|

市場調查報告書

商品編碼

1642038

現場可程式閘陣列(FPGA) -市場佔有率分析、產業趨勢與成長預測(2025-2030)Field Programmable Gate Array (FPGA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

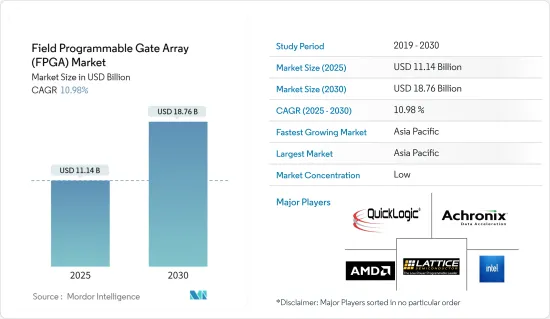

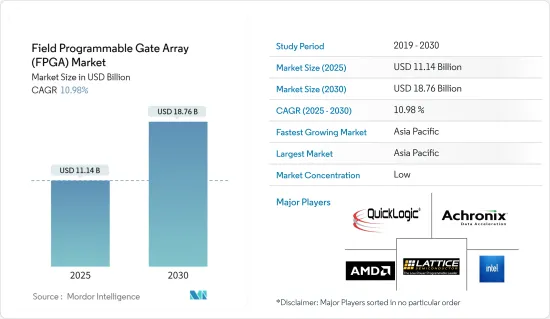

現場可程式閘陣列市場規模預計在 2025 年為 111.4 億美元,預計到 2030 年將達到 187.6 億美元,預測期內(2025-2030 年)的複合年成長率為 10.98%。

FPGA(現場可程式閘陣列)是一種具有可程式硬體結構的積體電路。與 ASIC 和圖形處理單元 (GPU) 不同,FPGA 晶片中的電路不是永久蝕刻的,可以根據需要重新編程。這種靈活性使 FPGA 成為 ASIC 的可行替代品,因為 ASIC 需要大量的開發時間和設計和製造投資。

關鍵亮點

- 因此,FPGA 加速了物件運動追蹤、視訊串流和語音辨識等即時場景的執行。高效能運算的需求不斷成長以及神經網路的日益複雜進一步凸顯了 FPGA 在現代技術中的重要性。隨著產業的不斷發展,FPGA 在促進高階運算任務方面發揮越來越重要的作用,使其成為各種高階應用的必需品。

- FPGA 的節能和可自訂的加速功能使其在資料中心和適應性雲端運算系統中變得越來越重要。英特爾、微軟、亞馬遜、百度、IBM 和華為等領先公司正在將 FPGA 整合到其雲端和資料中心服務中,使應用程式開發人員可以輕鬆使用它們。這種整合使開發人員能夠利用 FPGA 的高效能和低功耗來提高其應用程式的效率和可擴展性。除了商業應用外,世界各地的許多學術和研究舉措在利用 FPGA 實現遠端加速和提高用戶靈活性。這些舉措旨在探索新的應用並增強現有的應用,利用 FPGA 的獨特性能推動各個領域的創新和技術進步。

- 例如,2024 年 10 月,AMD 宣布推出 AMD Alveo UL3422,這是其破紀錄的加速器系列的最新成員。 Alveo UL3422 為貿易公司、做市商和金融機構提供緊湊、機架空間和成本最佳化的加速器。 Alveo UL3422 採用纖薄的全高半長 (FHHL)外形規格,可無縫整合到各種伺服器和主機託管交換資料中心。與前代產品相比,Alveo UL3422 的端口密度、板載內存和連接選項有所降低,但仍由相同的 AMD Virtex UltraScale+ VU2P FPGA 提供支持,可確保超低延遲性能。

- FPGA 為各種汽車子系統提供動力,包括車載資訊娛樂系統、高級駕駛輔助系統 (ADAS) 以及混合動力汽車和電動車的充電系統。隨著科技的進步,FPGA 的速度越來越快,價格也越來越便宜。 FPGA 在汽車應用領域的採用也迅速增加。例如,英特爾正在將 FPGA 整合到 HUD 顯示器、主機硬體、安全功能等中,以擴大車載應用的範圍。儘管存在一定的成本和性能限制,但 FPGA 越來越能滿足許多駕駛員希望購買的下一代汽車即軟體定義汽車的要求。

- 儘管 FPGA 具有吸引人的優勢,但它們也存在效能下降和功耗增加等固有缺點。例如,由於 FPGA 具有可程式架構,因此其功耗通常比 ASIC 更高。功耗的增加是由於可配置邏輯塊、互連和其他資源賦予了 FPGA 靈活性。在優先考慮能源效率的應用中,這樣的功率需求可能是一個重大缺點。此外,由於 FPGA 是可程式設計的,因此它們在面積、功耗和效能方面會產生開銷,因此不適合需要最高效率和速度的應用。

- 在複雜的地緣政治環境下,以色列與哈馬斯之間持續的衝突有可能擾亂全球半導體產業。以色列在積體電路(IC)生產和創新中發揮關鍵作用,這可以影響全球 FPGA 使用的半導體裝置的價格和可得性。

- 此外,2024年6月,英特爾計劃取消在以色列建造價值250億美元的新晶片製造廠的計畫。這可能會間接降低基於 FPGA 應用的解決方案的可得性和生產量,從而影響預測期內的全球市場。

現場可程式閘閘陣列(FPGA) 市場趨勢

IT和通訊佔據較大的市場佔有率

- IT 和通訊公司正在使用 FPGA 進行人工智慧 (AI) 和機器學習 (ML) 等高效能運算應用。 FPGA 支援影像識別、自然語言處理和巨量資料分析等任務的客製化演算法,並且通常比傳統的 CPU 和 GPU 更有效率。

- 5G 網路正在迅速擴張,需要高速、低延遲的資料處理才能達到最佳效能。 FPGA 非常適合滿足這些需求,尤其是在 5G基地台和邊緣運算領域。 FPGA 加速資料處理並專業地管理呈指數成長的流量。隨著5G基礎設施的不斷發展,核心和邊緣應用對FPGA的需求只會增加。

- GSMA預測,到2030年,中國的5G連線數將超過16億,佔全球整體的近三分之一。此外,VIAVI Solutions 強調,到 2023 年 4 月,美國將在 503 個城市的 5G網路存取方面領先全球,超過中國的 356 個城市。這些新興市場的發展有可能創造巨大的市場機會。

- 隨著資料流量不斷飆升以及連網設備數量的不斷成長,特別是在物聯網和通訊,網路安全和快速資料處理比以往任何時候都更加重要。透過硬體加速加密和安全資料處理,FPGA 可以快速適應不斷變化的安全需求。這種適應性使得 FPGA 對於網路營運商克服複雜的處理挑戰並保護大量資料至關重要。

- 隨著物聯網領域的不斷擴大,特別是在通訊領域,對能夠管理來自無數設備的多樣化資料流的多功能、節能的運算解決方案的需求日益成長。 FPGA 在物聯網閘道和邊緣運算領域佔有一席之地,能夠實現本地資料處理,從而減少延遲並節省頻寬。

亞太地區將經歷大幅成長

- 中國的現場可程式閘閘陣列市場正從高度依賴海外供應商轉向培育強大的國內生態系統,以抑制對進口的依賴。地緣政治因素,特別是貿易緊張和出口管制,凸顯了技術自力更生的迫切性。因此,高雲半導體、深圳磐石微系統和上海安路基資訊科技有限公司等國內參與企業紛紛湧現,專注於創新,與全球企業競爭。此外,市場正在經歷研發投資的激增,目的是開發用於高階應用的尖端 FPGA。

- 5G技術的出現已成為中國採用FPGA的關鍵催化劑。由於其高效的資料處理和訊號傳輸,FPGA 已成為基地台和更廣泛的網路基礎設施中不可或缺的一部分。基地台數量將從2019年的15萬個飆升至2023年的338萬個。中國工業部資料顯示,截至2024年8月底,5G基地台數量已超過404萬個,佔全國行動基地台總數的32.1%。工信部進一步強調,中國5G行動用戶已達9.66億。

- 日本在機器人、汽車、電子和精密製造領域佔據主導地位,並利用 FPGA 技術增強其競爭地位。瑞薩電子株式會社、NEC株式會社、Socionext Inc.等國內製造商正為日本現場可編程閘陣列市場做出越來越大的貢獻,並在日本先進技術生態系統中發揮著舉足輕重的作用。

- 隨著美國科技競爭加劇,日本正策略性地加強其半導體產業。 2022年至2025年期間,日本將向半導體領域投資257億美元,相當於國內生產總值(GDP)的0.71%。這項投資承諾非常出色,遠遠超過了其他工業國家為半導體產業提供的國家補貼。

- 印度現場可程式閘閘陣列市場已經從有限的學術和小眾工業用途發展到通訊、汽車和航太等領域的廣泛應用。印度擁有價值 2,500 億美元的 IT 產業,不僅是全球人工智慧生態系統的重要參與企業,也為全球許多銀行、製造商和企業提供服務。

現場可程式閘陣列(FPGA) 產業概況

競爭程度取決於影響所研究市場的各種因素,例如品牌身份驗證、強大的競爭策略和透明度。調查的市場包括Xilinx Inc.(AMD Corporation)、Lattice Semiconductor Corporation、Intel Corporation和Microchip Technology Incorporated等知名供應商,因此競爭高度整合。由於整合不斷加強、技術進步和地緣政治情勢的變化,研究市場正在發生變化。

在一個透過創新獲得永續競爭優勢相當高的市場中,由於來自終端用戶產業(如物聯網)的新客戶需求預計將激增,競爭也將加劇,而物聯網將推動對連網型設備邊緣運算的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第 3 章執行摘要和主要發現

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 宏觀經濟趨勢對產業的影響

第5章 市場動態

- 市場促進因素

- 物聯網需求不斷成長

- 汽車產業和日益增強的技術創新有望推動市場

- 市場限制

- 與 ASIC 相比功耗更高

第6章 市場細分

- 按成分

- 高階 FPGA

- 中階FPGA/低階 FPGA

- 按建築分類

- 基於 SRAM 的 FPGA

- 基於耐熔熔絲的 FPGA

- 基於快閃記憶體的 FPGA

- 按最終用戶產業

- 資訊科技/通訊

- 消費性電子產品

- 車

- 工業的

- 軍事和航太

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Advanced Micro Devices, Inc.

- Lattice Semiconductor Corporation

- QuickLogic Corporation

- Intel Corporation

- Achronix Semiconductor Corporation

- GOWIN Semiconductor Corp.

- Microchip Technology Incorporated

- Efinix, Inc.

8.供應商市場佔有率分析

第9章投資分析

第10章:投資分析市場的未來

The Field Programmable Gate Array Market size is estimated at USD 11.14 billion in 2025, and is expected to reach USD 18.76 billion by 2030, at a CAGR of 10.98% during the forecast period (2025-2030).

Field-programmable gate arrays (FPGAs) are integrated circuits featuring a programmable hardware fabric. In contrast to ASICs and graphics processing units (GPUs), the circuitry within an FPGA chip is not permanently etched; it can be reprogrammed as needed. This flexibility positions FPGAs as a viable alternative to ASICs, which demand extensive development time and substantial investment in design and fabrication.

Key Highlights

- Consequently, FPGAs accelerate execution in real-time scenarios such as object motion tracking, video streaming, and speech recognition. The growing demand for high-performance computing and the increasing complexity of neural networks further underscore the importance of FPGAs in modern technology. As industries continue to evolve, the role of FPGAs in facilitating advanced computational tasks becomes increasingly critical, making them indispensable in various high-stakes applications.

- FPGAs are becoming increasingly vital in data centers and adaptable cloud computing systems due to their energy-efficient and customizable acceleration capabilities. Major players such as Intel, Microsoft, Amazon, Baidu, IBM, and Huawei are integrating FPGAs into their cloud and data center services, making them readily available to application developers. This integration empowers developers to harness the high performance and low power consumption of FPGAs, boosting the efficiency and scalability of their applications. In addition to commercial applications, many academic and research initiatives worldwide utilize FPGAs for remote acceleration and user flexibility. These initiatives seek to explore novel applications and enhance existing ones, leveraging the distinct advantages of FPGAs to foster innovation and technological progress across diverse domains.

- For instance, in October 2024, AMD unveiled its latest addition to the record-breaking family of accelerators, the AMD Alveo UL3422, specifically designed for ultra-low latency electronic trading applications. The Alveo UL3422 offers trading firms, market makers, and financial institutions a compact accelerator optimized for rack space and cost, ensuring a swift deployment across various servers. Packaged in a slim FHHL (full height, half length) form factor, the Alveo UL3422 seamlessly integrates into diverse servers and co-location exchange data centers. While the Alveo UL3422 reduces port density, onboard memory, and connectivity options compared to its predecessor, it retains the same AMD Virtex UltraScale+ VU2P FPGA, ensuring ultra-low latency performance.

- FPGAs are enhancing various automotive subsystems, such as in-vehicle infotainment, advanced driver assistance systems (ADAS), and charging systems in hybrid and electric vehicles. Thanks to technological advancements, FPGA performance speeds are on the rise, and their prices are becoming more accessible. Their adoption in automotive applications is also witnessing a notable surge. For instance, Intel is broadening the chip's automotive applications, integrating it into HUD displays, head unit hardware, safety features, and beyond. Despite certain cost and performance constraints, FPGAs are increasingly aligning with the demand for next-generation, software-defined vehicles many drivers seek.

- FPGAs offer compelling advantages, but they also come with inherent drawbacks, such as lower performance and higher power consumption. For example, FPGAs, due to their programmable architecture, generally consume more power than ASICs. This increased power consumption stems from the configurable logic blocks, interconnects, and other resources that provide FPGAs with their flexibility. Such power demands can be a significant drawback in applications prioritizing energy efficiency. Furthermore, the very programmability of FPGAs introduces overheads in area, power consumption, and performance, rendering them less ideal for applications demanding peak efficiency and speed.

- The ongoing conflict between Israel and Hamas, amid geopolitical complexities, threatens to disrupt the global semiconductor industry. Israel plays a significant role in Integrated Circuit (IC) production and innovation, which can impact the price and availability of semiconductor devices worldwide used in FPGAs.

- Additionally, in June 2024, Intel Corporation plans to stop building a new chip manufacturing plant worth USD 25 billion in Israel. This could indirectly lower the availability and production volume of solutions based on FPGA applications and impact the global market during the forecast period.

Field Programmable Gate Array (FPGA) Market Trends

IT and Telecommunication Holds Significant Market Share

- IT and telecommunication companies leverage FPGAs for high-performance computing applications, such as artificial intelligence (AI) and machine learning (ML). FPGAs support customized algorithms for tasks like image recognition, natural language processing, and big data analytics, often more efficiently than traditional CPUs and GPUs.

- 5G networks are rapidly expanding, necessitating high-speed and low-latency data processing for optimal performance. FPGAs are ideally positioned to fulfill these demands, especially in 5G base stations and edge computing. They accelerate data processing and adeptly manage the surge in traffic. With the continuous evolution of 5G infrastructure, the appetite for FPGAs in core and edge applications is on the rise.

- According to projections by GSMA, by 2030, China will boast over 1.6 billion 5G connections, representing nearly a third of the global tally. In addition, VIAVI Solutions highlights that by April 2023, the U.S. led globally with 5G network access spanning 503 cities, outpacing China's 356 cities. These developments are poised to unlock significant market opportunities.

- As data traffic surges and the number of connected devices, particularly in IoT and telecommunications, continues to grow, the importance of network security and swift data processing has never been more pronounced. FPGAs, with their capability for hardware-accelerated encryption and secure data processing, adapt swiftly to evolving security demands. This adaptability makes them indispensable for network operators safeguarding vast data while navigating intricate processing challenges.

- The expanding realm of IoT, especially within telecommunications, underscores the demand for versatile, energy-efficient computing solutions adept at managing diverse data streams from myriad devices. FPGAs are carving a niche in IoT gateways and edge computing, enabling local data processing that curtails latency and conserves bandwidth.

Asia Pacific to Register Major Growth

- China's field programmable gate array market has transitioned from heavy reliance on international suppliers to cultivating a robust domestic ecosystem, all in a bid to curtail import dependency. Geopolitical factors, notably trade tensions and export controls, have accentuated the urgency for technological self-reliance. Consequently, domestic players like GOWIN Semiconductor, Shenzhen Pango Microsystems Co., Ltd, and Shanghai Anlogic Infotech Co., Ltd, among others, have risen to prominence, channeling their efforts into innovations to rival established global entities. Furthermore, the market has witnessed a surge in R&D investments, aiming to craft sophisticated FPGAs tailored for high-end applications.

- The advent of 5G technology has emerged as a pivotal catalyst for FPGA adoption in China. With their prowess in efficient data processing and signal transmission, FPGAs have become indispensable in base stations and broader network infrastructures. The count of base stations skyrocketed from 0.15 million in 2019 to 3.38 million in 2023. Data from China's Ministry of Industry and Information Technology reveals that by the close of August 2024, the nation had eclipsed 4.04 million 5G base stations, accounting for 32.1% of the country's total mobile base stations. Additionally, the ministry highlighted that China's 5G mobile subscriber count reached an impressive 966 million.

- Japan, renowned for its leadership in robotics, automotive, electronics, and high-precision manufacturing, has harnessed FPGA technology to bolster its competitive edge. Local manufacturers, including Renesas Electronics Corporation, NEC Corporation, and Socionext Inc., have increasingly contributed to the country's field programmable gate array market, which plays a pivotal role in Japan's advanced technology ecosystem.

- Amid the escalating technological rivalry between the United States and China, Japan is strategically bolstering its semiconductor industry. The nation is channeling 0.71% of its gross domestic product (GDP), equating to USD 25.7 billion, into the semiconductor sector from 2022 to 2025. This investment commitment stands out, being notably more substantial than the state subsidies provided by other industrial nations to their semiconductor sectors.

- The field programmable gate array market in India has transitioned from limited academic and niche industrial applications to widespread adoption in sectors like telecommunications, automotive, and aerospace. With a USD 250 billion IT industry, India is not only a significant player in the global AI ecosystem but also caters to many of the world's banks, manufacturers, and firms.

Field Programmable Gate Array (FPGA) Industry Overview

The degree of competition depends on various factors affecting the market studied, such as brand identity, powerful competitive strategy, and degree of transparency. The market studied has prominent vendors, including Xilinx Inc. (AMD Corporation), Lattice Semiconductor Corporation, Intel Corporation, and Microchip Technology Incorporated, which makes it highly consolidated and competitive. With growing consolidation, technological advancement, and geopolitical scenarios, the market studied is witnessing changes.

In a market where sustainable competitive advantage through innovation is considerably high, the competition will only increase, considering the anticipated surge in demand from new customers from the end-user industries, such as IoT, in which edge computing in connected devices has been witnessing increasing demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for IoT

- 5.1.2 Automotive Industry and Increasing Innovations are Expected to Drive the Market

- 5.2 Market Restraints

- 5.2.1 High Power Consumption Compared to ASIC

6 MARKET SEGMENTATION

- 6.1 By Configuration

- 6.1.1 High-end FPGA

- 6.1.2 Mid-range FPGA/Low-end FPGA

- 6.2 By Architecture

- 6.2.1 SRAM-based FPGA

- 6.2.2 Anti-fuse based FPGA

- 6.2.3 Flash-based FPGA

- 6.3 By End-user Industry

- 6.3.1 IT and Telecommunication

- 6.3.2 Consumer Electronics

- 6.3.3 Automotive

- 6.3.4 Industrial

- 6.3.5 Military and Aerospace

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.3.5 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advanced Micro Devices, Inc.

- 7.1.2 Lattice Semiconductor Corporation

- 7.1.3 QuickLogic Corporation

- 7.1.4 Intel Corporation

- 7.1.5 Achronix Semiconductor Corporation

- 7.1.6 GOWIN Semiconductor Corp.

- 7.1.7 Microchip Technology Incorporated

- 7.1.8 Efinix, Inc.