|

市場調查報告書

商品編碼

1641970

纜線連接器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Cable Connector - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

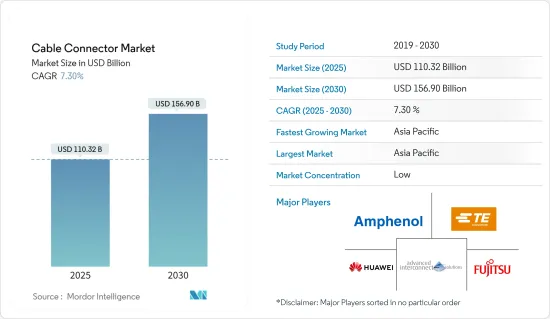

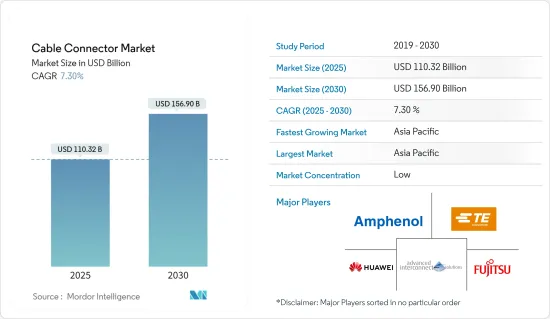

纜線連接器市場規模在 2025 年估計為 1103.2 億美元,預計到 2030 年將達到 1569 億美元,在市場估計和預測期(2025-2030 年)內以 7.3% 的複合年成長率成長。

新興經濟體對媒體和娛樂的需求不斷成長,以及網路普及率不斷提高,導致電視和網路用戶數量以及智慧型手機、PDA 和平板電腦用戶數量均有所增加。這些因素導致對纜線連接器適配器的需求龐大,沒有它們就無法實現有效的連網。

主要亮點

- 全球數位轉型正在推動纜線連接器市場的發展。可靠的連接、高效能和效率是推動市場成長的關鍵因素。高效能網路對於商業、製造、安全和媒體至關重要。此外,USB Type-C 和 HDMI 等電纜越來越受歡迎。

- 多年來固定寬頻連線數量的增加推動了所研究市場的成長。根據國際電信聯盟的數據,過去五年來全球固定寬頻連線數量大幅增加,而這些連接的安裝需要連接器,為研究的市場創造了成長機會。根據通訊預測,到2021年全球固定寬頻連線數量將成長到約13億。

- 纜線連接器在小型化應用中的使用正在迅速擴大。幾個主要市場正在推動市場成長,包括行動技術、航太和國防以及醫療技術。智慧型手機和其他手持裝置也需要更小、更薄的組件,包括能夠以超高速資料通訊的微連接器。例如10Gbps基板對基板連接器是標準配置,而一些先進的微型基板對基板連接器可以支援高達20Gbps。因此,消費性電子產品的成長對纜線連接器的需求有直接的影響。

- 此外,大多數資料和電源連接都使用射頻連接器和電纜,這一趨勢將繼續存在於高速資料、企業網路和工業IoT應用中。隨著歐洲和亞太地區工業物聯網 (IIoT) 的採用不斷增加,連接器公司正在轉向 USB、CAT 5/6/7、HDMI 和 DisplayPort 等新連接器。例如,2021年7月,伍爾特電子推出了超緊湊高頻同軸連接器WR-UMRF(超微型射頻同軸連接器)。

- 然而,複雜的故障識別和糾正程序、製造纜線連接器所用原料價格波動以及藍牙、無線 HDMI 發射器等無線連接技術的發展等挑戰正在挑戰所研究市場的成長。

- COVID-19 疫情爆發對研究市場的成長產生了顯著影響,因為它迫使中國和其他國家在初期宣布封鎖並實施社交疏離措施。這導致許多設備和機械的製造和生產停頓數週。此外,關鍵原料和工業設備的進出口也受到各種限制,導致供應鏈嚴重中斷。然而,隨著全球幾乎所有地區的限制措施都已取消,市場預計將恢復成長動能。

纜線連接器市場趨勢

汽車產業可望佔據主要市場佔有率

- 由於採用音訊控制、ADAS(高級駕駛輔助系統)、診斷系統、巡航控制和資訊娛樂系統等先進的電子系統,預計汽車產業對連接器的需求將會強勁。此外,電動車的日益普及預計將推動市場成長。該領域的主要市場趨勢包括技術創新和設計改進以滿足設備品質和可靠性標準、對多功能和小型化連接器的需求、RoHS 合規性的普及、UL 認證和IP 額定連接器以及EMI/其中包括具有RFI 抑制功能的智慧型連接器。

- 新的汽車技術改變了汽車的接線方式。關鍵電氣元件必須在認證條件下可靠地傳輸電力、訊號和資料。混合動力汽車和電動車已將堅固耐用連接器技術的應用範圍從賽車擴展到自動駕駛汽車形式的機器人。這導致了纜線連接器以及設計和材料的重大發展。

- 鑑於對能夠滿足現代車輛要求的連接器的需求不斷成長,纜線連接器供應商正致力於開發日益創新的產品。例如,Hirose Electric Co.Ltd於2021年12月開發了新型線對基板連接器GT50系列。此系列間距為1mm,耐熱溫度達125°C,是一款小型、堅固的產品,非常適合車載使用。

- 汽車產業的最新趨勢是電動車迅速取代傳統內燃機汽車,這也擴大了連接器的使用範圍,因為這些汽車配備了更多的感測器和電子元件。例如,根據國際能源總署的數據,全球使用的電動車數量將從 2016 年的 120 萬輛增加到 2021 年的 1,130 萬輛。

亞太地區可望創下最快成長

- 亞太地區通訊技術的不斷進步和其他終端用戶行業的成長是推動纜線連接器市場發展的關鍵因素之一。此外,IT和通訊對工業應用中自動化流程的支援正在簡化製造商的採用。

- 感測器組件、更快的網路、具有高可靠性和安全分層存取的靈活介面以及錯誤糾正選項有助於提高生產力、持續的品質交貨和最小化該地區的製造成本。此外,隨著物聯網成為開發、生產和物流鏈(稱為智慧工廠自動化)新技術方法的核心,該地區的電纜連接器採用率預計將大幅增加。

- 例如,GSMA 估計到 2025 年,全球整體將有 138 億個 IIoT 連線。大中華區預計將佔約 41 億個連線數,佔全球市場的三分之一。 2021 年 6 月,中國工業與資訊化部 (MIIT) 發布了《工業網際網路 2021 年工作計畫》,詳細列出了進一步擴大國家 5G 網路和工業物聯網 (IIoT) 的目標。此外,感測器和光纖電纜等電子元件的日益普及將推動對纜線連接器的需求,這些趨勢預計將創造進一步的成長機會。

- 此外,資料中心的激增和對更高頻寬的需求不斷成長,推動了對電纜和連接器的需求。中國非常注重在資料中心建置方面領先全球,大型企業都在尋求擴大資料中心規模,以確保資訊服務的穩定性和可靠性。例如5G、穿戴式裝置、物聯網、人工智慧的應用等,對算力的需求不斷激增。

- 此外,汽車產業的成長也有望成為亞太地區纜線連接器市場發展的關鍵因素。例如,根據中國工業協會(CAAM)的數據,預計 2021 年中國純電動車銷量約 290 萬輛。

纜線連接器產業概況

纜線連接器市場比較分散。相對較低的初始投資使新參與企業能夠快速進入市場。此外,多年來,收購一直是一個主要的市場趨勢,較大的參與者利用收購來減少競爭並進一步擴大其市場佔有率。主要參與者包括安費諾公司、富士通有限公司、泰科電子有限公司和華為技術有限公司。

- 2022 年 9 月-Amphenol RF 在其 AUTOMATE Type A MiniFAKRA 產品系列中加入了預配置電纜組件。根據該公司介紹,這些組件兩端均配備直四埠 miniFAKRA 插孔,專為低損耗 TFC302LL 設計。此外,這些連接器包含封閉式的入口電纜介面,該介面限制了配合部件的尺寸,以防止配合過程中的接觸損壞。

- 2022 年 7 月 - 領先的電子元件專業經銷商 TTI, Inc. 宣布,他們現已開始儲備 TE Connectivity 的工業 Mini-I/O 連接器。 Mini I/O 連接器系列具有出色的抗衝擊性、抗振動性、抗衝擊性和抗 EMI 性,體積小巧,在惡劣的工業應用中提供可靠的高性能。這項進展擴大了 TE Connectivity 的業務範圍,吸引了更多新客戶。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 電訊業不斷進步,對改善連結性的需求不斷成長

- 高頻寬的需求不斷增加

- 市場挑戰

- 原物料價格波動

第6章 市場細分

- 按類型

- PCB 連接器

- 圓形/方形連接器

- 光纖連接器

- 輸入輸出連接器

- 其他類型

- 按行業

- 資訊科技和電訊

- 汽車/運輸

- 消費性電子產品(包括電腦、周邊設備和商務設備)

- 工業的

- 其他最終用戶(海底、航太、能源/電力、醫療)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Amphenol Corporation

- Molex Inc.(Koch Industries)

- Fujitsu Limited

- Prysmian SpA

- Nexans SA

- TE Connectivity Limited

- 3M Company

- Huawei Technologies Co. Ltd

- Axon Cable SAS

- Alcatel-Lucent SA

- Aptiv PLC

- Yazaki Corporation

- Huber+Suhner AG

第8章投資分析

第9章:市場的未來

The Cable Connector Market size is estimated at USD 110.32 billion in 2025, and is expected to reach USD 156.90 billion by 2030, at a CAGR of 7.3% during the forecast period (2025-2030).

The growing demand for media and entertainment and the increasing penetration of the internet across emerging economies led to the increase in the number of television and internet subscribers and users of smartphones, PDAs, and tablets. These factors created an immense demand for cable connector adapters, without which effective networking cannot be established.

Key Highlights

- The market for cable connectors is booming, owing to the global digital transition. Reliable connectivity, high performance, and efficiency are the major factors boosting the market's growth. High-performance networks are essential for business, manufacturing, security, and media. Furthermore, cables, such as USB Type-C and HDMI, are hugely popular.

- The growing number of fixed broadband connections over the years has enabled the growth of the market studied. According to ITU, the number of global fixed broadband subscriptions increased significantly in the last five years, which provides an opportunity for the growth of the market studied, as the installation of these connections requires connectors. According to the International Telecommunication Union, the number of fixed broadband connections globally will increase to about 1.3 billion in 2021.

- The use of cable connectors for miniature applications is rapidly growing. Several key markets, including mobile technology, aerospace and defense, and medical technology, drive the market's growth. Smartphones and other handheld devices also require smaller and lower-profile components, including micro-connectors capable of providing very high data speeds. For example, 10 Gbps board-to-board connectors are standard, and some advanced miniature board-to-board connectors can handle up to 20 Gbps. Therefore, the growth of consumer electronics is having a direct impact on the demand for cable connectors.

- Furthermore, most data and power connections use RF connectors and cables, and these trends will likely continue with high-speed data, enterprise networking, and industrial IoT applications. With the adoption of the Industrial Internet of Things (IIoT) increasing in Europe and APAC, the connector companies are turning to newer connectors, such as USB, CAT 5/6/7, HDMI, and DisplayPort, to name a few. For instance, in July 2021, Wurth Elektronik launched WR-UMRF (Ultra-Miniature RF Coaxial Connector), an extremely compact high-frequency coaxial connector.

- However, the factors such as complex fault identification and correction procedure, fluctuation in raw material prices used to manufacture cable connectors, and the development of wireless connectivity technologies such as Bluetooth, and wireless HDMI transmitters, among others, are challenging the growth of the studied market.

- The outbreak of COVID-19 had a notable impact on the growth of the studied market as it led China, along with other countries, to announce a lockdown and practice social isolation during the initial phase. This factor halted the manufacturing and production of numerous pieces of equipment and machinery for several weeks. Furthermore, various restrictions imposed on importing and exporting critical raw materials and industrial equipment significantly disrupted the supply chain. However, the market is expected to regain momentum with restrictions lifted in almost all parts of the world.

Cable Connector Market Trends

Automotive Sector is Expected to Hold Significant Market Share

- The automotive sector is projected to witness a strong demand for connectors, aided by the adoption of highly advanced electronic systems, such as audio controls, driver assistance systems, diagnostic systems, cruise control, and infotainment systems. Moreover, the increasing popularity of electric vehicles is expected to boost the market's growth. Some of the significant market trends in the segment include innovations and design improvements to meet the quality and reliability standards of devices, demand for versatile miniature connectors, the popularity of RoHS - compliant, UL recognized, and IP -rated connectors, as well as intelligent connectors with EMI/RFI suppression features.

- New automotive technologies have altered the ways cars are wired. The critical electrical components are required to reliably transmit power, signal, and data in certified conditions. The hybrid electric and electric vehicle has expanded the vision for applying robust connector technology from race cars to robotics in the form of autonomous vehicles. This has led to a significant development in design, material, as well as cable connectors.

- Considering the growing demand for connectors that can fulfill the requirements of modern automobiles, the vendors offering cable connectors are increasingly focusing on developing innovative products. For instance, in December 2021, Hirose Electric developed a new wire-to-board connector, the GT50 Series. This small and robust product series has a 1mm pitch and heat resistance up to 125-degree celsius, making it ideal for use in automotive applications.

- The recent shift in the automotive industry's trend wherein electric vehicles are fast replacing the traditional ICE vehicles is also expected to support the growth of the studied market as these vehicles contain more sensors and electronic components, expanding the use cases for connectors. For instance, according to the International Energy Agency, the global number of battery electric vehicles in use has increased from 1.2 million in 2016 to 11.3 million in 2021.

Asia-Pacific Expected to Witness the Fastest Growth Rate

- The continuous advancements in communication technologies and the growth of other end-user industries in the Asia Pacific region are among the significant factors boosting the development of the cable connectors market. Moreover, the support by IT and communications for automated processes in industrial applications have facilitated easier adoption among manufacturers.

- Sensor components, faster networks, flexible interfaces with high levels of reliability and secured hierarchical access, and error-correction options added to productivity, continued quality deliveries and minimized manufacturing costs in the region. Furthermore, with IoT at the center of new technological approaches for the development, production, and the entire logistics chain (otherwise known as intelligent factory automation), the adoption of cable connectors is expected to increase significantly in the region.

- For instance, according to the GSMA estimates, there will be 13.8 billion IIoT connections globally by 2025. Greater China is expected to account for around 4.1 billion connections or a third of the global market. In June 2021, the Chinese Ministry of Industry and Information Technology (MIIT) released its Industrial Internet 2021 Work Plan, detailing its goal to expand further the country's 5G network and the Industrial Internet of Things (IIoT). Such trends are also expected to create further growth opportunities as increased deployment of electronic components such as sensors and optic fiber cables will drive the demand for cable connectors.

- Furthermore, the growing number of data centers and rising demand for higher bandwidth drive the need for cables and connectors. China is highly focused on taking the lead over global peers in data center construction, with larger enterprises looking to scale up their data centers to ensure stability and reliability of data services, such as the application of 5G, wearable devices, the internet of things, and artificial intelligence spurs a burgeoning demand for computing power.

- The growth of the automotive sector is also expected to be a vital contributor to the development of the cable connectors market in the Asia Pacific region. For instance, according to the China Association of Automobile Manufacturers (CAAM), about 2.9 million battery electric vehicles will be sold in China in 2021.

Cable Connector Industry Overview

The Cable Connector Market is fragmented. The relatively lower initial investment requirement enables new players to enter the market quickly. Moreover, acquisitions have been a critical trend in the market over the years as the bigger players are using this to reduce competition and further expand their market presence. Some key players include Amphenol Corporation, Fujitsu Limited, TE Connectivity Limited, and Huawei Technologies Co. Ltd.

- September 2022 - Amphenol RF expanded its AUTOMATE Type A MiniFAKRA product series with pre-configured cable assemblies. According to the company, these assemblies feature a straight quad port miniFAKRA jack on both ends and are designed for low-loss TFC302LL. Furthermore, these connectors are constructed with a closed entry cable interface which limits the size of mating parts to prevent contact damage during mating.

- July 2022 - TTI, Inc., a leading specialty distributor of electronic components, announced that it is stocking the Industrial Mini-I/O connectors from TE Connectivity. The Mini I/O range of connectors provides excellent shock, vibration, shock, and EMI resistance, in a compact size and delivers reliable high performance in rugged industrial applications. The development will expand the reach of TE Connectivity to new customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Advancements In The Telecom Sector Coupled With Greater Demand for Improved Connectivity

- 5.1.2 Increasing Demand for High Bandwidth

- 5.2 Market Challenges

- 5.2.1 Volatile Prices of Raw Material

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PCB Connectors

- 6.1.2 Circular/Rectangular Connectors

- 6.1.3 Fiber Optic Connectors

- 6.1.4 IO Connectors

- 6.1.5 Other Types

- 6.2 By End-user Vertical

- 6.2.1 IT and Telecom

- 6.2.2 Automotive/Transportation

- 6.2.3 Consumer Electronics (Including Computer, Peripherals, and Business Equipment)

- 6.2.4 Industrial

- 6.2.5 Other End -user Verticals (Submarine, Aerospace, Energy and Power, and Medical)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amphenol Corporation

- 7.1.2 Molex Inc. (Koch Industries)

- 7.1.3 Fujitsu Limited

- 7.1.4 Prysmian SpA

- 7.1.5 Nexans SA

- 7.1.6 TE Connectivity Limited

- 7.1.7 3M Company

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 Axon Cable SAS

- 7.1.10 Alcatel-Lucent SA

- 7.1.11 Aptiv PLC

- 7.1.12 Yazaki Corporation

- 7.1.13 Huber+Suhner AG