|

市場調查報告書

商品編碼

1642001

機器人流程自動化:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Robotic Process Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

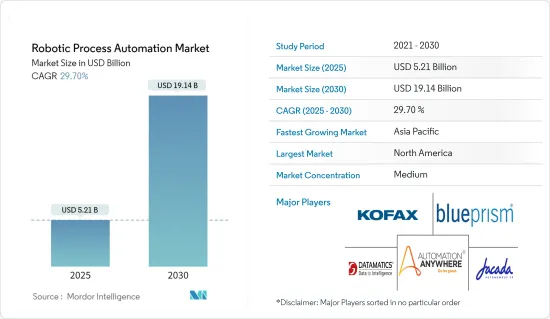

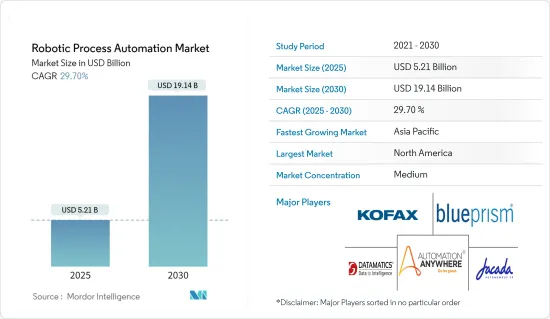

機器人流程自動化市場規模預計在 2025 年為 52.1 億美元,預計到 2030 年將達到 191.4 億美元,預測期內(2025-2030 年)的複合年成長率為 29.7%。

各種規模的組織都在擴大採用 RPA 來提高投資收益(ROI) 和生產力。主要市場參與企業正在宣布由人工智慧、機器學習和雲端模型提供支援的新型機器人流程自動化 (RPA) 解決方案,以滿足日益成長的需求。

關鍵亮點

- 機器人流程自動化 (RPA),也稱為智慧自動化或智慧自動化,可執行傳統上需要人工干預的各種任務,例如操縱資料、設定反應以及與其他流程和系統建立必要的通訊。的可透過程式設計來執行任務的最尖端科技術語。市場上的供應商也透過新的資料API 和新功能(例如自動化生命週期管理、工作負載管理、基於 SLA 的自動化、憑證管理、Citrix 自動化等)來改善其產品。這些改進涵蓋了需要更多操作和安全功能的新的行業領域。

- 預計人工智慧、機器學習和雲端運算等最尖端科技的日益使用將主要推動機器人流程自動化市場的成長。越來越多的企業採用 RPA 來自動化業務流程並處理日益複雜的資料。企業正在開發和部署基於雲端和人工智慧的 RPA 解決方案,以自動最佳化業務流程和工作流程。中小企業擴大採用人工智慧和雲端基礎的解決方案來提高內部效率,從而推動市場成長。據 Vistage 稱,在使用人工智慧的 13.6% 的中小企業中,很大一部分企業正在使用它來改善業務,其次是客戶參與。

- SaaS、IaaS 和 PaaS 服務在客戶關係管理、雲端運算、企業資源管理、開放原始碼資源、協作機器人學習、網路連接和其他金融用途的日益廣泛的應用也在塑造 RPA 解決方案市場。 RPA 在 IT 和通訊、BFSI、醫療保健、零售等各個終端用戶行業的功能優勢正在推動市場擴張。基於雲端基礎方案的成長趨勢以及各個終端用戶產業中基於機器人的解決方案的成長預計將為在全球範圍內建立機器人流程自動化開闢新的可能性。

- 雖然RPA有望提高產量和收益,但也存在著花費數十萬美元的風險。與機器人流程自動化相關的兩大安全威脅是資料遺失和竊盜。如果沒有適當的安全措施,RPA 機器人密碼和 RPA 處理的消費者資料等敏感資料可能會暴露給攻擊者,導致市場停滯。

- COVID-19 對機器人流程自動化市場產生了負面影響,由於自動化流程自動化解決方案的使用增加和社交距離規範的加強,該市場出現了顯著成長,預計這種成長將很快持續下去。的。此外,業內公司觀察到的人力資源緊縮預計將在未來兩年內進一步影響 RPA 的採用,從而推動對此類解決方案供應商的需求。隨著軟體機器人被用於管理通常由臨時工或季節性工人執行的任務,以及因監管激增、新業務產品發布或新創公司而導致的人員配備高峰,該行業繼續擴大。

機器人流程自動化市場趨勢

零售業將佔據 RPA 市場的大部分佔有率

- 退貨處理、工作流程管理、客戶支援管理、核算和財務、ERP 管理、行銷、消費行為分析等是 RPA 在零售領域發揮重要作用的一些應用。據估計,將近一半的人工任務自動化可以為全球勞動力節省超過 2 兆美元,尤其是在零售業等新興產業。

- 疫情引發的在家工作趨勢帶來的業務調整增加是零售業機器人自動化市場擴張的主要驅動力之一。該行業也受益於使用認知技術來修改整個組織的內部業務。

- 電子商務產業的快速成長是RPA市場成長的關鍵因素。根據美國商務部和美國人口普查局的數據,美國網路銷售額預計將達到總零售額的15%至16%左右。

- 為了吸引和留住更多顧客,零售業參與企業紛紛採用創新方法,利用新技術實現零售自動化,簡化流程,應對各種挑戰,成長動能強勁。隨著倉庫的興起,零售業正在轉向機器人流程自動化,以提高營運效率和效果。 Zebra Technologies 對零售業趨勢的一項研究表明,到 2023 年,大約 75% 的零售商將在所有關鍵職能中實現自動化。

預計美國將佔較大市場佔有率

- 在機器人技術應用領域的領先創新者和先驅者中,美國是最大的市場之一。該地區機器人的使用範圍不斷擴大,幫助美國企業更好地競爭並創造新的就業機會。此外,根據機器人工業協會 (RIA) 的數據,今年迄今工業機器人成長的最大驅動力是汽車OEM為製程自動化購買的機器人數量增加了 83%。

- 據先進自動化協會稱,自 2010 年以來,已有超過 18 萬台機器人被部署到美國公司,在此期間創造了超過 120 萬個新的製造業職位。根據麻省理工學院(MIT)的數據,汽車製造業占美國工業機器人需求的大部分,其次是電子製造業、塑膠製造業和化學製造業。這有望推動機器人流程自動化 (RPA) 的發展。

- 政府和監管機構將舉措推動各行業採用 RPA,預計將在預測期內推動市場成長。據 UiPath 稱,該地區有 30 多家機構正在使用 RPA 來消除合規問題、提高容量並減少積壓。

- 一些政府機構和私人公司正在投資創建用於流程自動化的對話式 RPA 聊天機器人。例如,美國國家科學基金會 (NSF) 創建了一個 RPA 機器人來幫助自動發送訊息並提醒人們即將舉行的公開會議。 NSF 組織每年舉行數千次會議,RPA 機器人幫助行政人員節省了超過 25,000 小時的時間。

機器人流程自動化產業概況

機器人流程自動化市場整合程度較低,只有 Automation Anywhere Inc.、Jafada 和 Kofax 等少數參與企業。

- 2024 年 1 月,Datamatics Global Services Ltd 宣布英國國家醫療服務體系 (NHS) 共享業務服務 (SBS) 根據為期兩年的框架合約選擇了該公司的 Datamatics TruBot RPA 解決方案。 TruBot 是一種人工智慧驅動的 RPA 解決方案,已被正式選定用於合作,以幫助公共部門自動執行各種業務,從員工招聘到患者登記和計費。

- 2024 年 6 月,Automation Anywhere 透過新的生成式 AI 平台增強了其業務自動化服務套件。該平台旨在簡化組織工作流程,並包含幫助發現、創建和實施人工智慧自動化流程的功能。 Automation Anywhere 的 AI Agent Studio 現在支援企業創建自訂 AI 機器人。這些人工智慧代理可以使用組織的資料進行訓練,並能夠在企業的數位環境中導航和做出決策。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 對產業的影響

- 市場促進因素

- 零售業將佔據 RPA 市場的大部分佔有率

- 採用人工智慧和雲端基礎的解決方案來提高中小企業的內部效率

- 市場限制

- 資料安全問題

第5章 市場區隔

- 實施形式

- 本地

- 雲

- 解決方案

- 軟體

- 服務

- 公司規模

- 中小企業

- 大型企業

- 最終用戶產業

- 資訊科技和電信

- BFSI

- 醫療

- 零售

- 製造業

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Automation Anywhere Inc.

- Blue Prism Group PLC

- Jacada Inc.

- Pegasystems Inc.

- UIPath Inc.

- Kofax Inc.(Thoma Bravo LLC)

- Be Informed BV(Hoogenberg Beheer BV)

- Datamatics Global Services Limited

- AutomationEdge Technologies Inc.

- Jidoka

- HelpSystems LLC(HGGC)

- Nice Robotic Automation Ltd

- CGI Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Robotic Process Automation Market size is estimated at USD 5.21 billion in 2025, and is expected to reach USD 19.14 billion by 2030, at a CAGR of 29.7% during the forecast period (2025-2030).

RPA adoption is increasing across organizations of all sizes to generate greater Return on Investment (ROI) and boost productivity. Major market players are launching new Robotic Process Automation (RPA) solutions based on AI, machine learning, and cloud models to help meet the increasing demand.

Key Highlights

- Robotic process automation (RPA), also known as intelligent automation or smart automation, is a general term for cutting-edge technologies that can be programmed to carry out a variety of tasks that previously required human intervention, such as data manipulation, setting off reactions, and establishing necessary communication with other processes and systems. Vendors in the market are also improving their products by including new capabilities like automation lifecycle management, workload management, SLA-based automation, credential management, and Citrix automation, in addition to new data APIs. These improvements are drawing in new sectors of industry that require more operational and security capabilities.

- The rising use of cutting-edge technologies like AI, machine learning, and the cloud will primarily fuel the robotic process automation market growth. More and more businesses are adopting RPA to automate business processes and handle increasingly complex data. Companies are developing and deploying cloud and AI-based RPA solutions to automatically optimize business processes and workflow. The increase in the adoption of Artificial Intelligence and cloud-based solutions for internal efficiency among SMEs is thriving the market growth. According to Vistage, among the 13.6% of SMBs leveraging AI, a significant share is using it to improve business operations, followed by customer engagement.

- The expanding use of SaaS, IaaS, and PaaS services for customer relationship management, cloud computing, enterprise resource management, open source resources, cooperative robot learning, network connectivity, and other financial applications is also creating a market for RPA solutions. RPA's functional advantages in various end-user industries, including IT and telecom, BFSI, healthcare, and retail, fuel the market's expansion. It is anticipated that the growing trend toward cloud-based solutions and the growth of robot-based solutions across a range of end-user industries will open up new potential for the construction of robotic process automation worldwide.

- RPA boosts output and revenue but also confronts risks that could cost millions. Two significant security threats associated with robotic process automation are data loss and theft. If the proper security measures are not in place, sensitive data, such as RPA bot passwords or consumer data handled by RPA, may be exposed to attackers, which could stifle the market.

- COVID-19 has negatively impacted the robotic process automation market and witnessed significant growth, owing to an increased usage of automated process automation solutions and increased social distancing norms, which will continue soon. Also, the human resource crunch observed by enterprises in industries is expected to further influence the adoption of RPA during the next two years, thus, driving the demand for such solution vendors. The industry continues to expand as software robots are used to manage regular tasks performed by temporary or seasonal workers and for staff peaks caused by regulatory spikes, new product launches, or new operations.

Robotic Process Automation Market Trends

Retail Sector to hold major share in RPA Market

- Returns processing, workflow management, customer support management, accounting and finance, ERP management and marketing, and consumer behavior analysis are some of the applications in the retail sector, with RPA playing an important role. It has been estimated that more than USD 2 trillion can be saved in a global workforce by automating almost half of human tasks, especially in an emerging industry like retail.

- The rise in business operational adjustments brought on by the pandemic-induced work-from-home trend is one of the major drivers of the robotic automation market expansion in the retail industry. The industry also benefits from using cognitive technologies and modifying internal business procedures across organizations.

- Rapid growth in the e-commerce industry is an essential factor adding to the growth of the RPA market. Online sales in the United States are expected to reach approximately 15% to 16% of the overall retail sector, according to the US Department of Commerce and the US Census Bureau.

- Along with adopting innovative practices to attract and engage more customers, the players in the retail industry have been using newer technologies for retail automation to smoothen their processes and gaining a growth momentum to counter various challenges. The growing number of warehouses is making the retail sector use robotic process automation to do tasks more efficiently and effectively. A study by Zebra Technologies on the trends in the retail industry revealed that around 75% of retailers are expected to adopt automation across all critical functions by 2023.

United States Expected to Hold Significant Market Share

- Among the leading innovators and pioneers in adopting robotics, The United States is one of the largest markets. Robot use in the region continues to grow, helping make US companies more competitive and leading to new job growth. Further, according to the Robotic Industries Association (RIA), the most significant driver of the year-to-date growth of industrial robots was an 83% increase in units purchased by automotive OEMs for process automation.

- According to the Association for Advancing Automation, over 180,000 robots have been dispatched to various American companies since 2010, and more than 1.2 million new manufacturing jobs have been created during this time. According to MIT, automotive manufacturing accounted for a significant portion of the demand for industrial robots in the United States, followed by electronic, plastics, and chemical manufacturing. It is anticipated to augment robotic process automation (RPA) growth.

- The increasing initiatives by the government and regulated authorities to boost the adoption of RPA across various industries are expected to fuel market growth over the forecast period. According to UiPath, more than 30 agencies in the region are using its RPA to eliminate compliance issues, improve throughput, and reduce their backlogs.

- Several government organizations and private companies are investing in creating conversational RPA chatbots for automating their processes. For instance, the National Science Foundation (NSF) Organization has created an RPA bot that automates messages and helps to remind people about upcoming public meetings. Since the NSF organization holds several thousand meetings annually, and the RPA bot helps save over 25,000 hours for the administrative staff.

Robotic Process Automation Industry Overview

The robotic process automation market is low consolidated with a few players such as Automation Anywhere Inc., Jafada, Kofax, etc., as various acquisitions and collaborations of large companies are expected to occur shortly. Some of the Key developments in this market are:

- In January 2024, Datamatics Global Services Ltd announced that the National Health Service (NHS) Shared Business Services (SBS) in the UK had selected their Datamatics TruBot RPA solution for a two-year framework contract. The TruBot, an AI-powered RPA solution, was officially onboarded for this collaboration, empowering public sector entities to automate a range of tasks, from staff onboarding to patient registration and billing.

- In June 2024, Automation Anywhere bolstered its suite of business automation services with a new generative AI platform. This platform is tailored to streamline organizational workflows, offering features that aid in discovering, creating, and implementing AI automation processes. With Automation Anywhere's AI Agent Studio, companies can now craft bespoke AI bots. These AI agents are trainable using the organization's data, enabling them to navigate and make decisions within the company's digital landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter Five Forces

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the industry

- 4.4 Market Drivers

- 4.4.1 Retail Sector to hold major share in RPA Market

- 4.4.2 Adoption of AI- and Cloud-based Solutions for Internal Efficiency among SMEs

- 4.5 Market Restraints

- 4.5.1 Data Security Concerns

5 MARKET SEGMENTATION

- 5.1 Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 Solution

- 5.2.1 Software

- 5.2.2 Service

- 5.3 Size of Enterprise

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 End User Industry

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Retail

- 5.4.5 Manufacturing

- 5.4.6 Other End User Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Latin America

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Automation Anywhere Inc.

- 6.1.2 Blue Prism Group PLC

- 6.1.3 Jacada Inc.

- 6.1.4 Pegasystems Inc.

- 6.1.5 UIPath Inc.

- 6.1.6 Kofax Inc. (Thoma Bravo LLC)

- 6.1.7 Be Informed BV (Hoogenberg Beheer BV)

- 6.1.8 Datamatics Global Services Limited

- 6.1.9 AutomationEdge Technologies Inc.

- 6.1.10 Jidoka

- 6.1.11 HelpSystems LLC (HGGC)

- 6.1.12 Nice Robotic Automation Ltd

- 6.1.13 CGI Inc.