|

市場調查報告書

商品編碼

1642107

拉丁美洲紡織品:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Latin America Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

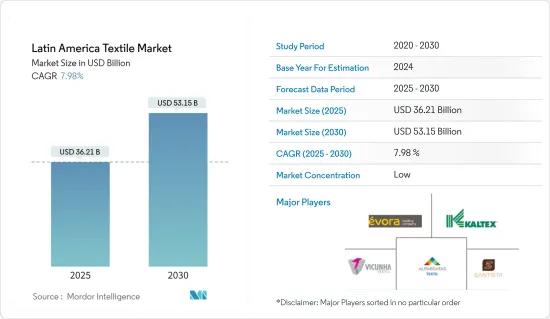

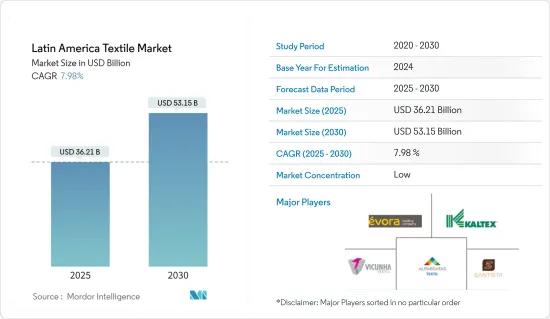

預計 2025 年拉丁美洲紡織品市場規模為 362.1 億美元,到 2030 年將達到 531.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.98%。

拉丁美洲紡織品市場的特點是行業多元化、充滿活力,牢牢紮根於傳統工藝,在全球時尚和家用紡織品領域的影響力日益增強。該地區擁有豐富的自然資源,例如棉花和羊毛,這些都是紡織品生產所必需的。巴西、墨西哥和哥倫比亞等主要市場在製造和出口方面處於領先地位,而秘魯和瓜地馬拉等國家則以其高品質的手工紡織品而聞名。

隨著全球向環保產品轉變,對永續和符合道德標準的紡織品的需求不斷增加,市場正在經歷成長。此外,紡織製造技術的進步和電子商務的興起進一步推動了該行業的擴張。但它也面臨來自亞洲低成本生產商的競爭以及該地區經濟波動等挑戰。

拉丁美洲紡織品市場趨勢

服飾產業崛起 市場活躍

服飾是拉丁美洲紡織品市場的主要驅動力,推動著全部區域的成長和創新。巴西、墨西哥和哥倫比亞等擁有悠久紡織品生產傳統的國家在國內和國際市場的服裝製造領域處於領先地位。該地區的服飾受益於消費者對時尚日益成長的需求,包括對本地製造、永續和符合道德標準的服飾日益成長的興趣。此外,由於拉丁美洲靠近北美主要消費市場,因此在交貨時間更快、運輸成本更低方面比亞洲生產商具有競爭優勢。

此外,快時尚的成長和電子商務平台的擴張正在加速服飾對紡織品的需求。本土設計師和品牌正獲得認可,使得該行業更具吸引力。然而,挑戰依然存在,包括與全球服裝製造商的競爭,以及需要投資現代化生產設施以滿足國際標準。儘管存在這些障礙,服飾仍然是推動市場前進的重要力量。

棉花產量增加推動市場成長

增加棉花產量對於拉丁美洲紡織品市場的成長至關重要。巴西、阿根廷和墨西哥等國家是該地區的主要棉花生產國,對紡織業供應鏈貢獻巨大。由於農業技術的進步和永續農耕實踐提高了生產能力,巴西已成為世界領先的棉花出口國之一。

棉花產量增加將為國內紡織業提供可靠的優質原料供應,減少對進口的依賴,並提高拉丁美洲紡織品在國際舞台上的競爭力。國內棉花供應量的增加也支持了嚴重依賴棉織物的服飾和家用紡織品行業的成長。

拉丁美洲紡織業概況

拉丁美洲紡織品市場被一分為二,且參與者眾多。秘魯、瓜地馬拉和哥倫比亞等擁有傳統手工紡織品生產的國家市場強勁。這些小型企業專注於手工藝品和具有文化意義的紡織品等利基市場,從而促進市場多樣化。主要參與者包括 Evora SA、Kaltex SA、Vicunha Textil SA、Alpargatas SAIC 和 Santista Argentina SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察與動態

- 市場概況

- 市場促進因素

- 對永續和本地生產的紡織產品的需求不斷成長

- 紡織工匠的悠久傳統

- 市場限制

- 經濟不穩定和外匯波動

- 市場機會

- 對永續產品的需求不斷增加

- 電子商務的興起

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業創新

- 新冠疫情對拉丁美洲紡織品市場的影響

第5章 市場區隔

- 按應用

- 服飾

- 工業/技術應用

- 家庭使用

- 按材質

- 棉布

- 黃麻

- 絲綢

- 合成的

- 羊毛

- 按工藝

- 機織布料

- 不織布

第6章 競爭格局

- 市場競爭概況

- 公司簡介

- Evora SA

- Kaltex SA

- Vicunha Textil SA

- Coteminas SA

- Alpargatas SAIC

- Santista Argentina SA

- Santana Textiles SA

- Fabricato SA

- Pettenati SA Textile Industry

- Australtex SA*

第7章 未來市場趨勢

第8章 免責聲明及發布者

The Latin America Textile Market size is estimated at USD 36.21 billion in 2025, and is expected to reach USD 53.15 billion by 2030, at a CAGR of 7.98% during the forecast period (2025-2030).

A diverse and vibrant industry with solid roots in traditional craftsmanship and a growing presence in the global fashion and home textiles sectors characterize the Latin American textiles market. The region benefits from an abundance of natural resources, including cotton and wool, which are integral to textile production. Key markets such as Brazil, Mexico, and Colombia are leading in manufacturing and export activities, while countries like Peru and Guatemala are renowned for their high-quality, artisanal textiles.

The market is witnessing growth due to increasing demand for sustainable and ethically produced textiles, driven by a global shift toward eco-friendly products. Additionally, technological advancements in textile manufacturing and a rise in e-commerce are further propelling the industry's expansion. However, the market also faces challenges, such as competition from low-cost producers in Asia and economic fluctuations within the region.

Latin America Textile Market Trends

Rise in the Clothing Industry is Fueling the Market

The clothing industry is a significant driver of the Latin American textile market, fueling growth and innovation across the region. With a strong tradition of textile production, countries like Brazil, Mexico, and Colombia are at the forefront of manufacturing apparel for domestic and international markets. The region's clothing industry is benefiting from increasing consumer demand for fashion, including a rising interest in locally made, sustainable, and ethically produced garments. Latin America's proximity to major consumer markets in North America also enhances its competitive edge, allowing for quicker turnaround times and lower transportation costs compared to Asian producers.

Additionally, the growth of fast fashion and the expansion of e-commerce platforms are accelerating the demand for textiles in the clothing sector. Local designers and brands are gaining recognition, boosting the industry's appeal. However, challenges remain, including competition from global apparel manufacturers and the need for investment in modernizing production facilities to meet international standards. Despite these obstacles, the clothing industry continues to be a pivotal force in driving the market forward.

Rising Cotton Production is Driving the Market's Growth

Increasing cotton production is crucial to the growth of the Latin American textile market. Countries including Brazil, Argentina, and Mexico are among the region's leading cotton producers, contributing significantly to the textile industry's supply chain. Brazil, in particular, has emerged as one of the world's top cotton exporters, with advancements in agricultural technology and sustainable farming practices boosting its production capacity.

The rise in cotton production supports the domestic textile industry by providing a reliable and high-quality raw material source, reducing dependency on imports, and enhancing the competitiveness of Latin American textiles on the global stage. This increase in local cotton availability also supports the growth of the clothing and home textiles sectors, which rely heavily on cotton fabrics.

Latin America Textile Industry Overview

The Latin American textiles market is semi-fragmented, with many players. The market is strong in countries like Peru, Guatemala, and Colombia, where traditional and artisanal textile production is prevalent. These smaller players focus on niche markets, such as handcrafted and culturally significant textiles, which contribute to the market's diversity. The key players include Evora SA, Kaltex SA, Vicunha Textil SA, Alpargatas SAIC, and Santista Argentina SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Sustainable and Locally Produced Textiles

- 4.2.2 Strong Tradition of Textile Craftsmanship

- 4.3 Market Restraints

- 4.3.1 Economic Instability and Fluctuations in Currency Exchange Rates

- 4.4 Market Opportunities

- 4.4.1 Increasing Demand for Sustainable Products

- 4.4.2 Expansion of E-commerce

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Technological Innovation in the Industry

- 4.8 Impact of the COVID-19 Pandemic on the Latin America Textiles Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Clothing

- 5.1.2 Industrial/Technical Applications

- 5.1.3 Household Applications

- 5.2 By Material

- 5.2.1 Cotton

- 5.2.2 Jute

- 5.2.3 Silk

- 5.2.4 Synthetics

- 5.2.5 Wool

- 5.3 By Process

- 5.3.1 Woven

- 5.3.2 Non-woven

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Evora SA

- 6.2.2 Kaltex SA

- 6.2.3 Vicunha Textil SA

- 6.2.4 Coteminas SA

- 6.2.5 Alpargatas SAIC

- 6.2.6 Santista Argentina SA

- 6.2.7 Santana Textiles SA

- 6.2.8 Fabricato SA

- 6.2.9 Pettenati SA Textile Industry

- 6.2.10 Australtex SA*