|

市場調查報告書

商品編碼

1642003

光度計:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Light Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

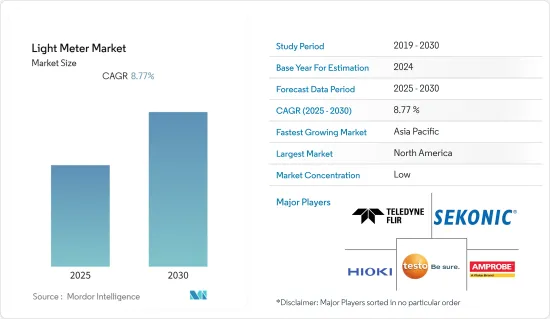

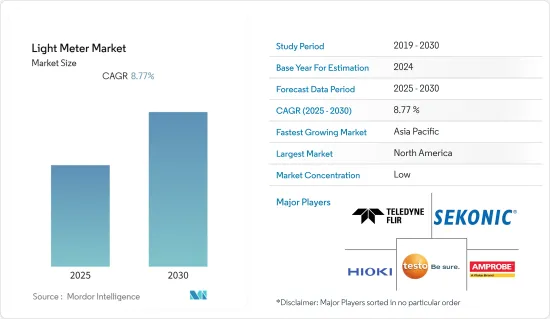

預測期內,光度計市場預期的複合年成長率為 8.77%。

在全球範圍內,政府對部署節能照明(例如 LED 照明)的監管力度不斷加強,這推動了光度計市場的發展。

主要亮點

- 包括 LED 照明在內的照明技術的進步正在對照明儀表市場產生重大影響。由於 LED 照明節能、持久且可控,因此準確測量和最佳化光輸出至關重要。

- 照明計市場也受到全球對照明計的需求以及電影攝影和攝影領域的先進技術進步等因素的推動。測光錶在攝影和電影攝影中發揮著至關重要的作用,它可以幫助專業人士實現拍攝所需的曝光水平和照明條件。

- 此外,政府加強對照明通訊協定標準化的舉措,可能會導致光度計市場成長率的激增。此外,政府加強職場照明的規定也將對測光錶市場的成長產生重大影響。

- 然而,智慧型手機應用和取代測光儀的光學測量儀器的進步可能會抑制市場成長率。正在開發一款智慧型手機應用程式,利用 iPhone 和其他智慧型手機的內藏相機作為光感應器,發揮照度儀的作用。

測光錶市場趨勢

LED 型測光錶預計將佔據較大的市場佔有率

- LED 測光錶用於製造 LED 燈時的品管和測試過程。製造商使用這些儀表來確保每個 LED 二極體和燈具符合色溫、顯色指數 (CRI)、光通量和其他參數的特定標準。

- LED光照度計是採用特定的演算法計算來測量LED的頻譜,從而克服錯誤結果的問題。測光錶可以幫助確保 LED 燈在所需範圍內,最大限度地減少對您生活的干擾。

- 測光錶對於測量 LED 照明的色溫至關重要。這種測量有助於確保 LED 照明系統發出具有所需色彩特性的光,例如暖色、冷色或日光色。色溫在營造所需的照明氛圍方面起著至關重要的作用。

- 此外,LED 光照度計還可以透過測量 LED 照明的潛在危害(例如藍光照射)來評估光生物安全性。確保 LED 照明對人體健康安全至關重要,尤其是在醫療保健和製造工廠等環境中。

- LED照明安裝數量的增加是市場成長的主要驅動力。 LED照度度計是測量和評估與 LED 照明相關的各種參數的重要工具。根據美國能源局的數據,預計2017年至2035年,美國LED照明安裝量將成長,從2017年的約14億台增加到2035年的約79億台。然而,到 2025 年,住宅領域的 LED 照明安裝量將出現最大成長。戶外領域應是 LED 照明滲透率最高的領域。

預計北美將佔據較大的市場佔有率

- 北美照明市場正在經歷向更節能的照明技術的重大轉變。測光錶對於確保這些照明系統以最佳水平運作、有助於實現節能和永續性目標至關重要。

- 智慧城市的興起和物聯網技術與城市基礎設施的融合正在推動測光錶的需求。根據《經濟學人》報道,2022年,全球領先的數位城市華盛頓特區的指數排名得分為71.2。最佳化智慧城市的戶外照明對於提高能源效率和安全性至關重要。

- 北美是攝影和電影製作行業的發源地,這些領域的專業人士依靠測光錶來實現準確的照明條件和曝光設置。

- 聯邦和州政府為提高能源效率和永續性所做的努力正在鼓勵採用 LED 照明,進而使用測光錶來檢驗照明性能。

- 隨著測光技術的發展,數位無線測光儀也應運而生,使得使用者的測量更加方便、有效率。工業數位化正在推動人們對可遠端監控和控制的連網照明系統的興趣。

照度計行業概況

光度計市場高度分散,主要參與者包括 FLIR Systems、SekonicA Corporation、Testo SE、Hioki EECorporation 和 Amprobe Instrument Corporation(丹納赫公司)。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 6 月-瑞典公司 LIT Systems 推出 LIT DUO 1。 LIT DUO 1 將色彩、照度、曝光、頻譜和閃爍計整合到一個儀器中,並裝在一個耐用的鋁製機身中。 LIT DUO 1 的概念是打造一個電影製作人可以使用的一體化設備。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 全球攝影和電影產業對測光錶的需求不斷增加

- 改善職場照明的規定

- 市場限制

- 開發智慧型手機應用程式和替代測光儀的光測量儀器

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 通用測光錶

- LED 照度計

- 紫外線照度計

- 按應用

- 照片拍攝

- 生產工廠

- 診所和醫院

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- FLIR Systems

- Sekonic Corporation

- Testo SE

- Hioki EE Corporation

- Amprobe Instrument Corporation(Danaher Corporation)

- KERN & SOHN GmbH

- B&K Precision Corporation

- Line Seiki Co., Ltd

- TENMARS ELECTRONICS CO., LTD.

- Martindale Electric Co. Ltd.

- LIT SYSTEMS AB

第7章投資分析

第8章 市場機會與未來趨勢

The Light Meter Market is expected to register a CAGR of 8.77% during the forecast period.

The Light Meter Market has been driven by the increasing government regulations across the globe for deploying energy-efficient lighting such as LED lighting.

Key Highlights

- The ongoing advancements in lighting technology, including LED lighting, have significantly impacted the lighting meter market. LED lighting is energy efficient, long-lasting, and controllable, making it essential to measure and optimize light levels accurately.

- The light meter market is also driven by factors such as global demand for light meters and advanced technological advancement in the cinematography and photography sector. Light meters play a crucial role in photography and cinematography by assisting professionals in achieving the desired exposure level and lighting conditions for their shoots.

- Furthermore, the increase in government initiatives toward the standardization of lighting protocols would result in the proliferation of the growth rate of the light meter market. Also, government regulations for enhancing workplace lighting will significantly influence the growth of the light meter market.

- However, advancing smartphone applications and light measuring devices to substitute light meters would restrain the market's growth rate. Smartphone applications have been developed to enable iPhones and other smartphones to work as a light meter using its built-in camera as a light sensor.

Light Meter Market Trends

LED Type Light Meters Segment is Expected to Hold Significant Market Share

- LED light meters are used in quality control and testing processes while manufacturing LED lights. Manufacturers use these meters to verify that each LED diode and lighting fixture meets the specific criteria for color temperature, color rendering index (CRI), luminous flux, and other parameters.

- The LED light meters are designed to overcome the problem of erroneous results by using specific algorithmic calculations to measure the LED light spectrum, which may not necessarily fall within the CIE Photopic curve. A light meter can check LED lights to ensure they fall into the desired range for minimal disruption to life.

- These Light meters are essential for measuring the color temperature of LED lights. This measurement helps ensure that LED lighting systems emit light with desired color characteristics, whether it's warm, cool, or daylight-like. Color temperature plays an important role in creating the required light ambiance.

- Moreover, The LED light meters can assess photobiological safety by measuring the potential hazards of LED lighting, such as blue light exposure. Ensuring LED lighting is safe for human health is crucial, especially in settings like healthcare and manufacturing plants.

- The increase in the number of LED lights installed has been significant drives the market growth. LED light meters are essential tools for measuring and assessing various parameters associated with LED lighting. According to the US Department of Energy, The number of LED light installations in the United States is forecast to grow between 2017 and 2035, increasing from about 1.4 billion units installed in 2017 to about 7.9 billion units in 2035. However, the residential sector would grow the most LED light installations in 2025. The outdoor sector should have the highest penetration rate of LED lights.

North America is Expected to Hold Significant Market Share

- The North American light market is witnessing a significant shift towards energy-efficient light technologies. Light meters are crucial in ensuring that these lighting systems operate at their optimal levels, contributing to energy savings and sustainability goals.

- The increasing number of smart cities and the integration of IoT technology in urban infrastructure have driven the demand for light meters. According to The Economist, In 2022, the leading global digital city on the index ranking score of Washington, DC is 71.2. They are crucial in optimizing outdoor lighting in smart cities to improve energy efficiency and safety.

- North America region has a thriving photography and film production industry, and light meters are essential for professionals in these fields to achieve precise lighting conditions and exposure settings for their work.

- Federal and state-level government initiatives promoting energy efficiency and sustainability have encouraged the adoption of LED lighting and, consequently, the use of light meters to verify lighting performance.

- Advancements in light meter technology have led to the development of digital and wireless light meters, making measurements more convenient and efficient for users. The digital transformation of industries has led to increased interest in connected lighting systems that can be monitored and controlled remotely.

Light Meter Industry Overview

The light meter market is fragmented with the presence of major players like FLIR Systems, SekonicA Corporation, Testo SE, Hioki E.E. Corporation, and Amprobe Instrument Corporation ( Danaher Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - LIT Systems, founded in Sweden has introduced the LIT DUO 1. The LIT DUO 1 combines color, illuminance, exposure, spectrum, and a flicker meter all into one device inside a durable aluminum body. The concept behind LIT DUO 1 was to make an all-in-one device that filmmakers could use.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Light Meters in the Photography and Cinematography Industry Worldwide

- 4.2.2 Regulations to Improve Workplace Lighting

- 4.3 Market Restraints

- 4.3.1 Development of Smartphone Applications and Light Measuring Devices to Substitute Light Meters

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 General Purpose Light Meters

- 5.1.2 LED Light Meters

- 5.1.3 UV Light Meters

- 5.2 By Application

- 5.2.1 Photography and Cinematography

- 5.2.2 Manufacturing Plants

- 5.2.3 Clinics and Hospitals

- 5.2.4 Others Application

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 FLIR Systems

- 6.1.2 Sekonic Corporation

- 6.1.3 Testo SE

- 6.1.4 Hioki E.E. Corporation

- 6.1.5 Amprobe Instrument Corporation ( Danaher Corporation)

- 6.1.6 KERN & SOHN GmbH

- 6.1.7 B&K Precision Corporation

- 6.1.8 Line Seiki Co., Ltd

- 6.1.9 TENMARS ELECTRONICS CO., LTD.

- 6.1.10 Martindale Electric Co. Ltd.

- 6.1.11 LIT SYSTEMS AB