|

市場調查報告書

商品編碼

1641947

離心式幫浦:市場佔有率分析、行業趨勢和成長預測(2025-2030)Centrifugal Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

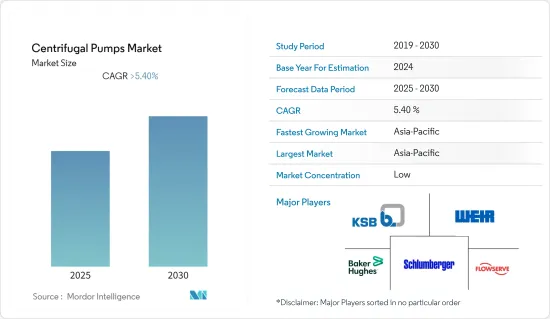

預測期內,離心式幫浦市場預計將以超過 5.4% 的複合年成長率成長。

COVID-19 導致供應鏈出現問題,損害了離心離心式幫浦市場,但市場在 2022 年有所復甦。

關鍵亮點

- 離心式幫浦的需求可能會受到北美、非洲和其他地區的海上深水油氣天然氣田探勘和生產增加的推動。

- 然而,由於探勘與生產公司採取的成本削減措施和計劃延遲,原油和天然氣價格的波動可能會影響離心式幫浦市場。

- 在預測期內,深海和超深海探勘的新技術預計將增加石油產量,為市場成長創造機會。

- 預計亞太地區將成為預測期內成長最快的地區。這是由於巨大的經濟成長帶動了該地區工業基礎設施的成長。

離心式幫浦的市場趨勢

石油和天然氣領域佔市場主導地位

- 離心式幫浦用於石油和天然氣領域,輸送石油和石油產品、液化氣和其他流體。預計預測期內石油和天然氣基礎設施建設的激增將為離心式幫浦市場提供巨大推動力。

- 根據《BP世界能源統計年鑑2022》預測,2021年全球天然氣產量將達到約4,3690億立方米(bcm),較2020年的3,861.5億立方米成長4.5%,較2015年下降約15%。幅度為1.4%。同樣,2021 年全球天然氣需求量將達到約 4,0375 億立方米,較 2019 年的 3,8456 億立方米成長 5%,較 2015 年成長約 16%。預計天然氣產量和消費量的增加將推動全球對離心式幫浦的需求。

- 2023年1月,Ebara Pumps推出了新款Inline 3E離心式幫浦。該泵浦具有鑄鐵外殼,配有 2 或 4 極馬達和整合式 E-SPD+ 變頻器。另外3E型為葉輪直接透過花鍵與馬達軸連接的緊聯結構,3ES型為葉輪透過剛性聯軸器透過花鍵與馬達連接的緊聯結構。

- 2023 年 2 月,CPC Pumps International 推出新款 BB5 泵,擴大產品範圍。 CPC離心式幫浦浦傳統上廣泛應用於精製和石化工業。 BB5 將用於碳捕獲、利用和儲存(CCUS)製程,這對於減少二氧化碳排放至關重要。

- 國際海事組織 (IMO) 2020 法規將於 2020 年 1 月生效,這將增加對低硫燃料的需求,迫使主要煉油廠升級其現有基礎設施以生產低硫燃料。隨著預期的煉油廠維修,未來幾年對離心式幫浦的需求可能會增加。

- 考慮到上述因素,預計預測期內石油和天然氣產業將佔據離心式幫浦市場的主導地位。

亞太地區佔市場主導地位

- 受商業友善政策的影響,亞太地區的工業基礎設施正在經歷成長。亞太地區大多數國家正處於發展階段,高人口成長率對水資源供應的需求日益增加。

- 2023年至2028年間,預計中國將在亞太地區的原油精製中佔據顯著成長。截至2021年,中國精製能力達1,690萬桶/日。

- 2011年至2021年該地區原油消費量成長了4.8%,約佔2021年全球消費量的16.41%。人口成長和工業化支撐著消費成長。近年來,用於運輸原油的離心式幫浦的需求大幅增加。

- 2022 年 1 月,喀拉拉邦水務局開始在阿魯瓦建造一座日處理能力為 1.42 億公升(MLD)的水處理廠。該水質淨化耗資 18 億印度盧比,預計將於 2024 年完工。因此,此類即將實施的水處理計劃可能會在預測期內增加對離心式幫浦的需求。

- 此外,根據聯合國大學水、環境與衛生實驗室的數據,2021 年,新加坡、阿拉伯聯合大公國、卡達和中國高所得國家處理了污水產生的約 74% 的工業和都市廢水。國家下降至43%,在中下收入國家下降至26% 左右。隨著環保意識的增強和水資源短缺的日益嚴重,亞太地區開發中國家對水處理廠的需求以及水處理廠離心式幫浦的需求預計將會增加。

- 因此,由於人口的成長和都市化的快速發展,對汽油、暖氣油、液化石油氣等石油產品的需求日益增加。因此,為了滿足現有的需求,需要建立新的煉油廠,預計這將在預測期內推動亞太離心式幫浦市場的發展。

離心式幫浦產業概況

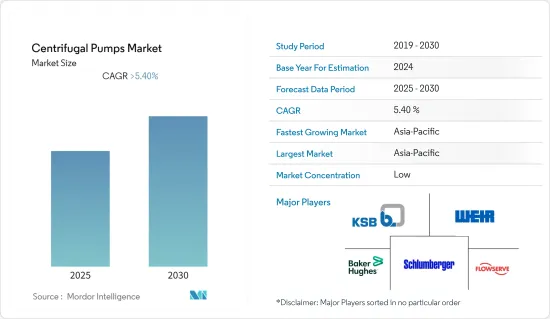

離心式幫浦市場是細分的。該市場的主要企業(不分先後順序)包括福斯公司、斯倫貝謝有限公司、貝克休斯公司、KSB SE &Co.KGaA 和威爾集團。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 階段

- 單級泵浦

- 多級泵浦

- 最終用戶

- 石油和天然氣

- 發電

- 其他

- 葉輪類型

- 開放式

- 部分開放式

- 封閉型

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Baker Hughes Company

- Dover Corporation

- Ebara Corporation

- Flowserve Corporation

- ITT Inc.

- KSB SE & Co. KGaA

- Ruhrpumpen Group

- Schlumberger Ltd.

- Sulzer Ltd

- Weir Group PLC

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 63508

The Centrifugal Pumps Market is expected to register a CAGR of greater than 5.4% during the forecast period.

COVID-19 caused problems in the supply chain, which hurt the market for centrifugal pumps.However, the market rebounded in 2022.

Key Highlights

- Demand for centrifugal pumps is likely to be driven by things like increased exploration and production in offshore deep-water oil and gas fields in places like North America and Africa.

- However, volatile crude oil and gas prices are likely to affect the centrifugal pump market due to cost-cutting and delayed projects by the E&P companies.

- During the forecast period, new technologies that make deep-water and ultra-deep-water explorations possible are expected to increase oil production and create opportunities for market growth.

- During the forecast period, Asia-Pacific is expected to be the biggest and fastest-growing region. This is because of the huge economic growth that has led to the growth of industrial infrastructure in the region.

Centrifugal Pumps Market Trends

Oil and Gas Segment to Dominate the Market

- Centrifugal pumps are used in the oil and gas sector to pump oil and petroleum products, liquefied gases, and other fluids during operations. The surge in oil and gas infrastructure development is expected to provide a huge thrust to the centrifugal pump market during the forecast period.

- According to the BP Statistical Review of World Energy 2022, the total global natural production reached around 4,036.9 billion cubic meters (bcm) in 2021, recording a 4.5% rise from the 3,861.5 bcm recorded in 2020 and around a 15% increase from 2015. Similarly, global natural gas demand stood at around 40,37.5 bcm in 2021, witnessing a 5% rise from 3845.6 bcm in 2019 and around a 16% rise from 2015. The increasing production and consumption of natural gas are expected to drive the global demand for centrifugal pumps.

- In January 2023, Ebara Pumps launched a new in-line 3E centrifugal pump model. The pumps are equipped with cast iron casing and are available with two or four-pole motors as well as an integrated E-SPD+ frequency converter. Additionally, the 3E model features close-coupled construction with the impeller directly splined to the motor shaft while the 3ES model offers a close-coupled construction connection of the pump with standard motor with the impeller splined to the motor by a rigid coupling.

- In February 2023, the CPC Pumps International extended its product range by launching its new BB5 pump. Applications for CPC centrifugal pumps are traditionally in the wider refining and petrochemical industries. The BB5 will be used in carbon capture, utilization and storage (CCUS) processes that are central to lowering CO2 emissions.

- With the IMO 2020 International (Maritime Organization) regulation implemented in January 2020, the increasing demand for low sulfur fuel was anticipated to force major refiners to upgrade the existing infrastructure in order to produce low sulfur fuels. With refineries expected to be revamped, the demand for centrifugal pumps is likely to increase over the next few years.

- Owing to the above points, the oil and gas segment is expected to dominate the centrifugal pumps market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region's industrial infrastructure is witnessing growth due to business-friendly policies. Most Asian-Pacific countries are in a growing phase, and the high population growth rate has led to an increased requirement for water supply.

- China is expected to account for the major growth in Asia-Pacific crude oil refining between 2023 and 2028. As of 2021, China's oil refinery capacity amounted to 16.9 million barrels per day.

- Crude oil consumption in the region grew at 4.8% between 2011-2021 and accounted for around 16.41% of global consumption in 2021. Increasing population and industrialization have supported the growth in consumption. Demand for centrifugal pumps, which are used to transport crude oil, has increased significantly in the past few years.

- In January 2022, Kerala Water Authority started the construction of a water treatment plant at Aluva with a treatment capacity of 142 million liters per day (MLD). The plant is likely to cost INR 180 crore and is expected to be completed by 2024. Thus, such upcoming water treatment projects are likely to increase demand for centrifugal pumps during the forecast period.

- Moreover, according to the United Nations University Institute of Water, Environment, and Health, in 2021, high-income countries such as Singapore, UAE, Qatar, and China treated about 74% of the industrial and municipal wastewater they generated, and this ratio dropped to 43% in upper-middle-income countries and about 26% in lower-middle-income countries. With increasing awareness about the environment and growing water shortage, the demand for water treatment plants, and in turn, centrifugal pumps in water treatment plants are expected to increase in the developing countries of Asia-Pacific.

- Hence, the demand for oil products such as gasoline, heating oil, and liquefied petroleum gas is increasing day-to-day with a growing population and rapid urbanization. Therefore, to meet the existing demand, there is a need to set up new refineries, which, in turn, is expected to drive the centrifugal pump market in the Asia-Pacific region during the forecast period.

Centrifugal Pumps Industry Overview

The centrifugal pump market is fragmented. Some key players in this market (not in particular order) are Flowserve Corporation, Schlumberger Ltd, Baker Hughes Company, KSB SE & Co. KGaA, and Weir Group PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Stage

- 5.1.1 Single-stage Pumps

- 5.1.2 Multi-stage Pumps

- 5.2 End-User

- 5.2.1 Oil and Gas

- 5.2.2 Power Generation

- 5.2.3 Other End-Users

- 5.3 Impeller Type

- 5.3.1 Open

- 5.3.2 Partially Open

- 5.3.3 Enclosed

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Company

- 6.3.2 Dover Corporation

- 6.3.3 Ebara Corporation

- 6.3.4 Flowserve Corporation

- 6.3.5 ITT Inc.

- 6.3.6 KSB SE & Co. KGaA

- 6.3.7 Ruhrpumpen Group

- 6.3.8 Schlumberger Ltd.

- 6.3.9 Sulzer Ltd

- 6.3.10 Weir Group PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219