|

市場調查報告書

商品編碼

1641940

射孔槍:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Perforating Gun - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

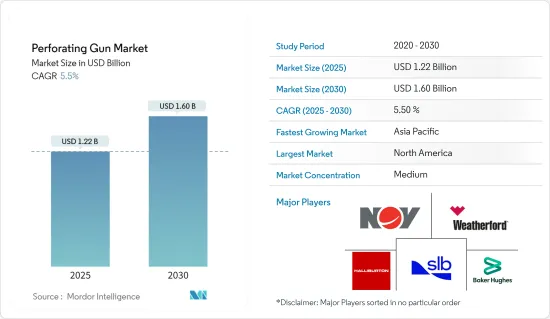

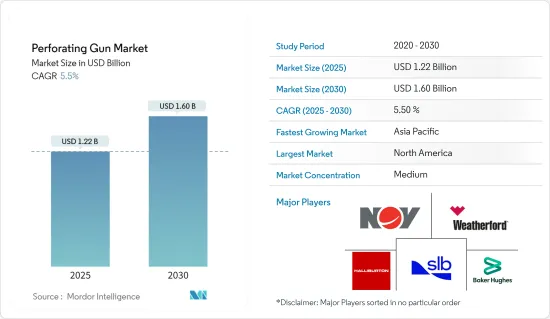

射孔槍市場規模預計在 2025 年為 12.2 億美元,預計到 2030 年將達到 16 億美元,預測期內(2025-2030 年)的複合年成長率為 5.5%。

關鍵亮點

- 從中期來看,全球石油和天然氣鑽探活動活性化、頁岩氣探勘增加以及鑽槍系統技術發展等因素預計將在預測期內推動鑽槍市場的發展。

- 同時,可再生能源在未來幾十年的佔有率可能會增加,並貢獻全球50%的電力。預計未來幾年可再生能源將抑制鑽槍市場。

- 新的非常規油井的發現有望為射孔槍市場提供機會。

- 北美是射孔槍最大的市場之一,主導美國是最大的市場,這主要歸因於緻密油和頁岩蘊藏量的探勘和生產活動的增加。

射孔槍市場趨勢

水平井和斜井領域佔據市場主導地位

- 隨著技術進步,水平井和斜井開發效益和經濟效益不斷提高,水平井和斜井開發也越來越受歡迎。

- 射孔槍在改善井孔通路和確保高效刺激儲存的有效性,激發了其在這一領域的受歡迎程度。隨著非常規資源的持續成長和對水平鑽井技術的日益偏好,水平井和斜井領域預計將成為引導射孔槍市場持續擴張的關鍵驅動力。

- 多分支井的日益普及增加了海上水平鑽井的需求,從而推動了市場的發展。持續的技術進步和水平鑽井效率的提高,加上多級水力壓裂技術的進步,正在釋放大量非常規頁岩和緻密碳氫化合物蘊藏量。這一趨勢反映了隨著能源探勘和生產的發展,市場動態發生了重大變化。

- 此外,2023 年 8 月,阿拉伯鑽井公司與沙烏地阿美公司簽訂了多份為期五年的契約,為沙烏地阿拉伯傳統天然氣項目額外提供 10 個陸上鑽機。沙烏地阿美也正在考慮進行探勘計劃並安裝必要的基礎設施,以獲取北阿拉伯、南加瓦爾和賈富拉等地區新的傳統型蘊藏量。因此,預計未來鑽孔槍市場將會成長。

- 此外,阿拉伯聯合大公國、埃及、卡達、阿爾及利亞、利比亞和沙烏地阿拉伯等國家也已開始探索其頁岩蘊藏量的商業性潛力。 2023 年 8 月,埃及石油和礦產資源部宣布,計劃在 2024 年至 2025 年間鑽探 35 口新天然氣井,投資超過 15 億美元以提高產量。

- 根據《世界能源統計評論》,2022年中東地區石油產量將達14.416億噸,高於2021年的13.16億噸,成長率超過9.5%。

- 因此,隨著水平鑽井對頁岩油氣的探勘和開採的增加,鑽槍市場預計也將出現較大的需求。因此,基於上述幾點,預計預測期內水平和異常健康部分將呈現主導成長。

北美佔據市場主導地位

- 石油和天然氣需求的不斷成長導致北美鑽探活動的增加。過去十年來,該地區最顯著的變化是從垂直井轉向水平井,這使得人們能夠更深入地接觸地層,而鑽井成本只會逐漸增加。鑽井活動的激增給北美石油和天然氣市場帶來了樂觀情緒,因此被認為是鑽槍市場的好徵兆。

- 然而,這種情況在 2023 年近幾個月已經呈現復甦跡象。例如,根據貝克休斯鑽井平台統計數據,截至 2023 年 6 月 9 日,美國共有 695 座旋轉鑽機在運作,其中 20 座為海上鑽機,675 座為陸上鑽機。與 2022年終投入營運的 15 座鑽機相比,運作鑽機的數量增加。預計這一趨勢將持續並支持該國海上石油和天然氣鑽探市場的成長。同樣,2022 年定向旋轉鑽機的數量將從 2021 年的 30 台增加到 46 台。

- 2023年3月,美國政府核准阿拉斯加Willow石油計劃的鑽探活動。預計 Willow計劃高峰期每天可生產約 18 萬桶石油,約佔阿拉斯加現有日產量的 40%。

- 此外,墨西哥灣地區正在啟動新的計劃,復甦跡象開始顯現。殼牌海上公司在墨西哥灣的 Vito 等深水和超深水鑽井活動方面持續的石油和天然氣投資預計將為該國的射孔槍市場開闢新的途徑。

- 因此,北美生產正在顯著發展,該地區不斷成長的頁岩產業預計將為從事鑽槍市場的油田服務供應商創造重大機會。

射孔槍產業概況

射孔槍市場呈半分散狀態。主要企業(不分先後順序)包括貝克休斯公司、斯倫貝謝有限公司、威德福國際有限公司、NOV 公司、哈里伯頓公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 石油及天然氣鑽探活動及相關投資增加

- 鑽槍系統的技術開發

- 限制因素

- 更加關注可再生能源技術以滿足不斷成長的能源需求

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 承運商類型

- 中空載體

- 加大充能槍

- 其他承運商類型

- 爆炸類型

- 環三亞甲基三硝胺 (RDX)

- 環四亞甲基三硝胺 (HMX)

- 六亞硝基苯 (HNS)

- 井型

- 水平井和斜井

- 垂直井

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 挪威

- 英國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 印度

- 馬來西亞

- 其他亞太地區

- 南美洲

- 智利

- 巴西

- 阿根廷

- 南非

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Baker Hughes Company

- Schlumberger Limited

- Weatherford International PLC

- NOV Inc.

- Halliburton Company

- Hunting PLC

- DMC Global Inc.

- DynaEnergetics GmbH & Co KG

- China Shaanxi FYPE Rigid Machinery Co. Ltd

- Core Laboratories NV

- 市場排名/佔有率(%)分析

第7章 市場機會與未來趨勢

- 傳統型儲存開發

簡介目錄

Product Code: 62635

The Perforating Gun Market size is estimated at USD 1.22 billion in 2025, and is expected to reach USD 1.60 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

Key Highlights

- Over the medium term factors such as the rise in oil and gas drilling activities across the world, increased shale gas exploration, and technological developments in perforating gun systems are expected to drive the perforating gun market during the forecast period.

- On the other hand, renewable energy is likely to increase its share and contribute to 50% of global power in the next few decades. It is expected to restrain the perforating gun market in the coming years.

- Nevertheless, the discovery of new unconventional wells is expected to provide opportunities for the perforation gun market.

- North America is one of the largest markets for perforating guns, led by the United States mainly due to increased exploration and production activities in its tight oil and shale reserves.

Perforating Gun Market Trends

Horizontal and Deviated Well Segment to Dominate the Market

- The horizontal and deviated well development is gaining popularity, owing to the benefits associated with the same and technological advancements that have led to increased economic viability.

- The effectiveness of perforating guns in enhancing wellbore access and ensuring efficient reservoir stimulation has fueled their popularity in this segment. With the continuous growth of unconventional resources and the increasing preference for horizontal drilling techniques, the horizontal and deviated well segment is anticipated to be a key driver, steering the trajectory of the perforating gun market toward sustained expansion.

- The rising prevalence of multilateral wells is fostering an increased demand for horizontal drilling in offshore areas, consequently propelling the market forward. Continuous technological advancements and enhanced efficiency in horizontal drilling, coupled with advancements in multi-stage hydraulic fracturing technologies, are unlocking extensive reserves of unconventional shale and tight hydrocarbons. This trend reflects a notable shift in the market dynamics, driven by the evolving landscape of energy exploration and production.

- Moreover, in August 2023, the Arabian Drilling Company received multiple contracts of five- years from Saudi Aramco for ten additional land rigs instead of the unconventional gas program in Saudi Arabia. Saudi Aramco is also investigating conducting trial projects and setting up the required infrastructure to access new unconventional reserves in regions such as North Arabia, South Ghawar, and Jafurah. This is expected to help the perforating gun market to grow in the future.

- Also, countries such as the United Arab Emirates, Egypt, Qatar, Algeria, Libya, and Saudi Arabia have started exploring the commercial viability of their shale reserves. In August 2023, the Ministry of Petroleum and Mineral Resources of Egypt noted forthcoming drilling activities for 35 new natural gas wells during 2024 & 2025 with estimated investments of over USD 1.5 billion to increase production rates, thus benefitting the perforating gun market in the forecast period.

- As per the Statistical Review of World Energy, in 2022, the oil production in the Middle-Eastern region stood at 1,441.6 million tonnes, an increase from 1,316 million tonnes in 2021, registering a growth rate of more than 9.5%.

- Hence, with the rising exploration and production of shale oil and gas through horizontal drilling, the perforating gun market is also expected to witness a significant demand. Therefore, the horizontal and deviated healthy segment will witness dominant growth during the forecast period due to the above points.

North America to Dominate the Market

- Drilling activities in North America have increased amid the rising oil and gas demand. The shift from vertical to horizontal wells is the most significant change over the last decade in the region, allowing for greater formation access while only incrementally increasing the cost of the well. The surge in drilling activities has created optimism in the North American oil and gas market and hence may be considered a good sign for perforating gun markets.

- However, this scenario saw a recovery in the recent months of 2023. For example, according to the Baker Hughes Rig Count, on 9th June 2023, the United States had 695 active rotary rigs, of which 20 were offshore rigs and 675 onshore rigs. This recorded a rise in the offshore rig counts compared to the 15 active rigs at the end of 2022. These trends will likely continue and support the growth of the country's offshore oil and gas drilling market. Likewise, the directional rotary drilling rig count in 2022 was 46, which increased from 30 counts in 2021.

- In March 2023, the United States government approved drilling activities on the Willow oil project in Alaska. The Willow project is expected to garner peak production of about 180,000 barrels of oil per day, nearly forty percent of existing daily production in Alaska.

- Also, the Gulf of Mexico has started to witness signs of recovery as new projects are coming up. Ongoing oil and gas investments in deepwater and ultra-deepwater drilling activities, such as one by Shell Offshore for Vito in the Gulf of Mexico, are expected to create new avenues for the perforating gun market in the country.

- Therefore, North American production has developed significantly, and the growing shale industry in the region is expected to create significant opportunities for the oilfield service providers engaged in the perforating gun market.

Perforating Gun Industry Overview

The perforating gun market is semi-fragmented. Some of the major companies (in no particular order) are Baker Hughes Company, Schlumberger Limited, Weatherford International PLC, NOV Inc., and Halliburton Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rise In Oil And Gas Drilling Activities And Associated Investments

- 4.5.1.2 Technological Developments In Perforating Gun Systems

- 4.5.2 Restraints

- 4.5.2.1 Increased Focus On Renewable Energy Technologies To Fulfill Rising Energy Demand

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Carrier Type

- 5.1.1 Hollow Carrier

- 5.1.2 Expandable Shaped Charged Gun

- 5.1.3 Other Carrier Types

- 5.2 Explosive Type

- 5.2.1 Cyclotrimethylene Trinitramine (RDX)

- 5.2.2 Cyclotetramethylene Trinitramine (HMX)

- 5.2.3 Hexanitrosilbene (HNS)

- 5.3 Well Type

- 5.3.1 Horizontal and Deviated Well

- 5.3.2 Vertical Well

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Norway

- 5.4.2.2 United Kingdom

- 5.4.2.3 Russia

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Indoensia

- 5.4.3.4 Malaysia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Chile

- 5.4.4.2 Brazil

- 5.4.4.3 Argentina

- 5.4.4.4 Rest of South Africa

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Afica

- 5.4.5.4 Egypt

- 5.4.5.5 Nigeria

- 5.4.5.6 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 Schlumberger Limited

- 6.3.3 Weatherford International PLC

- 6.3.4 NOV Inc.

- 6.3.5 Halliburton Company

- 6.3.6 Hunting PLC

- 6.3.7 DMC Global Inc.

- 6.3.8 DynaEnergetics GmbH & Co KG

- 6.3.9 China Shaanxi FYPE Rigid Machinery Co. Ltd

- 6.3.10 Core Laboratories NV

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Unconventional Reservoirs

02-2729-4219

+886-2-2729-4219