|

市場調查報告書

商品編碼

1642112

防火牆即服務 (FWaaS):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Firewall-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

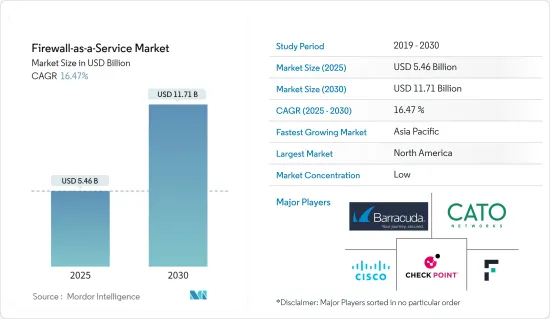

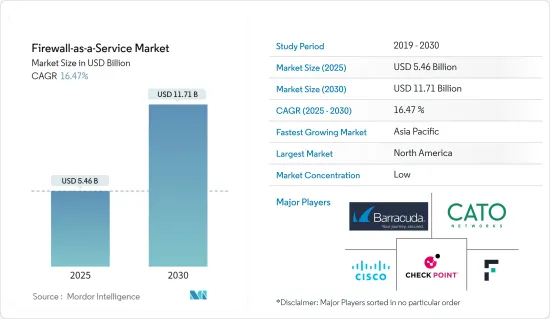

防火牆即服務 (FWaaS) 市場規模預計在 2025 年為 54.6 億美元,預計到 2030 年將達到 117.1 億美元,預測期內(2025-2030 年)的複合年成長率為 16.47%。

雲端基礎的防火牆服務為組織提供了多種好處,包括彈性擴充性、安全存取奇偶校驗、遷移後的安全性、身分保護和安全性效能管理。因此,許多公司正在採用防火牆即服務 (FWaaS) 來管理雲端網路上的資料封包。

主要亮點

- 基於硬體的安全選項變得越來越不常見,而雲端運算的興起正在推動使用服務交付模式的基於軟體的解決方案的採用。在過去五年中,這些變更加速了 FWaaS 解決方案和其他網路安全服務的採用,從而產生了更具可擴展性和更易於使用的安全解決方案。

- 雲端基礎的應用程式的快速成長、公共雲端環境中資料外洩的激增以及商業組織之間防火牆通訊協定的不斷變化是影響全球市場防火牆即服務 (FWaaS) 成長的主要因素。然而,託管和內部防火牆整合的複雜性以及低度開發國家IT基礎設施的不足阻礙了市場的成長。

- 防火牆即服務 (FWaaS) 用於多個行業,包括 BFSI、政府、IT 和通訊、醫療保健、零售、製造、航太和國防以及能源和公共產業,為企業提供先進的雲端基礎的網路安全解決方案。隨著雲端網路上的流量呈指數級成長,企業正在採用防火牆和端點安全等安全解決方案來保護其雲端網路上的資料。

- COVID-19 的影響導致在家工作和雲端運算採用的增加。提供遠端存取可能會成為 IT 員工待辦事項清單中最重要的一項。根據 Global Workplace Analytics 的數據,到年終,多達 30% 的勞動力可能每週在家工作數天。網路安全內幕調查顯示,超過一半 (54%) 的受訪者表示,COVID-19 增加了工作流程和應用程式對雲端的採用。此外,約 66% 的受訪者預計遠距工作者面臨的安全威脅將會增加。無論使用者在哪裡工作,防火牆都需要保護您組織的網路。

FWaaS(防火牆即服務)市場趨勢

公共雲端部署模式可望佔領大量市場佔有率

- 隨著企業轉向雲端環境,資料保護和安全漏洞已成為金融、政府、醫療保健、零售、國防和 IT/通訊等各行各業的主要議題。

- 根據 RedLock Inc. 的報告,全球近一半(49%)的資料庫未加密,這使得它們容易受到潛在的網路攻擊。此外,超過一半(51%)的組織使用雲端儲存服務,增加了託管環境中運行的應用程式遭受攻擊的風險。

- 此外,隨著從傳統IT基礎設施向雲端環境的轉變,端點數量正在迅速增加,因此需要專門針對雲端平台的高階防火牆保護服務。

- 市場上的供應商正在響應這一需求,提供增強版的防火牆即服務 (FWaaS) 解決方案,該解決方案具有 SSL 卸載、內容快取和負載平衡功能,可確保應用程式的順利處理。全球新興經濟體都在採用 FWaaS 作為必要服務,以保護其雲端環境並改善整體業務功能。

- 2023 年 4 月,Akamai Technologies Inc. 宣布推出 Prolexic Network Cloud Firewall。 Akamai Prolexic 的此功能使客戶能夠管理和定義自己的存取控制清單 (ACL),從而為保護自己的網路邊緣提供更大的靈活性。 Prolexic 是 Akamai雲端基礎的 DDoS 保護平台,可在攻擊到達應用程式、資料中心和網路導向的基礎架構之前將其封鎖。

亞太地區預計將出現顯著的市場成長

- 目前,亞太地區是防火牆即服務 (FWaaS) 普及速度最快的地區,大大小小的企業都紛紛採用這項技術。中國面臨的網路攻擊日益增多,促使其提高防禦能力。然而,該國很可能成為世界其他地區網路攻擊的重要來源。此外,中國的技術進步也正在增加連網設備的數量。隨著 5G 設備的出現,設備互聯互通預計也將大幅提升。因此,連網設備的數量將會增加,進而大幅增加安全產品的市場需求。

- 隨著企業日益走向數位化並將相關技術作為業務的一部分,中國的網路安全事件急劇增加。技術進步正在推動中國連網設備的興起。此外,隨著5G設備的使用不斷增加,設備的互聯互通也將顯著增加,這將直接增加對安全產品的需求,並大幅推動該地區的市場發展。

- 日本企業和政府對網路安全的興趣正在迅速成長。針對日本組織的網路攻擊不斷增加,促使政府制定新的策略、法律和設施。此外,智慧型手機的廣泛使用以及上網的電器產品日益增多,在為人們的生活帶來便利的同時,也使人們的日常生活面臨資訊被竊取的風險。

- 日本正在探索與各國進行雙邊合作,以落實網路安全優先事項,例如其與美國國防安全保障部達成的協議,以改善和合作遏制政府面臨的網路威脅。美國國防安全保障部表示,2023年1月,美日簽署了更新的網路安全合作備忘錄,主要是為了美國作戰合作。

- 澳洲政府致力於實現 2030 年成為網路安全最強的國家的目標。隨著網路威脅日益嚴重,網路安全解決方案的需求不斷增加,國家開始對持久和適應能力進行投資。為了實現這一目標,政府希望打造一個公認的網路安全產品和服務品牌,幫助擴大國內市場。

防火牆即服務 (FWaaS) 產業概覽

防火牆即服務 (FWaaS) 市場較為分散,主要參與者包括 Barracuda Networks, Inc.、Cato Networks、Check Point Software Technologies, Inc.、Cisco Systems, Inc. 和 Forcepoint。市場參與者正在採取夥伴關係和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 2 月-Fortinet 推出了一款新的 ASIC,預計將為其核心 FortiGate 防火牆產品提供更有效率、更強大的安全功能和網路功能組合。此客自訂晶片採用 7 奈米封裝,被稱為第五代安全處理系統 (FortiSP5),有望提高 FortiGate 系統的性能。

- 2022 年 10 月-線上安全領域的領導者 McAfee Corp. 在英國推出 McAfee+。此新產品系列包括全新的隱私和身分保護功能,讓用戶在網路上安心無憂。新的 McAfee+ 產品套件首先在美國推出,現在也在英國推出,為用戶提供廣泛的身份清理服務、身份恢復幫助、錢包丟失幫助以及使用世界一流的威脅防禦保護所有設備的能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 雲端基礎的應用程式快速成長

- 公共雲端環境中的資料外洩激增

- 企業組織中防火牆通訊協定的變化

- 市場限制

- 整合託管和本地防火牆的複雜性

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按服務模式

- SaaS

- IaaS

- PaaS

- 按部署模型

- 私人的

- 民眾

- 混合

- 依使用者類型

- 大型企業

- 中小型企業

- 按行業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 零售

- 航太和國防

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲國家

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Barracuda Networks, Inc.

- Cato Networks

- Check Point Software Technologies, Inc.

- Cisco Systems, Inc.

- Forcepoint

- Fortinet, Inc.

- IntraSystems

- Juniper Networks, Inc.

- Microsoft Corporation

- Sprout Technologies Ltd

- Vocus Communications

- Zscaler, Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Firewall-as-a-Service Market size is estimated at USD 5.46 billion in 2025, and is expected to reach USD 11.71 billion by 2030, at a CAGR of 16.47% during the forecast period (2025-2030).

Cloud-based firewall services offer several benefits to organizations, including flexible scalability, secure access parity, security over migration, identity protection, and secure performance management. As a result, many organizations are implementing firewall-as-a-service to manage their data packets in the cloud network.

Key Highlights

- Hardware-based security options are becoming less common, and the implementation of more software-based solutions that use a service delivery paradigm has increased due to widespread cloud adoption. Over the past five years, these changes have accelerated the uptake of FWaaS solutions and other network and security services, bringing about more scalable and user-friendly security solutions.

- The enormous growth in cloud-based applications, the surge in data breaches in the public cloud environment, and ever-changing firewall protocols for business organizations are major factors influencing growth for the firewall-as-a-service in the global market. However, the complexity of integrating hosted firewalls with on-premise firewalls and inadequate IT infrastructures in underdeveloped nations are obstructing market growth.

- Firewall-as-a-service has found a place in various industries such as BFSI, government, IT & telecom, healthcare, retail, manufacturing, aerospace & defense, energy & utilities, and others, offering an advanced cloud-based network security solution for enterprises. As traffic increases exponentially over the cloud network, organizations have adopted security solutions like firewalls and endpoint security to protect their data on their respective cloud network.

- The impact of Covid-19 led to a rise in work-from-home and cloud adoption. The majority of IT employees' to-do lists will be dominated by providing remote access. According to Global Workplace Analytics, up to 30% of the workforce could be working from home multiple days per week by the end of the year. More than half (54%) of a Cybersecurity Insiders survey respondents said Covid-19 increased their cloud adoption for workflows and apps. Furthermore, about 66% of respondents anticipate increased security threats to remote workers. No matter where the users are located while working, firewalls must safeguard the organization's networks.

Firewall as a Service Market Trends

Public Cloud Deployment Model is Expected to Hold Significant Market Share

- As organizations continue to move their operations to cloud environments, data protection, and security breaches have become major concerns across various industries, including financial services, government organizations, healthcare institutions, retail, defense, IT & telecom, and others.

- A report by RedLock Inc. reveals that nearly half (49%) of all databases worldwide are not encrypted, leaving them vulnerable to potential cyber-attacks. Additionally, over half (51%) of organizations are exposed to cloud storage services, increasing the risk of attacks on applications running in hosted environments.

- Furthermore, the shift from traditional IT infrastructure to cloud environments has resulted in a rapid increase in endpoints, necessitating advanced firewall protection services that are specific to cloud platforms.

- Vendors in the market are responding to this demand by offering enhanced versions of firewall-as-a-service (FWaaS) solutions with SSL offloading, content caching, and load balancing to ensure the smooth processing of applications. Developed countries worldwide are adopting FWaaS as a necessary service to protect their cloud environments and improve overall business functions.

- In April 2023, Akamai Technologies, Inc. launched the Prolexic Network Cloud Firewall. This capability of Akamai Prolexic allows customers to manage and define their own access control lists (ACLs) while enabling greater flexibility to secure their own network edge. Prolexic is Akamai's cloud-based DDoS protection platform that stops attacks before they reach applications, data centers, and internet-facing infrastructure.

Asia Pacific Expected to Witness Significant Growth in the Market

- The Asia Pacific region is currently experiencing the fastest adoption of firewall-as-a-service, with both large and small enterprises adopting this technology. China has witnessed an increase in cyberattacks, which has prompted the country to improve its defense capabilities. However, the country also has a good chance of serving as a significant point of origin for cyberattacks in other parts of the globe. Moreover, the number of connected devices has increased in China due to technological advancements. The interconnectivity of the devices will also grow exponentially with 5G-enabled devices. Consequently, there are more connected devices, which immediately increases the market's need for security products.

- Cybersecurity incidents have sharply increased in China as a result of the growing organizational propensity toward digitization and the usage of related technology as part of their operations. Due to technological advancements, there are more connected gadgets in China. Moreover, with the rise in the usage of 5G-enabled gadgets, the interconnectedness of the devices will also significantly increase, which in turn directly increases the need for security products, driving the market significantly within the region.

- Cybersecurity is gaining interest from Japanese enterprises and the government rapidly. The rise in cyberattacks on Japanese organizations prompts the government to establish new strategies, legislation, and facilities. Moreover, the widespread utilization of smartphones and the increasing connection of various electrical appliances to the Internet have made life more convenient but however, had exposed people to the daily risk of information theft.

- Japan is seeking bilateral cooperation with countries to operationalize its cybersecurity priorities, such as the agreement with the U.S. Department of Homeland Security, to improve and collaborate on curbing cyber threats faced by the governments. In January 2023, The United States and Japan signed an updated memorandum of cooperation on cybersecurity mainly to strengthen operational collaboration, as stated by the U.S. Department of Homeland Security.

- The government of Australia is focusing on the goal of becoming the most cyber-secure nation by 2030 as a result of growing cyber threats and demand for cyber security solutions for which the country is investing in enduring and adaptive capabilities. With this aim, the government wants the country to be a recognized brand for cybersecurity products and services, boosting domestic market growth.

Firewall as a Service Industry Overview

The Firewall-as-a-Service market is fragmented with the presence of major players like Barracuda Networks, Inc., Cato Networks, Check Point Software Technologies, Inc., Cisco Systems, Inc., and Forcepoint. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2023 - Fortinet introduced a new ASIC that promises to meld the security and network functions of its core family of FortiGate firewalls more efficiently and powerfully. The custom chip is a 7-nanometer package, called a fifth-generation security processing system or FortiSP5, that promises several performance improvements for the FortiGate system.

- October 2022 - McAfee Corp., a leader in online security, introduced McAfee+ in the UK. This new product line includes all-new privacy and identity protections that let users live their lives online with confidence and security. The new McAfee+ product suite, which first debuted in the US, is now accessible in the UK and gives users access to extensive Personal Data Cleanup services, identity recovery assistance, lost wallet assistance, and the ability to secure all of their devices with world-class defense against threats.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Enormous Growth in Cloud Based Applications

- 4.3.2 Surge in Data Breaches on Public Cloud Environment

- 4.3.3 Everchanging Firewall Protocols for Business Organisations

- 4.4 Market Restraints

- 4.4.1 Complexity in Integrating Hosted Firewalls with On-premise Firewalls

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Model

- 5.1.1 SaaS

- 5.1.2 IaaS

- 5.1.3 PaaS

- 5.2 By Deployment Model

- 5.2.1 Private

- 5.2.2 Public

- 5.2.3 Hybrid

- 5.3 By User Type

- 5.3.1 Large Enterprises

- 5.3.2 SMEs

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 IT & Telecom

- 5.4.3 Healthcare

- 5.4.4 Retail

- 5.4.5 Aerospace & Defence

- 5.4.6 Other Industry Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 Australia

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle-East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Barracuda Networks, Inc.

- 6.1.2 Cato Networks

- 6.1.3 Check Point Software Technologies, Inc.

- 6.1.4 Cisco Systems, Inc.

- 6.1.5 Forcepoint

- 6.1.6 Fortinet, Inc.

- 6.1.7 IntraSystems

- 6.1.8 Juniper Networks, Inc.

- 6.1.9 Microsoft Corporation

- 6.1.10 Sprout Technologies Ltd

- 6.1.11 Vocus Communications

- 6.1.12 Zscaler, Inc.