|

市場調查報告書

商品編碼

1641908

物聯網分析:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)IoT Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

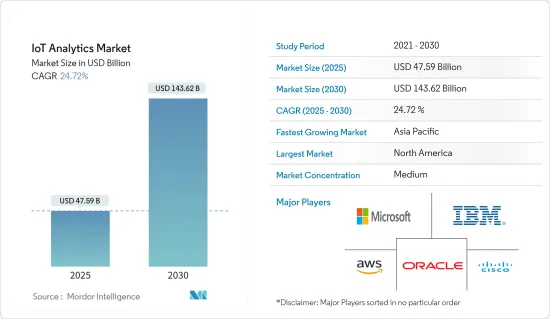

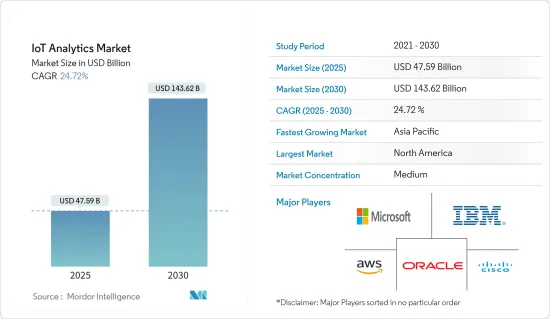

物聯網分析市場規模預計在 2025 年為 475.9 億美元,預計到 2030 年將達到 1,436.2 億美元,預測期內(2025-2030 年)的複合年成長率為 24.72%。

由於連網設備和物聯網資料的豐富,以及企業需要分析和自動化來保持競爭力,物聯網分析市場正在不斷成長。

主要亮點

- 物聯網 (IoT) 分析是一種資料分析工具,可評估從 IoT 裝置收集的資料。物聯網分析在各個終端用戶產業中獲得了顯著的關注,以充分利用資料資產並增強業務決策。

- 物聯網分析可以收集和分析客戶資料以了解他們的需求和偏好。這有助於組織設計出更好的產品和服務來滿足客戶需求。例如,零售商可以使用物聯網分析來追蹤商店內的顧客活動,並根據顧客興趣提供個人化的產品推薦。

- 此外,各終端用戶垂直領域的連網設備的增加是推動物聯網分析市場成長的主要因素之一。例如,根據愛立信行動報告,今年將有 15 億台物聯網設備具有蜂巢式連線功能。

- 此外,工業部門開始採用物聯網分析來簡化日益自動化的工廠。這些機器人通常聯網,使得製造商能夠利用資料做出更好的決策。此外,透過分析各種感測器的資料,工業公司可以識別潛在的安全隱患並採取預防措施來避免它們。

- COVID-19 疫情對物聯網分析市場產生了負面影響,迫使客戶和最終用戶凍結預算並推遲 IT 和物聯網支出。然而,在疫情過後,物聯網分析市場將見證顯著成長,這得益於醫療保健和製造業的應用增加、數位轉型和連網型設備的增加。

物聯網分析市場趨勢

醫療保健可望大幅成長

- 基於物聯網的醫療保健解決方案可以提高護理品質和效率。由物聯網和分析技術提供支援的互聯醫療保健解決方案正在為主動、數位化、以患者為中心的模式鋪平道路,推動預測期內的市場成長。

- 此外,醫療保健中使用的物聯網 (IoT) 應用會產生大量資料,必須對這些數據進行分析才能獲得必要的見解。醫療保健行業的資料以及來自各種感測器和連接設備的流資料需要高級分析才能將資料轉化為可用於患者照護和監測的可行見解,從而使醫療保健組織更具成本效益。正在成長。

- 此外,物聯網分析設備可以即時收集、分析和通訊資料,從而減少了儲存原始資料的需要。此外,醫療保健組織可以獲得關鍵的醫療保健分析和資料主導的洞察力,從而可以更快地做出決策並減少錯誤。預計這些優勢將在預測期內推動醫療保健領域對物聯網分析的需求。

能夠追蹤心率、血壓等的穿戴式裝置的成長和普及率不斷提高,再加上需要結構化和分析的大量資料的產生,正在推動預測期內對物聯網分析的需求。例如,根據Cisco的資料,今年連網穿戴裝置的數量預計將達到11.05億。

預計北美將佔最大佔有率

- 北美擁有最大的市場佔有率,因為該地區有多家知名供應商,而且物聯網在零售、製造、IT、電信、生命科學和醫療保健等各個行業中的應用日益廣泛。人。

- 此外,該地區大量的連網設備也推動了物聯網分析的發展。例如,根據 GSMA Intelligence 的資料,到 2025 年,北美消費者和工業物聯網 (IoT) 連接總數預計將成長到 54 億。

- 此外,該地區是資訊科技市場一些最知名參與者的所在地。進入市場的供應商正在大力投資,透過持續的研究和開發來建立物聯網生態系統。預計這將在預測期內推動物聯網分析的成長。

- 例如,Airwire Technologies 等公司正在與 IBM 合作實施聯網汽車和物聯網服務平台,以收集車輛感測器資料和周圍環境的見解並採取行動,以便更好地服務車輛和駕駛員。預計這些因素將進一步推動該地區對物聯網分析的採用。

物聯網分析產業概覽

由於以下主要參與者的存在,物聯網分析市場參與者之間的競爭相當激烈:微軟、AWS、思科等等。

2022 年 8 月,亞馬遜網路服務 (AWS) 宣布 CEAT LTD (CEAT) 將利用 AWS 推進智慧製造,開發配備感測器的智慧輪胎,可以預測負載和磨損等各種資料點。 CEAT 將利用 AWS 雲端功能的廣度和深度,包括物聯網 (IoT)、分析、商業智慧和機器學習,將其工廠數位化,以提高製造效率,並透過 AWS 上的 SAP主導資料驅動的決策。是做出決策並推出創新的數位服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 物聯網資料量不斷增加

- 聯網汽車和智慧城市的出現

- 市場限制

- 資料隱私和安全問題

第6章 市場細分

- 按類型

- 解決方案

- 按服務

- 按部署

- 本地

- 雲

- 按行業

- 能源與公共事業

- BFSI

- 零售

- 製造業

- 衛生保健

- 其他終端用戶產業(IT、通訊、運輸)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Microsoft Corporation

- Oracle Corporation

- Amazon Web Services, Inc.

- Cisco Systems, Inc

- IBM Corporation

- SAP SE

- Accenture PLC

- Dell Technologies Inc.

- Google LLC

- The Hewlett Packard Enterprise Company

- Teradata Corporation

- Salesforce.com Inc

第8章投資分析

第9章 市場機會與未來趨勢

The IoT Analytics Market size is estimated at USD 47.59 billion in 2025, and is expected to reach USD 143.62 billion by 2030, at a CAGR of 24.72% during the forecast period (2025-2030).

The IoT analytics market is growing because of the large number of connected devices and IoT data, as well as the fact that businesses need analytics and automation to stay competitive.

Key Highlights

- Internet of Things (IoT) analytics is a data analysis tool that assesses the broad range of data collected from IoT devices. IoT analytics are gaining significant traction in various end-user industries to make the most of their data assets and empower their business decisions.

- IoT analytics can collect and analyze customer data to understand their needs and preferences. This can help organizations design better products and services that meet the needs of their customers. For instance, a retailer can use IoT analytics to track customers' movements in its store and offer personalized recommendations based on their interests.

- In addition, the increasing number of connected devices across various end-user verticals is one of the prominent factors driving the growth of the IoT analytics market. For instance, according to Ericcson's mobility report, there will be 1.5 billion IoT devices with cellular connections this year.

- Further, the industrial sector has started adopting IoT analytics to streamline their factories, which are increasingly automated by robots. These robots, which are often networked together, enable manufacturers to use the data to make better decisions. In addition, by analyzing data from various sensors, businesses in the industrial sector can identify potential safety hazards and take preventive measures to avoid them.

- The COVID-19 pandemic negatively impacted the IoT analytics market, forcing their customers or end-users to freeze budgets or delay IT and IoT spending. However, post-pandemic, the IoT analytics market is experiencing significant growth due to increased adoption among healthcare and manufacturing organizations in line with increasing digital transformation and connected device growth.

IoT Analytics Market Trends

Healthcare is Expected to Witness Significant Growth

- IoT-based healthcare solutions can improve the quality and efficiency of treatments. With connected healthcare solutions leveraging IoT and analytics, it would pave the way for a proactive, digitally enabled, and patient-centric model, boosting market growth over the forecast period.

- Moreover, Internet of Things (IoT) applications used in healthcare generate a vast amount of data that needs to be analyzed to produce the required insights. Healthcare industry data or streaming data generated by various sensors and connected devices requires advanced analytics to transform data into actionable insights for patient care and monitoring, thus driving the demand for IoT analytics in healthcare organizations.

- Further, IoT analytics devices can gather, analyze, and communicate data in real time, reducing the need to store raw data. Moreover, it enables healthcare organizations to get vital healthcare analytics and data-driven insights, which speed up decision-making and are less prone to errors. Such benefits are expected to drive the demand for IoT analytics in the healthcare sector over the forecast period.

The growth in wearable devices that allow the user to track heart rates, blood pressure, and many more, coupled with their increased adoption, has resulted in the generation of voluminous data that has to be structured and analyzed, thus driving the demand for IoT analytics over the forecast period. For instance, according to the data from Cisco Systems, the number of connected wearable devices is expected to reach 1,105 million this year.

North America is Expected to Hold the Largest Share

- North America held the largest market share due to the presence of several established vendors in the region and also due to the earliest adoption of IoT technology in various industries, including retail, manufacturing, IT, telecom, life sciences, and healthcare. most of the companies in this region are increasingly adopting IoT to keep track of the performance of their offerings.

- Further, the high number of connected devices in the region propels the growth of IoT analytics. For instance, according to the GSMA Intelligence data, North America's total number of consumer and industrial Internet of Things (IoT) connections is expected to grow to 5.4 billion in 2025.

- Moreover, the region is home to some of the most prominent players in the information technology market. Market vendors are investing heavily to create an IoT ecosystem by enabling continued research and development. This is expected to fuel the growth of IoT Analytics over the forecast period.

- For instance, companies, such as Airwire Technologies are working with IBM to implement its connected car and IoT services platform, to collect insights and act upon vehicle sensor data and the environment around it to establish a relationship with the driver, not just the vehicle. These factors are further expected to drive the adoption of IoT Analytics in the region.

IoT Analytics Industry Overview

The competitive rivalry amongst the players in the IoT analytics market is moderately high owing to the presence of some key players such as Microsoft, AWS, CISCO, and many more. Their ability to continually innovate their offerings by conducting extensive research and development activities has enabled them to gain a competitive advantage over the other players.

In August 2022, Amazon Web Services (AWS) announced that CEAT LTD (CEAT) is using AWS to drive smart manufacturing and invent intelligent tires with sensors that can predict various data points, such as load and wear. Using the breadth and depth of AWS cloud capabilities, including the Internet of Things (IoT), analytics and business intelligence, and machine learning, CEAT is digitizing factories to unlock manufacturing efficiencies, make data-driven decisions with SAP on AWS, and launch innovative digital services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Volume of IoT Data

- 5.1.2 Emergence of Connected Cars and Smart Cities

- 5.2 Market Restraints

- 5.2.1 Concerns Associated with Data Privacy and Security

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-User Vertical

- 6.3.1 Energy & Utility

- 6.3.2 BFSI

- 6.3.3 Retail

- 6.3.4 Manufacturing

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries (IT & Telecom, Transportation)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 Amazon Web Services, Inc.

- 7.1.4 Cisco Systems, Inc

- 7.1.5 IBM Corporation

- 7.1.6 SAP SE

- 7.1.7 Accenture PLC

- 7.1.8 Dell Technologies Inc.

- 7.1.9 Google LLC

- 7.1.10 The Hewlett Packard Enterprise Company

- 7.1.11 Teradata Corporation

- 7.1.12 Salesforce.com Inc