|

市場調查報告書

商品編碼

1642043

私有 LTE-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Private LTE - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

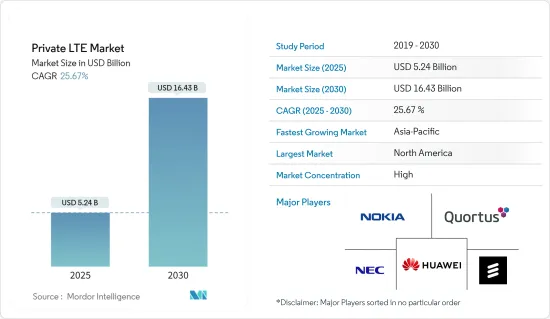

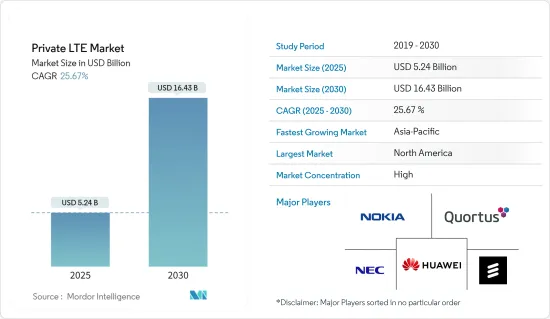

預計 2025 年私人 LTE 市場規模為 52.4 億美元,到 2030 年將達到 164.3 億美元,預測期內(2025-2030 年)的複合年成長率為 25.67%。

CBRS 和 MulteFire 頻段等未經授權的頻譜的可用性以及私有 LTE 網路的日益普及,將為消費者提供更好的情境察覺和更準確的資訊,從而可以縮短響應時間。預計這些因素將促進整個預測期內市場的快速成長。

關鍵亮點

- 私有 LTE 網路的發展源自於日益成長的需求,即將異質、斷開的網路轉變為智慧、連結的系統,以提供更好的客戶接觸點和服務交付。此外,私有 LTE 網路透過單一網路實現人機通訊,消除了乙太網路和 Wi-Fi 等傳統網路系統的限制。

- 私有 LTE/5G 網路的潛力正在吸引包括基礎設施供應商和行動營運商在內的供應商以及各行各業的商業買家的極大關注。私有 LTE/5G 網路支援大量應用程式和使用案例,可以替代或補充傳統網路技術。

- 分離式系統的普及化是私有 LTE 網路發展的關鍵促進因素。私有 LTE 網路具有速度更快、容量更大、安全性更高、延遲更低、效能穩定、範圍更廣和互通性等優勢,可滿足 IIoT 的需求。以上因素是對私有LTE市場產生重大影響的關鍵因素。

- 此外,自動化產業將私有 LTE 網路用於各種應用,包括工廠車間機器人以及物流和倉儲(用於揀選和包裝機器)。工廠車間機器人、物流和倉儲部門也使用私有 LTE。隨著這些網路的優勢不斷成長,它們也被部署到其他用戶,包括運輸、採礦和企業 IIoT 應用。

- 然而,私有LTE/5G網路的規格複雜且高度特定,導致該行業難以擴展。進一步阻礙私有 LTE 發展的是實施私有 LTE 網路的複雜性以及與部署私有 LTE 網路的授權要求相關的限制。

- COVID-19 對 LTE 市場產生了多種影響。 COVID-19 對 LTE 市場產生了多種影響。然而,在疫情的進一步階段,在家工作文化和社交距離規範對整個 LTE 市場,尤其是私人 LTE 產生了巨大的需求,從而帶來了快速的正成長。

私有 LTE 市場趨勢

智慧型手機的普及推動了市場成長

- 隨著智慧型手機越來越普及,全球人均資料使用量不斷增加,對 LTE 服務的需求也日益成長。 《世界人口評論》報告稱,到 2022 年,將有 49 億人(佔世界人口的 69%)積極使用網路。趨勢顯示,網路用戶數以每年4%的速度成長,相當於每年有超過1.96億用戶加入網路。

- 此外,根據 GSMA 的數據,去年全球智慧型手機普及率約為 75%,預計到 2025 年將達到 84%。如此強勁的成長率可能會為各種 LTE 供應商創造機會以滿足不斷成長的需求。

- 智慧型手機改變了網路的使用模式,讓每個人都可以存取網路世界。 2021年至2022年間,全球智慧型手機用戶數將增加2.68億。短短五年間,隨著智慧型手機用戶的增加,行動裝置上網比例已從43.7%增加到55%。到 2025 年,預計 72.6% 的智慧型手機用戶將僅使用智慧型手機存取網路。智慧型手機普及率的大幅成長可能會在預測期內推動市場發展。

- 智慧型手機的全球普及正在增加資料流量並給通訊基礎設施帶來額外的壓力。因此,通訊服務供應商需要升級其4G(LTE)網路以確保容量並以合理的價格滿足客戶需求。因此,預計這些因素將在預測期內進一步推動市場擴張。

亞太地區可望維持強勁成長率

- 亞太地區可望為私有LTE網路供應商創造新的市場前景。日本、中國和澳洲是亞太地區私人LTE市場擴張的關鍵國家。

- 中國和日本是生產電子、資訊設備和汽車產品的著名製造業國家。 M2M通訊的快速成長、智慧型手機的使用不斷成長以及醫療保健、運輸和製造業等各個工業領域對物聯網平台的廣泛應用正在促進該地區私有 LTE 市場的擴張。因此,對私有物聯網的需求日益成長,允許企業整合各種設備以實現更高的可靠性和安全性。

- 私有 LTE 市場的需求主要受到工業 4.0、工業IoT和自動化技術的日益普及的推動。對市場產生正面影響的關鍵因素是連結性的持續發展。在工業領域,連網設備的興起產生了大量的資料。為了確保公司能有效率運轉,需要妥善處理這些資料。推動各行各業採用私有 LTE 的規模經濟不斷成長,是透過對機器對機器 (M2M) 和傳統物聯網 (IoT) 的不斷增加的投資實現的。

- 受強勁經濟成長和電訊業持續發展的推動,該地區在預測期內將實現顯著成長,鼓勵企業大力投資私有 LTE,以維持成長並提高生產力。此外,數位化轉型等因素也在推動市場成長。

私有 LTE 產業概覽

私有 LTE 市場已被整合,並由少數佔有較大市場佔有率的參與企業所主導。市場見證了大公司對小公司的各種併購和收購,從而使市場整合,使新進入者難以進入和競爭。主要市場參與企業包括諾基亞、Quortus Limited、愛立信電話公司、華為技術和 NEC。

2022 年 11 月,網路設計和服務供應商 Betacom 與高通合作,將其私人 LTE/5G 網路設計和管理服務與高通的 RAN 自動化和管理服務相結合,並為工業 4.0 領域的公司提供支援。批Qualcomm核准的實施合作夥伴可供我們的客戶使用。此次夥伴關係旨在為客戶提供端到端、現成的私人網路解決方案,這些解決方案經過了全面的測試和檢驗,並提供了知識和協助支援。

2022 年 7 月,無線傳輸解決方案產業領導者 Aviat Networks, Inc. 和任務關鍵型資料基礎設施的知名供應商 Redline Communications Group Inc. 宣布,將根據加拿大商業法規定的法定重組計劃進行合併。併入Aviat 宣布其子公司已完成對Redline 的收購。因此,Aviat 現在可以為其客戶提供整合的端對端無線存取和傳輸服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 分離系統的採用日益增多

- 智慧型手機日益普及

- 市場問題

- 許可證要求

- 安裝成本高、頻帶干擾

第6章 技術簡介

第7章 市場區隔

- 按組件

- 基礎設施

- 服務

- 依技術分類

- 頻分雙工 (FDD)

- 時分雙工 (TDD)

- 按部署

- 集中

- 分散式

- 按頻段

- 授權

- 未經許可

- 共用頻譜

- 按最終用戶產業

- 產業(公共、供應鏈管理、公共產業、製造業)

- 醫療

- 企業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 其他

- 北美洲

第8章 競爭格局

- 公司簡介

- Nokia Corporation

- Quortus Limited

- LM Ericsson Telephone Company

- NEC Corporation

- Luminate Wireless Inc.

- Huawei Technologies Co., Ltd.

- Qualcomm Technologies, Inc.

- Future Technologies Pvt. Ltd.

- Sierra Wireless Inc.

- Redline Communications Group Inc.(Aviat Networks, Inc.)

- Ruckus Networks Inc.

第9章投資分析

第10章 市場機會與未來趨勢

The Private LTE Market size is estimated at USD 5.24 billion in 2025, and is expected to reach USD 16.43 billion by 2030, at a CAGR of 25.67% during the forecast period (2025-2030).

The availability of unlicensed spectrums like CBRS and MulteFire bands, as well as the growing adoption of private LTE networks, enable consumers to improve situational awareness, obtain more accurate information, and speed up response times. These factors are anticipated to contribute to the market's rapid growth throughout the forecast period.

Key Highlights

- The development of private LTE networks is a result of the expanding need to convert heterogeneous, disconnected networks into smart linked systems in order to provide better customer contact and service delivery methods. Additionally, a private LTE network eliminates the limitations of a traditional network system, like Ethernet or Wi-Fi, by enabling both human and machine communication on a single network.

- The potential for a private LTE/5G network is gaining a lot of attention from suppliers, including infrastructure providers and mobile carriers, as well as from business purchasers across various industries. A vast number of applications and use cases are made possible by private LTE/5G networks, which can replace or supplement traditional network technologies.

- The widespread use of isolated systems is a primary factor driving private LTE networks. Private LTE networks provide benefits such as high speed, high capacity, high security, low latency, consistent performance, more extended range, and interoperability that support the demand necessary to achieve IIoT. The abovementioned factors are critical elements significantly affecting the private LTE market.

- Moreover, the automation Industry uses private LTE networks for various applications such as factory-floor robotics and logistics and warehousing (for pick and pack machines). Factory-floor robotics, logistics, and warehouse divisions also use private LTE. Due to these networks' growing advantages, they are increasingly being deployed for other users, such as transportation, mining, and enterprise IIoT applications.

- However, the specifications for private LTE/5G networks are complicated and highly individualized, making it challenging to expand the industry. Further, factors hindering the growth of private LTE are the complexity associated with implementing private LTE networks and constraints in terms of the requirement for an authorized license to deploy a private LTE network.

- COVID-19 had a mixed impact on the LTE market. In the initial stages of the epidemic, the market witnessed a decline in smartphone demand and reduced deployment of cell towers. However, in the further stages of the pandemic, the work-from-home culture and social distancing norms created a significant demand for the overall LTE market, especially private LTE, thereby witnessing rapid positive growth.

Private LTE Market Trends

Growing Adoption of Smartphones may Drive the Market Growth

- The growing adoption of smartphones has increased global data usage on a per-person basis, increasing the need for LTE services and driving the industry. The World Population Review reported that 4.9 billion people, or 69% of the world's population, will be actively using the internet by 2022. According to trends, the number of internet users is increasing at a 4% yearly pace, which amounts to over 196 million additional users joining the network yearly.

- Further, according to GSMA, the global smartphone adoption rate was around 75% last year and is anticipated to reach 84% by 2025. Such significant growth rates could increase the opportunities for various LTE providers to meet the growing requirement.

- Smartphones have altered internet usage patterns and increased everyone's access to the online world. Global smartphone usage increased by 268 million people alone between 2021 and 2022. In only five years, the percentage of internet usage on mobile devices has increased from 43.7% to 55%, owing to the rise in smartphone users. By 2025, it is anticipated that 72.6% of smartphone users will solely use their phones to access the internet. Such significant growth in smartphone adoption could drive the market during the forecast period.

- The global expansion of smartphones has increased data traffic, putting additional strain on the communication infrastructure. As a result, 4G (LTE) network upgrades have become necessary for telecommunication service providers in order to guarantee capacity and satisfy customer needs at reasonable prices. Accordingly, these factors would further drive market expansion during the projection period.

Asia-Pacific Expected to Hold Significant Growth Rates

- The Asia-Pacific region is predicted to generate new market prospects for private LTE network vendors. Japan, China, and Australia are significant nations in APAC considering the expansion of the private LTE market.

- China and Japan are prominent manufacturing nations that create electronic, informational, and automotive goods. The surge in M2M communications, greater smartphone use, and the uptake of IoT platforms across a variety of industrial verticals, including healthcare, transportation, and manufacturing, are all contributing factors to the market expansion of private LTE in this area. The need for private IoT networks that allow businesses to integrate various devices for better dependability and security is growing as a result.

- The need for the private LTE market is considerably driven by the growing deployment of Industry 4.0, industrial IoT, and automated technologies. The primary factor positively affecting the market is connectivity's ongoing development. The increasing number of linked devices in the industrial industry produces enormous data. This data must be adequately processed to ensure efficient company operations. The rising economies of scale that drive the adoption of private LTE across the industry have been made possible by the expanding investments in machine-to-machine (M2M) and classical IoT.

- The region is predicted to witness significant growth rates throughout the projection period due to its robust economic growth and continued telecom industry development, encouraging businesses to actively invest in private LTE to maintain growth and boost productivity. Additionally, factors like the significant shift toward digital drive market growth.

Private LTE Industry Overview

The Private LTE market is consolidated, and it is dominated by a few significant shareholding players present in the market. The market witnessed various mergers and acquisitions of smaller firms by the larger firms, thereby consolidating the market, which often makes it difficult for new entrants to enter and compete in the market, along with larger firms accounting for considerable network expansions globally. A few of the significant market players include Nokia Corporation, Quortus Limited, LM Ericsson Telephone Company, Huawei Technologies Co., Ltd., and NEC Corporation.

In November 2022, Betacom, a provider of network design and services, partnered with Qualcomm to link its private LTE/5G network design and management service with Qualcomm's RAN automation and management offering, as well as a ready pool of Qualcomm-approved deployment partners for enterprise customers in the Industry 4.0 space. This partnership aims to provide clients with access to an end-to-end, off-the-shelf private network solution that has been thoroughly tested and verified and is supported by knowledge and assistance.

In July 2022, Aviat Networks, Inc., an industry player in wireless transport solutions, and Redline Communications Group Inc., a prominent supplier of mission-critical data infrastructure, announced that the acquisition of Redline by a subsidiary of Aviat had been completed following a statutory plan of arrangement under the Canada Business Corporations Act. As a result, Aviat can now provide its clients with an integrated end-to-end offering for wireless access and transport.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Isolated Systems

- 5.1.2 Growing Adoption of Smartphones

- 5.2 Market Challenges

- 5.2.1 Requirements for Authorized License

- 5.2.2 High Deployment Costs and Frequency Band Interference

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Component

- 7.1.1 Infrastructure

- 7.1.2 Services

- 7.2 By Technology

- 7.2.1 Frequency-Division Duplexing (FDD)

- 7.2.2 Time Division Duplex (TDD)

- 7.3 By Deployment

- 7.3.1 Centralized

- 7.3.2 Distributed

- 7.4 By Frequency Band

- 7.4.1 Licensed

- 7.4.2 Unlicensed

- 7.4.3 Shared Spectrum

- 7.5 By End-user Industry

- 7.5.1 Industrial (Public Safety, Supply Chain Management, Utilities, Manufacturing)

- 7.5.2 Healthcare

- 7.5.3 Enterprise

- 7.5.4 Other End-user Industries

- 7.6 Geography

- 7.6.1 North America

- 7.6.1.1 United States

- 7.6.1.2 Canada

- 7.6.2 Europe

- 7.6.2.1 Germany

- 7.6.2.2 United Kingdom

- 7.6.2.3 France

- 7.6.2.4 Rest of Europe

- 7.6.3 Asia-Pacific

- 7.6.3.1 China

- 7.6.3.2 Japan

- 7.6.3.3 India

- 7.6.3.4 Rest of Asia-Pacific

- 7.6.4 Rest of the world

- 7.6.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Nokia Corporation

- 8.1.2 Quortus Limited

- 8.1.3 LM Ericsson Telephone Company

- 8.1.4 NEC Corporation

- 8.1.5 Luminate Wireless Inc.

- 8.1.6 Huawei Technologies Co., Ltd.

- 8.1.7 Qualcomm Technologies, Inc.

- 8.1.8 Future Technologies Pvt. Ltd.

- 8.1.9 Sierra Wireless Inc.

- 8.1.10 Redline Communications Group Inc. (Aviat Networks, Inc.)

- 8.1.11 Ruckus Networks Inc.