|

市場調查報告書

商品編碼

1642072

Over-the-Top(OTT):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Over The Top (OTT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

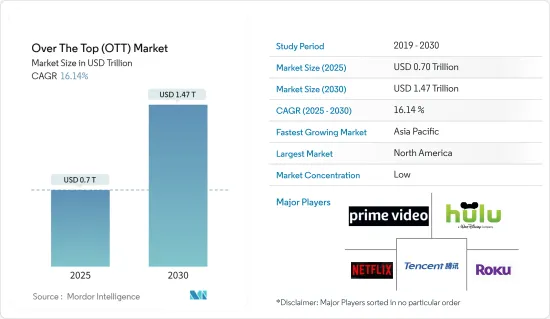

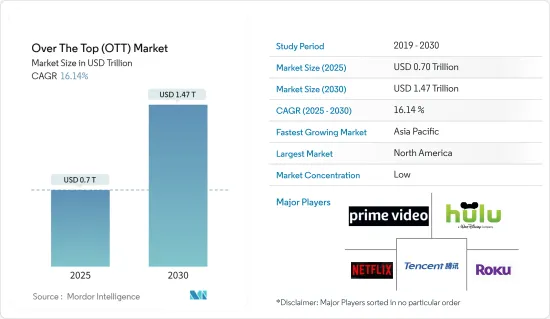

預計 2025 年Over-the-Top(OTT) 市場規模將達到 7,000 億美元,預計到 2030 年將達到 1.47 兆美元,預測期內(2025-2030 年)的複合年成長率為 16.14%。

Over-the-Top+(OTT)市場是指透過網路直接向使用者提供視訊、音訊和其他媒體內容,繞過有線和衛星電視等傳統傳輸管道。 OTT 平台提供各種內容的隨選訪問,包括電影、電視節目、實況活動和原創節目。

主要亮點

- Over-the-Top(OTT)是一種透過高速網路連線而非透過有線或衛星供應商平台交付的電影和電視內容平台。 OTT 的採用正在推動視訊、音樂、播客和音訊串流類別的大幅成長。推動採用率提高的因素包括類型選擇狹窄、包裝靈活、設備可用性廣泛、網際網路普及率高以及成本低廉。對客製化內容的需求不斷成長,導致 OTT 設備的大量採用。

- 體育和娛樂服務的日益商品化以及 OTT 提供者之間日益激烈的競爭預計將推動Over-the-Top(OTT) 市場的發展。近年來,體育賽事和娛樂內容的消費方式發生了重大轉變。傳統上,這些服務主要透過有線或衛星訂閱提供,客製化和點播觀看選項有限。然而,OTT平台的興起顛覆了這種模式,它直接向消費者提供各種體育賽事、直播和娛樂內容。

- 新興市場中訂閱隨選視訊 (SVOD) 服務的日益普及預計將推動 Over-the-Top (OTT) 市場的發展。由於多種因素,SVOD 服務在世界各地(包括新興市場)獲得了極大的歡迎。許多新興國家的中階不斷壯大以及可支配收入不斷提高,推動了 SVOD 服務的成長。隨著越來越多的個人能夠負擔訂閱費用,透過 OTT 平台存取更多種類內容的需求也日益成長。

- 影片內容盜版是影響 OTT 市場的重大問題。盜版涉及未經授權分發和消費受版權保護的內容,導致內容創作者和合法串流媒體平台的收益損失。盜版破壞了 OTT 提供者的經營模式,他們依靠訂閱費和廣告收入來維持業務並為內容製作提供資金。

- COVID-19 疫情對Over-the-Top(OTT)市場產生了重大影響。全球健康危機和隨之而來的封鎖措施導致串流媒體服務需求激增,並從多個方面加速了 OTT 產業的成長。由於人們因限制而滯留在家中並尋求娛樂選擇,對串流媒體服務的需求激增。許多人轉向 OTT 平台觀看電影、電視節目、紀錄片和其他形式的內容。需求的激增導致現有串流媒體服務的訂閱量大幅增加,並出現了新的平台。

Over-the-Top(OTT) 市場趨勢

智慧型設備的普及和更快的網際網路速度預計將推動 OTT 市場的發展

- 智慧型裝置的日益普及和高速網路的存取是推動Over-the-Top市場成長的關鍵因素。智慧型手機、平板電腦、智慧型電視和其他連網裝置的日益普及為用戶提供了更多存取 OTT 服務的方式。這些設備配備了網際網路連接並支援串流媒體應用程式,讓消費者可以輕鬆觀看自己喜歡的節目、電影和其他點播內容。

- 寬頻和4G/5G行動網路等高速網路連線對於實現無縫串流體驗起著至關重要的作用。網路使用者數量增加是全球趨勢,但也存在地區差異。

- 據Cisco稱,預測期內北美將擁有最高的網路普及率(其次是西歐)。儘管如此,中東和非洲預計仍將實現成長(2018 年至 2023 年複合年成長率為 10%)。更快的網路速度意味著更流暢的播放、更少的緩衝時間以及傳輸高清 (HD) 和超高清 (UHD) 內容的能力。這顯著改善了整體用戶體驗,有助於推動 OTT 服務日益普及。

- 智慧型設備與高速網際網路的結合也帶來了個人化和便利性的提升。 OTT 平台使用資料分析和推薦演算法來了解用戶偏好並提供個人化的內容推薦。只要有網路連接,使用者就可以隨時隨地存取內容。

- 這些因素推動了OTT平台的成長,吸引了更多的用戶,並提高了訂閱費和廣告收益。因此,傳統媒體公司和廣播公司意識到了 OTT 的重要性,並推出串流媒體服務或與現有的 OTT 平台合作進入這個不斷擴大的市場。

預計北美將佔據較大的市場佔有率

- 近年來,北美OTT市場經歷了顯著的成長。北美是一些最著名和最成熟的 OTT 平台的所在地,包括 Netflix、Amazon Prime Video、Hulu 和 Disney+。這些平台擁有龐大的用戶群,並提供大量內容庫,包括電影、電視節目、紀錄片和原創內容。

- Roku、Apple TV、Amazon Fire TV 和 Google Chromecast 等串流裝置在北美被廣泛使用。這些設備可以存取各種 OTT 平台,並允許用戶直接在電視上播放內容。

- 北美消費者的觀看習慣正在發生重大轉變,越來越多的人選擇 OTT 服務,而不是訂閱傳統的有線或衛星電視服務。 OTT 平台的靈活性、成本效益和個人化內容產品助長了這一趨勢。

- 體育串流媒體在北美越來越受歡迎,各大體育聯盟和組織推出OTT 平台或與現有服務合作。這些平台透過提供實況活動、獨家內容和幕後報道來滿足日益成長的體育內容需求。

- 內容在地化是北美 OTT 市場的一個主要趨勢。提供者正在投資製作針對當地偏好和人口統計的原創、在地化內容。這種方法有助於吸引和留住用戶,並使平台在競爭激烈的市場中脫穎而出。

Over-the-Top(OTT) 產業概述

Over-the-Top(OTT)市場十分分散。隨著越來越多的媒體和內容公司加入串流電視潮流,市場競爭變得越來越激烈,爭奪優質內容以吸引觀眾的競爭也更加激烈。公司正專注於產品創新以吸引消費者的注意。市場的主要企業是 Netflix Inc.、亞馬遜公司(Prime Video)、華特迪士尼公司(Hulu)、騰訊控股有限公司和 Roku Inc.市場參與者正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 2 月 - 媒體與娛樂集團 Shemaroo Entertainment 與四家國際通訊業者合作,擴展其 OTT 平台 ShemarooMe。與 Zain、STC、沙烏地阿拉伯的 Mobily 和卡達的 Vodafone 的合作由 DCB(營運商直接計費)合作夥伴 3A net 和 one97 communications 促成,體現了該公司致力於在全球範圍內提供多樣化娛樂體驗的承諾。

- 2024 年 2 月 - Verimatrix 與 Amazon Web Services (AWS) 合作,進一步增強其雲端基礎的OTT 內容安全平台 Streamkeeper Multi-DRM 的擴充性、可用性和易用性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 生態系分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 智慧型裝置的普及和高速網路存取的增加

- 隨著 OTT 提供者之間的競爭日益激烈,體育和娛樂服務的競爭也日益激烈

- SVOD 在新興市場日益流行

- 市場限制

- 影片內容盜版的威脅以及間諜軟體對用戶資料庫的安全威脅增加

- 影響OTT和電視產業的宏觀經濟因素

第6章 市場細分

- 按服務類型

- SVOD

- TVOD

- AVOD

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Netflix Inc.

- Amazon.com Inc.(Prime Video)

- The Walt Disney Company(Hulu)

- Tencent Holdings Ltd

- Roku Inc.

- Google LLC(YouTube)

- DAZN Group Limited

- NBC Universal(Hayu)

- PCCW Media Group(Viu)

第8章投資分析

第9章:市場的未來

The Over The Top Market size is estimated at USD 0.70 trillion in 2025, and is expected to reach USD 1.47 trillion by 2030, at a CAGR of 16.14% during the forecast period (2025-2030).

The over-the-top (OTT) market refers to delivering video, audio, and other media content over the internet directly to users, bypassing traditional distribution channels like cable or satellite television. OTT platforms provide on-demand access to a wide range of content, including movies, TV shows, live events, and original programming.

Key Highlights

- Over-the-top (OTT) is a film and television content platform provided via a high-speed internet connection instead of a cable or satellite provider-based platform. OTT adoption has significantly aided the video, music, podcast, and audio streaming category. Increasing adoption may be attributed to narrow genre choices, packaging flexibility, wider device availability, internet penetration, and lower costs. The rising demand for customized content led to significant adoption rates of OTT devices.

- The ongoing shift toward commoditizing sporting and entertainment services and growing competition among OTT providers are expected to drive the over-the-top (OTT) market. In recent years, there has been a significant shift in how sporting events and entertainment content are consumed. Traditionally, these services were primarily delivered through cable and satellite TV subscriptions, with limited options for customization and on-demand viewing. However, the rise of OTT platforms has disrupted this model by offering a wide range of sporting events, live broadcasts, and entertainment content directly to consumers.

- The increasing adoption of Subscription Video on Demand (SVOD) services in emerging markets is expected to drive the over-the-top (OTT) market. Due to several factors, SVOD services have gained significant popularity worldwide, including in emerging markets. The expanding middle class and rising disposable incomes in many emerging economies have contributed to the growth of SVOD services. As more individuals have the financial means to afford subscriptions, there is an increased demand for access to a wide variety of content through OTT platforms.

- Video content piracy is a significant issue affecting the OTT market. Piracy involves the unauthorized distribution and consumption of copyrighted content, leading to revenue losses for content creators and legitimate streaming platforms. It undermines the business models of OTT providers, who rely on subscription fees or advertising revenue to sustain their operations and fund content creation.

- The COVID-19 pandemic significantly impacted the over-the-top (OTT) market. The global health crisis and associated lockdown measures led to a surge in demand for streaming services and accelerated the growth of the OTT industry in several ways. With people staying at home due to restrictions and seeking entertainment options, the demand for streaming services skyrocketed. Many individuals turned to OTT platforms for movies, TV shows, documentaries, and other forms of content. This surge in demand resulted in a significant increase in subscriptions for established streaming services and the launch of new platforms.

Over the Top (OTT) Market Trends

Adoption of Smart Devices and higher Internet Speeds is Expected to Drive Over the Top (OTT) Market

- The growth in the adoption of smart devices and greater access to higher internet speeds are key factors driving the growth of the over-the-top (OTT) market. The increasing penetration of smartphones, tablets, smart TVs, and other connected devices has provided users with more avenues to access OTT services. These devices come equipped with internet connectivity and support streaming applications, making it easier for consumers to watch their favorite shows, movies, and other content on demand.

- The availability of high-speed internet connections, such as broadband and 4G/5G mobile networks, has played a crucial role in enabling seamless streaming experiences. While the increase in Internet users is a worldwide trend, regional variances exist.

- According to Cisco Systems, North America is likely to have the greatest internet adoption rate during the projection period (followed by Western Europe). Still, the Middle East and Africa are expected to increase (10% CAGR from 2018 to 2023). Faster internet speeds allow for smoother playback, reduced buffering times, and the ability to stream high-definition (HD) and ultra-high-definition (UHD) content. This has greatly improved the overall user experience and contributed to the growing popularity of OTT services.

- The combination of smart devices and high-speed internet has also led to increased personalization and convenience. OTT platforms leverage data analytics and recommendation algorithms to understand users' preferences and provide personalized content recommendations. Users may access content whenever and wherever they want, as long as they have an internet connection.

- These factors have fueled the growth of OTT platforms, attracting many subscribers and driving the revenue generated by subscription fees and advertisements. As a result, traditional media companies and broadcasters have recognized the importance of OTT and have launched their streaming services or partnered with existing OTT platforms to tap into this expanding market.

North America is Expected to Hold the Significant Market Share

- The North American OTT market has witnessed significant growth in recent years. North America is home to some of the most prominent and established OTT platforms, including Netflix, Amazon Prime Video, Hulu, and Disney+. These platforms have gained a large subscriber base and offer a vast content library, including movies, TV shows, documentaries, and original productions.

- Streaming devices, such as Roku, Apple TV, Amazon Fire TV, and Google Chromecast, have seen widespread adoption in North America. These devices provide access to various OTT platforms and allow users to stream content directly on their TVs.

- North America has experienced a significant shift in consumer viewing habits, with an increasing number of individuals opting for OTT services and not subscribing to traditional cable or satellite TV services. OTT platforms' flexibility, cost-effectiveness, and personalized content offerings have contributed to this trend.

- Sports streaming has gained traction in North America, with major sports leagues and organizations launching their OTT platforms or partnering with existing services. These platforms offer live sports events, exclusive content, and behind-the-scenes coverage to cater to the growing demand for sports content.

- Localization of content is a significant trend in the North American OTT market. Providers invest in original content production specific to the region, targeting local preferences and demographics. This approach helps attract and retain subscribers and differentiate platforms in a competitive market.

Over the Top (OTT) Industry Overview

The over-the-top (OTT) market is fragmented. With many media and content companies jumping on the streaming TV bandwagon, the marketplace is becoming increasingly competitive, creating even more competition for high-quality content to keep viewers hooked. The companies are focusing on product innovation to gain consumer attention. Major players in the market are Netflix Inc., Amazon.com Inc.(Prime Video), The Walt Disney Company (Hulu), Tencent Holdings Ltd, and Roku Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024 - Shemaroo Entertainment, a media and entertainment conglomerate, collaborated with four international telecom operators to expand its OTT platform, ShemarooMe. This partnership with Zain, STC, Mobily in Saudi Arabia, and Vodafone in Qatar, facilitated by DCB (Direct Carrier Billing) partners, 3A net, and one97 communications, showcases the company's global commitment to offering diverse entertainment experiences.

- February 2024 - Verimatrix collaborated with Amazon Web Services (AWS) to further increase scalability, availability, and ease of use for its Streamkeeper Multi-DRM cloud-based OTT content security platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of Smart Devices and Greater Access to Higher Internet Speeds

- 5.1.2 Ongoing Shift Towards Commoditization of Sporting and Entertainment Services Coupled with Growing Competition Among OTT Providers

- 5.1.3 Increasing Adoption of SVOD (Subscription - Based Services) in Emerging Markets

- 5.2 Market Restraints

- 5.2.1 Growing Threat of Video Content Piracy and Security Threat of User Database Due to Spyware

- 5.3 Impact of Macro Economic Factors on the OTT and TV industry

6 MARKET SEGMENTATION

- 6.1 By Type of Service

- 6.1.1 SVOD

- 6.1.2 TVOD

- 6.1.3 AVOD

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Netflix Inc.

- 7.1.2 Amazon.com Inc. (Prime Video)

- 7.1.3 The Walt Disney Company (Hulu)

- 7.1.4 Tencent Holdings Ltd

- 7.1.5 Roku Inc.

- 7.1.6 Google LLC (YouTube)

- 7.1.7 DAZN Group Limited

- 7.1.8 NBC Universal (Hayu)

- 7.1.9 PCCW Media Group (Viu)