|

市場調查報告書

商品編碼

1642014

資料中心基礎設施管理 (DCIM):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Data Center Infrastructure Management (DCIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

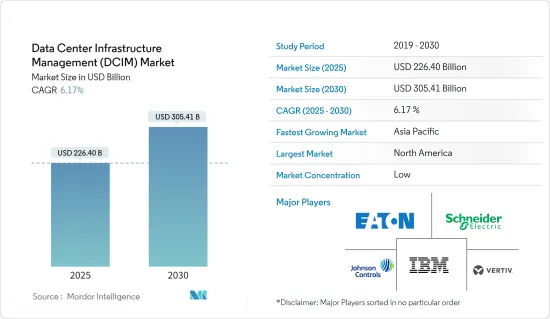

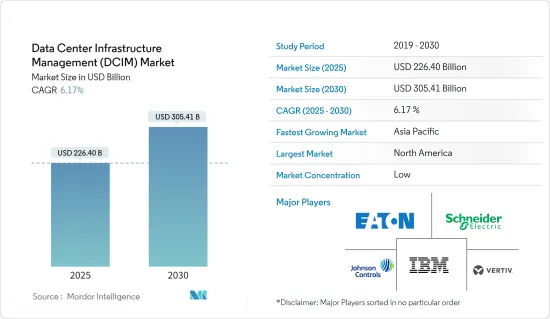

資料中心基礎設施管理 (DCIM) 市場規模預計在 2025 年為 2,264 億美元,預計到 2030 年將達到 3,054.1 億美元,預測期內(2025-2030 年)的複合年成長率為 6.17%。

資料中心基礎設施管理是 IT 經理和營運商用來有效監控、管理和最佳化資料中心設施內的基礎架構和資源的整合軟體和硬體解決方案。 DCIM 包含各種工具和技術,可協助組織規劃、營運和維護其資料中心環境。

主要亮點

- 對安全IT基礎設施和可靠、高效的資料中心營運的需求不斷增加至關重要。隨著雲端處理變得越來越重要,以及連網設備的增加,企業開始轉向資料中心來滿足IT基礎設施需求。

- 自動化和最佳化可以降低營運成本,提高營運效率並擴大規模。自動化工具可以提高資料中心的效能和效率,減少管理IT基礎設施所需的時間和精力。另一方面,最佳化工具可以讓您深入了解基礎設施,以便您做出明智的選擇。

- 消費者服務和企業對雲端資源和資料中心的需求不斷成長,導致了大型公共雲端資料中心的發展。預計這些因素將對DCIM市場的發展產生影響。

- 此外,隨著世界各地的企業出於資料安全和更容易恢復的好處而將工作負載轉移到雲端服務,對資料中心的實體和網路基礎設施的維護需求正在增加。

- 從資本支出和能源效率費用的角度來看,將伺服器置於資料中心已被證明是有利的。然而,成本上升正在阻礙市場成長。具體來說,由於工程師為提高效率而通勤增加而導致的服務需求上升、資料安全問題以及對資料中心設施的依賴增加而產生的困難是這種成長的主要原因。

- 在後疫情時代,隨著企業對數位科技的依賴越來越大,對 DCIM 解決方案的需求預計將會增加。由於物聯網技術的日益普及、智慧型裝置的普及以及數位交易量的不斷成長,資料中心的建立預計將增加對 DCIM 解決方案和服務的需求。

資料中心基礎設施管理 (DCIM) 市場趨勢

醫療保健產業預計將成長

- 由於將醫院資訊中心更新為新的經營模式有助於改善醫療服務的成本、品質和交付,醫療保健產業對資料中心基礎設施管理的需求日益增加。 《健康保險隱私及責任法》、《一般資料保護條例》和其他一些強制法規要求醫療保健專業人員對病患資料負責。 DCIM 必須監控使用者存取並確保工作負載基礎架構正確安裝和保護。

- 此外,資料中心是電子健康記錄的安全中心,可以輕鬆存取重要的病患資訊。為了確保全面的護理,交換醫療資訊平台將進一步促進不同醫療機構之間的資料安全共用。例如,從2023年第四季開始的90天內,義大利艾米利亞-羅馬涅大區選擇了電子健康記錄,約81%的人口選擇了電子健康記錄。

- 此外,DCIM 使醫療保健提供者能夠儲存、處理和深入分析大量患者資訊。這些分析有助於識別趨勢、模式和可能的爆發,從而改善決策和患者結果。

- 透過物聯網連接的醫療設備傳輸患者資料進行即時監控。資料中心將提供管理和處理這些資料所需的基礎設施,使患者能夠就其醫療保健做出更明智的決定,並協助有效管理藥房和庫存系統。最佳化了供應鏈。

北美預計將成長

- 該地區成長的主要驅動力之一是早期採用IT基礎設施管理軟體和服務。該地區無線寬頻、雲端處理和巨量資料分析的成長將推動對資料中心基礎設施的額外需求。

- 由於物聯網和邊緣運算技術的廣泛採用,北美對 DCIM 解決方案的需求正在增加,這些技術正在資料中心創建龐大的資料集。預計在預測期內,DCIM 解決方案市場將受到資料中心營運商優先考慮資源建置和選擇主機託管服務作為基礎設施管理服務的推動。

- 該地區也是亞馬遜、微軟和谷歌等一些全球最大資料中心營運商的所在地,在擴大其 DCIM 市場佔有率方面發揮關鍵作用。北美市場也受到該地區企業擴大採用 DCIM 解決方案的推動。投資 DCIM 解決方案以提高業務效率的企業已經意識到有效資料中心管理的必要性。

- 為了降低能耗、提高能源效率,資料中心正逐步採用DCIM系統。隨著資料中心和企業採用DCIM解決方案和節能資料中心的需求不斷增加,北美市場預計未來幾年將進一步成長。

資料中心基礎設施管理 (DCIM) 產業概覽

資料中心基礎設施管理市場的競爭格局較為分散,主要參與者包括 Vertiv Group Corp、施耐德電機 SE、江森自控國際 PLC、伊頓公司 PLC 和 IBM 公司。透過不斷提供創新產品,我們獲得了相對於其他參與者的競爭優勢。透過策略夥伴關係、研發和併購,我們在市場上站穩了腳步。

- 2024 年 3 月:推出自助式線上工具,協助設計和建構預製模組化資料中心。 Vertiv Modular Designer Lite 是一款基於 Web 的應用程式,用於配置 Vertiv 的 SmartMod 和 SmartMod Max 預製模組化資料中心。一個方便用戶使用的基於網路的應用程式,可簡化模組化設計流程。

- 2024年3月,Schneider Electric宣布與Nvidia合作,最佳化資料中心基礎設施,為邊緣人工智慧(AI)數位雙胞胎技術的突破性進步鋪平道路。同時,它將推出第一個公開可用的AI資料中心參考設計,利用資料中心基礎設施專業知識和NVIDIA先進的AI技術。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估新冠肺炎疫情對產業的影響

第5章 市場動態

- 市場促進因素

- 管理資料中心能源消耗的需求日益成長

- 資料中心數量不斷增加

- 市場挑戰

- 需要增強實體和網路基礎設施的安全性

第6章 市場細分

- 依資料中心類型

- 中小型資料中心

- 大型資料中心

- 企業資料中心

- 依部署類型

- 本地

- 搭配

- 按最終用戶

- IT

- BFSI

- 衛生保健

- 製造業

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Vertiv Group Corp.

- Schneider Electric SE

- Johnson Controls International PLC

- Eaton Corporation PLC

- IBM Corporation

- Siemens AG

- ABB Ltd

- FNT GmbH

- Nlyte Software Inc.

- Itracs Corporation Inc.(CommScope Inc.)

第 8 章 供應商排名分析

第9章投資分析

第10章:市場的未來

The Data Center Infrastructure Management Market size is estimated at USD 226.40 billion in 2025, and is expected to reach USD 305.41 billion by 2030, at a CAGR of 6.17% during the forecast period (2025-2030).

To effectively monitor, manage, and optimize the infrastructure and resources in a data center facility, data center infrastructure management is an integrated software and hardware solution used by IT managers and operators. DCIM encompasses various tools and technologies that help organizations plan, operate, and maintain their data center environments.

Key Highlights

- Due to the rising demand for secure IT infrastructure and reliable, efficient data center operations have become essential. As the importance of cloud computing increases, companies are turning to data centers for their IT infrastructure requirements as they connect to more interconnected devices.

- Automation and optimization make it possible to reduce operating costs, improve the efficiency of operations, and scale up. Automated tools improve the performance and efficiency of data centers and allow organizations to reduce the amount of time and effort needed for IT infrastructure management, while optimization tools enable them to gain insight into their infrastructures so that they can make informed choices.

- The increasing demand for cloud resources and data centers in terms of consumer services and business has led to the development of a large-scale public cloud data center. Factors are expected to influence the development of the DCIM market.

- Moreover, the demand for the maintenance of physical and network infrastructure in data centers is increasing as enterprises across the world move their workloads to cloud services due to data security and easy recovery benefits that come with them.

- In terms of capital expenditure and energy efficiency charges, the establishment of servers in data centers has proven to be advantageous. However, the growth of the market was hampered by the increase in costs. Increasing demand for services, in particular, as a result of the increased number of engineers commutating to achieve better efficiency, data security problems, and difficulties arising from greater dependency on data center facilities are largely responsible for this increase.

- The demand for DCIM solutions is expected to increase in the post-COVID era as businesses rely on digital technologies. The establishment of data centers is expected to increase the demand for DCIM solutions and services, driven by the increasing use of Internet of Things technology, smart device proliferation, and a rise in digital transaction volumes.

Data Center Infrastructure Management (DCIM) Market Trends

The Healthcare Industry is Expected to Witness Growth

- The healthcare industry is growing in demand for data center infrastructure management, as it helps to improve the cost, quality, and delivery of medical services by updating hospital information centers with new business models. The HIPPA Act, the General Data Protection Regulation, and several further compulsory provisions require that healthcare professionals be held responsible for patient data. The DCIM shall monitor user access and ensure the workload infrastructure is properly installed and secured.

- Moreover, data centers are a secure hub for electronic medical records, allowing easy access to critical patient information. In order to ensure comprehensive care, health information exchange platforms further facilitate the sharing of secure data between different healthcare facilities. For example, in the last 90 days, from the fourth quarter of 2023, according to Ministero della Salute, the Italian region of Emilia-Romagna opted for electronic health records, with around 81% of the population choosing to do so.

- In addition, DCIM enables healthcare providers to keep and process vast amounts of information on patients to analyze it with insight. These analyses help to identify trends, patterns, and possible outbreaks and increase decision-making and patient outcomes.

- Connected medical devices, driven by IoT, transmit patient data for real-time monitoring. Data centers provide the infrastructure needed for managing and processing this data, enabling patients to make more informed decisions on their medical care and assisting with the effective management of pharmacies and inventory systems to ensure the availability of medicines, prevent shortages, and optimize supply chains.

North America is Expected to Witness Growth

- One of the major drivers of growth in this region is the adoption of IT infrastructure management software and services at an earlier stage. The demand for additional data center infrastructure is driven by the growth of wireless broadband, cloud computing, and big data analysis in this area.

- In North America, due to the high adoption rate of the Internet of Things and edge computing technologies that are creating massive data sets in data centers, there is an increasing demand for DCIM solutions. The market for DCIM solutions is expected to be driven by data center operators' priority of building their resources and choosing colocation services as an infrastructure management service during the forecast period.

- The region is also home to some of the world's biggest data center operators, such as Amazon, Microsoft, and Google, which have played an important role in increasing the DCIM market's share. The North American market is also driven by the growing adoption of DCIM solutions among companies across the region. Enterprises investing in DCIM solutions to improve the efficiency of their operations are becoming aware of the need for effective data center management.

- In order to reduce energy consumption and increase energy efficiency, data centers are gradually adopting DCIM systems. The North American market is expected to grow further over the coming years as demand for data centers increases and businesses adopt DCIM solutions and energy-saving data centers.

Data Center Infrastructure Management (DCIM) Industry Overview

The competitive rivalry in the data center infrastructure management market is high and fragmented owing to some major players, such as Vertiv Group Corp, Schneider Electric SE, Johnson Controls International PLC, Eaton Corporation PLC, and IBM Corporation. Their continually innovating offerings have given them a competitive advantage over other players. They have obtained a stronger foothold in the market through strategic partnerships, R&D, and mergers and acquisitions.

- March 2024: Vertiv released a self-service online tool to help customers design and configure prefabricated modular data centers. Vertiv Modular Designer Lite is a web-based application that configures Vertiv's SmartMod and SmartMod Max prefabricated modular data centers. It is a 'user-friendly' web-based application that streamlines the module design process.

- March 2024: Schneider Electric announced a collaboration with Nvidia to optimize data center infrastructure and pave the way for groundbreaking advancements in edge artificial intelligence (AI) and digital twin technologies and, along with it, be able to leverage its expertise in data center infrastructure and NVIDIA's advanced AI technologies to introduce the first publicly available AI data center reference designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of the COVID-19 Pandemic on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need to Manage Energy Consumption Across Data Centers

- 5.1.2 Increase in the Number of Data Centers

- 5.2 Market Challenges

- 5.2.1 Need for Heightened Security for Physical and Network Infrastructures

6 MARKET SEGMENTATION

- 6.1 By Data Center Type

- 6.1.1 Small and Medium-sized Data Centers

- 6.1.2 Large Data Centers

- 6.1.3 Enterprise Data Centers

- 6.2 By Deployment Type

- 6.2.1 On-premise

- 6.2.2 Colocation

- 6.3 By End User

- 6.3.1 IT

- 6.3.2 BFSI

- 6.3.3 Healthcare

- 6.3.4 Manufacturing

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vertiv Group Corp.

- 7.1.2 Schneider Electric SE

- 7.1.3 Johnson Controls International PLC

- 7.1.4 Eaton Corporation PLC

- 7.1.5 IBM Corporation

- 7.1.6 Siemens AG

- 7.1.7 ABB Ltd

- 7.1.8 FNT GmbH

- 7.1.9 Nlyte Software Inc.

- 7.1.10 Itracs Corporation Inc. (CommScope Inc.)