|

市場調查報告書

商品編碼

1641943

紫外線固化黏合劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)UV-Curable Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

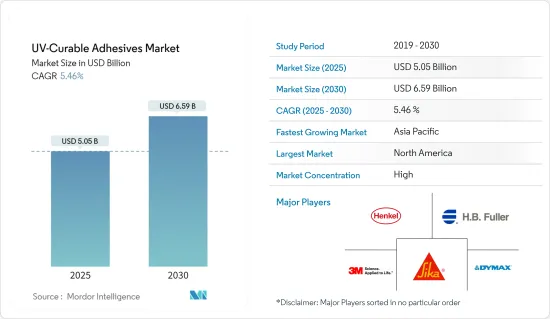

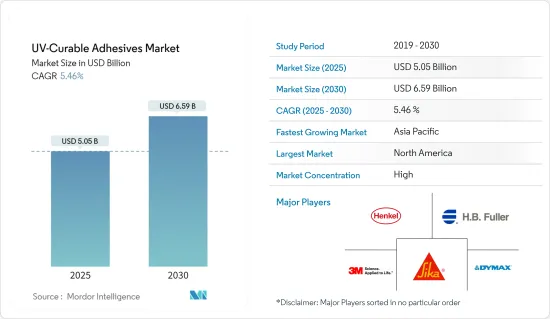

預計 2025 年紫外線固化黏合劑市場規模為 50.5 億美元,到 2030 年將達到 65.9 億美元,預測期內(2025-2030 年)的複合年成長率為 5.46%。

2020 年,新冠疫情導致全國範圍的封鎖、製造活動和供應鏈的中斷以及全球範圍內的生產停頓,對市場產生了負面影響。然而,2021年情況開始好轉,市場也因此恢復了成長軌跡。

主要亮點

- 推動市場發展的首要因素是汽車和航太應用對紫外線膠黏劑的需求不斷增加,以及環境法規對紫外線膠合劑的需求不斷增加。

- 然而,紫外線固化黏合劑的高製造成本和替代黏合劑的可用性預計會阻礙市場的成長。

- 包裝行業的需求不斷成長和紫外線固化黏合劑技術的改進預計將為市場研究帶來機會。

- 北美佔據全球市場主導地位,其中美國的消費量最高。

紫外線固化膠黏劑的市場趨勢

市場區隔強勁成長

- 紫外線固化黏合劑以其耐用性、生物相容性、潤滑性以及抗化學性和耐刮擦性而聞名,這使其對於滿足各種醫療應用的標籤標準至關重要。其中包括藥品、藥物貼片、水凝膠、過濾器、試紙以及血袋和醫療用電子設備等一次性物品。

- 紫外線固化黏合劑由於其獨特的性能,在醫療產業中佔有一席之地。紫外線固化黏合劑在組裝醫療設備時非常有用,特別是在黏合導管組件時,可以提供牢固、無洩漏的密封。

- 中國是世界上最大且成長最快的醫療保健市場之一。 2023年,國家藥品監督管理局(NMPA)將總合批准第三類(國內外)和第二類(國外)醫療設備和體外診斷器材的新註冊、延續註冊和許可事項變更13,260件。已被接受。與2022年相比,申請數量增加了25.4%。全國藥品註冊申請13260件,其中國家藥監局總合核准12213件,比前一年核准278件。

- 近年來,印度醫療保健和醫療設備產業經歷了顯著的成長。印度生產植入式醫療設備醫療設備設備等各種各樣的醫療設備。印度製造的大多數醫療設備都是導管、灌溉套件、延長線、插管、餵食管、針頭和注射器等消耗品,以及心臟支架、藥物釋放型支架、人工水晶體和整形外科植入。植入。

- 據MedTech Europe稱,預計2024年歐洲醫療技術市場規模將達到約1,600億歐元(1,772.5億美元)。主要市場包括德國、法國、英國、義大利和西班牙。以製造商價格計算,歐洲醫療設備市場佔全球市場的26.1%,是僅次於美國的47.2%的第二大股東。過去十年,歐洲醫療設備市場年均成長率為5.4%。 2024年,歐洲醫療設備貿易順差將達到110億歐元。與往年一樣,歐洲醫療設備的主要貿易夥伴是美國、中國、日本和墨西哥。

- 所有上述因素都顯示未來幾年市場需求成長前景樂觀。

北美佔據市場主導地位

- 預計北美國家將主導紫外線固化黏合劑市場。最近,美國和加拿大對半導體生產的投資增加,推動了該地區對紫外線固化膠合劑的需求。

- 2024年8月,美國商務部宣布將向德克薩斯投資16億美元,以提高其半導體產量。一旦全面運作,德克薩斯謝爾曼工廠每天將生產超過 1 億個晶片。

- 2024 年 7 月,加拿大創新、科學與經濟發展部 (ISED) 宣布向 FABrIC(網際網路邊緣整合組件製造)網路投資 1.2 億美元。該五年計畫總額超過 2.2 億美元,將加強加拿大半導體的製造和商業化。

- 近年來,醫療產業也成為該地區紫外線固化黏合劑的主要消費者。紫外線固化黏合劑廣泛應用於醫療領域,包括醫療設備中的注射器和電子元件的組裝。

- 北美擁有全球最大的醫療設備產業,以美國為首。最近,全國各地對新的醫療保健製造設施進行了大量投資。

- 2023年11月,美國製藥公司禮來公司同意投資約25億美元在德國建造新的製藥製造工廠,生產注射和醫療設備,包括治療糖尿病和肥胖症的藥物。該運作。

- 這些發展預計將促進製藥和醫療設備製造領域對紫外線固化黏合劑的需求。

- 預計所有這些因素將在預測期內推動北美對紫外線固化黏合劑市場的需求。

紫外光固化膠黏劑產業概況

紫外線固化黏合劑市場分散,市場參與企業多種多樣,既有大型企業,也有小型區域企業。主要市場參與者(不分先後順序)包括漢高股份公司、HB Fuller 公司、3M 公司、西卡股份公司、Dymax 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 紫外線固化黏合劑在汽車和航太工業中越來越受歡迎

- 由於有利的環境法規而更加受歡迎

- 其他促進因素

- 限制因素

- 生產紫外線固化黏合劑的高成本

- 替代產品的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 矽膠

- 丙烯酸纖維

- 聚氨酯

- 環氧樹脂

- 其他樹脂類型

- 按最終用戶產業

- 醫療

- 電氣和電子

- 運輸

- 包裝

- 家具

- 其他最終用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- Delo

- Dymax

- HB Fuller Company

- Henkel AG & Co. KGaA

- Master Bond Inc.

- Panacol-elosol Gmbh

- Parson Adhesives Inc.

- Permabond LLC

- Sika AG

第7章 市場機會與未來趨勢

- 蓬勃發展的包裝產業對紫外線固化黏合劑的需求不斷增加

- 與尖端科技融合

The UV-Curable Adhesives Market size is estimated at USD 5.05 billion in 2025, and is expected to reach USD 6.59 billion by 2030, at a CAGR of 5.46% during the forecast period (2025-2030).

Due to the COVID-19 pandemic, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, conditions started recovering in 2021, thereby restoring the growth trajectory of the market.

Key Highlights

- The major factors driving the market studied are the rising demand for UV adhesives in automotive and aerospace applications and the increasing demand for these adhesives due to favorable environmental regulations.

- On the flip side, the high cost of producing UV-curable adhesives and the availability of alternative adhesives are expected to hinder the market's growth.

- An increase in demand from the packaging industry and a rise in the technologies for UV-curable adhesives are expected to act as opportunities for the market studied.

- North America dominated the global market, with the highest consumption registered in the United States.

UV-Curable Adhesives Market Trends

Medical Segment to Witness Strong Market Growth

- UV-curable adhesives, celebrated for their durability, biocompatibility, lubricity, and resistance to chemicals and scratches, are pivotal in meeting labeling standards for various medical applications. These include medicines, medication patches, hydrogels, filters, test strips, and disposable items like blood bags and medical electronics.

- Owing to their distinct properties, UV-curable adhesives are carving a niche in the medical industry. They are instrumental in medical device assembly, notably bonding catheter components for robust, leak-proof seals.

- China is one of the world's largest and fastest-growing healthcare markets. In 2023, the National Medical Products Administration (NMPA) received a total of 13,260 applications for initial registrations, registration renewals, and changes in licensing items of Class III (Domestic and Overseas) and Class II (Overseas) medical devices and IVDs. The number of applications represented a 25.4% increase when compared to 2022. Of the 13,260 applications, the NMPA approved a total of 12,213 applications, and an additional 278 products were approved in comparison with the previous year.

- The healthcare and medical device industries in India have experienced significant growth in recent years. A wide range of medical devices, from consumables to implantable medical devices, are manufactured in India. Most medical devices produced in India are disposables like catheters, perfusion sets, extension lines, cannulas, feeding tubes, needles, syringes, and implants like cardiac stents, drug-eluting stents, intraocular lenses, and orthopedic implants.

- As per MedTech Europe, the European medical technologies market has been projected to reach approximately EUR 160 billion (USD 177.25 billion) in 2024. The leading markets include Germany, France, the United Kingdom, Italy, and Spain. Valued at manufacturer prices, the European medical devices market constitutes 26.1% of the global market, making it the second-largest shareholder after the United States, which accounts for a 47.2% share. Over the past decade, the European medical devices market registered an average annual growth of 5.4%. In 2024, Europe boasts a positive trade balance in medical devices, standing at EUR 11 billion. Consistent with previous years, Europe's primary trade partners for medical devices have been the United States, China, Japan, and Mexico.

- All the abovementioned factors indicate a positive outlook for growth in market demand over the coming years.

North America to Dominate the Market

- North American countries are expected to dominate the UV-curable adhesives market. In recent times, there have been growing investments in semiconductor production in the United States and Canada, which has propelled demand for UV-curable adhesives in the region.

- In August 2024, the US Department of Commerce announced a USD 1.6 billion investment to enhance semiconductor production at Texas Instruments. Once fully operational, TI's Sherman facilities are projected to churn out over 100 million chips daily.

- In July 2024, Innovation, Science and Economic Development Canada (ISED) unveiled a USD 120 million investment into the FABrIC (Fabrication of Integrated Components for the Internet's Edge) network. This five-year initiative, with a total commitment exceeding USD 220 million, is set to strengthen Canada's semiconductor manufacturing and commercialization landscape.

- The medical industry has been another major consumer of UV-curable adhesives in the region in recent times. UV-curable adhesives are used in a wide range of medical applications, including syringe assembly and electronic components in medical devices.

- North America boasts the largest medical devices industry globally, spearheaded by the United States. In recent times, significant investments have been made in new healthcare manufacturing facilities across the country.

- In November 2023, Eli Lilly, a US pharmaceutical company, invested around USD 2.5 billion to build a new pharmaceutical manufacturing facility in Germany for producing injectable pharmaceutical products and medical devices, including those for diabetes and obesity. The construction began in 2024, and the facility is expected to be operational by 2027.

- Such developments are expected to boost the demand for UV-curable adhesives in pharmaceutical products and medical device manufacturing.

- All such factors are expected to boost the demand in the North American UV-curable adhesives market during the forecast period.

UV-Curable Adhesives Industry Overview

The UV-curable adhesives market is fragmented and features diverse participants, ranging from major corporations to smaller regional entities. The major market players (not in any particular order) include Henkel AG & Co. KGaA, H.B. Fuller Company, 3M Company, Sika AG, and Dymax.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 UV-curable Adhesives Gaining Traction in the Automotive and Aerospace Sectors

- 4.1.2 Growing Popularity Due to Favorable Environmental Regulations

- 4.1.3 Others Drivers

- 4.2 Restraints

- 4.2.1 High Costs Associated With the Production of UV-curable Adhesives

- 4.2.2 Availability of Substitutes

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Silicone

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Other Resin Types

- 5.2 End-user Industry

- 5.2.1 Medical

- 5.2.2 Electrical and Electronics

- 5.2.3 Transportation

- 5.2.4 Packaging

- 5.2.5 Furniture

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Delo

- 6.4.3 Dymax

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Master Bond Inc.

- 6.4.7 Panacol-elosol Gmbh

- 6.4.8 Parson Adhesives Inc.

- 6.4.9 Permabond LLC

- 6.4.10 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for UV-curable Adhesives in the Booming Packaging Industry

- 7.2 Integration With Advanced Technologies