|

市場調查報告書

商品編碼

1641945

地板塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Floor Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

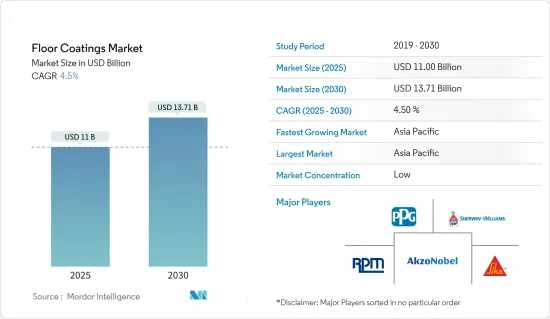

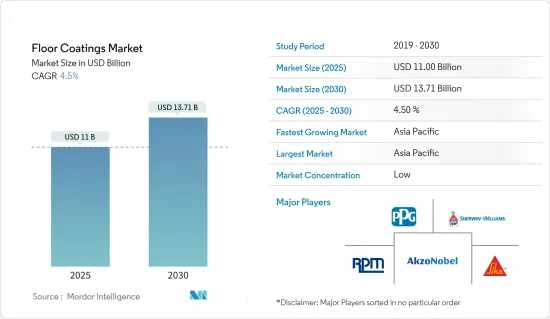

地板塗料市場規模預計在 2025 年為 110 億美元,預計到 2030 年將達到 137.1 億美元,預測期內(2025-2030 年)的複合年成長率為 4.5%。

受新冠疫情影響,地板塗料市場遭遇挫折。全球封鎖和嚴格的政府監管導致大面積製造工廠關閉。不過,預計市場將在 2021 年復甦,並在未來幾年內實現顯著成長。

關鍵亮點

- 短期內,人們對地板塗料益處的認知不斷提高和全球建設活動的活性化是推動所調查市場需求的關鍵因素。

- 然而,有關地板塗料排放的VOC的嚴格規定以及混凝土拋光相對於地板塗料的優勢預計會阻礙市場的成長。

- 環保和生物基地板塗料的日益普及以及聚天冬胺酸基塗料的良好性能有望為所研究的市場創造新的機會。

- 預計亞太地區將主導全球整體市場,其中中國和印度的需求將佔據大部分市場。

地板塗料市場趨勢

工業領域佔市場主導地位

- 工業領域引領地板塗料市場。化學、汽車、製造、食品飲料、電子等關鍵產業是地板塗料的主要消費者。

- 地坪塗料在工業建設中發揮著至關重要的作用。地板塗料可保護底層地板免受污漬、溢出、潮濕和紫外線的損害,確保材料的安全並為員工提供安全的環境。

- 當今,化學工業已成為至關重要的產業,化學品對於幾乎所有製造的產品都至關重要。這凸顯了化學工業的全球重要性。鑑於其重要性,高性能地板對於實驗室、生產工廠和其他設施至關重要。

- 在化學工業中,耐化學腐蝕且符合嚴格衛生和安全通訊協定的地板材料至關重要。這些措施有助於減少損害、事故和工人的健康風險,凸顯了地板塗料的重要性。

- 印度的工業基礎設施正在快速成長,這得益於政府吸引外國直接投資(FDI)和促進國家發展的舉措。

- 由董事長穆克什·安巴尼領導的信實工業(RIL)計劃在印度建立四家超級工廠。迪魯拜·安巴尼綠色能源巨型綜合體位於古吉拉特邦賈姆訥格爾,佔地 5,000 英畝,將匯集新能源生態系統的關鍵組成部分。 RIL 計劃在未來三年內投資超過 6,000 億印度盧比(約 73.1 億美元),該項目預計於 2030 年完工。

- 隨著工業建設的擴大和新興市場投資的激增,未來幾年對地板塗料的需求預計會增加。

- 根據美國人口普查局的資料,2023年美國製造業建設支出以電腦、電子和電氣產業為主。化工產業建設計劃投資3,400萬美元,食品、飲料、菸草業建設工程投資1,600萬美元。

- 2023年3月,新墨西哥州立法機構核准在新墨西哥州東南部建造核廢棄物倉儲設施。該設施由 Holtec International 建造和營運,旨在儲存從全國各地商業發電廠通過鐵路運輸的核廢棄物。

- 義大利也正在進行大規模的工業建設。 2024 年 3 月,新加坡 Silicon Box 表示將投資 32 億歐元(35 億美元)建造專門從事人工智慧、電動車和高效能運算的晶片代工廠。

- 此外,斯洛維尼亞放射性廢棄物機構(ARAO)計劃投資9,400萬歐元(1.02億美元),在克爾斯科核能發電廠附近建立放射性廢棄物處置,併計劃進行檢查工作至2026年。

- 鑑於這些發展,工業應用很可能在未來幾年佔據市場主導地位。

亞太地區佔市場主導地位

- 預計亞太地區將主導地板塗料市場,並在預測期內見證最快的成長。這一勢頭主要得益於各領域不斷成長的需求,尤其是住宅、商業和工業建築。中國、印度、韓國、日本和許多東南亞國家處於這一快速成長的前沿。

- 在住宅建築領域,地板塗料起著雙重作用,既能增強住宅的美觀度,又能確保耐用性和最低限度的維護。地板塗料通常用於車庫、露台、人行道、地下室等,可根據您的特定需求進行客製化,例如防滑或耐化學性。隨著該地區住宅的擴大,對塗料的需求也隨之增加。

- 中國正大力推動都市化,目標是到2030年實現都市化率達70%。都市化推動了對更多生活空間的需求,反映了中階對更好生活條件的渴望。這些動態預計將促進住宅市場和住宅,並對地板塗料市場產生積極影響。

- 在中國香港,住宅管理部門已推出多項舉措,啟動經濟適用住宅建設。當局已設定目標,在 2030 年提供 301,000 套公共住宅。

- 中國政府雄心勃勃的建設計畫計劃在 2025 年將 2.5 億農村居民遷移到新興大城市,這將推動地板塗料市場的發展。

- 為應對尚未從疫情相關挑戰中復甦的困境,中國各省市正尋求在 2024 年將大型建築計劃的預算增加近 20%。中國超過三分之二的地區正在實施交通基礎設施和工業園區等重大計劃,2024年總預算將超過12.2兆元(1.8兆美元)。

- 在商業建築中,地板塗料對於企業的安全和效率至關重要。地板塗料可以減少滑倒,從而減少工作場所受傷的主要原因之一。此外,它還可以根據嚴格的消防安全標準進行調整,有助於在緊急情況下減緩火勢蔓延。隨著該地區商業建築的增加,對被覆劑的需求也隨之增加。

- 中國可支配收入的增加正推動對購物中心和酒店等豪華商業設施的需求。中國是購物中心發展的先驅,現有購物中心近 4,000 個,預計到 2025 年將新增 7,000 個。此外,武漢佛山東外灘中心T1等計劃也將進一步鞏固市場地位,計畫於2021年第三季破土動工,2025年第四季完工。

- 到 2024 年,印度的經濟適用住宅預計將成長 70%。根據投資印度 (Invest India) 的數據,到 2025 年,建築業的估值預計將達到 1.4 兆美元。預計到2030年,城鎮居住者將佔總人口的30%以上,急需住宅多萬套中階及經濟適用住宅。 《房地產法》、《商品及服務稅》(GST)和《房地產投資信託》(REIT)等旨在加快核准速度和加強建築業的改革正在推動市場成長。

- 在工業建築中,地板塗層承受的壓力遠大於典型的住宅或辦公室的壓力。它旨在處理重型機械和人流,確保基材保持完好。耐用且易於維護的塗層可減少停機時間來提高生產效率。隨著該地區工業建設的擴大,對塗料的需求也隨之增加。

- 韓國正在進行大規模工業建設工程。一個顯著的例子是 S-Oil 公司正在蔚山建設的雄心勃勃的沙欣煉油綜合石化廠,預計於 2026 年竣工。該設施將擁有世界上最大的石腦油蒸汽裂解裝置,每年可生產 180 萬噸乙烯。

- 由於這些趨勢,預計預測期內亞太地區對地板塗料的需求將大幅成長。

地板塗料行業概況

地板塗料市場高度分散。主要參與企業(不分先後順序)包括 Sika AG、Akzo Nobel NV、PPG Industries, Inc.、RPM International Inc. 和 The Sherwin-Williams Company。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 提高對地板塗料益處的認知

- 全球建設活動活性化

- 其他促進因素

- 限制因素

- 地板塗料VOC法規趨嚴

- 混凝土拋光相對於地板塗層的優勢

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 產品類型

- 環氧樹脂

- 聚縮醛

- 丙烯酸纖維

- 聚氨酯

- 其他

- 地板材料

- 木頭

- 混凝土的

- 其他地板材料

- 最終用戶產業

- 住宅

- 商業的

- 工業的

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- ArmorPoxy

- Asian Paints

- BASF SE

- Epoxy-Coat

- Henkel AG & Co. KGaA

- JOTUN

- Kansai Nerolac Paints Limited

- LATICRETE International, Inc.

- MAPEI SpA

- PPG Industries Inc.

- Saint-Gobain(Maris Polymers)

- Sika AG

- Sto Ltd

- Teknos Group

- The Sherwin-Williams Company

- Tikkurila

第7章 市場機會與未來趨勢

- 環保、生物基地板塗料越來越受歡迎

- 聚天門冬胺酸塗料性能優異

- 其他機會

The Floor Coatings Market size is estimated at USD 11.00 billion in 2025, and is expected to reach USD 13.71 billion by 2030, at a CAGR of 4.5% during the forecast period (2025-2030).

The floor coatings market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, growing awareness about the advantages of floor coatings and increasing construction activities across the globe are the major factors driving the demand for the market studied.

- However, strict regulations on VOCs released from floor coatings and the benefits of concrete polishing over floor coatings are expected to hinder the market's growth.

- Nevertheless, the increasing popularity of eco-friendly bio-based floor coatings and the promising performance of polyaspartic coatings are expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Floor Coatings Market Trends

Industrial Segment to Dominate the Market

- The industrial segment leads the floor coatings market. Key sectors, including chemicals, automotive, and manufacturing, along with industries like food and beverages and electronics, are primary consumers of floor coatings.

- In industrial construction, floor coatings play a vital role. They shield the underlying floor from stains, spills, moisture, and UV damage, safeguarding both the material and ensuring a safe environment for employees.

- The chemical sector stands out as a pivotal industry today, with chemicals being integral to nearly every manufactured product. This underscores the global significance of the chemical industry. Given its importance, high-performance flooring is paramount for research labs, production plants, and other facilities.

- In the chemical industry, flooring with chemical resistance and stringent hygiene and safety protocols is crucial. These measures help mitigate damage, accidents, and worker health risks, highlighting the significance of floor coatings.

- India's industrial infrastructure is witnessing rapid growth, bolstered by government initiatives aimed at attracting foreign direct investment (FDI) in construction, expediting national development.

- Reliance Industries Limited (RIL), under Chairman Mukesh Ambani, is set to establish four giga factories in India. Spread over 5,000 acres in Jamnagar, Gujarat, the Dhirubhai Ambani Green Energy Giga Complex will integrate critical components of the new energy ecosystem. With a completion target of 2030, RIL plans to invest over INR 6,00,000 million (~ USD 7,310 million) in the next three years.

- As industrial construction grows and investments surge in emerging markets, the demand for floor coatings is poised to rise in the coming years.

- According to data from the US Census Bureau, in 2023, the computer, electronic, and electrical industry led the way in manufacturing construction spending in the United States. Construction projects for the chemical industry reached a value of USD 34 million, while the food, beverage, and tobacco industry saw spending of USD 16 million.

- In March 2023, New Mexico's legislature greenlit a nuclear waste storage facility in Southeast New Mexico. Holtec International will construct and operate the site, designed to house nuclear waste transported by rail from commercial power plants nationwide.

- Italy is also witnessing significant industrial construction. In March 2024, Singapore's Silicon Box announced a EUR 3.2 billion (USD 3.5 billion) investment for a chip manufacturing plant, focusing on AI (Artificial intelligence), electric vehicles, and high-performance computing.

- Additionally, Slovenia's Agency for Radioactive Waste (ARAO) plans a EUR 94 million (USD 102 million) investment in a radioactive waste disposal site near the Krsko nuclear plant, aiming for trial operations by 2026.

- Given these developments, the industrial application segment is set to dominate the market in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is set to dominate the floor coatings market, showcasing the swiftest growth during the forecast period. This momentum is primarily fueled by escalating demands in various sectors, notably residential, commercial, and industrial construction. Countries like China, India, South Korea, Japan, and numerous Southeast Asian nations are at the forefront of this surge.

- In the realm of residential construction, floor coatings play a dual role: they elevate the aesthetic charm of homes while ensuring durability and minimal maintenance. Commonly applied in garages, patios, walkways, and basements, these coatings can be tailored for specific needs, such as slip or chemical resistance. As residential construction in the region expands, so does the demand for these coatings.

- China is actively pursuing urbanization, aiming for a 70% urban rate by 2030. This urbanization drives a demand for more living spaces and reflects the middle class's aspirations for better living conditions. Such dynamics are set to boost the housing market and residential construction, positively influencing the floor coatings market.

- In Hong Kong, China, housing authorities have initiated multiple measures to kickstart the construction of affordable housing. Officials have set a target to deliver 301,000 public housing units by 2030.

- The Chinese government's ambitious construction initiatives, which plan to relocate 250 million rural residents to new megacities by 2025, are set to boost the floor coatings market.

- In response to a struggling economy, still reeling from pandemic-related challenges, Chinese governors are ramping up budgets for major building projects by nearly 20% in 2024. Over two-thirds of China's regions have committed to significant projects, including transportation infrastructure and industrial zones, with a combined budget exceeding CNY 12.2 trillion (USD 1.8 trillion) for 2024.

- In commercial construction, floor coatings are crucial for business safety and efficiency. They offer slip resistance, mitigating one of the leading causes of workplace injuries. Furthermore, they can be tailored to meet stringent fire code standards, slowing flame spread during emergencies. As commercial construction grows in the region, so does the demand for these coatings.

- Rising disposable incomes in China are fueling the demand for upscale commercial spaces, including malls and hotels. China stands at the forefront of shopping center development, boasting nearly 4,000 existing centers and an estimated 7,000 more by 2025. Additionally, projects like the Wuhan Fosun Bund Center T1, with construction starting in Q3 2021 and completion slated for Q4 2025, further bolster the market.

- In 2024, India is set to witness a 70% surge in the availability of affordable housing. According to Invest India, the construction sector is projected to attain a valuation of USD 1.4 trillion by 2025. With forecasts suggesting that over 30% of the population will be urban dwellers by 2030, there's a pressing need for 25 million more mid-end and affordable housing units. Recent reforms, such as the Real Estate Act, GST (Goods and Services Tax) and REITs (Real Estate Investment Trusts), aim to expedite approvals and strengthen the construction industry, driving market growth.

- In industrial construction, floor coatings endure stresses far exceeding those in typical homes or offices. Designed to handle heavy machinery and foot traffic, they ensure the underlying substrate remains intact. Offering durability and low maintenance, these coatings enhance productivity by reducing downtime. As industrial construction expands in the region, so does the demand for these coatings.

- South Korea is undertaking significant industrial construction ventures. A notable example is S-Oil Corp.'s ambitious Shaheen refinery-integrated petrochemical plant in Ulsan, set to finish by 2026. This facility will house the world's largest naphtha-fed steam cracker, capable of producing 1.8 million mt/year of ethylene, underscoring the project's potential to elevate industrial demand and support market growth.

- Given these dynamics, the demand for floor coatings in the Asia-Pacific region is poised for a significant uptick during the forecast period.

Floor Coatings Industry Overview

The floor coatings market is highly fragmented in nature. The major players (not in any particular order) include Sika AG, Akzo Nobel N.V., PPG Industries, Inc., RPM International Inc., and The Sherwin-Williams Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Awareness about the Advantages of Floor Coatings

- 4.1.2 Increasing Construction Activities across the Globe

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Regulations on VOCs Released for Floor Coatings

- 4.2.2 Benefits of Concrete Polishing over Floor Coatings

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Epoxy

- 5.1.2 Polyaspartics

- 5.1.3 Acrylic

- 5.1.4 Polyurethane

- 5.1.5 Other Product Types

- 5.2 Floor Material

- 5.2.1 Wood

- 5.2.2 Concrete

- 5.2.3 Other Floor Materials

- 5.3 End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 ArmorPoxy

- 6.4.3 Asian Paints

- 6.4.4 BASF SE

- 6.4.5 Epoxy-Coat

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 JOTUN

- 6.4.8 Kansai Nerolac Paints Limited

- 6.4.9 LATICRETE International, Inc.

- 6.4.10 MAPEI S.p.A

- 6.4.11 PPG Industries Inc.

- 6.4.12 Saint-Gobain (Maris Polymers)

- 6.4.13 Sika AG

- 6.4.14 Sto Ltd

- 6.4.15 Teknos Group

- 6.4.16 The Sherwin-Williams Company

- 6.4.17 Tikkurila

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity of Eco-friendly Bio-based Floor Coatings

- 7.2 Promising Performance of Polyaspartic Coatings

- 7.3 Other Opportunities