|

市場調查報告書

商品編碼

1641941

混合複合材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hybrid Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

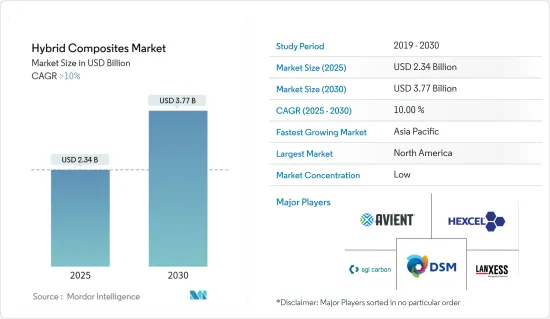

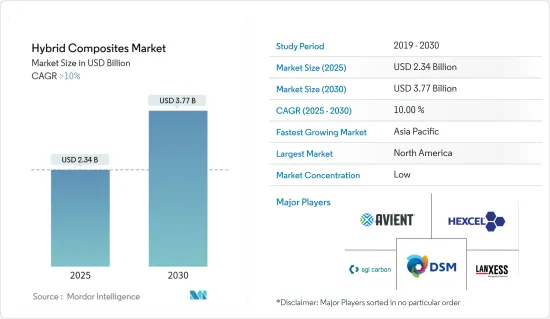

混合複合材料市場規模預計在 2025 年將達到 23.4 億美元,預計到 2030 年將達到 37.7 億美元,預測期內(2025-2030 年)的複合年成長率將超過 10%。

COVID-19 疫情對混合複合材料市場的影響好壞參半。雖然這帶來了眼前的挑戰,但也凸顯了這種材料的潛力,並引發了可能有助於其長期成長的趨勢。

封鎖和旅行限制擾亂了原料和成品的流動,導致生產延遲和材料短缺。航太、汽車和風力發電等嚴重依賴混合複合材料的行業由於出行限制和經濟放緩而遭受了嚴重景氣衰退,從而減少了對材料的需求。另一方面,疫情凸顯了醫療器材與設備對先進材料的需求,為矯正器具、植入和手術器材中的生物相容性混合複合材料創造了機會。

關鍵亮點

- 輕型車輛領域對複合材料的採用日益廣泛,以及混合複合材料相對於傳統複合材料所表現出的優異性能,是受調查市場的主要促進因素。

- 然而,混合複合材料的加工和製造通常涉及複雜且勞動密集的技術,這可能會增加成本並抑制所調查市場的成長。

- 對複合材料製造自動化、數位化和積層製造的探索可以簡化流程、降低成本並提高產品一致性,從而在全球市場上提供有利可圖的機會。

- 由於中國的需求旺盛,預計亞太地區將在預測期內出現最高成長率。

混合複合材料市場趨勢

碳/玻璃佔市場主導地位

- 最常用的混合複合材料是玻璃纖維增強聚合物(GFRP)和碳纖維增強聚合物(CFRP)複合材料,其次是醯胺纖維和天然纖維增強複合材料。

- 碳纖維-玻璃纖維混合材料為汽車和運輸、建築和施工以及其他工業市場中的傳統玻璃纖維和金屬應用提供了一種輕質、高強度的替代品。

- 這種混合材料具有碳纖維的性能優勢,但成本與高性能玻璃纖維相似。

- 混合複合材料擴大應用於自動化和高速製造程序,以滿足汽車和其他領域大規模生產的需求。

- 根據國際汽車製造商協會(OICA)的數據,2022年全球汽車產量將達到約8,501萬輛,而2021年為8,020.5萬輛,成長率為5.99%。 2022年全球乘用車產量約6,000萬輛,較2021年成長近7.35%。

- 使用案例可以以比使用碳纖維低得多的成本獲得高達90%的碳效益。

- 由這些混合複合材料製成的零件具有高強度重量比,並且不會腐蝕。它的使用壽命很長,幾乎不需要維護。其特殊的性能滿足了安全性和強度至關重要的應用需求。

- 在建築領域,許多複合材料產品和應用由於其獨特的性能(例如耐腐蝕、隔熱、輕質等)而越來越受歡迎。從用於混凝土加固的複合鋼筋到用於窗框和複合屋瓦的拉擠型材,複合產品不僅可以實現更永續的設計,還可以有效地修復、升級和加固現有建築物和橋樑。本文提供了一種解決方案。

- 據 JEC Composites 稱,人們對材料回收和再利用的興趣很高,複合材料行業的主要企業正在採取許多舉措。例如,歐洲風電產業承諾在2025年實現100%的風力渦輪機葉片的再利用、再循環和回收。

- 由於上述因素,碳/玻璃纖維類型很可能在預測期內佔據市場主導地位。

亞太地區成長率最高

- 近年來,亞太基礎設施產業健康成長。因此,預計該地區在評估期內水泥板市場將呈現驚人的成長率。

- 亞太地區目前正在經歷住宅和商業建築的高投資,尤其是中國、日本、台灣、韓國、印度、馬來西亞、印尼和越南等新興經濟體。

- JEC Composites 表示,展望未來,隨著新興亞洲引領經濟成長,長期趨勢將得以恢復。預計中國的成長速度將超過5%的複合年成長率,超過歐洲和美國,印度、菲律賓、印尼和馬來西亞也有望實現類似的成長。從中期來看(2021-2026 年),複合材料市場應在所有地區恢復成長,尤其是亞洲(能源、電子電氣等)仍顯示出巨大的長期成長潛力。

- 在汽車領域,這些獨特的材料結合了各種纖維和樹脂的優點,實現了減輕重量、提高性能和改善燃油經濟性的完美結合,從而增加了亞太市場對混合複合材料的消費量。

- 中國是世界上最大的汽車製造業國家。 2022年產業略有成長,產銷量增加。預計 2021 年將繼續保持類似的趨勢,2022 年產量將成長 3%。據中國工業協會稱,汽車產量預計將繼續成長,比亞迪和上汽集團等公司將推動燃油和電動車領域的產銷量。

- 據中國汽車工業協會稱,預計 2022 年中國汽車工業的電動和混合動力汽車汽車銷量將達到約 940 萬輛,低於去年的 690 萬輛。該協會進一步預測,2024年銷售量將持續成長,達到 1,150 萬台。

- 例如,中國汽車巨頭比亞迪計劃在 2023 年銷售超過 300 萬輛電動車,其中包括 160 萬輛由電池和汽油動力來源的全電動車,以及另外 140 萬輛混合動力汽車。與 2022 年相比,成長了 62%。據比亞迪公司稱,該公司也已實現收益,去年上半年利潤成長兩倍,達到 15 億美元。

- 根據《今日印度》報道,2023年國內市場汽車銷量為410.8萬輛。這是自然年度內銷售首次突破400萬台。 2022年銷量為379.2萬台。在印度,由於庫存未售出,瑪魯蒂、現代、塔塔、本田和馬恆達等主要汽車製造商已停止生產。預計這將在不久的將來對印度汽車生產產生重大負面影響。

- 中國是世界上最大的醫療保健產業之一。中國政府在「十三五」規劃中將健康和技術創新列為優先事項,預計這將在預測期內帶動醫療設備製造業的投資增加。此外,由於新冠疫情爆發,該國對醫療保健領域的投資正在逐漸增加。

- 混合複合材料可以達到極佳的強度重量比,在某些情況下甚至超過鋼。這使得它們成為承重結構、橋樑和抗震建築的理想選擇。

- 中國的成長也受到住宅和商業建築行業快速擴張以及國家經濟不斷成長的推動。中國正在推動並持續推動都市化進程,預計2030年都市化率將達70%。因此,中國等國家建築活動的活性化預計將刺激該地區黏合劑產業的發展。所有這些因素都傾向於增加全部區域黏合劑的需求。

- 根據中國國家統計局的數據,預計 2022 年建築業產值將達到 31.2 兆元(4.5 兆美元),高於 2021 年的 29.31 兆元(4.2 兆美元)。此外,根據住宅及城鄉建設部的預測,預計2025年後中國建築業將佔GDP的比重維持在6%。

- 根據印度投資局的數據,到 2025子部門,印度建築業預計將達到 1.4 兆美元。科技在U的技術推動下,印度建築業將迎來新紀元。

- 此外,亞洲、北美和太平洋地區的強勁需求,使得2022年韓國建築商的海外建築訂單連續第三年超過300億美元。

- 所有這些因素均受到該地區人口成長、都市化和購買力增強的推動。目前亞太地區許多地區正在實施有關VOC排放的法規,這也可能鼓勵使用纖維水泥板(FCB)和水泥黏結塑合板(CBPB)等水泥板。

- 因此,由於上述因素,亞太地區很可能在預測期內見證最高成長。

混合複合材料產業概況

混合複合材料市場適度細分。主要參與企業(不分先後順序)包括朗盛、帝斯曼、Avient Corporation、赫氏公司和西格里碳素。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 輕型車輛領域複合材料的使用增加

- 某些混合動力汽車可抵禦多種威脅

- 其他促進因素

- 限制因素

- 加工製造成本高

- 對永續性和環境影響的擔憂

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 光纖類型

- 碳/玻璃

- 碳/芳香聚醯胺

- HMPP/碳

- 木材/塑膠

- 其他纖維類型(天然纖維、玄武岩纖維等)

- 樹脂類型

- 熱固性樹脂

- 熱塑性樹脂

- 其他樹脂類型(例如 PEEK(聚醚醚酮))

- 最終用戶產業

- 汽車和運輸設備

- 建築基礎設施

- 航太和國防

- 海洋

- 其他終端使用者產業(體育用品、醫療等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Avient Corporation

- DSM

- Gurit Services AG

- Hexcel Corporation

- Huntsman International LLC

- KINECO-KAMAN

- LANXESS

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- RTP Company

- Owens Corning

- SABIC

- SGL Carbon

- Simcas Composites

- Solvay

- TEIJIN LIMITED

- Textum OPCO, LLC

- Toray Advanced Composites

第7章 市場機會與未來趨勢

- 混合複合材料在各市場的應用日益廣泛

- 探索複合材料製造的自動化、數位化和積層製造技術

The Hybrid Composites Market size is estimated at USD 2.34 billion in 2025, and is expected to reach USD 3.77 billion by 2030, at a CAGR of greater than 10% during the forecast period (2025-2030).

The impact of the COVID-19 pandemic on the hybrid composites market was mixed. While it presented immediate challenges, it also highlighted the potential of these materials and triggered trends that could contribute to long-term growth.

Lockdowns and travel restrictions disrupted the flow of raw materials and finished products, leading to production delays and material shortages. Industries heavily reliant on hybrid composites, such as aerospace, automotive, and wind energy, experienced significant downturns due to travel restrictions and economic slowdown, dampening demand for material. On the flip side, the pandemic highlighted the need for advanced materials in medical devices and equipment, creating opportunities for biocompatible hybrid composites in prosthetics, implants, and surgical instruments.

Key Highlights

- The growing adoption of composite materials in the light vehicle sector and compared to traditional composites, better properties exhibited by hybrid composites in comparison to the traditional composites is a major driving factor for the market studied.

- On the flip side, the processing and manufacturing of hybrid composites often involve complex and labor-intensive techniques, driving up costs and may act as a hindrance to the growth of the market studied.

- Exploring automation, digitalization, and additive manufacturing techniques for composite production can streamline processes, reduce costs, and improve product consistency can provide lucrative opportunities in the global market.

- Asia-Pacific is expected to witness the highest growth rate during the forecast period owing to the high demand from China.

Hybrid Composites Market Trends

Carbon/Glass to Dominate the Market

- The most commonly used hybrid composites are glass fiber-reinforced polymer (GFRP) and carbon fiber-reinforced polymer (CFRP) composites, followed by composites reinforced by aramid or natural fibers.

- Hybrid carbon fiber/glass fiber material is a lightweight and high-strength alternative for traditional fiberglass and metal applications in the automotive & transportation, building & construction, and other industrial markets.

- The hybrid material offers the performance benefits of carbon fiber at a cost similar to high-performance fiberglass.

- Increased application of hybrid composites in automation and fast-paced manufacturing processes meet mass production requirements in automotive and other sectors.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.205 million vehicles in 2021, thereby indicating an increased demand for metal hoses from the automotive industry. In 2022, around 60 million passenger cars were manufactured worldwide, up nearly 7.35% compared to 2021.

- Users can get up to 90% of carbon's benefits at a cost much lower than what they would have to incur in case of using carbon fiber.

- Parts made out of these hybrid composites provide a high strength-to-weight ratio and are devoid of corrosion. These have extended service life, requiring less maintenance. Their particular properties meet the needs of applications that lay utmost importance on safety and strength.

- In building and construction, many composite products and applications are gaining more and more traction thanks to their unique properties (e.g., corrosion resistance, insulation, lightweight). From composite rebars for reinforcing concrete to pultruded profiles for window frames and composite roofing tiles, composite products not only enable more sustainable designs but also provide an effective solution to repair, upgrade, or strengthen existing buildings, bridges, etc.

- As per JEC Composites, interest in recycling and reusing materials is high, and key players in the composites industry are involved in many initiatives. The application sectors are also setting ambitious goals in this area, e.g., Europe's wind industry is committing to reusing, recycling, or recovering 100% of turbine blades by 2025.

- Owing to the factors mentioned above, carbon/glass fiber type is likely to dominate the market during the forecast period.

Asia-Pacific to Witness the Highest Growth Rate

- The infrastructure industry in Asia-Pacific has been growing at a healthy rate in recent times. Hence, it is estimated that the region will witness a tremendous growth rate in the cement board market over the assessment period.

- The Asia-Pacific region is currently experiencing high investments in residential and commercial construction, especially in China, Japan, Taiwan, and South Korea, and in developing economies such as India, Malaysia, Indonesia, and Vietnam.

- According to JEC Composites, In the future, long-term trends should resume, with economic growth driven by emerging Asia: China's growth is expected to exceed 5% CAGR per annum, higher than Europe and the US; India, Philippines, Indonesia, and Malaysia should grow at a comparable rate. In the mid-term (2021-2026), the composites market should resume growth in all regions, and there is still substantial potential for long-term growth, especially in Asia (energy, E&E, ...).

- In automotive, these unique materials, combining the strengths of various fibers and resins, offer a winning combination of lightweight, enhanced performance, and improved fuel efficiency, leading to increased consumption of hybrid composites in the Asia-Pacific market.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slight growth in 2022, wherein production and sales increased. A similar trend continued in 2021, with production witnessing a 3% incline in 2022. According to the China Association of Automobile Manufacturers (CAAM), automotive production is expected to grow in the future, with companies like BYD, SAIC Motors, and more increasing their automotive production sales in the fuel-run and electric vehicles segment.

- According to the China Association of Automobile Manufacturers, Chinese automakers are anticipated to report sales of approximately 9.4 million electric vehicles and hybrids in the previous year, up from 6.9 million in 2022. The association further projects a continued increase in sales for 2024, reaching 11.5 million units.

- For Example, China's automotive giant BYD sold over 3 million battery-powered cars in 2023, of which both batteries and gasoline power 1.6 million fully electric vehicles and another 1.4 million hybrids. Together, that is a 62 percent increase over 2022. BYD is also making money, tripling its profit to USD 1.5 billion in the first half of last year, according to BYD.

- According to India Today, 4,108,000 cars were sold in the domestic market in 2023. This was the first time during a calendar year that over 4 million units were sold in the country. In 2022, the industry witnessed sales of 3,792,000 units. In India, major automotive manufacturers, like Maruti, Hyundai, Tata, Honda, and Mahindra, have shut down their production owing to the unsold stock. This is expected to have a substantial negative impact on India's automotive production in the near future.

- China has one of the largest healthcare sectors in the world. Under the 13th Five-Year Plan, the Government of China prioritized health and innovation, which is expected to increase investments in the medical device manufacturing sector during the forecast period. Additionally, due to the COVID-19 outbreak, investment in the healthcare sector has been gradually growing in the country.

- Hybrid composites can achieve exceptional strength-to-weight ratios, exceeding even steel in some cases. This makes them ideal for load-bearing structures, bridges, and earthquake-resistant buildings.

- China's growth is also fueled by rapid expansion in the residential and commercial building sectors and the country's expanding economy. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. As a result, increased building activity in nations like China is projected to fuel the region's adhesive industry. All such factors tend to increase the demand for adhesives across the region.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- As per Invest India, the construction industry in India is expected to reach USD 1.4 Trillion by 2025, and the construction industry in India works across 250 sub-sectors with linkages across sectors and over 54 global innovative construction technologies identified under a Technology Sub-Mission of PMAY-U to start a new era in Indian Construction Sectors.

- Furthermore, South Korean builders' overseas building orders have surpassed 30 billion US dollars for the third consecutive year in 2022, owing to strong demand from Asia, North America, and the Pacific Ocean regions.

- All of these factors will be supported by the ever-increasing population in the region, urbanization, ion, and their increasing purchasing power. Regulations related to VOC emissions are currently being implemented in many regions of Asia-Pacific, and this might also drive the usage of cement boards such as fiber cement board (FCB) and cement bonded particleboard (CBPB).

- Hence, owing to the factors mentioned above, Asia-Pacific is likely to witness the highest growth during the forecast period.

Hybrid Composites Industry Overview

The hybrid composites market is moderately fragmented in nature. The major players (not in any order) include LANXESS, DSM, Avient Corporation, Hexcel Corporation, and SGL Carbon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Composite Material in Light Vehicle Segment

- 4.1.2 Specific Hybrids offer Multi-threat Protection

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Processing and Manufacturing Costs

- 4.2.2 Concerns about Sustainability and Environmental Impact

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Fiber Type

- 5.1.1 Carbon/Glass

- 5.1.2 Carbon/Aramid

- 5.1.3 HMPP/Carbon

- 5.1.4 Wood/Plastic

- 5.1.5 Other Fiber Types (Natural Fibers, Basalt Fibers, etc.)

- 5.2 Resin Type

- 5.2.1 Thermoset Resins

- 5.2.2 Thermoplastic Resins

- 5.2.3 Other Resin Types (PEEK(Polyether Ether Ketone), etc.)

- 5.3 End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction and Infrastructure

- 5.3.3 Aerospace and Defense

- 5.3.4 Marine

- 5.3.5 Other End-user Industries (Sporting Goods, Medical, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 DSM

- 6.4.3 Gurit Services AG

- 6.4.4 Hexcel Corporation

- 6.4.5 Huntsman International LLC

- 6.4.6 KINECO - KAMAN

- 6.4.7 LANXESS

- 6.4.8 Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- 6.4.9 RTP Company

- 6.4.10 Owens Corning

- 6.4.11 SABIC

- 6.4.12 SGL Carbon

- 6.4.13 Simcas Composites

- 6.4.14 Solvay

- 6.4.15 TEIJIN LIMITED

- 6.4.16 Textum OPCO, LLC

- 6.4.17 Toray Advanced Composites

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption of Hybrid Composites into Various Markets

- 7.2 Exploring Automation, Digitalization, and Additive Manufacturing Techniques for Composite Production