|

市場調查報告書

商品編碼

1642002

半導體材料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Semiconductor Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

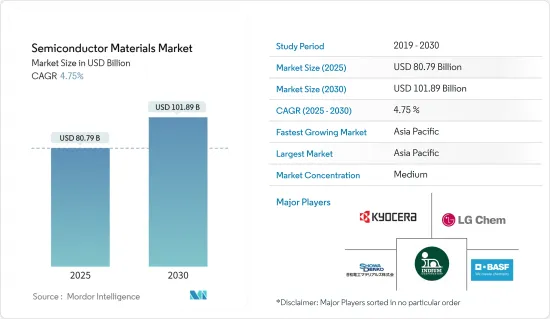

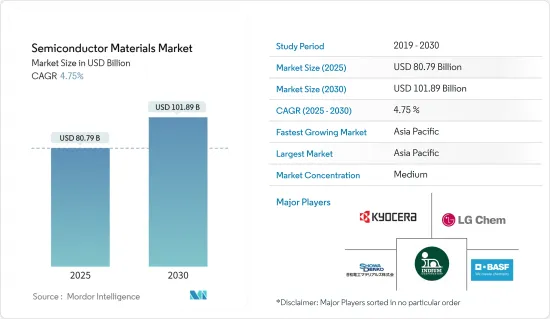

預計2025年半導體材料市場規模為807.9億美元,預計2030年將達到1,018.9億美元,預測期間(2025-2030年)的複合年成長率為4.75%。

半導體材料是電子產業的關鍵技術創新之一。矽(Si)、鍺(Ge)和砷化鎵(GaAs)等材料使電子製造商能夠取代導致電子產品笨重且昂貴的傳統熱電子裝置。自從半導體裝置問世以來,小型化技術取得了巨大進步,使得電子設備變得更小、更便攜。

主要亮點

- 半導體產業正加速向晶片小型化發展,隨著製造先進節點 IC、異構整合和 3D 記憶體架構所需的更多處理步驟,對半導體材料的需求預計將成長。這也將導致晶圓製造和封裝材料的消費量增加。

- 包括三星和SK海力士在內的韓國主要晶片製造商正試圖加強其供應鏈的穩定性,但韓國政府也在推動達成協議,到2030年在地採購。投資國內設備生產。

- 半導體正在從剛性電路基板轉向更柔韌的塑膠材料和紙張。更靈活的基板趨勢使一系列設備成為可能,從發光二極體到太陽能電池到電晶體。此外,工業4.0政策推動的消費性電子設備產量增加以及工業部門對物聯網和自動化設備的需求增加是全球市場對半導體材料需求不斷成長的一些關鍵因素。

- 市場的成長得益於智慧型手機的普及和全球5G行動網路的高普及率。行動電話智慧技術的普及以及LTE、5G等下一代行動通訊標準的快速推出,正在推動對半導體材料的需求。根據 5G Americas 預測,到 2023 年全球第五代 (5G) 網路用戶數量將達到 19 億。預計到 2024 年這一數字將成長到 28 億,到 2027 年將成長到 59 億。

- 市場上有多家公司正在建立策略夥伴關係、聯盟,探索新產品並在現有產品中添加新功能,以滿足最終用戶的複雜需求,擴大其市場佔有率並從不同地區創造收益。整合功能。例如,在全球半導體製造競爭加劇的背景下,三菱化學於2023年9月宣佈建造新的半導體材料工廠,計劃於2025年3月投入運作。

- 半導體產業是最複雜的產業之一,因為製造各種產品涉及多個(超過 500 個)製程步驟,電子產業的波動性,不可預測的需求以及工人面臨的惡劣環境。根據製造流程的複雜程度,僅製造半導體晶圓就涉及多達 1,400 個步驟。電晶體在底層形成,這個過程不斷重複,直到組裝許多電路來製造最終產品。

- 俄烏戰爭正在影響半導體供應鏈。烏克蘭是生產電子元件(包括半導體和各種設備)原料的重要供應國。戰爭可能破壞供應鏈,造成原料短缺和價格上漲,影響製造商並導致最終用戶成本上升。此外,2023年第一季,地緣政治緊張局勢和消費者支出下降導致行動電話產業出貨量較去年與前一年同期比較,也影響了市場成長。同樣,美國和中國的衝突可能會為全球半導體供應鏈帶來新的挑戰,阻礙未來幾年的市場成長。

半導體材料市場趨勢

消費性電子產品將佔據大量市場佔有率

- 消費性電子產品在推動半導體材料市場成長方面發揮關鍵作用。隨著對更小、更快、更節能的設備的需求不斷增加,對先進半導體材料的需求也不斷增加。在網路普及和數位經濟擴張的推動下,各地區消費性電子產品的成長增加了可用的連網型設備數量,包括智慧型手錶、智慧家電、智慧家居產品、筆記型電腦、智慧型手機等。這增加了硬體製造對半導體材料的需求,從而推動了市場成長。物聯網的出現正在推動各個終端用戶產業採用先進的消費性電子產品來增強業務。

- 據思科稱,物聯網 (IoT) 是一個無所不在的系統,其中人員、流程、設備和資料連接到網際網路並相互連接。根據Cisco預測,2023年全球行動M2M連線數將達到44億人。

- 電子製造商希望延長電池壽命,這推動了對 SiC 半導體的需求。隨著消費者對低電量設備的需求不斷增加,消費性電子產品製造商正在對其產品中的電池進行升級。該市場SiC半導體的主要消費者是智慧型手機、穿戴式裝置和其他主要消費性電子產品。

- 行動電話智慧技術的普及以及LTE、5G等下一代行動通訊標準的快速推出是推動半導體材料需求的關鍵因素。例如,2023 年 8 月,歐洲投資銀行 (EIB) 向 Iliad SA 提供了一筆 3 億歐元的新貸款,用於資金籌措其 5G 網路部署。預計這將使 Iliad 能夠在法國擴大其 5G 網路的部署。歐洲投資銀行的投資重點包括為符合歐盟為個人和企業提供超高速固定和行動連接的目標的數位經濟計劃提供融資。

- 根據GSMA《歐洲移動經濟2023》報告,到2030年,5G連接和服務預計將產生1530億歐元的經濟效益,透過增加連網消費電子設備的數量來推動市場成長。

- 預計各地區光纖的成長將推動連網智慧設備的成長,進而增加對半導體原料的需求。 2024 年 2 月,科技公司和包括光纖電纜 (OFC) 在內的綜合通訊產品供應商及解決方案供應商HFCL Limited (HFCL) 宣布透過在波蘭建立OFC 製造工廠,向歐洲進行策略擴張,協助光纖電纜市場的成長建築物中的光纖連接並增加對智慧互聯家用電器的需求。

- 智慧型手機是半導體最重要的消費者之一。近年來,智慧型手機產業競爭異常激烈。智慧型手機的使用量不斷成長預計將推動市場的發展。例如,據愛立信稱,到 2028 年,智慧型手機用戶數量預計將達到 1,200 萬,高於去年的 450 萬。

中國:市場可望實現顯著成長

- 隨著美國技術競爭加劇,許多晶片設計公司尋求獨立,中國半導體原料市場蓬勃發展。 2023年3月,國家積體電路產業投資基金有限公司第二支投資,也就是所謂的“大基金二號”,將大量投資半導體製造、設備及相關材料,以對抗美國政府對美國的遏制和打壓。

- 政府在塑造國內市場方面發揮了關鍵作用。近年來,中國政府相繼推出多項新的相關政策措施,推動半導體產業的發展。中國政府的「中國製造2025」計畫旨在2030年將半導體產業產值提高到3,050億美元,滿足80%的國內需求。中國國家智慧財產局 (CNIP) 的預算目標是到 2023 年實現每年 200 萬件註冊,預計將促進市場發展。

- 該國推出的 5G 服務帶動了需求增加,尤其是對智慧型手機的需求。 GSMA預測,到2024年,5G將取代4G成為中國主導的行動技術。 4G和5G在中國的主導地位顯示傳統網路正在被淘汰。雖然大多數用戶已經遷移到 4G 和 5G,但傳統網路仍繼續支援各種物聯網服務。然而,GSMA 估計,到 2025 年,中國傳統網路可能會幾乎完全關閉。向5G的過渡可能會推動先進消費性電子和通訊產品的採用。預計這將推動市場發展。

- 穿戴式電子產品的成長推動了新型微型晶片的採用,從而推動了市場成長並增加了晶圓需求。愛立信預計,到2028年智慧型手機行動網路用戶數量將達到約78億人。

- 中國汽車產業正在崛起,並在全球汽車市場中發揮越來越重要的作用。中國政府把汽車產業,包括零件產業定位為重點產業之一。據政府稱,到2025年中國汽車產量預計將達到3500萬輛。

- 製造業是亞太地區的重點產業。在這方面發揮至關重要作用的中國經濟正在經歷快速轉型,人事費用飆升,傳統的移工模式已不永續性。這些趨勢正在推動經濟體採用自動化作為製造流程的一部分。根據《智慧製造「十三五」規劃》,中國的目標是到2025年使智慧製造系統和產業轉型成為主流。該計畫由工業和資訊化部等七部門發布,正值美國、德國、日本等國家努力拓展智慧製造之際。依照規劃,2025年,我國70%以上的大型企業將數位化,在全國建成超大規模示範製造設施。該計劃還包括加強人工智慧、5G、物聯網、巨量資料和邊緣運算等關鍵技術的研究。預計這些舉措將為市場成長提供巨大動力。

半導體材料產業概況

半導體材料市場較為分散,主要參與者包括BASF、LG 化學有限公司、銦泰公司和京瓷。公司不斷投資於策略聯盟和產品開發以擴大市場佔有率。

- 2023 年 9 月電子元件製造商 CDIL 成為印度第一家開始為高電力消耗技術產品生產 SiC 半導體的公司。 CDIL 在莫哈里和德里擁有製造設施和可靠性實驗室,主要服務於汽車、國防和航太等領域。該公司的擴張得到了中央政府根據電子元件和半導體製造促進計劃(SPECS)提供的激勵措施的支持。該公司已開始在其表面黏著技術封裝線上生產第一階段的 5,000 萬個 SiC 零件,並計劃逐步提高至 1 億個。

- 2023年8月,台積電與英飛凌科技股份公司、羅伯特·博世有限公司和恩智浦半導體公司共同投資了提供先進半導體製造服務的德國公司歐洲半導體製造公司(ESMC)有限公司。 ESMC 已朝著建造 300 毫米晶圓廠的方向邁進,以滿足汽車和工業領域未來的產能需求。該廠將具備每月4萬片300毫米(12吋)晶圓的產能,採用台積電的28/22奈米平面CMOS和16/12奈米FinFET製程技術,並將推動歐洲半導體製造生態系統的增強。 ESMC 的目標是於 2024 年動工,並於 2027 年開始生產。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估主要宏觀經濟趨勢的市場影響

第5章 市場動態

- 市場促進因素

- 電子材料的技術進步與產品創新

- 家電需求不斷成長

- OSAT/封裝公司的需求增加

- 市場限制

- 製造過程的複雜性

第6章 市場細分

- 按應用

- 製造

- 製程化學

- 光罩

- 電子氣體

- 光阻劑

- 濺鍍靶材

- 矽

- 其他製造材料

- 包裝

- 基板

- 導線架

- 陶瓷封裝

- 接合線

- 封裝樹脂(液態)

- 晶片黏接材料

- 其他包裝應用

- 製造

- 按最終用戶產業

- 消費性電子產品

- 通訊業

- 製造業

- 車

- 能源與公共事業

- 其他最終用戶產業

- 按地區

- 台灣

- 韓國

- 中國

- 日本

- 北美洲

- 歐洲

- 世界其他地區

第7章 競爭格局

- 公司簡介

- BASF SE

- LG Chem Ltd

- Indium Corporation

- Showa Denko Materials Co. Ltd(showa Denko KK)

- KYOCERA Corporation

- Henkel AG & Company KGAA

- Sumitomo Chemical Co. Ltd

- Dow Chemical Co.(Dow Inc.)

- International Quantum Epitaxy PLC

- Nichia Corporation

- CAPLINQ Europe BV

- ShinEtsu Microsi

第8章投資分析

第9章:市場的未來

The Semiconductor Materials Market size is estimated at USD 80.79 billion in 2025, and is expected to reach USD 101.89 billion by 2030, at a CAGR of 4.75% during the forecast period (2025-2030).

Semiconductor materials represent one of the significant innovations in the electronics industry. By using materials such as silicon (Si), germanium (Ge), and gallium arsenide (GaAs), electronics manufacturers can replace traditional thermionic devices that make electronic devices heavy and expensive. Since the introduction of semiconductor devices, advanced miniaturization has progressed, and electronic devices have become more compact and mobile.

Key Highlights

- With the miniaturization trend gaining momentum in the semiconductor industry, the demand for semiconductor materials is also expected to grow as manufacturing advanced node ICs, heterogeneous integration, and 3D memory architectures require more processing steps. This would also drive higher wafer fabrication and packaging materials consumption.

- Although significant chip manufacturing companies in South Korea, such as Samsung and SK Hynix, are seeking to bolster supply chain stability, the South Korean government is investing in the domestic production of semiconductor materials and equipment to source about 50% of its materials, components, and equipment demand locally by 2030.

- Semiconductors are moving away from rigid substrates to more flexible plastic material and paper, all due to new material and fabrication discoveries. The trend toward more flexible substrates has led to numerous devices, from light-emitting diodes to solar cells and transistors. Further, the increasing production of consumer electronics devices and demand from the industrial sector for IoT and automation devices, owing to the policies of Industry 4.0, are some of the significant factors that govern the increasing demand for semiconductor materials in the global market.

- The market's growth is driven by the growing proliferation of smartphones and the high penetration of 5G mobile networks worldwide. The increasing adoption of smart technologies in mobile phones and the rapid introduction of next-generation mobile communications standards, like LTE or 5G, are factors driving the demand for semiconductor materials. According to 5G Americas, as of 2023, there were an estimated 1.9 billion fifth-generation (5G) subscriptions worldwide. This figure is expected to increase to 2.8 billion by 2024 and 5.9 billion by 2027.

- Several companies in the market are focusing on strategic partnerships, collaborations, and developing new products or incorporating new features in the existing products to cater to the complex needs of the end users, expand their market share, and generate revenue from different regions. For instance, in September 2023, Mitsubishi Chemical announced the construction of a new semiconductor materials plant, aiming to become operational by March 2025 as the global competition in semiconductor manufacturing intensifies.

- The semiconductor industry is one of the most complex because of the several (more than 500) processing steps involved in manufacturing different products and the challenging environment faced by workers, including volatile electronics industries and unpredictable demand. Depending on the complexity of the manufacturing process, there can be up to 1,400 process steps in semiconductor wafer manufacturing alone. Transistors are formed on the bottom layer, and the process is repeated as many circuits are assembled to create the final product.

- The Russia-Ukraine War is impacting the supply chain of semiconductors, and it is a significant supplier of raw materials for producing semiconductors and electronic components, including various equipment. The war disrupted the supply chain, causing shortages and price increases for these materials, impacting manufacturers and potentially leading to higher costs for end users. Also, in the first quarter of 2023, the mobile phone industry witnessed a decline in shipments compared to the previous year due to geopolitical tensions and decreased consumer spending, which also affected the market's growth. Similarly, the US-China conflict created new challenges for the global semiconductor supply chain; it may hamper market growth in the coming years.

Semiconductor Materials Market Trends

Consumer Electronics to Hold Significant Market Share

- Consumer electronics play a significant role in driving the growth of the semiconductor materials market. With the increase in demand for smaller, faster, and more energy-efficient devices, the demand for advanced semiconductor materials also rises. The growth of consumer electronics in various regions, supported by increased internet penetration and the expansion of digital economies, has raised the number of available connected devices, including smartwatches, smart electronics appliances, smart home products, laptops, and smartphones. This has raised the demand for semiconductor materials for hardware manufacturing, driving market growth. With the advent of IoT, various end-user industries are increasingly adopting advanced consumer electronic products to enhance their operations.

- According to Cisco, the Internet of Things (IoT) has become a prevalent system by which people, processes, devices, and data connect to the Internet and each other. According to Cisco Systems, there were 4.4 billion mobile M2M connections worldwide in 2023.

- The requirement for electronic makers to extend battery life is fueling the demand for SiC semiconductors. Manufacturers of consumer gadgets are upgrading their products' batteries, driven by consumer desire for low-charging gadgets. The primary consumers of SiC semiconductors in this market are smartphones, wearable devices, and other major consumer electronics.

- The increasing adoption of smart technologies in mobile phones and the rapid introduction of next-generation mobile communications standards, like LTE or 5G, are significant factors driving the demand for semiconductor materials. For instance, in August 2023, the European Investment Bank (EIB) granted Iliad SA a new EUR 300 million loan to finance its 5G network rollout. It was expected to enable Iliad to expand the rollout of its 5G network in France. The EIB's investment priorities include financing digital economy projects, which align with the European Union's objectives of enhancing fixed and mobile ultra-fast connectivity for individuals and businesses.

- The GSMA Mobile Economy Europe 2023 report stated that 5G connectivity and services are expected to generate economic benefits of EUR 153 billion by 2030, increasing the number of connected consumer electronic devices and fueling market growth.

- The growth of fiber optics in the regions would fuel the growth of connected smart devices and raise the demand for semiconductor raw materials. In February 2024, HFCL Limited (HFCL), a technology enterprise and integrated communications product including optical fiber cable (OFC) and solutions provider, announced its strategic expansion into Europe by setting up an OFC manufacturing plant in Poland, supporting the growth of fiber connections in the buildings and raising the demand for connected smart consumer electronic devices.

- Smartphones are among the most significant consumers of semiconductors. The smartphone industry has been very competitive in recent years. The increasing usage of smartphones is anticipated to drive the market. For instance, according to Ericsson, smartphone subscriptions are expected to reach 12 million by 2028, from 4.5 million in the previous years.

China is Expected to Witness Significant Market Growth

- The semiconductor raw materials market is proliferating in China, with many chip design companies striving for self-reliance amid an escalating US-China technology rivalry. In March 2023, the second phase of the National Integrated Circuit Industry Investment Fund Co, also known as "Big Fund II," invested heavily in semiconductor manufacturing, equipment, and related materials to deal with the US government's containment and suppression.

- The government has played a significant role in molding the country's market. For a couple of years, the Chinese government issued several new related policy measures to boost the development of its semiconductor industry. The Chinese government's "Made in China 2025" initiative aims to make its semiconductor industry reach USD 305 billion in terms of output by 2030 and meet 80% of the domestic demand. The budget of the China National Intellectual Property Administration (CNIP) targeted 2 million registrations annually by 2023, which was expected to revitalize the market.

- With the launch of 5G services in the country, the demand for smartphones, among other things, has been increasing. GSMA predicts that 5G will overtake 4G in 2024 to become the dominant mobile technology in China. The dominance of 4G and 5G in China suggests that legacy networks are being phased out. While most users have migrated to 4G and 5G, legacy networks continue to support various IoT services. However, GSMA estimates suggest legacy networks could be almost entirely shut down in China by 2025. The push toward 5G will likely propel the adoption of advanced consumer electronics and telecommunication products. This is anticipated to drive the market.

- The growth in wearable electronic devices has led to the adoption of new miniaturized chips, propelling the market's growth and increasing the demand for wafers. According to Ericsson, smartphone mobile network subscriptions are expected to reach approximately 7.8 billion by 2028.

- China's automotive sector has been increasing, and the country plays an increasingly important role in the global automotive market. The Chinese government positions the automobile industry, including the auto parts industry, as one of its key industries. According to the government, China's car production will reach 35 million vehicles by 2025.

- Manufacturing serves as a significant industry in Asia-Pacific. China's economy, being a significant contributor, is undergoing a rapid transformation with the rise in labor costs and the conventional model of migrant workers losing its sustainability. Such trends have pushed the economy to adopt automation as a part of the manufacturing processes. As per the 13th Five-year Plan of Smart Manufacturing, China aims to mainstream its intelligent manufacturing system and industry transformation by 2025. The plan, released by the Ministry of Industry and Information Technology (MIIT) and seven other departments, came as countries like the United States, Germany, and Japan pushed to increase intelligent manufacturing. According to the plan, more than 70% of large-scale Chinese enterprises would be digitalized by 2025, and over-demonstration manufacturing facilities would be built nationwide. The plan also involves strengthening research on critical technologies such as artificial intelligence, 5G, IoT, big data, and edge computing. Such initiatives would offer significant momentum to the growth of the market.

Semiconductor Materials Industry Overview

The semiconductor raw materials market is fragmented, with the presence of significant companies like BASF, LG Chem Ltd, Indium Corporation, and KYOCERA Corporation. The companies continuously invest in strategic collaborations and product developments to gain market share.

- September 2023: Electronic component maker CDIL became the first company in India to start manufacturing SiC semiconductors for high power-consuming technology products. CDIL operates manufacturing facilities and a reliability lab in Mohali and Delhi, serving industries focusing on the automotive, defense, and aerospace sectors. The company's expansion received incentive support from the Centre under the Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS). The company initiated the first phase of production of 50 million SiC components with a surface-mount packaging line and plans to ramp up it to 100 million devices.

- August 2023: TSMC, Infineon Technologies AG, Robert Bosch GmbH, and NXP Semiconductors NV collaborated to invest in European Semiconductor Manufacturing Company (ESMC) GmbH in Germany to provide advanced semiconductor manufacturing services. ESMC marked a step toward constructing a 300 mm fab to support the automotive and industrial sectors' future capacity needs. The facility is anticipated to have a monthly production capacity of 40,000 300 mm (12 inch) wafers on TSMC's 28/22 nanometer planar CMOS and 16/12 nanometer FinFET process technology, strengthening Europe's semiconductor manufacturing ecosystem. ESMC aimed to begin construction in 2024, with production targeted to commence by 2027.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technical Advancements and Product Innovation of the Electronic Materials

- 5.1.2 Rising Demand for Consumer Electronics Goods

- 5.1.3 Increased Demand From OSAT/Packaging Companies

- 5.2 Market Restraints

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Fabrication

- 6.1.1.1 Process Chemicals

- 6.1.1.2 Photomasks

- 6.1.1.3 Electronic Gases

- 6.1.1.4 Photoresists Ancilliaries

- 6.1.1.5 Sputtering Targets

- 6.1.1.6 Silicon

- 6.1.1.7 Other Fabrication Materials

- 6.1.2 Packaging

- 6.1.2.1 Substrates

- 6.1.2.2 Lead-frames

- 6.1.2.3 Ceramic Packages

- 6.1.2.4 Bonding Wire

- 6.1.2.5 Encapsulation Resins (Liquid)

- 6.1.2.6 Die Attach Materials

- 6.1.2.7 Other Packaging Applications

- 6.1.1 Fabrication

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecommunication

- 6.2.3 Manufacturing

- 6.2.4 Automotive

- 6.2.5 Energy and Utility

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 Taiwan

- 6.3.2 South Korea

- 6.3.3 China

- 6.3.4 Japan

- 6.3.5 North America

- 6.3.6 Europe

- 6.3.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 BASF SE

- 7.1.2 LG Chem Ltd

- 7.1.3 Indium Corporation

- 7.1.4 Showa Denko Materials Co. Ltd (showa Denko K.K)

- 7.1.5 KYOCERA Corporation

- 7.1.6 Henkel AG & Company KGAA

- 7.1.7 Sumitomo Chemical Co. Ltd

- 7.1.8 Dow Chemical Co. (Dow Inc.)

- 7.1.9 International Quantum Epitaxy PLC

- 7.1.10 Nichia Corporation

- 7.1.11 CAPLINQ Europe BV

- 7.1.12 ShinEtsu Microsi