|

市場調查報告書

商品編碼

1642010

AIS(自動識別系統):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Automatic Identification System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

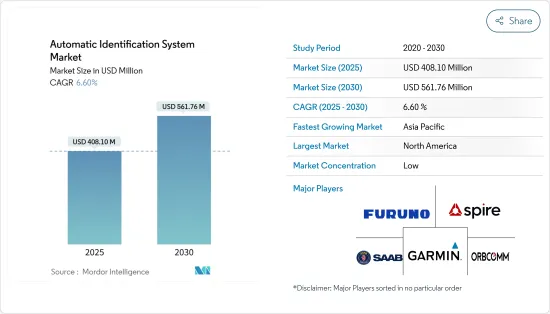

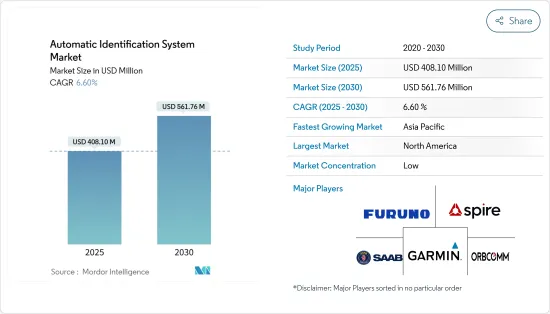

AIS(自動識別系統)市場規模預計在 2025 年為 4.1085 億美元,預計到 2030 年將達到 5.7221 億美元,在預測期內(2025-2030 年)的複合年成長率為 6.85%。

國際海事組織的《國際海上人命安全公約》規定,300GT(總噸位)以上的國際船舶和客船,無論大小,都必須配備AIS(自動識別系統)。

主要亮點

- 近年來,世界各地的海上運輸取得了長足的成長。全球對海運業的投資龐大,推動了對 AIS 的需求,尤其是船舶追蹤。

- 英國發布《海上貿易與投資戰略》,重點關注綠色航海、數位技術、自主船舶、海洋科學、海事專業人員和商業服務五大重點領域,並制定了五年規劃。緬甸也宣布將在沿海船舶和漁船上安裝AIS,確保海上安全。將在19個碼頭安裝AIS站,控制AIS並交換導航訊息,AIS範圍可從48公里擴展到80公里。

- AIS 系統在海上以甚高頻 (VHF) 波段傳輸無線電訊號,但無線電波本質上具有雜訊。由於競爭訊號相互干擾,港口和繁忙區域經常會出現頻寬擁塞的情況。此外,衛星和地面接收器只能同時接收有限的資訊。由於堵塞,個別船隻可能會或可能不會出現在地圖上。可以透過增加接收AIS訊號的衛星數量來擴大覆蓋範圍,但目前接收容量是有限的。

AIS(自動辨識系統)市場趨勢

車隊管理預計將佔很大佔有率

- 船隻可以透過船隊管理系統連接以共用重要資訊和最新動態。操作員可以在預先定義的區域內規劃船舶的到達和離開。這對於在擁擠的港口或預定義區域航行非常重要,因為在這些港口或預定義區域中,您必須安排僅在有限時間內可用的時段。航運公司必須為此類艙位支付費用。如果您沒有在預定時間內到達,您可能需要支付更多費用。

- 像 Big Ocean 資料這樣的公司正在為其車隊管理解決方案添加一些功能,例如五天天氣預報和基於風險的路線規劃功能。隨著歐盟(EU)計劃隨後訂定歐盟監測、報告和檢驗(MRV)法規來監測排放,船隊管理解決方案將在未來對在歐盟營運的船舶發揮關鍵作用。車隊管理系統可以減少記錄速度、燃料消費量、污染和工作統計所需的時間和精力。

- 借助船隊管理解決方案,航運公司可以即時管理其船隊,使船舶避免不可預見的天氣狀況。船隊管理人員可以前置作業時間啟動警報,以便船員及時做出決策。

預計北美將佔很大佔有率

- 美國海岸警衛隊防衛隊(USCG) 一直是北美廣泛採用和採用 AIS 的主要推動力量。美國海岸防衛隊實施國家自動識別系統 (NAIS),這是一個沿著美國海岸線和內陸水道的 AIS接收器和發送器網路。該計畫旨在增強海上情境察覺,提高航行安全並支援海上安全工作。美國海岸防衛隊對採用 AIS 的承諾體現了北美在該市場的領導地位。

- 加拿大海岸防衛隊也將實施 AIS 作為其海上安全保障工作的一部分。加拿大擁有覆蓋五大湖和聖勞倫斯航道等主要水道的國家 AIS 系統。該系統可實現船舶追蹤和防撞,並協助搜索和救援行動。加拿大海岸防衛隊對 AIS 的關注凸顯了北美在推動市場成長方面的作用。

- 北美擁有主要的 AIS 技術供應商,為市場做出了重大貢獻。例如,總部位於加拿大的 exactEarth 是基於衛星的 AIS 解決方案的領先供應商。該公司營運衛星星系,向全世界提供即時船舶追蹤資料。同樣,ORBCOMM 和 Kongsberg Maritime 等美國公司也提供 AIS 解決方案和服務,包括硬體、軟體和分析,以服務北美及其他市場。

- 北美國防和國防安全保障部門已廣泛採用 AIS 技術用於海上監視和安全目的。例如,美國國防部 (DoD) 使用 AIS資料來增強海上意識並監控船舶運動,以確保國家安全。 AIS 在國防和國防安全保障領域的應用凸顯了該地區在全球市場中的重要性。

AIS(自動辨識系統)產業概況

全球 AIS(自動識別系統)市場正趨向於分散化,因為現有參與者佔據市場主導地位。重大的技術創新和與國防安全保障機構日益加強的合作導致市場對 AIS 解決方案的需求龐大。最近的市場趨勢包括:

2022 年 6 月,新加坡海事學院 (SMI) 與新加坡國家研究基金會啟動了一項研發合作夥伴關係,即Rightship 海事人工智慧(RMAI) 研究與開發(R&D),以推進基於人工智慧(AI) 的船舶風險剖析。軟體供應商 Kongsberg Digital AS、科技公司 Wartsila Voyage Limited 和托運人 RightShip 也是合作夥伴。作為潛在合作提案的一部分,RightShip 將向新加坡 80 多名人工智慧專家提供高達 450 萬美元的研究津貼。

Accelleron 於 2022 年 6 月更名為 ABB 渦輪增壓子公司,已分別與 Hoppe Marine 和 Danelec Marine 簽署了兩項新的資料收集和分析合作協議。與 Danelec 的新聯合服務將結合 Axelon 的船舶性能分析系統“Tekomar XPERT”與海事物聯網 (IoT) 產品“DanelecConnect”,提供即時營運資料。資料是從船舶系統收集的,例如自動化系統、航行資料記錄器、全球定位系統 (GPS)、電子海圖顯示和資訊系統 (ECDIS)、指南針、引擎、螺旋槳、AIS (自動識別系統) 和單個感測器。 Tekomar XPERT 將用於檢驗資料並就可能的效率改進和程序提供建議,以最大限度地減少港口維護和維修的停機時間。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 海上交通量增加

- 需要改善船舶停留時間和港口性能

- 市場挑戰

- 範圍和報告

第6章 技術簡介

- AIS A 類、B 類、AIS 基地台主要類

第7章 市場區隔

- 按應用

- 車隊管理

- 船舶追蹤

- 海上安全

- 其他應用(事故調查、基礎設施保護)

- 按平台

- 艦載

- 陸上

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第8章 競爭格局

- 公司簡介

- Saab AB

- Furuno Electric Co. Ltd

- ExactEarth Ltd

- Orbcomm Inc.

- Garmin Ltd

- Kongsberg Gruppen ASA

- True Heading AB

- Japan Radio Company Ltd.

- CNS Systems AB

- Wartsila OYJ Abp

- ComNav Marine Ltd

- L3 Technologies Inc.

第9章投資分析

第10章:市場的未來

The Automatic Identification System Market size is estimated at USD 410.85 million in 2025, and is expected to reach USD 572.21 million by 2030, at a CAGR of 6.85% during the forecast period (2025-2030).

The International Maritime Organization's International Convention for the Safety of Life at Sea requires automatic identification systems to be fitted in international voyaging ships with 300 or more GT ( Gross Tonnage) and passenger ships, regardless of size.

Key Highlights

- Sea freight has witnessed significant growth across the world in recent years. Considerable investments are being made for the marine industry at a global level, which has led to an increased demand for AIS, especially for vessel tracking.

- The UK planned a Maritime Trade and Investment Five-Year Plan, focusing on five main areas - Green Maritime, Digital Technologies, Autonomous Vessels, Marine Science, Maritime Professional, and Business Services. Additionally, Myanmar announced the installation of AIS on its coastal and fishing vessels to ensure maritime security. To control AIS and exchange navigation information, AIS stations are expected to be established at 19 jetties, and the range of the AIS may stretch to 48-80 kilometres.

- AIS systems transmit radio signals in the maritime VHF band, and airwaves are inherently noisy. In ports and crowded areas, bandwidths often become congested due to competing signals, which interfere with each other. Additionally, satellites and ground-based receivers may only take in limited information simultaneously. Due to this congestion, any individual vessel may drop on and off the map. More satellites receiving AIS signals shall help enhance the coverage, but currently, they are of limited receiving capacity.

Automatic Identification System (AIS) Market Trends

Fleet Management is Expected to Hold Significant Share

- Ships can connect via the fleet management system, sharing crucial information and updates. The operators can plan the arrival and departure of ships in predetermined zones. This is critical for traveling through congested ports and pre-defined zones where they must schedule slots that are only available for a limited time. The shipping businesses must pay for these slots; they may have to pay even more if they do not arrive during the scheduled time.

- Companies such as Big Ocean Data are adding capabilities to their fleet management solutions, such as a 5-day weather forecast and risk-based routing capability. As the European Union (EU) plans the subsequent EU monitoring, reporting, and verification (MRV) rule to monitor emissions, fleet management solutions will play a critical role in the future for ships operating in the EU. The fleet management system may reduce the time and effort required to record speed, fuel consumption, pollutants, and work statistics.

- With the help of fleet management solutions, shipping companies can control their fleet in real-time, due to which ships can navigate around any unforeseen climate situation. The fleet managers can now trigger alarms with no lead times, so the crew on the ships can make timely decisions.

North America is Expected to Hold Significant Share

- The United States Coast Guard (USCG) has been a key driver in promoting AIS adoption and implementation in North America. The USCG has implemented the Nationwide Automatic Identification System (NAIS), a network of AIS receivers and transmitters along the US coastline and inland waterways. This program aims to enhance maritime situational awareness, improve navigation safety, and support maritime security efforts. The USCG's commitment to AIS implementation demonstrates North America's leadership in the market.

- The Canadian Coast Guard has also prioritized AIS adoption as part of its maritime safety and security initiatives. Canada has implemented the National AIS System, which covers major waterways, including the Great Lakes and the St. Lawrence Seaway. The system enables vessel tracking and collision avoidance and aids in search and rescue operations. The Canadian Coast Guard's emphasis on AIS highlights North America's role in driving the market's growth.

- North America is home to leading AIS technology providers that have made significant contributions to the market. For instance, exactEarth, headquartered in Canada, is a major player in satellite-based AIS solutions. They operate a constellation of satellites to provide real-time vessel tracking data globally. Similarly, companies like ORBCOMM and Kongsberg Maritime, based in the United States, offer AIS solutions and services, including hardware, software, and analytics, catering to the North American market and beyond.

- North America's defense and homeland security sectors have extensively adopted AIS technology for maritime surveillance and security purposes. For example, the United States Department of Defense (DoD) utilizes AIS data to enhance maritime domain awareness and monitor vessel movements for national security purposes. These applications of AIS in defense and homeland security underline the region's significance in the global market.

Automatic Identification System (AIS) Industry Overview

The global automatic identification system market is tending toward a fragmented market as the established players in the market dominate it. Due to significant innovations and increased partnerships by the players with Homeland Security agencies, the market is leading to a massive demand for AIS solutions. The recent developments in the market are:

In June 2022, the Singapore Maritime Institute (SMI) and the National Research Foundation Singapore formed the research and development partnership Rightship Maritime Artificial Intelligence (RMAI) research and development (R&D) to promote artificial intelligence (AI)-based vessel risk profiling. Software vendor Kongsberg Digital AS, technology company Wartsila Voyage Limited, and shipper RightShip are other partners. Rightship is offering a research grant of up to USD 4.5 million to more than 80 Singaporean AI professionals as part of a potential collaboration working proposal.

In June 2022, Accelleron, the renamed ABB Turbocharging subsidiary, signed two new data collecting and analysis collaborations with Hoppe Marine and Danelec Marine, respectively. The new joint service with Danelec will provide real-time operating data by combining Accelleron's Tekomar XPERT marine performance analysis system and the DanelecConnect maritime Internet of Things (IoT) product. Data will be collected from vessel systems such as the automation system, the voyage data recorder, the global positioning system (GPS), the electronic chart display and information system (ECDIS), the gyro compass, the engine, the propeller, the automatic identification system (AIS), and individual sensors. Tekomar XPERT will be used to examine the data and provide recommendations on possible efficiency enhancements and procedures to minimize downtime for maintenance or repairs in port.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Maritime Traffic

- 5.1.2 Need for Improvement in Vessel Dwell Time and Port Performance

- 5.2 Market Challenges

- 5.2.1 Range and Reporting Capabilities

6 TECHNOLOGY SNAPSHOT

- 6.1 Major Classes of AIS Class A, Class B, and AIS Base Stations

7 MARKET SEGMENTATION

- 7.1 Application

- 7.1.1 Fleet Management

- 7.1.2 Vessel Tracking

- 7.1.3 Maritime Security

- 7.1.4 Other Applications (Accident investigation and Infrastructure Protection)

- 7.2 Platform

- 7.2.1 Vessel-Based

- 7.2.2 On-Shore

- 7.3 Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Saab AB

- 8.1.2 Furuno Electric Co. Ltd

- 8.1.3 ExactEarth Ltd

- 8.1.4 Orbcomm Inc.

- 8.1.5 Garmin Ltd

- 8.1.6 Kongsberg Gruppen ASA

- 8.1.7 True Heading AB

- 8.1.8 Japan Radio Company Ltd.

- 8.1.9 C.N.S. Systems AB

- 8.1.10 Wartsila OYJ Abp

- 8.1.11 ComNav Marine Ltd

- 8.1.12 L3 Technologies Inc.