|

市場調查報告書

商品編碼

1642078

電腦輔助製造:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Computer Aided Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

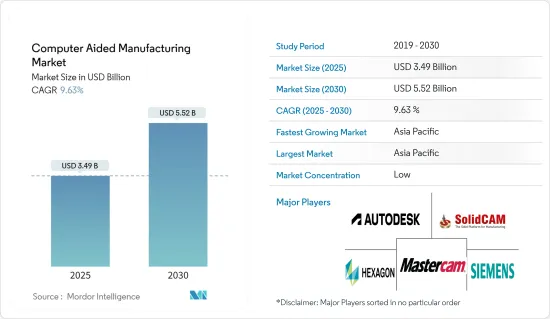

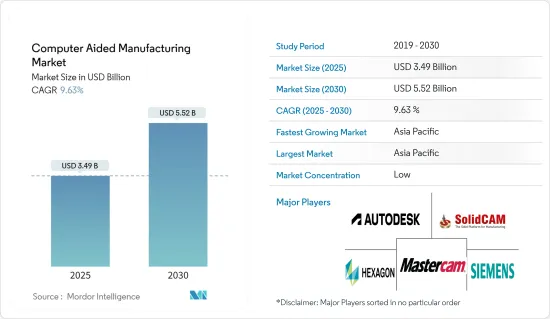

電腦輔助製造市場規模預計在 2025 年為 34.9 億美元,預計到 2030 年將達到 55.2 億美元,預測期內(2025-2030 年)的複合年成長率為 9.63%。

關鍵亮點

- 電腦輔助製造 (CAM) 正在發展以與工業 4.0 技術無縫整合,包括物聯網 (IoT)、人工智慧 (AI) 和巨量資料分析。這種整合促進了機器、系統和人員之間的即時資料交換和通訊,從而實現了更智慧的製造過程。

- 此外,CAM 系統現在支援積層製造技術,使得設計和製造使用傳統方法無法實現的複雜形狀成為可能。此外,混合製造(融合了積層和減材製程)在 CAM 應用中越來越受歡迎,為複雜零件的製造提供了更大的靈活性和準確性。

- CAM 軟體為各種 CNC 工具機開發程序,包括銑削、車削、邊緣加工和積層製造工具機。由於積層製造具有成本效益、減少材料浪費和簡化製造流程等優勢,其需求正在上升。積層製造有助於快速原型製作,從而實現快速設計迭代並縮短產品上市時間。

- 汽車製造商使用 CAM 來生產車身零件、引擎零件和其他複雜元件。 CAM 可以縮短前置作業時間、提高準確性並為您的車輛提供卓越的精度和品質。電動和聯網汽車產量的不斷增加進一步推動了該市場的成長。

- 開放原始碼電腦輔助製造(CAM)軟體的興起對CAM市場的成長構成了重大挑戰。這一趨勢主要由開放原始碼解決方案的成本效益和可訪問性推動,它吸引了多樣化的用戶群,尤其是中小型企業 (SME)。由於預算緊張,這些小型企業發現開放原始碼選項是經濟上可行的選擇。

- 隨著工業4.0的到來,工業領域正在迅速採用創新技術和增強的網路架構,顯示出良好的市場擴展前景。石油和天然氣、汽車、製藥和航太等主要行業正在整合 CAM 軟體以減少生產延遲並提高業務效率。然而,地緣政治緊張局勢,尤其是美國衝突、以色列與哈馬斯局勢以及俄羅斯與烏克蘭戰爭,對這些地區的市場成長構成潛在威脅。

電腦輔助製造市場趨勢

汽車產業將強勁成長

- CAM 在汽車產業的主要應用之一是設計和原型製作階段。先進的軟體工具使工程師和設計師能夠創建汽車零件和系統的複雜 3D 模型。此功能大大減少了與傳統原型製作方法相關的時間和成本。

- CAM 讓製造商在實際生產開始之前模擬效能、評估可製造性並識別潛在的設計缺陷。 3D 列印等快速原型製作技術進一步增強了這一過程,實現了設計的快速迭代。

- CAM 系統透過分析生產能力、前置作業時間和資源分配來促進有效的生產計畫和調度。透過將 CAM 與企業資源規劃 (ERP) 系統結合,汽車製造商可以最佳化生產計劃以滿足需求波動,同時最大限度地減少停機時間。這種程度的最佳化對於以準時生產(JIT)為特徵的行業來說至關重要,因為及時交貨對於保持競爭力至關重要。

- 此外,汽車產業對引擎零件、傳動系統和底盤等零件的製造要求很高的精度。 CAM 軟體可以精確控制 CNC(電腦數值控制)機器,這對於加工過程至關重要。這些機器能夠精確加工複雜的幾何形狀,確保零件符合嚴格的品質標準。此外,CAM 可以實現加工過程的自動化,減少人為錯誤的可能性並提高整體生產力。

- 電動車需求的成長預計也將為新興市場的發展提供重大推動力。例如,根據國際能源總署 (IEA) 的數據,2023 年全球將註冊約 1,400 萬輛新電動車,使道路上的電動車總數達到 4,000 萬輛。

- 2023年電動車銷量將比2022年增加350萬輛,與前一年同期比較成長35%。到 2023 年,電動車將佔所有汽車銷量的 18% 左右,高於 2022 年的 14%。此外,國際能源總署(IEA)預測,在淨零情境下,到2030年電動車(EV)銷量將佔汽車銷量的約65%。為實現這一目標,2023 年至 2030 年間,電動車銷量每年需要成長約 25%。

亞太地區將經歷大幅成長

- 中國在全球製造業供應鏈中的關鍵作用,加上數位轉型的浪潮,成為中國電腦輔助製造業快速成長的主要催化劑。過去一年來,地緣政治對全球供應鏈的影響日益加深。在已開發國家紛紛製造地註資的同時,墨西哥和東南亞等地區正逐漸成為人們關注的焦點。這種動態加劇了各國之間在生產線方面的競爭。

- 從歷史上看,日本製造業一直是全球創新、效率和彈性的象徵。日本企業,包括豐田這樣的汽車巨頭和索尼這樣的電子巨頭,不僅獲得了競爭優勢,而且享有相當長的壽命。

- 然而,當今日本製造業正處於一個關鍵的十字路口。過去三年來,該領域的供應鏈遭遇了顯著中斷,主要原因是新冠疫情以及美國關係惡化。面對這些挑戰,公司正在擴大其供應商網路以提高可靠性。日本公司以其可靠性和最尖端科技而聞名,它們已做好戰略準備來利用這些行業變化。

- 韓國充滿活力的市場特徵是,眾多的應用推動著各個領域的成長。韓國利用最尖端科技框架和創新精神,在多個行業中佔據領先地位。在製造業方面,ICT 和電子領域表現出色,由三星電子和 LG 電子公司等工業巨頭引領。這些企業集團也巧妙地將製造範圍拓展到韓國以外,三星在越南的兩家主要工廠目前佔其全球產量的三分之一。

- 隨著對高科技自動化機器的需求激增,製造業正經歷強勁的市場成長。人們對電動車和家用電子電器產品的需求日益成長,進一步增強了這一勢頭,凸顯了各個領域對精密工具機的需求日益成長。隨著全球製造業的擴張,最終產品的生產越來越依賴瑞士型自動車床等工具機。

- 此外,隨著製造方法的進步,對於具有卓越精度和準確度的高階工具機的需求也日益強烈。這種發展推動了對 CAM 軟體的需求,以便熟練地操作這些先進的工具。

電腦輔助製造業概況

CAM 軟體市場競爭激烈,參與企業。儘管進入門檻較高,但一些新參與企業正在增強實力。此市場的特點是產品差異化程度中/高,產品滲透率高,競爭激烈。

創新帶來永續的競爭優勢。人工智慧、機器學習和雲端運算等新興技術正在重塑安全格局。

領先的供應商正在增強其現有軟體並推出先進的解決方案,以滿足技術進步推動的不斷變化的消費者需求。其中包括 Autodesk Inc.、SolidCAM Ltd.、Siemens AG、CNC Software, LLC.(Mastercam)和 Hexagon AB。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

- 技術簡介

- 2D 設計

- 3D 設計

- 5D 設計

第5章 市場動態

- 市場促進因素

- 工業 4.0 的採用率不斷提高

- 包裝器材領域 CAM 軟體的使用日益增多

- 市場限制

- 開放原始碼CAM 軟體的興起

第6章 市場細分

- 按部署模型

- 本地

- 雲端基礎

- 按最終用戶產業

- 航太和國防

- 車

- 醫療

- 能源與公共產業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 瑞士

- 西班牙

- 奧地利

- 比利時

- 荷蘭

- 英國

- 法國

- 義大利

- 瑞典

- 波蘭

- 亞洲

- 中國

- 日本

- 韓國

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Autodesk, Inc.

- Siemens AG

- SolidCAM Ltd.

- CNC Software, LLC.(Mastercam)

- Hexagon AB

- Cimatron Ltd.

- HCL Technologies Limited

- NTT Data Engineering Systems Corporation(NTT DATA Corporation)

- OPEN MIND Technologies AG

- BobCAD-CAM Inc.

- MecSoft Corporation

- Dassault Systmes

- PTC Inc.

- ZWSOFT CO., LTD.(Guangzhou)

- SmartCAMcnc, Inc.

8.供應商市場佔有率分析

第9章投資分析

第10章:投資分析市場的未來

The Computer Aided Manufacturing Market size is estimated at USD 3.49 billion in 2025, and is expected to reach USD 5.52 billion by 2030, at a CAGR of 9.63% during the forecast period (2025-2030).

Key Highlights

- Computer-Aided Manufacturing (CAM) is evolving to seamlessly integrate with Industry 4.0 technologies, including the Internet of Things (IoT), artificial intelligence (AI), and big data analytics. This integration facilitates real-time data exchange and communication among machines, systems, and humans, resulting in more intelligent manufacturing processes.

- Furthermore, CAM systems increasingly support additive manufacturing techniques, enabling the design and production of intricate geometries that traditional methods couldn't achieve. Additionally, hybrid manufacturing, which merges both additive and subtractive processes, is gaining traction in CAM applications, providing enhanced flexibility and precision in crafting complex parts.

- CAM software develops programs for a range of CNC machines, including milling, turning, edge machining, and additive manufacturing machines. The demand for additive manufacturing is on the rise, driven by its benefits like cost efficiency, reduced material waste, and fewer production steps. It facilitates rapid prototyping, allowing for swift design iterations and a faster time-to-market.

- Manufacturers in the automotive industry utilize CAM to produce body parts, engine components, and other intricate elements. With CAM, they can shorten lead times, enhance accuracy, and achieve superior precision and quality in vehicles. The rising production of electric and connected vehicles further propels this market growth.

- The rise of open-source computer-aided manufacturing (CAM) software poses a significant challenge to the growth of the CAM market. This trend is primarily fueled by the cost-effectiveness and accessibility of open-source solutions, drawing in a diverse user base, especially small and medium-sized enterprises (SMEs). Operating on tighter budgets, these SMEs find open-source options to be a financially viable choice.

- With the dawn of Industry 4.0, the industrial sector is rapidly adopting innovative techniques and enhanced networking architectures, signaling promising prospects for market expansion. Key industries, including oil and gas, automotive, pharmaceutical, and aerospace, are integrating CAM software to mitigate production delays and boost operational efficiency. However, geopolitical tensions, notably the U.S.-China conflict, the Israel-Hamas situation, and the Russia-Ukraine war, loom as potential threats to market growth in these regions.

Computer Aided Manufacturing Market Trends

Automotive Segment to Witness Major Growth

- One of the primary applications of CAM in the automotive industry is in the design and prototyping phase. Advanced software tools enable engineers and designers to create intricate 3D models of automotive components and systems. This capability significantly reduces the time and cost associated with traditional prototyping methods.

- By utilizing CAM, manufacturers can simulate performance, assess manufacturability, and identify potential design flaws before physical production begins. Rapid prototyping technologies, such as 3D printing, further enhance this process, allowing for the quick iteration of designs.

- CAM systems facilitate effective production planning and scheduling by analyzing production capacities, lead times, and resource allocation. By integrating CAM with Enterprise Resource Planning (ERP) systems, automotive manufacturers can optimize their production schedules to meet demand fluctuations while minimizing downtime. This level of optimization is critical in a sector characterized by just-in-time (JIT) manufacturing practices, where timely delivery is essential to maintaining competitiveness.

- Further, the automotive sector demands high precision in manufacturing components, such as engine parts, transmission systems, and chassis. CAM software enables the precise control of CNC (Computer Numerical Control) machines, which are integral to the machining process. These machines can execute complex geometries accurately, ensuring that components adhere to stringent quality standards. Additionally, CAM allows for the automation of machining processes, reducing the likelihood of human error and enhancing overall productivity.

- The growth in the demand for electric vehicles is also likely to aid the development of the studied market significantly. For instance, according to the International Energy Agency (IEA), almost 14 million new electric cars were registered globally in 2023, bringing their total number on the roads to 40 million.

- Electric car sales in 2023 were 3.5 million higher than in 2022, a 35% year-on-year increase. Electric cars accounted for around 18% of all cars sold in 2023, up from 14% in 2022. Further, the International Energy Agency (IEA) projected that electric vehicle (EV) sales will make up approximately 65% of total car sales by 2030 in the Net Zero Scenario. To achieve this, there should be an annual growth rate of around 25% in EV sales from 2023 to 2030.

Asia Pacific to Witness Major Growth

- China's pivotal role in the global manufacturing supply chain, coupled with a wave of digital transformation, has been the primary catalyst for the country's burgeoning computer-aided manufacturing sector. Over the past year, geopolitics have increasingly influenced global supply chains. While developed nations are reshoring their manufacturing bases, regions such as Mexico and Southeast Asia are gaining prominence. This dynamic has heightened competition among nations vying for manufacturing lines.

- Japan's manufacturing landscape has historically epitomized global innovation, efficiency, and resilience. With automotive giants like Toyota and electronic powerhouses such as Sony, Japanese companies have not only secured a competitive advantage but have also demonstrated remarkable longevity.

- Yet, today, Japanese manufacturing stands at a crucial juncture. The sector has grappled with notable supply chain disruptions over the last three years, primarily due to the COVID-19 pandemic and evolving US-China relations. In light of these challenges, companies are broadening their supplier networks to bolster reliability. With their renowned dependability and state-of-the-art technology, Japanese firms are strategically poised to leverage these industry shifts.

- South Korea's dynamic market is marked by a multitude of applications driving growth across its diverse sectors. Harnessing its cutting-edge technological framework and innovative spirit, South Korea has positioned itself as a leader in several industries. At the forefront of the nation's manufacturing landscape, the ICT and electronics sectors shine brightly, spearheaded by industry titans like Samsung Electronics Co., Ltd. and LG Electronics Inc. These conglomerates have adeptly broadened their manufacturing horizons beyond South Korea, with Samsung's two pivotal plants in Vietnam now constituting a third of its global production.

- As the demand for advanced, tech-driven automated machines surges, the manufacturing industry is witnessing a robust market upswing. This momentum is further amplified by the escalating appetite for electric vehicles and consumer electronics, underscoring the heightened need for sophisticated machine tools across diverse sectors. With the global manufacturing landscape expanding, the dependence on machine tools, such as Swiss-type automatic lathe machines, for final product production is deepening.

- Furthermore, as manufacturing methodologies advance, there's a pronounced demand for high-end machine tools that promise superior accuracy and precision. This evolution, in turn, amplifies the need for CAM software to adeptly operate these advanced tools.

Computer Aided Manufacturing Industry Overview

The CAM software market comprises global and regional players in a competitive space. Although the market poses high barriers to entry for new players, several new entrants have gained traction. This market is characterized by moderate/high product differentiation, growing levels of product penetration, and high levels of competition.

Innovation can bring about a sustainable competitive advantage. New technologies such as AI, machine learning, cloud computing, and others are reshaping security trends.

Leading vendors are responding to evolving consumer demands driven by technological advancements by enhancing their existing software and introducing advanced solutions. Some of the players include Autodesk Inc., SolidCAM Ltd, Siemens AG, and CNC Software, LLC. (Mastercam), Hexagon AB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

- 4.4 TECHNOLOGY SNAPSHOT

- 4.4.1 2D Design

- 4.4.2 3D Design

- 4.4.3 5D Design

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Industry 4.0

- 5.1.2 Growing Utilization of CAM Software in the Packaging Machinery Sector

- 5.2 Market Restraints

- 5.2.1 Wide Availability of Open Source CAM Software

6 MARKET SEGMENTATION

- 6.1 By Deployment Model

- 6.1.1 On-Premises

- 6.1.2 Cloud-Based

- 6.2 By End-User Industry

- 6.2.1 Aerospace & Defense

- 6.2.2 Automotive

- 6.2.3 Medical

- 6.2.4 Energy & Utilities

- 6.2.5 Other End-User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 Switzerland

- 6.3.2.3 Spain

- 6.3.2.4 Austria

- 6.3.2.5 Belgium

- 6.3.2.6 Netherlands

- 6.3.2.7 United Kingdom

- 6.3.2.8 France

- 6.3.2.9 Italy

- 6.3.2.10 Sweden

- 6.3.2.11 Poland

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 Saudi Arabia

- 6.3.6.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Autodesk, Inc.

- 7.1.2 Siemens AG

- 7.1.3 SolidCAM Ltd.

- 7.1.4 CNC Software, LLC. (Mastercam)

- 7.1.5 Hexagon AB

- 7.1.6 Cimatron Ltd.

- 7.1.7 HCL Technologies Limited

- 7.1.8 NTT Data Engineering Systems Corporation (NTT DATA Corporation)

- 7.1.9 OPEN MIND Technologies AG

- 7.1.10 BobCAD-CAM Inc.

- 7.1.11 MecSoft Corporation

- 7.1.12 Dassault Systmes

- 7.1.13 PTC Inc.

- 7.1.14 ZWSOFT CO., LTD. (Guangzhou)

- 7.1.15 SmartCAMcnc, Inc.