|

市場調查報告書

商品編碼

1642040

木地板:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Wood Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

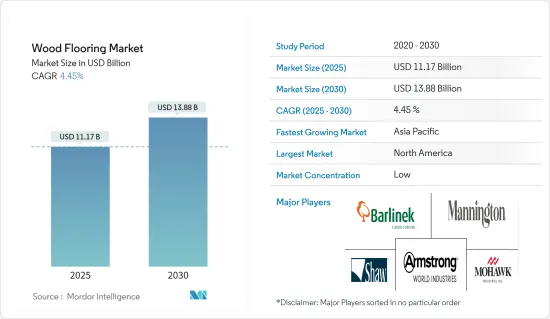

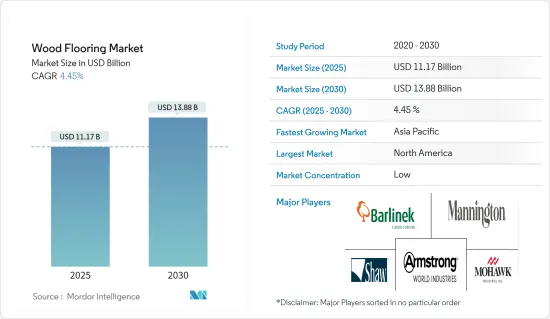

預計 2025 年木地板市場規模為 111.7 億美元,到 2030 年將達到 138.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.45%。

多年來,隨著都市化進程加快、可支配收入增加、對永續建築材料認知的不斷提高以及消費者對美觀耐用地板選擇的偏好發生變化,木地板市場經歷了顯著的成長和演變。

木地板市場成長的主要驅動力之一是永續性和環保意識的增強。由於對氣候變遷和森林砍伐的擔憂,人們越來越傾向於環保建築材料。特別是,來自森林的木地板引起了有環保意識的消費者的共鳴,因為它得到了永續管理,並獲得了森林管理委員會 (FSC) 等組織的認證。為了滿足這種需求,製造商提供各種永續木地板解決方案,包括再生木材和竹地板。

室內設計客製化和個性化的趨勢日益成長,推動了對具有獨特紋理、飾面和顏色的木地板產品的需求。透過使用數位印刷和染色技術,製造商正在創造出模仿稀有樹種或具有複雜圖案的木地板設計,使消費者能夠實現他們想要的美感,而無需承擔與稀有或異國風材料相關的高成本和環境影響。

木地板市場趨勢

複合木地板推動市場成長

相對於實木地板,複合地板的市場佔有率較大。工程木材比硬木尺寸更穩定,並且不太可能因溫度或濕度的變化而膨脹或收縮。這種穩定性使得工程木材可以安裝在不適合使用實木的環境中,例如地下室或有加熱地板的房間。此外,工程木材的價格通常比實心硬木低,但外觀卻相似。

複合木地板通常使用實木作為頂層,增強硬木的自然美感、溫暖感和耐用性。與強化地板相比,工程木材具有更真實的外觀和感覺,因為它使用的是真正的木質飾面而不是印刷圖像。工程木材的多功能性、耐用性和美觀性使其成為尋求高品質地板的住宅的熱門選擇。

北美引領木地板市場

受建設活動增加、改造和裝修計劃增加以及對環保和永續建築材料的偏好日益增加等因素影響,北美木地板市場正在穩步成長。在美國和加拿大,實木地板歷來是一種受歡迎的選擇,因其永恆的吸引力和耐用性而受到重視。然而,近年來,複合木地板由於其增強的穩定性、多功能性和防潮性而獲得了廣泛支持,使其適用於各種應用,包括潮濕地區和輻射供暖系統。

此外,對經森林管理委員會 (FSC) 認證機構認證的木地板產品的需求不斷成長,反映出消費者對環境永續性的意識不斷增強。更寬的木板寬度、紋理飾面和再生木材的使用等趨勢正在促進北美木地板市場的多樣性。製造技術的進步帶來了創新的木地板產品,滿足了不斷變化的消費者需求和興趣。總體而言,北美木地板市場充滿活力且競爭激烈,都市化、設計趨勢和永續實踐的進步等因素提供了成長機會。

木地板產業概況

木地板市場競爭激烈,幾個主要企業佔據市場主導地位。 Mohawk Industries、Armstrong World Industries、Mannington Mills Inc.、Barlinek SA 和 Shaw Industries Group 等公司都是知名參與者,提供各種各樣的木地板產品。此外,還存在著來自專注於細分市場或特定區域的地區性和本地性的公司的競爭。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 建築和裝修活動增加

- 更重視永續和環保產品

- 市場限制

- 來自替代地板市場的競爭

- 原物料價格上漲

- 市場機會

- 木地板技術的進步,包括改進的表面處理和安裝技術

- 客製化和設計趨勢日益興起

- 價值鏈分析

- 產業吸引力:波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察產業技術進步

- COVID-19 市場影響

第5章 市場區隔

- 按產品

- 實木

- 工程木材

- 按分銷管道

- 家裝中心

- 旗艦店

- 專賣店

- 網路商店

- 按最終用戶

- 住宅

- 商業的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Mohawk Industries

- Armstrong World Industries

- Mannington Mills Inc.

- Barlinek SA

- Shaw Industries Group

- Beaulieu International Group

- Home Legend LLC

- Provenza Floors Inc.

- Boral Limited

- Tarkett SA*

第7章 未來市場趨勢

第8章 免責聲明和出版商

The Wood Flooring Market size is estimated at USD 11.17 billion in 2025, and is expected to reach USD 13.88 billion by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The wood flooring market has witnessed significant growth and evolution over the years, driven by increasing urbanization, rising disposable income, growing awareness of sustainable construction materials, and changing consumer preferences for aesthetic and durable flooring options.

One of the key drivers behind the growth of the wood flooring market is the increasing emphasis on sustainability and environmental consciousness. With concerns about climate change and deforestation, there's a growing preference for eco-friendly building materials. Particularly, wood flooring that is sourced from forests is sustainably managed and has certification from groups like the Forest Stewardship Council (FSC), which resonates well with environmentally conscious consumers. In response to this demand, manufacturers are providing a variety of sustainable wood flooring solutions, including reclaimed wood and bamboo flooring, which are gaining popularity due to their eco-friendly attributes.

The growing trend of customization and personalization in interior design is fueling the demand for wood flooring products that offer unique textures, finishes, and colors. Manufacturers are leveraging digital printing and staining techniques to create wood flooring designs that mimic rare wood species or feature intricate patterns, allowing consumers to achieve their desired aesthetic without the high cost or environmental impact associated with rare or exotic woods.

Wood Flooring Market Trends

Engineered Wood Flooring is Boosting the Market's Growth

Engineered wood flooring holds a larger market share compared to solid wood flooring. Engineered wood is dimensionally more stable than solid hardwood, featuring less expansion and contraction with changes in temperature and humidity. This stability allows engineered wood to be installed in environments where solid hardwood may not be suitable, such as basements or rooms with underfloor heating systems. Additionally, engineered wood is often available at a lower price point than solid hardwood while still providing a similar aesthetic appeal.

Engineered wood flooring typically utilizes a top layer of real wood, offering the natural beauty and warmth of hardwood with enhanced durability. Compared to laminate flooring, engineered wood provides a more authentic look and feel, as it is constructed using genuine wood veneers rather than printed images. The versatility, durability, and aesthetic appeal of engineered wood make it a popular choice for homeowners seeking high-quality flooring solutions.

North America is Leading the Wood Flooring Market

The wood flooring market in North America is defined by steady growth, driven by factors such as increasing construction activities, rising renovation and remodeling projects, and a growing preference for eco-friendly and sustainable building materials. In the United States and Canada, solid hardwood flooring has historically been a popular choice, valued for its timeless appeal and durability. However, engineered wood flooring has gained significant traction in recent years due to its enhanced stability, versatility, and resistance to moisture, making it suitable for various applications, including areas with high humidity levels or radiant heating systems.

Additionally, the demand for wood flooring products approved by Forest Stewardship Council (FSC) certification bodies is increasing, reflecting consumers' growing awareness of environmental sustainability. Trends such as wider plank widths, textured finishes, and the use of reclaimed wood contribute to the diversity of offerings in the North American wood flooring market. Technological advancements in manufacturing techniques have led to the development of innovative wood flooring products, meeting consumers' changing needs and interests. Overall, the wood flooring market in North America is dynamic and competitive, with growth opportunities driven by factors such as urbanization, design trends, and advancements in sustainable practices.

Wood Flooring Industry Overview

The wood flooring market is highly competitive, with several key players dominating the market. Companies like Mohawk Industries, Armstrong World Industries, Mannington Mills Inc., Barlinek SA, and Shaw Industries Group are prominent players, offering a wide range of wood flooring products. Additionally, the market also sees competition from regional and local players, focusing on niche segments or specific geographical areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Construction and Renovation Activities

- 4.2.2 Increasing Focus on Sustainable and Eco-friendly Products

- 4.3 Market Restraints

- 4.3.1 Competition from Alternative Flooring Market

- 4.3.2 High Price of Raw Materials

- 4.4 Market Opportunities

- 4.4.1 Advancements in Wood Flooring Technology, Such as Enhanced Finishes and Installation Techniques

- 4.4.2 Rising Customization and Design Trends

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Solid Wood

- 5.1.2 Engineered Wood

- 5.2 By Distribution Channel

- 5.2.1 Home Centers

- 5.2.2 Flagship Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online Stores

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mohawk Industries

- 6.2.2 Armstrong World Industries

- 6.2.3 Mannington Mills Inc.

- 6.2.4 Barlinek SA

- 6.2.5 Shaw Industries Group

- 6.2.6 Beaulieu International Group

- 6.2.7 Home Legend LLC

- 6.2.8 Provenza Floors Inc.

- 6.2.9 Boral Limited

- 6.2.10 Tarkett SA*