Open RAN 公司 Parallel Wireless 計畫在加拿大開設研發實驗室。該公司希望在渥太華擁有一支強大的研發團隊,並期待開發與大規模 MIMO、系統結構、無線電設計等相關的新產品。

大規模多投入多產產業概述

由於公司數量眾多,大規模多輸入多輸出 (MIMO) 市場競爭激烈。為了實現產品陣容多樣化、擴大地理覆蓋範圍並最終保持市場競爭力,公司正在實施產品創新、合併和收購等方法。市場的主要企業包括 Verizon Communications Inc.、三星電子、Telefonaktiebolaget LM Ericsson 和華為技術有限公司。

- 2022 年 6 月—恩智浦推出氮化鎵 (GaN) 電晶體,以擴大 5G 大規模 MIMO 覆蓋範圍。此電晶體將促進城市和郊區的5G MIMO部署。這些電晶體將提高驅動蜂窩天線所需的功率,以便通訊服務供應商能夠提供高中頻頻寬並在全國範圍內提供強大的 5G 體驗。

- 2022 年 9 月-華為開始在菲律賓推出第三代 5G Massive MIMO。 Meta AAU產品將提升37%的流量效能,提升上傳下載速度,讓更多用戶能夠使用5G。 5G網路覆蓋菲律賓首都地區90%人口。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章 市場動態

- 市場促進因素

- 行動裝置的興起

- 增加5G部署

- 市場問題

- 設備高成本

第6章 市場細分

- 依技術分類

- LTE

- 5G

- 依天線類型

- 16T16R

- 32T32R

- 64T64R

- 128T128R 或更高版本

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Samsung Electronics Co. Ltd

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd

- Nokia Corporation

- ZTE Corporation

- Texas Instruments Incorporated

- Qorvo Inc.

- NEC Corporation

- Qualcomm Technologies Inc.

- Intel Corporation

第8章投資分析

第9章:市場的未來

The Massive MIMO Market size is estimated at USD 6.53 billion in 2025, and is expected to reach USD 32.51 billion by 2030, at a CAGR of 37.84% during the forecast period (2025-2030).

Approximately 5.25 billion people, i.e, 66.2% of the world's population, use the internet today. North America and Europe have the highest internet penetration of, 93.4% and 88.4%, respectively. It is believed that 54.4% of all internet traffic worldwide is consumed by mobile phone users. This surging demand for mobile subscribers and online usage is putting a burden on existing networks. To ease this pressure, telecom companies are adopting solutions, like MIMO, to provide uninterrupted services to their consumers with enhanced speeds.

Key Highlights

- The technological advancement in network generations like LTE to 5G also creates a demand for uninterrupted connectivity. With the introduction of MIMO in the networks, the market can continue to benefit from existing 4G FDD networks while enhancing the performance of 5G FDD networks. Since telcos focus more on promoting 5G services, it is expected to drive the growth of the massive MIMO market over the forecast period.

- The intensity of internet usage has increased substantially during the COVID-19 Pandemic. From online education, work from home to teleconsultation, online shopping demands high-speed internet services. Telecom operators realized the need for high bandwidth, which created the demand for solutions like MIMO for better connectivity.

- Wi-Fi and cellular networks employ MIMO technology to enhance a computer's spectrum efficiency, maximum data transmission rate, and network capability. It only works well with fast-moving devices because the beam-forming process is more complicated and less efficient. Therefore, MU-MIMO does not benefit devices that frequently roam your corporate network.

Massive Multiple-Input Multiple-Output Market Trends

Increasing 5G Deployment May Drive the Market Growth

- Massive MIMO is an extension of MIMO, that expands beyond the legacy systems by installing a significantly greater number of antennas on the base station. Increased number of antennas helps focus energy, which brings drastic improvements in throughput and efficiency for smooth functioning of 5G.

- October 2022 - EE, the internet service provider and part of BT group teamed with Ericsson to deliver 5G energy efficiency and network performance across the UK using the ultra-light radio technology developed by Ericsson. The company claims this to be the lightest and smallest Massive MIMO radio with energy efficient feature reducing up to 40% energy usage, contributing to wider sustainability goals. In the initial stages, EE plans to deploy the equipments in London, there after expanding to more urban and suburban areas.

- September 2022 - NEC and Mavenir deployed massive MIMO Orange's 5G standalone (SA) experimental network. the deployment of 5G SA mMIMO is an important milestone to develop Open RAN and make the switch from virtualized to cloudified networks. Such collaborations will prove the potential of the multi-vendor, cloud-native, standards-based approach.

North America Occupies a Significant Market Share

- According to GSMA's report, the US is expected to have the world's second-highest 5G adoption rate by 2025. The 5G connections will contribute 64% of all mobile connections in North America and will reach 280 million by 2025. US and Canada are expected to perform well in terms of 5G penetration as operators step up deployments of mid-band spectrum, taking overall population coverage to 92% in Canada and 100% in the US by 2025.

- Furthermore, GSMA highlited that T-Mobile is the biggest provider of 5G with 0.9 million FWA subscribers by the first quarter of 2022 and plans to achieve around 7 million subscribers by 2025. The 5G FWA market is also being investigated by Canadian operators, particularly in rural areas.

- With most of the telecom companies investing heavily in 5G technology, massive MIMO is expected to witness an increased rate of adoption in this region, during the forecast period.

- February 2022 - Parallel Wireless the U.S. based Open RAN company planned to open R&D lab in Canada. With a vision to have a stellar R&D team in Ottawa, the company look forward to develop new products related to massive MIMO, system architecture, radio design and more.

Massive Multiple-Input Multiple-Output Industry Overview

Due to numerous companies, the massive multiple-input, multiple-output (MIMO) market is highly competitive. To diversify their product offerings, broaden their geographic reach, and ultimately maintain their competitiveness in the market, the businesses are implementing methods including product innovation, mergers, and acquisitions. Some of the major players in the market are Verizon Communications Inc., Samsung Electronics Co. Ltd, Telefonaktiebolaget LM Ericsson, and Huawei Technologies Co. Ltd, among others.

- June 2022 - NXP launched Gallium Nitride (GaN) transistors to expand 5G Massive MIMO coverage. It will be easy to install 5G MIMO in cities and suburbs with the help of these transistors. These transistors enhance the power needed to drive cellular antennas for communication service providers to offer larger bandwidth of the mid-band to deliver powerful 5G experiences nationwide.

- September 2022 - Huawei began the rollout of third-generation 5G Massive MIMO in the Philippines. The Meta AAU product will increase traffic performance by 37%, and 5G will be accessible to more users with improved upload and download speeds. 5G networks have covered 90 percent of the population in the National Capital Region of the Philippines.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing number of Mobile Devices

- 5.1.2 Increasing 5G Deployment

- 5.2 Market Challenges

- 5.2.1 High Cost of Equipment

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 LTE

- 6.1.2 5G

- 6.2 By Type of Antenna

- 6.2.1 16T16R

- 6.2.2 32T32R

- 6.2.3 64T64R

- 6.2.4 128T128R and Above

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Electronics Co. Ltd

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Nokia Corporation

- 7.1.5 ZTE Corporation

- 7.1.6 Texas Instruments Incorporated

- 7.1.7 Qorvo Inc.

- 7.1.8 NEC Corporation

- 7.1.9 Qualcomm Technologies Inc.

- 7.1.10 Intel Corporation