|

市場調查報告書

商品編碼

1642116

LTE IoT:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)LTE IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

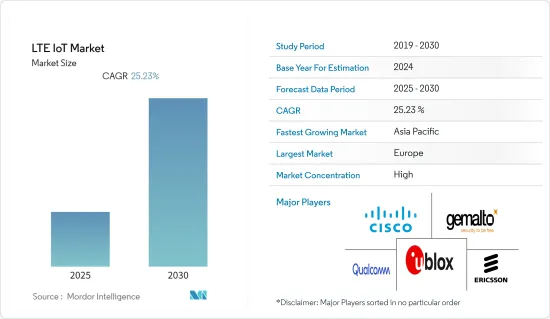

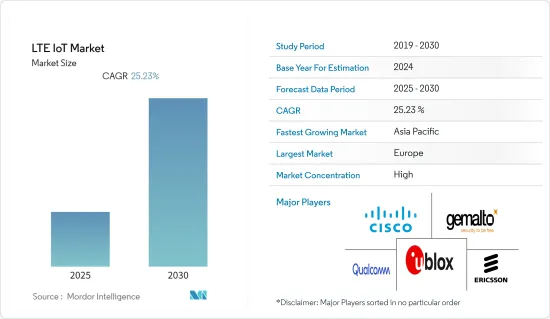

預計預測期內 LTE IoT 市場複合年成長率將達到 25.23%。

主要亮點

- 託管服務提供者為其客戶提供全面且經濟高效的解決方案,為他們提供處理各種營運活動(基礎設施管理、保全行動、雲端營運等)的專業知識,並使他們能夠推出多種機器對機器 (M2M) 服務。

- 由於製造業務的敏感性,製造商正在採用物聯網解決方案、感測器和無線連接平台來提高生產力並將業務轉變為智慧製造。

- 許多軟體解決方案提供者提供包含主動和自動化分析功能的智慧製造應用程式,使工業製造成為一個智慧的、自我管理的環境。 LTE技術用於在工廠內的各個設備之間建立穩定的連接以進行資料傳輸,使工業部門能夠解決與預測性維護和自主生產相關的問題。

- 然而,市場也面臨獨特的挑戰。希望在美國部署物聯網計劃的公司需要以 LTE-M 網路為基礎,因為 LTE 無線是主流。 LTE CAT M1 設備在亞洲、非洲和東歐的存在是由於行動網路營運商仍在使用 3G 連線。然而,由於低成本設備製造商的存在,NB-IoT 設備在亞洲各地(尤其是在中國)非常豐富。

- COVID-19 的蔓延正在影響許多作為 LTE IoT 技術關鍵市場的領域。受疫情影響,建築業成長放緩,許多正在進行的計劃停滯或取消。這阻礙了智慧路燈、電錶、停車收費表等物聯網設備的進一步安裝。此外,疫情也影響了消費和零售市場,導致智慧型設備和家電的銷售下降。所有這些設備都積極使用 NB-IoT 晶片組。

LTE 物聯網市場趨勢

工業部門預計將大幅成長

- 物聯網將改變組織的通訊方式以及規範日常業務和工業流程的方式。物聯網在工業應用中的廣泛應用已證明其適用於管理大量資產和協調複雜分散式業務的部門。

- 工業需求的複雜性和多樣性需要多種通訊系統。隨著新技術的引入,現代戰爭被稱為網路中心戰爭,其中強大的網路架構改善了資訊共用,提高了資訊品質和共用的情境察覺。這些市場類型不斷擴大的應用和服務能力有助於創造特定於市場和最終用戶的需求。

- 靈活性、互通性和長壽命是 LTE 應用的關鍵網路通訊特性,有助於創造最終用戶的需求。隨著 LTE 的進步和物聯網的開放,未來市場前景廣闊,可以透過語音、視訊和資料為緊急行動/服務調度員以及地面急救人員提供增強的情境察覺。

- 石油鑽井平台、水下管道、海上平台和高爐等惡劣危險環境中物聯網設備的快速自動化和發展可能會推動對 LTE 物聯網設備和感測器的需求。

- NB-IoT技術也廣泛應用於製造業。 LTE-M 和 NB-IoT 兩種物聯網技術非常適合為使用壽命長的大型機器提供經濟高效、安全可靠的連接。這兩種技術都能夠深入工廠結構,從而可以連接到位於地下等難以到達位置的機器。例如,中國萬向集團正在使用中國聯通的NB-IoT網路來監控汽車零件的生產,以確保品質的可追溯性。

歐洲佔有較大市場佔有率

- 由於企業物聯網應用廣泛採用 LTE 技術,歐洲在 LTE 物聯網市場的佔有率正在不斷擴大。該地區擁有 Telefonaktiebolaget LM Ericsson、Halberd Bastion Pty Ltd 和 u-blox AG 等知名公司,預計這些公司將進一步推動該地區的整體市場成長。

- 該地區在 LTE IoT 覆蓋範圍方面處於領先地位,而推動全部區域需求的因素是該地區知名企業的持續發展。例如,華為與沃達豐在英國紐伯里開設了一個開放實驗室,用於研究和開發LTE物聯網技術和應用。

- 歐盟委員會和歐盟成員國正在製定一項策略,以支援物聯網通訊和相關服務的實驗和部署。此外,各行動電話營運商正在英國和其他歐洲國家廣泛部署LTE IoT,其中德國、英國和法國是歐洲LTE IoT市場的三大貢獻者。此外,行動通訊業者(MNO)也在歐洲各地部署了多個預商用試驗和地塊。

- 歐洲國家依賴最新技術來保持競爭力和高效運作是歐洲工業快速採用LTE IoT的關鍵原因。這些設備可廣泛應用於建築、物流、車隊管理、能源和製造業等多個領域。例如,溫度、濕度、運動和光感測器在建設產業有廣泛的應用。

LTE 物聯網產業概覽

LTE IoT 市場高度整合,由多家主要參與者組成。從市場佔有率來看,目前少數幾家大公司佔據著市場主導地位。然而,隨著工業IoT應用在多個終端用戶行業的進步,新參與企業正在增加其在市場的佔有率,並擴大企業發展。

- 2022 年 12 月-Aeris Communications 與愛立信合作,打造快速成長的物聯網產業的領導者。 Aeris 與愛立信合併後的物聯網平台連接了覆蓋全球190個國家的超過1億台物聯網設備,並為數千家企業提供物聯網連接和軟體解決方案,為企業提供了無與倫比的物聯網平台,也為通訊服務供應商帶來了新的收益來源。

- 2022年6月-高通推出七款全新下一代物聯網設備,推出了強大的尖端物聯網解決方案陣容:高通 QCS8250、高通 QCS6490/QCM6490、高通 QCS4290/QCM4290 和高通 QCS2290/QCM2290。我們提供一系列解決方案,為運輸和物流、倉庫管理、視訊協作、智慧攝影機、零售和醫療保健等關鍵領域改造工業和企業物聯網應用,提供尖端性能和無縫連接,推動跨行業的全球數位轉型。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 參與企業的議價能力

- 競爭對手之間的競爭

- 替代品的威脅

- 技術簡介

- 私有 LTE

- 商用 LTE

- 企業 LTE

第5章 市場動態

- 市場促進因素

- 高速寬頻連線的需求不斷增加

- 終端用戶產業對工業IoT的需求日益增加

- 市場挑戰

- 頻譜頻寬短缺

第6章 市場細分

- 按服務

- 專業的

- 託管

- 依產品類型

- NB-IoT(Cat-NB1)

- LTE-M(eMTC Cat-M1)

- 按最終用戶產業

- 資訊科技/通訊

- 消費性電子產品

- 零售(數位電子商務)

- 衛生保健

- 工業的

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Qualcomm Technologies, Inc

- Gemalto NV

- u-blox AG

- Telefonaktiebolaget LM Ericsson

- Cisco Syatem Inc.(Jasper)

- Cradlepoint Inc.

- Sequans Communications SA

- PureSoftware

- TELUS Corporation

- MediaTek Inc.

- Verizon Communications

- AT&T Inc.

第8章投資分析

第9章 市場機會與未來趨勢

簡介目錄

Product Code: 66676

The LTE IoT Market is expected to register a CAGR of 25.23% during the forecast period.

Key Highlights

- The managed service provider offers customers comprehensive and cost-effective solutions, thereby delivering their expertise in handling various operating activities (including infrastructure management, security operations, and cloud operations) to clients, enabling them to launch multiple Machine-to-Machine (M2M) offerings.

- Due to the delicate nature of manufacturing operations, manufacturers are adopting IoT solutions, sensors, and wireless connectivity platforms to increase their productivity, transforming their operations into smart manufacturing.

- Many software and solution providers offer industries smart manufacturing applications that include proactive and automatic analytics capabilities, making industrial manufacturing an intelligent and self-manageable environment. The LTE technology is availed to establish stable connectivity among various devices in a factory for data transmission, to enable industries to tackle the issues related to predictive maintenance and autonomous production.

- However, the market observed highly region-specific challenges. The enterprises demanding to deploy an IoT project within the United States have to be based on the LTE-M network due to the predominant presence of LTE radios. LTE CAT M1 devices' presence in Asia, Africa, and Eastern Europe is because mobile network operators still use 3G connectivity. However, NB-IoT devices can be found in abundance across Asia, especially in China, due to the presence of low-cost device manufacturers.

- The spread of COVID-19 has impacted many sectors that are the main markets for LTE IoT technology. The construction sector is witnessing a slower growth rate due to COVID; many running projects need to be stalled or canceled. This stops the further installation of IoT devices, such as smart street lights, meters, and parking meters. Moreover, the pandemic also affected the consumer and retail market; the sales of smart devices and smart appliances declined. All these devices actively use NB-IoT Chipset.

LTE IoT Market Trends

Industrial Sector is Expected to Grow at a Significant Rate

- The IoT transforms how organizations communicate and regulate their everyday businesses and industrial processes. Its widespread adoption across industries has proven well-suited for sectors that manage many assets and coordinate complex and distributed operations.

- Due to the complexity and diversity of industrial requirements, numerous communication systems are required. With new technologies in place, current warfare is now referred to as network-centric warfare, wherein a robustly networked architecture improves information sharing, enhancing the quality of information and shared situational awareness. Such extended applications and serviceability of the market type have helped it to create a demand specific to the market and end users' needs.

- Flexibility, interoperability, and longevity are critical characteristics of networked communications for the LTE applications that are helping to create demand for the end users, maintaining close coordination within the team and across an adjacent and higher operating units in industries. With the advancement in the LTE and the development of IoT, the market's future holds a lot of promise for enhanced situational awareness via voice, video, and data delivered not only limited to the emergency operations/dispatch of services but also first responders in the field.

- IoT devices' rapid automation and development in harsh and dangerous environments, such as oil rigs, underwater pipelines, off-shore platforms, blast furnaces, etc., will boost the demand for LTE IoT devices and sensors.

- The NB-IoT technology is also widely used for manufacturing purposes. LTE-M and NB-IoT, the two IoT technologies, are well-suited to enable cost-effective, secure, and dependable connectivity to large machinery with a long lifespan. Both technologies can penetrate deep inside factory structures, allowing connectivity to reach machines below ground level and other inaccessible areas. For instance, the Wanxiang group in China uses China Unicom's NB-IoT network to monitor the manufacturing of automotive parts to ensure quality traceability.

Europe holds a Significant Market Share

- Europe is gaining the LTE IoT market presence owing to the widespread adoption of LTE technology for enterprises' IoT applications. The well-established company of some prominent players across the region, such as Telefonaktiebolaget LM Ericsson, Halberd Bastion Pty Ltd, and u-blox AG, among others, is expected further to assist the regional market in the overall growth.

- The region is leading in terms of the LTE IoT coverage area, with some of the ongoing development by prominent players across the region fueling the demand across the region. For instance, Huawei and Vodafone opened an open lab in Newbury, UK, for R&D of LTE IoT technologies and applications.

- European Commission and European Union member states are committed to developing strategies to support experiments and the deployment of IoT telecom and allied services. Various cellular operators are also set for the widespread deployment of LTE IoT in the UK and the rest of Europe, where Germany, the UK, and France are the top 3 contributors to the LTE IoT market in Europe. Further, Mobile Network Operators (MNOs) have also deployed several pre-commercial trials and plots across Europe.

- The European country's reliance on the latest technology to maintain its competitiveness and business efficiency are the major reason for the rapid acceptance of LTE IoT in European Industries. These devices have wide applications in construction, logistics and fleet management, energy, manufacturing, etc. For instance, the construction industry finds wide applications for Temperature, Humidity, motion, and light sensors.

LTE IoT Industry Overview

The LTE IoT market is highly consolidated and consists of several significant players. Regarding market share, some of the major players currently dominate the market. However, with the advancement in the industrial IoT application across multiple end-user industries, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

- December 2022 - Aeris Communications and Ericsson joined together to create a leader in the fast-growing IoT industry. The combination of Aeris and Ericsson's IoT platforms will offer an unparalleled IoT platform for enterprises and new revenue streams for communication service providers by connecting over 100 million IoT devices worldwide, covering 190 countries, and providing IoT connectivity and software solutions to thousands of enterprises.

- June 2022 - Qualcomm launched a robust roster of cutting-edge IoT solutions by introducing seven new next-generation IoT devices: Qualcomm QCS8250, Qualcomm, QCS6490/ QCM6490, Qualcomm QCS4290/ QCM4290, and the Qualcomm QCS2290/ QCM2290. for key segments including transportation and logistics, warehousing, video collaboration, smart cameras, retail, and healthcare providing a portfolio of solutions to transform industrial and enterprise IoT applications to achieve cutting edge performance and seamless connectivity to drive global digital transformation across industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technology Snapshot

- 4.3.1 Private LTE

- 4.3.2 Commercial LTE

- 4.3.3 Enterprise LTE

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for High-speed Broadband Connectivity

- 5.1.2 Rising Demand for the Industrial IoT among End-user Industries

- 5.2 Market Challenges

- 5.2.1 Scarcity of Spectrum Bandwidth

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Professional

- 6.1.2 Managed

- 6.2 By Product Type

- 6.2.1 NB-IoT (Cat-NB1)

- 6.2.2 LTE-M (eMTC Cat-M1)

- 6.3 By End-user Industry

- 6.3.1 IT & Telecommunication

- 6.3.2 Consumer Electronics

- 6.3.3 Retail (Digital Ecommerce)

- 6.3.4 Healthcare

- 6.3.5 Industrial

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies, Inc

- 7.1.2 Gemalto N.V.

- 7.1.3 u-blox AG

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Cisco Syatem Inc. (Jasper)

- 7.1.6 Cradlepoint Inc.

- 7.1.7 Sequans Communications S.A.

- 7.1.8 PureSoftware

- 7.1.9 TELUS Corporation

- 7.1.10 MediaTek Inc.

- 7.1.11 Verizon Communications

- 7.1.12 AT&T Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219