|

市場調查報告書

商品編碼

1641906

定向纖維板(OSB):市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Oriented Strand Board (OSB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

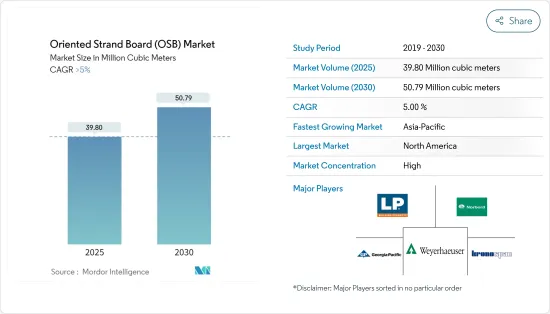

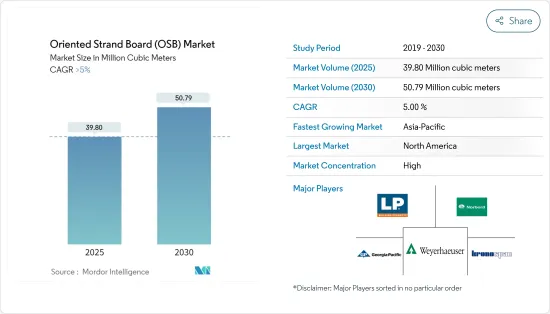

定向纖維板(OSB) 市場規模預計在 2025 年為 3980 萬立方米,預計到 2030 年將達到 5079 萬立方米,預測期(2025-2030 年)的複合年成長率將預測…5%。 …

COVID-19 對市場產生了負面影響。疫情導致建設活動中斷,尤其是在停工初期。許多建築計劃被推遲或取消,導致建築業對OSB的需求下降。隨著門禁限制的放寬和疫苗接種的進展,建設活動開始復甦,導致建築業對 OSB 產品的需求增加。

關鍵亮點

- OSB作為膠合板替代品的重要性日益增加以及建築業的成長等因素預計將推動定向板市場的發展。

- 另一方面,甲醛等揮發性有機化合物(VOC)的排放可能會減緩市場成長。

- OSB在結構絕緣板中的應用越來越廣泛,以及歐洲建築業的復甦可能會在未來帶來機會。

- 北美佔據全球市場主導地位,其中美國佔消費量最大。

定向纖維板的市場趨勢

建築業佔據市場主導地位

- 定向纖維板廣泛用於建築領域,例如地板、牆壁、屋頂襯墊和地板等。它的多功能性使其適合於各種建築計劃,包括住宅,商業和工業。

- 定向纖維板具有優異的結構強度與尺寸穩定性,適合承重應用。 OSB可以承受嚴苛的施工要求,並在各種環境條件下提供持久的性能。

- 根據歐盟委員會的資料,2023年12月整個歐元區的建築業產量較2022年12月成長1.9%,整個歐盟的建築業產量較2022年12月成長2.4%。 2023年與2022年相比,建築產量平均成長率為歐元區0.2%,歐盟0.1%。

- 據歐盟統計局稱,2023年歐元區建築年均產量與2022年相比成長0.2%,歐盟成長0.1%。

- 根據國家統計局的數據,中國建築業商務活動指數(BASI)從2023年11月的55.9上升至12月的56.9。 BASI 分數高於 50 表示行業成長,2023 年 10 月的 BASI 分數為 53.5。

- 預計到 2025 年,印度建築業規模將成長至 1.4 兆美元。到2030年,預計將有6億人居住在城市中心,從而需要額外2500萬套中高階住宅。根據國家投資計畫(NIP),印度的基礎設施投資預算為1.4兆美元,其中24%用於可再生能源、道路、高速公路和城市基礎設施,12%用於鐵路。

- 根據國土交通省 2024 年 1 月發布的最新估計,2023 年日本將開工約 366,800 棟獨戶房屋住宅和 37,971 棟公寓。

- 因此,未來幾年,定向纖維板市場預計將受到各地區建築市場成長的推動。

北美佔據市場主導地位

- 北美建築業蓬勃發展,住宅、商業和工業建築計劃對定向纖維板等建材的需求很高。該地區龐大的人口和都市化趨勢正在推動持續的建設活動,並有助於定向板市場的主導地位。

- 北美建築實踐通常青睞木質建築材料,因為它們易於供應、具有成本效益且易於施工。 OSB 是符合這些偏好的工程木產品,廣泛應用於各種建築應用。

- 美國擁有龐大的建築業,在建立企業、工業、機構、住宅、基礎設施、能源和公共工程方面發揮關鍵作用。該國2022年1月至12月的年度建築支出預計為16772億美元。此外,美國2 月建築支出成長了 1.3%,而 2022 年 1 月經季節性已調整的的年率為 1.677 兆美元。

- 根據美國人口普查局發布的估計,2023年美國建築業總建設活動將增加1,310億美元以上。

- 此外,美國人口普查局發布的估計數字顯示,2024年1月,美國將新建約140萬套私人住宅。

- 所有上述因素預計將推動北美市場的成長。

定向纖維板(OSB) 產業概覽

定向纖維板(OSB)市場本質上是整合的,五大主要企業佔據了全球市場的很大一部分。市場的主要企業包括 Norbord Inc.(West Fraser)、Louisiana-Pacific Corporation、Kronospan Limited、Georgia-Pacific Wood Products LLC 和 Weyerhaeuser Company。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- OSB作為膠合板的替代品正變得越來越受歡迎。

- 建築業成長

- 限制因素

- 甲醛等揮發性有機化合物 (VOC) 的排放

- 其他限制因素

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(按數量分類的市場規模)

- 按年級

- OSB/1

- OSB/2

- OSB/3

- OSB/4

- 最終用戶應用程式

- 家具

- 住宅

- 商業的

- 建築學

- 地板和屋頂

- 牆

- 門

- 柱子和橫樑

- 樓梯

- 其他結構(隔間)

- 包裝

- 飲食

- 工業的

- 藥品

- 化妝品

- 其他包裝(可重複使用的包裝)

- 家具

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 印尼

- 馬來西亞

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 埃及

- 卡達

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Arbec Forestry Products Inc.

- Coillte

- EGGER

- Georgia-Pacific Wood Products LLC

- Huber Engineered Woods LLC

- Kronospan Limited

- Louisiana-Pacific Corporation

- Norbord Inc.(West Fraser)

- RoyOMartin

- Sonae Arauco

- SWISS KRONO Group

- Tolko Industries Ltd

- Weyerhaeuser Company

第7章 市場機會與未來趨勢

- 擴大 OSB 在結構絕緣板 (SIPS) 中的應用

The Oriented Strand Board Market size is estimated at 39.80 million cubic meters in 2025, and is expected to reach 50.79 million cubic meters by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

COVID-19 negatively impacted the market. The pandemic caused disruptions in construction activity, particularly during the initial phases of lockdowns. Many construction projects were postponed or canceled, leading to decreased demand for OSB in the construction sector. As lockdown restrictions eased and vaccination efforts progressed, construction activity began to rebound, leading to increased demand for OSB products in the construction sector.

Key Highlights

- Factors such as the growing importance of OSB as a substitute for plywood and the growth of the construction sector are expected to drive the oriented board market.

- On the other hand, emissions of volatile organic compounds (VOCs) like formaldehyde are likely to slow the growth of the market.

- Increasing applications of OSB in structural insulated panels and the recovering European construction industry are likely to act as opportunities in the future.

- North America dominated the market across the world, with the most significant consumption coming from the United States.

Oriented Strand Board Market Trends

The Construction Segment to Dominate the Market

- Oriented strand boards are widely used in the construction sector for applications such as flooring, walls, roof sheathing, and subflooring. Their versatility makes them suitable for various residential, commercial, and industrial construction projects.

- Oriented strand boards offer excellent structural strength and dimensional stability, making them suitable for load-bearing applications. OSBs can withstand the rigors of construction and provide long-lasting performance in various environmental conditions.

- According to data from the European Commission, construction production grew by 1.9% in December 2023 compared to December 2022 across the euro area and 2.4% across the European Union. The year-on-year average increase in construction production in 2023 compared to 2022 was 0.2% for the euro area and 0.1% for the European Union.

- According to Eurostat, the annual average production of buildings in the euro area and the European Union increased by 0.2% and 0.1%, respectively, in 2023 compared to 2022.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. A BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% of the budget earmarked for renewable energy, roads and highways, and urban infrastructure and 12% for railways.

- According to the latest estimate released by the Ministry of Land, Infrastructure, Transport and Tourism in January 2024, in 2023, construction works for around 366.8 thousand detached houses and 379.71 apartments were launched in Japan.

- Thus, in the upcoming years, the oriented strand boards market is expected to be driven by the growing construction market in all regions.

North America to Dominate the Market

- North America has a robust construction industry, with a high demand for building materials like oriented strand boards in residential, commercial, and industrial construction projects. The region's large population and urbanization trends drive continuous construction activity, contributing to the dominance of the oriented board market.

- North American construction practices often favor wood-based building materials due to their availability, cost-effectiveness, and ease of installation. OSB, being an engineered wood product, fits well with this preference, leading to its widespread use across various construction applications.

- The United States has a massive construction industry, which plays an important role in the establishment of businesses, industries, institutions, homes, infrastructure, energy, and public utilities. The country's annual construction expenditure from January to December 2022 was estimated at USD 1,677.2 billion. In addition, construction spending in the United States increased by 1.3% in February, compared to a seasonally adjusted annual rate of USD 1.677 trillion in January 2022.

- According to the estimate released by the US Census Bureau, the total value of building and construction activities in the United States increased by more than USD 131 billion in 2023.

- Furthermore, according to the estimate released by the US Census Bureau, the number of new privately owned residential houses in the United States was approximately 1.4 million units in January 2024.

- All the factors mentioned above are expected to boost the growth of the market studied in North America.

Oriented Strand Board Industry Overview

The oriented strand board (OSB) market is consolidated in nature, with the top five players accounting for a significant portion of the global market. The major players in the market include Norbord Inc. (West Fraser), Louisiana-Pacific Corporation, Kronospan Limited, Georgia-Pacific Wood Products LLC, and Weyerhaeuser Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Prominence of OSB as a Substitute to Plywood

- 4.1.2 Growth in the Construction Industry

- 4.2 Restraints

- 4.2.1 Emissions of Volatile Organic Compounds (VOCs), such as Formaldehyde

- 4.2.2 Other Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Volume)

- 5.1 By Grade

- 5.1.1 OSB/1

- 5.1.2 OSB/2

- 5.1.3 OSB/3

- 5.1.4 OSB/4

- 5.2 End-user Application

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Column and Beam

- 5.2.2.5 Staircase

- 5.2.2.6 Other Constructions (Partitions)

- 5.2.3 Packaging

- 5.2.3.1 Food and Beverage

- 5.2.3.2 Industrial

- 5.2.3.3 Pharmaceutical

- 5.2.3.4 Cosmetics

- 5.2.3.5 Other Packaging (Reusable Packaging)

- 5.2.1 Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Indonesia

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arbec Forestry Products Inc.

- 6.4.2 Coillte

- 6.4.3 EGGER

- 6.4.4 Georgia-Pacific Wood Products LLC

- 6.4.5 Huber Engineered Woods LLC

- 6.4.6 Kronospan Limited

- 6.4.7 Louisiana-Pacific Corporation

- 6.4.8 Norbord Inc. (West Fraser)

- 6.4.9 RoyOMartin

- 6.4.10 Sonae Arauco

- 6.4.11 SWISS KRONO Group

- 6.4.12 Tolko Industries Ltd

- 6.4.13 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application of OSB in Structural Insulated Panels (SIPS)