|

市場調查報告書

商品編碼

1642106

邊緣 AI 硬體:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Edge AI Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

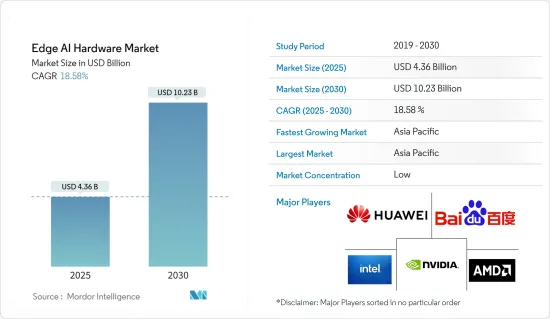

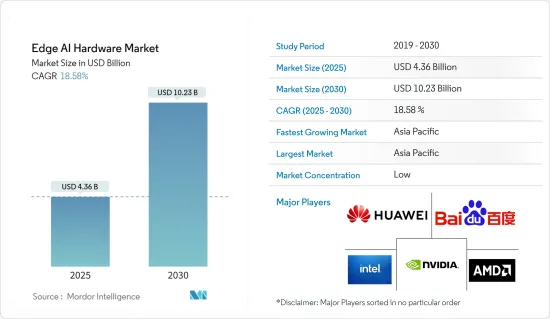

邊緣AI硬體市場規模在2025年估計為43.6億美元,預計到2030年將達到102.3億美元,預測期內(2025-2030年)的複合年成長率為18.58%。

主要亮點

- 在對沉浸式虛擬實境(VR)環境的追求的推動下,對邊緣 AI 硬體的需求激增。 VR 環境需要超低延遲才能提供真正身臨其境的體驗,即使是最輕微的處理延遲也會破壞使用者的存在感。邊緣 AI 硬體促進了設備上的處理,大大減少了設備和雲端之間的資料傳輸。這確保了即時效能,這對於遊戲、模擬和培訓程式等 VR 應用至關重要。

- 邊緣 AI 硬體正在改變媒體和娛樂產業,這主要歸功於其即時、高效能的處理能力。此特性對於創造身臨其境的客製化體驗至關重要。 Netflix、YouTube 和 Amazon Prime Video 等領先的串流媒體平台正在擴大利用邊緣 AI 硬體來增強即時內容傳送。透過更接近最終用戶處理資料,Edge AI 有效降低了延遲,確保了流暢的影片串流和更好的觀看體驗。

- 除了串流媒體之外,Edge AI 硬體還可以幫助視訊編輯和廣播。它具有解析度升級、影格速率提高以及過濾器和效果的即時應用等功能。例如,AI演算法可以直接在邊緣裝置上將標準影片提升到4K或8K,因此無需依賴雲端即可提高觀看品質。此外,邊緣設備上的人工智慧驅動的視訊壓縮最佳化了頻寬使用率。這是直播的關鍵因素,保持視訊品質的同時減少資料負載至關重要。

- 然而,邊緣AI硬體市場面臨挑戰,主要是由於硬體和軟體都前期投資。邊緣AI硬體的基礎由專用晶片、GPU(例如Nvidia的Jetson平台)、張量處理單元(TPU)和其他高效能處理器組成。這些組件對於即時資料處理和人工智慧推理至關重要,但其高成本成為其採用的障礙,尤其是對於預算緊張的中小型企業和行業而言。

- 疫情爆發後,通訊設備需求、數位化、智慧建築興起、汽車搭載ADAS、工業4.0等趨勢,帶動了智慧電子和通訊設備的成長,從而支持了後續市場的擴張。

邊緣人工智慧 (AI) 硬體市場趨勢

機器人設備領域預計將佔據主要市場佔有率

- 人工智慧 (AI) 和邊緣運算正在迅速重塑機器人格局,開啟更智慧、自主的機器時代。邊緣運算可以有效地處理大量資料並解決機器人技術中的傳統挑戰,例如延遲和頻寬問題。同時,人工智慧將使機器人能夠從經驗中學習並做出明智的決策,從而打造出智慧且適應性強的機器。在報導中,我們探討這些技術對機器人和自動化未來的影響。

- 邊緣人工智慧使機器人能夠動態處理環境資料,從而做出即時決策並快速適應周圍環境。這種 AI 邊緣處理同時利用了機器學習和推理演算法。這種響應能力對於自動駕駛汽車和製造業等領域至關重要,因為及時對環境變化做出反應至關重要。

- 此外,邊緣人工智慧提高了機器人決策的準確性。透過在邊緣設備上實現人工智慧演算法,機器人可以提高其決策的準確性。對於醫療保健等高風險產業來說,這種準確度至關重要。

- 此外,邊緣人工智慧將改善隱私和安全性並增強機器人技術。將資料儲存在邊緣裝置上可降低敏感資訊在傳輸到集中資料中心或雲端的過程中被攔截的風險。這種保護對於處理個人資料的行業(例如醫療保健和金融)至關重要。透過在邊緣處理資料,敏感資訊的傳輸大大減少。然後,雲端充當這些處理過的資料的儲存庫和連接設備的控制中心。這種轉變導致對彌合軟體和機器人之間差距的邊緣人工智慧硬體的需求激增。

- 2024 年 4 月,高通發布了針對物聯網和機器人技術的 Edge AI RB3 Gen 2 晶片,並附帶「微功率」Wi-Fi SoC。這些開發套件旨在加速該公司AI加速晶片的部署,這些晶片面向嵌入式應用以及機器人和物聯網,並具有高達88%的節能潛力。這些投資重點關注邊緣人工智慧,正在推動機器人領域的市場成長。

亞太地區成長強勁

- 亞太地區在消費性電子產品市場佔有主導地位。印度、中國和韓國等主要國家正在透過政府措施和主要產業參與者的存在來加強本地製造業。此舉可能會刺激家電的需求。人工智慧演算法直接整合到智慧型手機、物聯網設備和嵌入式系統等邊緣設備將進一步推動市場擴張。此外,隨著該地區投資的增加,市場對這些技術的需求將大幅成長。

- 根據中國資訊通訊研究院預測,2023年中國行動電話出貨量預計將達2.89億部,與前一年同期比較增加6.5%。 5G行動電話出貨量2.4億部,較去年成長11.9%,佔國內行動電話出貨量的82.8%。中國信通院資料也顯示,國產品牌行動電話新機型上市406款,與前一年同期比較成長5.5%。 2023年12月行動電話出與前一年同期比較增1.5%至約2,828萬部。這些重大發展將對市場成長產生正面影響。

- 此外,根據Invest India的數據,印度電子產品市場目前價值1,550億美元,其中國內生產佔65%。電子產品的加速普及是由技術變革所推動的,尤其是5G網路和物聯網(IoT)的推出。 「數位印度」和「智慧城市」計劃等措施正在推動電子市場對物聯網的需求,開創電子產品的新時代。過去六年裡,印度不僅一躍成為全球第二大行動電話製造國,國內電子設備產量也增加了一倍以上。

- 亞太地區歷來是製造業強國,但物聯網 (IoT) 的應用日益普及。 Telenor IoT報告顯示,在韓國、日本、澳洲和中國等物聯網已開發國家以及印度、巴基斯坦、孟加拉、印尼和泰國等新興經濟體的協同效應推動下,亞太地區的物聯網設備數量預計將從最近的145億成長到2030年的389億。隨著物聯網預計將快速成長,對邊緣人工智慧硬體的需求也預計將同時大幅增加。

- 此外,該地區多個行業對機器人技術的採用日益廣泛,也有望推動市場機會。根據IFR的數據,到2023年,亞洲將成為工業機器人應用的主導力量,佔所有新安裝量的70%。其中,中國尤為突出,共有1,755,132台機器人投入運作,佔全球整體的51%。

邊緣人工智慧(AI)硬體產業概覽

邊緣AI硬體市場由主要供應商主導,他們在各個地理市場激烈競爭以站穩腳跟。出於此原因,供應商正在建立多種聯盟和夥伴關係關係以獲得市場佔有率和技術力。市場的主要企業包括英特爾公司、華為科技公司、英偉達公司、超微半導體公司和百度公司。

廠商之間的競爭策略是透過創新在市場上站穩腳步,由於主要廠商的研發投入能力較強,市場競爭日益激烈。

獲得分銷管道、現有的業務關係、更好的供應鏈知識甚至自有平台,使現有的科技巨頭比新參與企業擁有市場優勢。總體而言,所研究市場中競爭公司之間的敵意程度適中,預計在預測期內將保持不變。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估影響市場的宏觀經濟因素

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 在虛擬實境環境中創造更逼真體驗的興起

- 電腦視覺在運動產業的應用日益廣泛

- 媒體和娛樂應用中擴大採用邊緣 AI 硬體將推動成長

- 市場限制

- 需要在邊緣 AI 硬體和軟體上進行大量的前期投資

第6章 市場細分

- 按處理器

- CPU

- GPU

- FPGA

- ASIC

- 按設備

- 智慧型手機

- 相機

- 機器人

- 穿戴式裝置

- 智慧音箱

- 其他設備

- 按最終用戶產業

- 政府

- 房地產

- 家電

- 車

- 運輸

- 衛生保健

- 製造業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Intel Corporation

- Huawei Technologies Co. Ltd

- Nvidia Corporation

- Advanced Micro Devices Inc.

- Baidu Inc.

- Google LLC(Alphabet Inc.)

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Amazon.com Inc.

- Alibaba Cloud(Alibaba Group Holding Limited)

- Continental AG

- Denso Corporation

- Robert Bosch GmbH

- Kalray

- MediaTek Inc.

- Imagination Technologies

第8章投資分析

第9章:市場的未來

The Edge AI Hardware Market size is estimated at USD 4.36 billion in 2025, and is expected to reach USD 10.23 billion by 2030, at a CAGR of 18.58% during the forecast period (2025-2030).

Key Highlights

- Driven by the quest for heightened realism in virtual reality (VR) environments, the demand for Edge AI hardware is witnessing a significant surge. VR environments necessitate ultra-low latency for a truly immersive experience; even a minor processing delay can disrupt the user's sense of presence. Edge AI hardware facilitates on-device processing, significantly reducing the data transfer between the device and the cloud. This ensures the real-time performance crucial for VR applications, including gaming, simulations, and training programs.

- Edge AI hardware is transforming the media and entertainment industry, primarily due to its capability for real-time, high-performance processing. This attribute is essential for creating immersive and tailored experiences. Leading media streaming platforms, such as Netflix, YouTube, and Amazon Prime Video, are increasingly leveraging Edge AI hardware to enhance real-time content delivery. By processing data closer to the end-users, Edge AI effectively reduces latency, guaranteeing smooth video streaming and an enhanced viewing experience.

- Beyond the realm of streaming, Edge AI hardware is instrumental in video editing and broadcasting. It boasts capabilities like upscaling resolutions, enhancing frame rates, and applying filters or effects in real-time. For example, AI algorithms can elevate a standard video directly to 4K or even 8K on edge devices, boosting viewing quality without relying on the cloud. Furthermore, AI-driven video compression on edge devices optimizes bandwidth usage, a critical factor for live streaming where it's essential to maintain video quality while reducing data loads.

- However, the Edge AI hardware market grapples with challenges, primarily due to the hefty upfront investments in both hardware and software. The foundation of Edge AI hardware comprises specialized chips, GPUs (such as Nvidia's Jetson platform), Tensor Processing Units (TPUs), and other high-performance processors. While these components are vital for real-time data processing and AI inference, their high costs pose a barrier to adoption, particularly for smaller enterprises and industries with tighter budgets.

- Post the COVID-19 pandemic, trends like the demand for communication devices, digitalization, the rise of smart buildings, ADAS-equipped vehicles, and the principles of Industry 4.0 have spurred the growth of smart electronics and communication devices, subsequently driving the market expansion.

Edge Artificial Intelligence (AI) Hardware Market Trends

Robots Device Segment is Expected to Hold Significant Market Share

- Artificial intelligence (AI) and edge computing are rapidly reshaping the landscape of robotics, ushering in an era of smarter and more autonomous machines. Edge computing efficiently processes vast data volumes, tackling traditional challenges in robotics, such as latency and bandwidth issues. Concurrently, AI equips robots to learn from their experiences and make informed decisions, leading to machines that are both intelligent and adaptable. This article explores the profound influence of these technologies on the future of robotics and automation.

- Edge-AI enables robots to make real-time decisions by processing environmental data on-site, allowing for swift adaptation to their surroundings. This edge processing, powered by AI, utilizes both machine learning and inference algorithms. Such responsiveness is vital in sectors like autonomous vehicles and manufacturing, where timely reactions to environmental changes are crucial.

- Moreover, edge AI boosts the accuracy of robotic decisions. By deploying AI algorithms on edge devices, robots enhance their decision-making precision. This heightened accuracy is paramount in industries like healthcare, where the stakes are high.

- Additionally, Edge-AI fortifies robotics with enhanced privacy and security. By storing data on edge devices, the risk of sensitive information being intercepted en route to centralized data centers or the cloud diminishes. This protection is essential for sectors like healthcare and finance, which handle personal data. With data processed on the edge, the transfer of sensitive information is significantly reduced. The cloud then acts as both a repository for this processed data and a control center for connected devices. This shift has led to a surge in demand for edge AI hardware, bridging the gap between software and robotics.

- In April 2024, Qualcomm launched its Edge AI RB3 Gen 2 Chip tailored for IoT and robotics, accompanied by a "Micro-Power" Wi-Fi SoC. These development kits aim to expedite the company's AI-accelerating chip's deployment, targeting not just robotics and IoT but also embedded applications and boasting a potential power draw reduction of up to 88%. Such investments, heavily leaning on Edge AI, are driving the robotics segment's growth in the market.

Asia Pacific to Register Major Growth

- The Asia Pacific region stands out as a dominant player in the consumer electronics market. Major countries, including India, China, and Korea, are ramping up local production through government initiatives and the presence of key industry players. This push is set to amplify the demand for consumer electronics. The market's expansion is further fueled by the direct integration of AI algorithms into edge devices, encompassing smartphones, IoT devices, and embedded systems. Additionally, with rising investments in the region, the appetite for these market technologies is poised for substantial growth.

- According to the China Academy of Information and Communications Technology (CAICT), China's mobile phone shipments in 2023 reached 289 million units, marking a 6.5% increase from the previous year. Shipments of 5G phones hit 240 million units, an 11.9% annual rise, making up 82.8% of the country's total mobile phone shipments. CAICT data also highlighted the introduction of 406 new domestic-brand phone models, a 5.5% increase from the prior year. December 2023 saw mobile phone shipments touch approximately 28.28 million units, reflecting a 1.5% year-on-year growth. These significant developments are poised to positively influence the market's growth.

- Moreover, according to Invest India, the electronics market in India is currently valued at USD 155 billion, with domestic production constituting 65% of this value. The accelerated adoption of electronic products is being driven by technological transitions, notably the rollout of 5G networks and the Internet of Things (IoT). Initiatives like 'Digital India' and 'Smart City' projects have heightened the demand for IoT in the electronics devices market, signaling the dawn of a new era for electronic products. Over the past six years, India has not only emerged as the world's second-largest mobile manufacturer but has also seen its domestic production of electronics more than double.

- The Asia Pacific region, historically a manufacturing powerhouse, is increasingly embracing the Internet of Things (IoT). Telenor IoT reports that in APAC, the synergy between established IoT frontrunners like South Korea, Japan, Australia, and China and emerging players such as India, Pakistan, Bangladesh, Indonesia, and Thailand is propelling the number of IoT devices from a recent tally of 14.5 billion to a projected 38.9 billion by 2030. With this anticipated surge in IoT, there's a parallel expectation for a significant uptick in demand for Edge AI hardware.

- Furthermore, the growing adoption of robots across multiple industries in the region is also expected to drive market opportunities. According to IFR, in 2023, Asia emerged as the dominant force in industrial robot adoption, representing 70% of all new installations. Notably, China stands out, contributing a significant 51% to the global tally, boasting 1,755,132 operational robots across its factories.

Edge Artificial Intelligence (AI) Hardware Industry Overview

The Edge AI Hardware market is dominated by major vendors that cover a significant share of the market studied, and they are intensely competing to gain a foothold in different regional markets. Owing to this, vendors are involved in several partnerships and alliances to gain market presence and technological capabilities. Some of the major players in the market are Intel Corporation, Huawei Technologies Co. Ltd, Nvidia Corporation, Advanced Micro Devices Inc., and Baidu Inc., among others.

The competitive strategy among the vendors is to gain a foothold in the market studied with innovation, and the capability of investing in R&D by major vendors is on the higher side, thus, intensifying the competition in the market studied.

Access to the distribution channel, existing business relations, and better supply chain knowledge, along with the self-owned platform, give the established tech giants a market advantage over the new competitors. Overall, the degree of competitive rivalry in the market studied is moderately high and expected to remain the same over the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

- 4.4 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in the Creation of More Realistic Experiences for Virtual Reality Environments

- 5.1.2 Increased Usage of Computer Vision in the Sports Industry

- 5.1.3 Growing Adoption of Edge AI Hardware in Media and Entertainment Applications Is Boosting Growth

- 5.2 Market Restraints

- 5.2.1 Significant Upfront Investment Required for Edge AI Hardware and Software

6 MARKET SEGMENTATION

- 6.1 By Processor

- 6.1.1 CPU

- 6.1.2 GPU

- 6.1.3 FPGA

- 6.1.4 ASICs

- 6.2 By Device

- 6.2.1 Smartphones

- 6.2.2 Cameras

- 6.2.3 Robots

- 6.2.4 Wearables

- 6.2.5 Smart Speaker

- 6.2.6 Other Devices

- 6.3 By End-User Industry

- 6.3.1 Government

- 6.3.2 Real Estate

- 6.3.3 Consumer Electronics

- 6.3.4 Automotive

- 6.3.5 Transportation

- 6.3.6 Healthcare

- 6.3.7 Manufacturing

- 6.3.8 Others

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intel Corporation

- 7.1.2 Huawei Technologies Co. Ltd

- 7.1.3 Nvidia Corporation

- 7.1.4 Advanced Micro Devices Inc.

- 7.1.5 Baidu Inc.

- 7.1.6 Google LLC (Alphabet Inc.)

- 7.1.7 Qualcomm Incorporated

- 7.1.8 Samsung Electronics Co., Ltd.

- 7.1.9 Apple Inc.

- 7.1.10 Amazon.com Inc.

- 7.1.11 Alibaba Cloud (Alibaba Group Holding Limited)

- 7.1.12 Continental AG

- 7.1.13 Denso Corporation

- 7.1.14 Robert Bosch GmbH

- 7.1.15 Kalray

- 7.1.16 MediaTek Inc.

- 7.1.17 Imagination Technologies