|

市場調查報告書

商品編碼

1641889

冷媒:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Refrigerants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

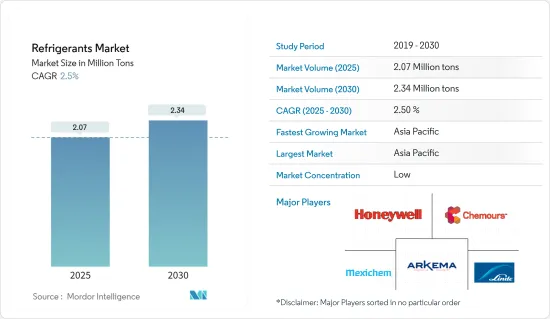

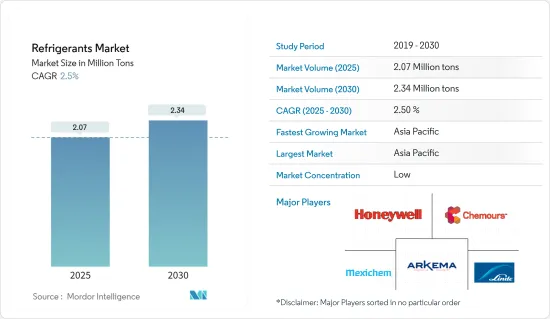

預計2025年冷媒市場規模為207萬噸,至2030年預估達234萬噸,預測期(2025-2030年)複合年成長率為2.5%。

COVID-19對市場產生了負面影響。疫情導致其他主要製造活動暫時停止,從而減少了冷凍、空調和其他應用中使用的冷媒的需求。然而,隨著 2022 年各產業生產流程的恢復,市場保持了成長軌跡。

關鍵亮點

- 推動市場發展的關鍵因素是全球低溫運輸市場的擴張和對 HVAC 應用的需求的增加。

- 然而,針對氟碳冷媒的嚴格環境法規和《蒙特婁議定書》的持續修訂可能會限制市場的發展。

- 人們對綠色和低 GWP 冷媒的認知和發展可能會為未來幾年的市場成長提供機會。

- 由於印度、中國和東南亞國協等國家的需求快速成長,亞太地區在全球市場佔據主導地位。

冷媒市場趨勢

空調應用需求增加

- 冷媒是一種從周圍環境吸收熱量的化學物質,此特性用於冷卻產品。冷媒是現代冷卻系統的基本組成部分,包括空調、冰箱、冷凍庫和冷凍。

- 此外,建築業的擴張正在推動商務用空調市場的發展,這也對冷媒需求的成長產生了積極影響。辦公大樓、機場、地鐵等基礎設施開發活動的增加也導致了商務用空調需求的增加。例如,2023年3月,美國政府資助11個主要地鐵計劃,價值44.5億美元。

- 根據國際能源總署 (IEA) 的數據,全球建築空調存量預計將從 2022 年的 16 億台成長到 2050 年的 56 億台,這意味著未來 30 年,全球每秒鐘都會新增 10 台空調。將出售。

- 根據日本冷凍空調工業協會預測,2021年北美空調設備需求量預計將達到約1,650萬台。

- 根據美國勞工統計局的數據,2021 年,美國屋主在窗型冷氣上的平均每單位支出為 4.81 美元。

- 此外,對環保冷卻解決方案的需求正在推動冷凍和空調製造商的創新。例如,2022 年 2 月,總部位於華盛頓的飲料加工和工業市場冷凍設備製造商和供應商 Pro-Refrigeration, Inc. 宣布將開始使用二氧化碳冷凍,這是一種對全球暖化影響為零的天然製冷劑。

- 由於對永續產品的需求不斷增加,各製造商都在致力於開發永續產品和解決方案。

- 在全球範圍內,由於便利性、可支配收入的增加和繁忙的生活方式等多種因素,冷凍和加工食品的消費量正在增加,從而推動了市場對冷媒的需求。

- 資料中心會產生過多的熱量,帶來經濟和環境挑戰。這些高排放、對高效冷卻的需求以及資料中心新興市場的開放,正在推動資料中心 HVAC 系統中對高效冷凍的需求,從而促進市場的成長。

- 例如,Facebook母公司Meta將於2022年4月在密蘇裡州和德克薩斯州啟用兩個新的資料中心計劃,使其在美國建造和營運資料中心的總投資達到約160億美元。預計資料中心的興起將顯著推動冷媒市場的發展。

- 因此,預計上述因素將在未來幾年對冷媒產生重大影響。

亞太地區佔市場主導地位

- 亞太地區佔據了最高的市場佔有率,並可能在預測期內佔據市場主導地位。

- 中國是世界上成長最快的經濟體之一,人口、生活水準和人均收入的不斷提高推動了幾乎所有終端使用者產業的顯著成長。

- 中國消費者擴大購買健康食品,包括豌豆和玉米等需要低溫儲存的有機食品。包裝冷凍食品也越來越受歡迎,尤其是乳製品、嬰兒食品和糖果零食。

- 根據中國冷鏈委員會及情報研究小組預測,未來中國低溫運輸產業規模仍將持續成長,預計可達約1,301.3億美元。

- 在中國,隨著已烹調包裝食品的使用越來越多,許多消費者將冷凍設備視為家庭必需品,為進入設備市場鋪平了道路。這一形勢將進一步促進中國製冷市場的成長。

- 印度正處於現代經濟蓬勃發展時期,生活水準和人均收入大幅提高,個人的選擇和偏好也正在改變。這推動了印度經濟所有主要領域的擴張,增強了該國的成長前景。

- 印度2022年4月空調銷售量為175萬台,較去年同期成長一倍。根據兩家公司的報告,Voltas 銷售了 120 萬住宅空調,LG 電子銷售了 100 多萬住宅變頻空調。

- 此外,該地區建設活動的活性化也支持了對冷媒的需求。中國計劃在2022年興建200座機場,預計年終年底完工。預測期內,該國建設活動投資的增加可能會推動對空調的需求,進而推動冷媒市場的需求。

- 因此,預計上述因素將在未來幾年推動亞太地區對冷媒的需求。

冷媒產業概況

冷媒市場部分整合,五大主要企業佔據相當大的佔有率。主要企業包括霍尼韋爾國際公司、科慕公司、Mexichem SAB de CV、阿科瑪集團、林德公司等(排名不分先後)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 全球低溫運輸市場的擴張

- 建築業對暖通空調系統的需求不斷增加

- 限制因素

- 氟碳冷媒的嚴格環境法規

- 正在進行的《蒙特婁議定書》修正案

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 類型

- 氟碳

- 氟烴塑膠(HCFC)

- 氫氟碳化物 (HFC)

- 無機

- 氨

- 二氧化碳

- 其他無機物質

- 碳氫化合物

- 異丁烷

- 丙烷

- 其他碳氫化合物

- 其他類型

- 氟碳

- 應用

- 冷凍

- 適合家庭使用

- 商務用

- 運輸

- 工業的

- 空調

- 固定式

- 冷卻器

- 移動的

- 其他

- 冷凍

- 地區

- 亞太地區

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- A-Gas

- Arkema Group(Bostik SA)

- DAIKIN INDUSTRIES Ltd

- Dongyue Group

- Harp International Ltd

- Honeywell International Inc.

- Hudson Technologies

- Mexichem SAB de CV

- Navin Fluorine International Limited

- Sinochem Group

- SRF Limited

- The Chemours Company

- LINDE PLC

第7章 市場機會與未來趨勢

- 綠色低GWP冷媒的認知與發展

- 其他機會

The Refrigerants Market size is estimated at 2.07 million tons in 2025, and is expected to reach 2.34 million tons by 2030, at a CAGR of 2.5% during the forecast period (2025-2030).

COVID-19 had a detrimental effect on the market. All the major manufacturing activities were on a temporary halt owing to the pandemic scenario, which minimized the demand for refrigerants used for refrigeration, air conditioners, and other applications. However, the market retained its growth trajectory in 2022 due to the resumed production processes in all industries.

Key Highlights

- The major factors driving the market are the expansion of the global cold chain market and increasing demand for HVAC applications.

- However, stringent environmental regulations against fluorocarbon refrigerants and the continuous amendments in the Montreal Protocol are likely to restrain the market.

- The awareness and development of green and low GWP refrigerants are likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the market across the world, owing to the rapidly growing demand from the countries like India, China and ASEAN Countries.

Refrigerants Market Trends

Increasing Demand from Air-conditioning Application

- Refrigerants are chemicals that absorb heat from their surroundings and are used in cooling products because of this characteristic. Refrigerant is a fundamental part of contemporary cooling systems, such as air conditioners, refrigerators, freezers, chillers, and other applications.

- Moreover, the expansion of the construction industry accounts for the propulsion of the commercial AC market, which in turn positively impacts the growth in demand for refrigerants. The growing infrastructure development activities, such as office complexes, airports, and metro rail systems, contribute to the increasing requirement for commercial AC after their completion. For instance, in March 2023, the United States government funded 11 major metro rail projects with an amount of USD 4.45 billion.

- According to the International Energy Agency, the global stock of air conditioners in buildings is anticipated to grow up to 5.6 billion by 2050, up from 1.6 billion in 2022, which amounts to 10 new ACs sold every second for the next 30 years.

- According to the Japan Refrigeration and Air Conditioning Industry, the demand for air conditioning devices in North America amounted to approximately 16.5 million units in 2021.

- According to the U.S. Bureau of Labor Statistics, in 2021, the mean household expenditure on window air conditioners by homeowners in the United States amounted to USD 4.81 per consumer unit.

- Additionally, the demand for environmentally friendly cooling solutions is driving chiller and air conditioner manufacturers to innovate. For instance, in February 2022, a Washington-based manufacturer and supplier of chillers for beverage processing and industrial markets, Pro-Refrigeration, Inc., developed the idea of a CO2 chiller, a natural refrigerant with zero impact on global warming.

- The increasing need for sustainable products is leading various manufacturers to develop sustainable products and solutions.

- Globally, there has been an increase in the consumption of frozen and processed food due to several factors, like convenience, an increase in disposable income, busy lifestyles, and many others, that have boosted the demand for refrigerants in the market.

- The data centers produce excessive heat, which presents an economic and environmental challenge. Such heavy emissions, the need for efficient cooling, and the increasing development of data centers have driven the demand for efficient chillers in HVAC systems in data centers and contributed to the market's growth.

- For instance, in April 2022, Meta, the parent company of Facebook, started two new data center projects in Missouri and Texas, bringing its total investment in the United States data center construction and operations to almost USD 16 billion. The increasing number of data centers is expected to significantly drive the refrigerants market.

- Therefore, the aforementioned factors are expected to have a significant impact on refrigerants in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region accounted for the highest market share and is likely to dominate the market during the forecast period.

- China is one of the fastest-growing economies worldwide, and almost all the end-user industries have been experiencing significant growth owing to the rising population, living standards, and per capita income.

- Chinese consumers are increasingly purchasing health and wellness food products, including organic foods that require cold storage, including peas, corn, etc. Packaged frozen foods are also increasingly popular, especially dairy, baby food, and confectionery products.

- According to the China Cold Chain Committee and the Intelligence Research Group, the cold chain industry sector in China is expected to increase further to about USD 130.13 billion in the future.

- Many consumers in China are considering refrigeration appliances as household necessities owing to the increasing usage of ready-to-eat packaged food, which paves the way for appliances to penetrate the market. The scenario further strengthens the growth of the Chinese refrigeration market.

- India is a booming economy in modern times, due to significantly rising living standards and per capita income, which are changing the choices and preferences of an individual. These are resulting in the broadening of all major sectors of the Indian economy, leading to higher growth prospects in the country.

- India recorded a sale of 1.75 million units of air conditioners in April 2022, double as compared to the same period in the year prior. According to the companies' reports, Voltas sold 1.2 million units of residential ACs, while LG Electronic sold over one million units of residential inverter air conditioners.

- Moreover, rising construction activities in the region are also supporting the demand for refrigerants. China concentrated on constructing 200 airports in 2022, with completion anticipated for the end of 2035.The growing investments in construction activities in the country are driving the demand for ACs, which, in turn, may drive the refrigerants market over the forecast period.

- Therefore, the aforementioned factors are expected to boost the demand for refrigerants in the Asia-Pacific region in the coming years.

Refrigerants Industry Overview

The refrigerants market is partially consolidated, with the top five players accounting for a decent share of the market. The major companies include (not in any particular order) Honeywell International Inc., The Chemours Company, Mexichem SAB de CV, Arkema Group, and Linde PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion of the Global Cold Chain Market

- 4.1.2 Increasing Demand from Construction Sector for HVAC Systems

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations against Fluorocarbon Refrigerants

- 4.2.2 Continuous Amendments in the Montreal Protocol

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Fluorocarbons

- 5.1.1.1 Hydrochlorofluorocarbons (HCFC)

- 5.1.1.2 Hydrofluorocarbons (HFC)

- 5.1.2 Inorganics

- 5.1.2.1 Ammonia

- 5.1.2.2 Carbon Dioxide

- 5.1.2.3 Other Inorganics

- 5.1.3 Hydrocarbons

- 5.1.3.1 Isobutane

- 5.1.3.2 Propane

- 5.1.3.3 Other Hydrocarbons

- 5.1.4 Other Types

- 5.1.1 Fluorocarbons

- 5.2 Application

- 5.2.1 Refrigeration

- 5.2.1.1 Domestic

- 5.2.1.2 Commercial

- 5.2.1.3 Transportation

- 5.2.1.4 Industrial

- 5.2.2 Air-conditioning

- 5.2.2.1 Stationary

- 5.2.2.2 Chiller

- 5.2.2.3 Mobile

- 5.2.3 Other Applications

- 5.2.1 Refrigeration

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 India

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 ASEAN Countries

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa (MEA)

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A-Gas

- 6.4.2 Arkema Group (Bostik SA)

- 6.4.3 DAIKIN INDUSTRIES Ltd

- 6.4.4 Dongyue Group

- 6.4.5 Harp International Ltd

- 6.4.6 Honeywell International Inc.

- 6.4.7 Hudson Technologies

- 6.4.8 Mexichem SAB de CV

- 6.4.9 Navin Fluorine International Limited

- 6.4.10 Sinochem Group

- 6.4.11 SRF Limited

- 6.4.12 The Chemours Company

- 6.4.13 LINDE PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Awareness and Development of Green and Low GWP Refrigerants

- 7.2 Other Opportunities