|

市場調查報告書

商品編碼

1642104

媒體、廣告和娛樂領域的區塊鏈:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Blockchain in Media, Advertising, and Entertainment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

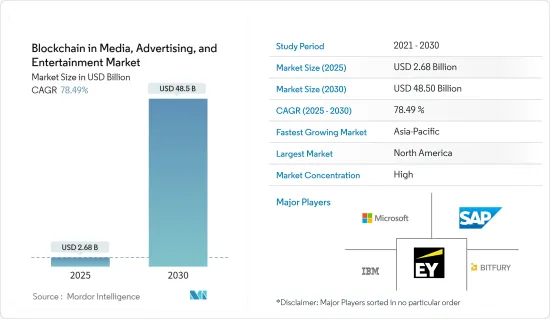

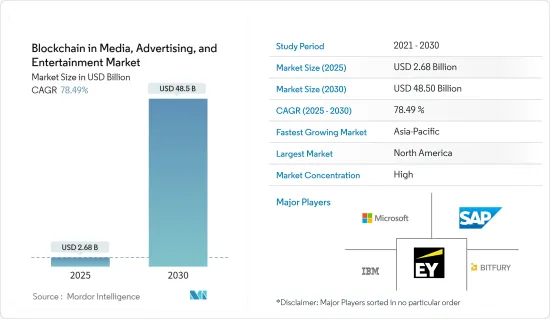

預計 2025 年媒體、廣告和娛樂領域的區塊鏈市場規模為 26.8 億美元,預計到 2030 年將達到 485 億美元,預測期內(2025-2030 年)的複合年成長率為 78.49%。

區塊鏈不僅顛覆了現有的經營模式,而且還促進了新經營模式的發展,尤其是在媒體產業。數位技術正在深刻地改變全球媒體和娛樂產業,特別是在內容創作和發行方面,其中區塊鏈是最突出的技術顛覆者。

主要亮點

- 內容的商品化和智慧財產權(IP)的猖獗盜版正在推動媒體和娛樂產業對區塊鏈的需求。推動市場發展的主要因素包括:內容創作者和最終用戶之間消除中間人的需求日益成長、對安全快捷交易的需求日益增加以及媒體和娛樂行業資料盜版案例日益增多。

- 此外,由於媒體和娛樂產業是一種基於合約的業務,非常重視保護智慧財產權,因此媒體使用者習慣於免費存取各種各樣的內容。此外,所有媒體行業都受到數位化的嚴重影響,因為內容可以在不影響品質的情況下快速複製和分發。仍然需要數位版權管理系統來減少盜版。

- 區塊鏈的出現可能會極大地改變這個行業結構。區塊鏈技術可以很大程度上繞過內容聚合器、平台提供者和版稅收集機構。因此,市場力量轉移到版權所有者手中。區塊鏈技術可以為具有不可變狀態和數位身分的資產提供即時的、基於消費的定價,從而增加內容創作者和媒體公司的利潤。付款應用程式是一個特別關鍵的部分,因為該解決方案可將交易成本降低 40-80%。

- 後疫情時代,全球各地的人們都希望參與音樂節、電影節、體育賽事等實體娛樂活動,同時數位化的採用也顯著增加。分析認為,NFT的普及正在推動市場成長率。

- 例如,根據 Dapper Labs 於今年 8 月發布的數位參與第 1 層區塊鏈 Flow,Live Nation 的子公司 Ticketmaster 最近宣佈在其區塊鏈上為活動組織者鑄造非同質化代幣(NFT) 門票。 NFT 票證的主要用途是其檔案價值。但它不僅僅是一件紀念品;它還可以作為您參加過一場著名音樂會的證明。

- 此外,透過 Ticketmaster,Flow 區塊鏈上已鑄造了超過 500 萬個 NFT。 Meta 在 8 月透露,Instagram 現已支援 100 多個國家的 NFT。 Instagram 上共用的所有 NFT 收藏品都將在 Flow 區塊鏈上創建。此外,Meta 還透過 Facebook 用戶的數位錢包引入了新的 NFT 連線。

- 該技術消除了中間人,減少了供應商和付款人的管理成本和時間。然而,缺乏標準化在一定程度上阻礙了市場的成長。此外,採用新技術的過程成本高且耗時,這限制了市場的成長。

媒體、廣告和娛樂領域的區塊鏈市場趨勢

付款應用可望主導市場

- 媒體用戶現在已經非常習慣免費存取各種各樣的內容。這主要是因為媒體和娛樂產業是一個基於合約的業務,非常重視保護智慧財產權。此外,各種媒體都受到了數位化的沉重打擊,因為現在更容易快速複製和共用內容而不影響品質。

- 區塊鏈技術為具有不可變狀態和數位身分的資產提供即時的、基於消費的定價。付款應用是此解決方案的關鍵領域之一,可將交易成本降低 40% 至 80%,具體取決於產業的採用和滲透程度。另一個流行的應用程式是加密貨幣,它為內容提供者提供小額支付便利。公司利用這項服務允許客戶購買和播放單首歌曲或影片,或購買閱讀新聞報導的權限。

- 此外,基於區塊鏈的微支付使得按使用付費消費成為可能。區塊鏈全面記錄資料的能力可以讓我們更精確地追蹤受版權保護的內容的消費時間和方式。

- 許多內容提供者正在使用該技術接受加密貨幣付款。例如,今年 11 月,總部位於德克薩斯州的金融科技公司 Oveit 與瑞士Start-UpsUtrust 合作,提供加密貨幣付款服務。透過向娛樂產業引入新的付款機制,這些公司希望讓活動策劃者更容易接受和使用加密貨幣付款並覆蓋更大的市場。兩家公司將為全球多達 10 億的活動、主題樂園和旅遊套裝遊客提供加密貨幣付款服務。

- 今年 10 月,領先的 B2B 和 B2C 公司首選的全球付款編配平台 BlueSnap 宣布與著名的比特幣和加密貨幣付款服務提供商 BitPay 建立新的合作。該產品合作夥伴關係支持 BlueSnap 的使命,透過支持全球 15 種最大的加密貨幣和 7 種法定貨幣的接受和支付,幫助世界各地的企業增加收益並降低成本。

預計北美將佔據最大市場佔有率

- 媒體用戶現在已經習慣免費存取各種各樣的內容。這主要是因為媒體和娛樂產業是一個基於合約的業務,非常重視保護智慧財產權。此外,各種媒體都受到了數位化的沉重打擊,因為現在更容易快速複製和共用內容而不影響品質。

- 區塊鏈技術為具有不可變狀態和數位身分的資產提供即時的、基於消費的定價。付款應用是此解決方案的關鍵領域之一,可將交易成本降低 40% 至 80%,具體取決於產業的採用和滲透程度。另一個流行的應用程式是加密貨幣,它為內容提供者提供小額支付便利。公司利用此功能允許客戶購買和播放單首歌曲或影片,或購買閱讀新聞報導的權限。

- 此外,基於區塊鏈的微支付使得按使用付費消費成為可能。區塊鏈全面記錄資料的能力可以讓我們更精確地追蹤受版權保護的內容的消費時間和方式。

- 許多內容提供者正在使用該技術接受加密貨幣付款。例如,今年 11 月,總部位於德克薩斯州的金融科技公司 Oveit 與瑞士Start-UpsUtrust 合作,提供加密貨幣付款服務。透過向娛樂產業引入新的付款機制,這些公司希望讓活動策劃者更容易接受和使用加密貨幣付款並覆蓋更大的市場。兩家公司將為全球多達 10 億的活動、主題樂園和旅遊套裝遊客提供加密貨幣付款服務。

- 今年 10 月,領先的 B2B 和 B2C 公司首選的全球付款編配平台 BlueSnap 宣布與著名的比特幣和加密貨幣付款服務提供商 BitPay 建立新的合作夥伴關係。此次產品合作將使 BlueSnap 實現其目標,即透過支援多達 15 種加密貨幣和 7 種法定貨幣進行支付,幫助世界各地的企業增加收益並降低成本。

媒體、廣告和娛樂領域區塊鏈概述

全球媒體、廣告和娛樂領域的區塊鏈競爭格局中等集中,只有少數參與者提供區塊鏈解決方案,尤其是在媒體和娛樂產業。供應商正在採用聯盟、合作、收購和新產品發布等各種策略來擴大其在全球市場的影響力並增加市場佔有率。

2022年10月,領先的區塊鏈生態系統和加密貨幣基礎設施供應商幣安宣布與韓國頂級全球娛樂公司YG娛樂(YG)簽署合作備忘錄,達成策略合作。作為策略合作的一部分,幣安和YG將合作進行各種區塊鏈計劃,包括NFT領域的計劃。 Binance 將提供 NFT 平台和技術基礎設施,而 YG 將提供 NFT 內容和遊戲資產。除此之外,兩家公司計劃開發基於幣安智慧鏈的遊戲,共同建立元宇宙,並積極探索其他數位資產機會,為客戶創造獨特的產品和服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 內容商品化與智慧財產權盜版猖獗

- 消除內容創作者和最終用戶之間的中間人的需求日益成長

- 安全、快速交易的需求日益增加

- 市場限制

- 缺乏標準化

- 實施成本高且耗時

第6章 市場細分

- 按區塊鏈類型

- 民眾

- 私人的

- 按公司規模

- 中小型企業

- 大型企業

- 按應用

- 授權和權利管理

- 數位廣告

- 智慧合約

- 支付

- 線上遊戲

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Ernst & Young Global Limited

- Bitfury Group Limited

- SAP SE

- Accenture

- Amazon Web Services, Inc.

- Oracle Corporation

- Infosys Limited

- Ujo Music

第8章投資分析

第9章 市場機會與未來趨勢

The Blockchain in Media, Advertising, and Entertainment Market size is estimated at USD 2.68 billion in 2025, and is expected to reach USD 48.50 billion by 2030, at a CAGR of 78.49% during the forecast period (2025-2030).

Blockchain is disrupting not only the existing business models but is also enabling the development of new business models, especially in the media industry. Digital technologies are substantially transforming the global media and entertainment industries, especially in content production and distribution, with blockchain being the most prominent technological disruptor.

Key Highlights

- The need for blockchain in media and entertainment is increasing owing to the subsequent commoditization of content and widespread piracy of intellectual property (IP). The increasing need for eliminating intermediaries between content creators and end-users, the growing demand for secure and faster transactions, and the growing instances of data piracy in the media and entertainment industries are some key factors driving the market.

- Further, media users are accustomed to having free access to a wide variety of content, as the media and entertainment industry is a contract-based business that places a premium on protecting intellectual property. Also, all media segments have suffered significantly from digitization since content can be copied and distributed quickly without losing quality. This is because digital rights management systems still need to reduce copyright infringements.

- With the advent of blockchain, this industry structure could change significantly. Blockchain technology permits bypassing content aggregators, platform providers, and royalty collection associations to a large extent. Thus, market power shifts to the copyright owners. Blockchain technology can increase profits for content creators and media companies by providing real-time consumption-based pricing against assets with an immutable state and digital identity. This solution reduces transaction costs by 40-80%, thus making payment applications the leading segment amongst others.

- After the pandemic, people across the globe are interested in attending physical entertainment events such as music and movie festivals and sports, along with the significant adoption of digitalization. NFT penetration is analyzed to contribute to the market growth rate.

- For instance, in August this year, Ticketmaster, a Live Nation subsidiary, recently announced non fungible tokens (NFTs) tickets for event organizers minted on its blockchain, according to Flow, a digital engagement layer-1 blockchain established by Dapper Labs. The NFT tickets' main use will be for their archival value. But in addition to serving as souvenirs, they can be used as evidence of attendance at prominent concerts.

- Additionally, through Ticketmaster, more than 5 million NFTs have been created on the Flow blockchain. Meta revealed in August that Instagram now supports NFT in more than 100 nations. All NFT collectibles shared on Instagram are created on the Flow blockchain. Additionally, Meta introduced a new NFT connection through users' digital wallets on Facebook.

- This technology eliminates the need for intermediaries and reduces administrative costs and time for providers and payers. However, lack of standardization hinders the market's growth to a certain extent. Also, the process of implementing new technology is expensive and time-consuming, which restrains market growth.

Blockchain in Media, Advertisement and Entertainment Market Trends

Payments Application is Expected to Dominate the Market

- Media users are nowadays highly accustomed to having free access to a wide variety of content. This is primarily because the media and entertainment industry is a contract-based business that places a premium on protecting intellectual property. Also, all types of media have been hurt by digitization because it makes it easy to copy and share content quickly without losing quality.

- Blockchain technology provides real-time consumption-based pricing against assets with an immutable state and digital identity. This solution reduces transaction costs by 40% to 80%, depending upon the level of adoption and extension in the industry, thus making payment applications the leading segment amongst others. Another popular application, cryptocurrency, facilitate micropayments to content providers. Companies use it to enable customers to buy and play single songs or videos, for instance, or to purchase permission to read a news article.

- Further, pay-per-use consumption has become feasible due to blockchain-powered micropayments. Blockchain's ability to record its data comprehensively could allow for more accurate tracking of when and how copyrighted content is consumed.

- Many content providers are using technology to accept payments through cryptocurrency. For instance, in November this year, the Austin, Texas-based fintech business Oveit collaborated with the Swiss start-up Utrust to provide cryptocurrency payment services. They want to introduce a new payment mechanism to the entertainment industry so that event planners may more readily accept and use cryptocurrency payments and reach a larger market. The businesses will act as an intermediary for cryptocurrency payments made by up to 1 billion visitors globally to events, theme parks, and travel packages.

- In October of this year, BlueSnap, the preferred worldwide payment orchestration platform for major B2B and B2C companies, announced a new collaboration with BitPay, the prominent provider of Bitcoin and cryptocurrency payment services. This product collaboration supports BlueSnap's objective to assist businesses all over the world in growing their revenue and decreasing their costs by enabling them to accept and be paid out in up to 15 different cryptocurrencies and seven fiat currencies globally.

North America Expected to Hold the Largest Market Share

- Media users are nowadays highly accustomed to having free access to a wide variety of content. This is primarily because the media and entertainment industry is a contract-based business that places a premium on protecting intellectual property. Also, all types of media have been hurt by digitization because it makes it easy to copy and share content quickly without losing quality.

- Blockchain technology provides real-time consumption-based pricing against assets with an immutable state and digital identity. This solution reduces transaction costs by 40% to 80%, depending upon the level of adoption and extension in the industry, thus making payment applications the leading segment amongst others. Another popular application, cryptocurrency, facilitates micropayments to content providers. Companies use it to enable customers to buy and play single songs or videos, for instance, or to purchase permission to read a news article.

- Further, pay-per-use consumption has become feasible due to blockchain-powered micropayments. Blockchain's ability to record its data comprehensively could allow for more accurate tracking of when and how copyrighted content is consumed.

- Many content providers are using technology to accept payments through cryptocurrency. For instance, in November this year, the Austin, Texas-based fintech business Oveit collaborated with the Swiss start-up Utrust to provide cryptocurrency payment services. They want to introduce a new payment mechanism to the entertainment industry so that event planners may more readily accept and use cryptocurrency payments and reach a larger market. The businesses will act as an intermediary for cryptocurrency payments made by up to 1 billion visitors globally to events, theme parks, and travel packages.

- In October of this year, BlueSnap, the preferred worldwide payment orchestration platform for major B2B and B2C companies, announced a new collaboration with BitPay, the prominent provider of Bitcoin and cryptocurrency payment services. This product partnership helps BlueSnap reach its goal of helping businesses around the world make more money and cut costs by letting them accept and be paid in up to 15 different cryptocurrencies and seven fiat currencies.

Blockchain in Media, Advertisement and Entertainment Industry Overview

The competitive landscape of the global blockchain in the media, advertising, and entertainment industries is moderately concentrated, as only a few players offer blockchain solutions, especially in the media and entertainment industries. The vendors have adopted different strategies, such as partnerships, collaborations, acquisitions, and new product launches, to expand their presence in the global market and increase their market share.

In October 2022, Binance, a major blockchain ecosystem and cryptocurrency infrastructure provider, announced signing a Memorandum of Understanding (MOU) to form a strategic cooperation with YG Entertainment Inc. (YG), one of South Korea's top global entertainment businesses. Binance and YG will work on various blockchain projects as part of their strategic cooperation, including projects in the NFT sector. Binance will provide the NFT platform and technological infrastructure, and YG will offer the NFT content and gaming assets. Additionally, the two businesses intend to create games based on the Binance Smart Chain, work together to establish the Metaverse, and actively explore other digital asset opportunities to create distinctive products and services for customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Subsequent Commoditization of Content and Widespread Piracy of Intellectual Property

- 5.1.2 The Increasing Need for Eliminating Intermediaries Between Content Creators and End-Users

- 5.1.3 The Growing Demand for Secure and Faster Transactions

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization

- 5.2.2 Expensive and Time Consuming Deployment

6 MARKET SEGMENTATION

- 6.1 By Type of Blockchain

- 6.1.1 Public

- 6.1.2 Private

- 6.2 By Size of the Enterprise

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By Application

- 6.3.1 Licensing and Rights Management

- 6.3.2 Digital Advertising

- 6.3.3 Smart Contracts

- 6.3.4 Payments

- 6.3.5 Online Gaming

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Ernst & Young Global Limited

- 7.1.4 Bitfury Group Limited

- 7.1.5 SAP SE

- 7.1.6 Accenture

- 7.1.7 Amazon Web Services, Inc.

- 7.1.8 Oracle Corporation

- 7.1.9 Infosys Limited

- 7.1.10 Ujo Music